Managerial Accounting

3rd Edition

ISBN: 9780077826482

Author: Stacey M Whitecotton Associate Professor, Robert Libby, Fred Phillips Associate Professor

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 5.1GAP

Analyzing Multiproduct CVP, Break-Even Point, Target Profit, margin of safety

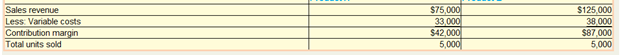

Lindstrom Company products two fountain pen models. Information about its products following:

Lindstrom’s fixed costs total $78,500.

Determine Lindstrom’s weighted-average unit contribution margin and weighted-average contribution margin ratio.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Lillibridge & Friends, Incorporated provides you with the following data for its single product:

Sales price per unit

Fixed costs (per quarter):

Selling, general, and administrative (SG&A)

Manufacturing overhead

Variable costs (per unit):

Direct labor

Direct materials

Manufacturing overhead

SG&A

Number of units produced per quarter

a. Prime cost per unit

b. Contribution margin per unit

c. Gross margin per unit

d. Conversion cost per unit

e. Variable cost per unit

Required:

Compute the amounts for each of the following assuming that the production levels are within the relevant range if the number of units

is 500,000 per quarter. Also calculate if the number of units increases to 600,000 per quarter.

Note: Do not round intermediate calculations. Round your answers to 2 decimal places.

f. Full absorption cost per unit

g. Variable production cost per unit

h. Full cost per unit

$ 140

1,500,000

4,500,000

$

17

20

18

14

500,000 units

500,000 units 600,000 units

37.00 $

$

37.00

55.00 $

55.00

Lillibridge & Friends, Incorporated provides you with the following data for its single product:

Sales price per unit

Fixed costs (per quarter):

Selling, general, and administrative (SG&A)

Manufacturing overhead

Variable costs (per unit):

Direct labor

Direct materials

Manufacturing overhead

SG&A

Number of units produced per quarter

a. Prime cost per unit

b. Contribution margin per unit

c. Gross margin per unit

d. Conversion cost per unit

e. Variable cost per unit

f. Full absorption cost per unit

g. Variable production cost per unit

h. Full cost per unit

500,000 units

$50

1,500,000

4,500,000

Required:

Compute the amounts for each of the following assuming that the production levels are within the relevant range if the number of units

is 500,000 per quarter. Also calculate if the number of units increases to 600,000 per quarter.

Note: Round your answers to 2 decimal places.

8

600,000 units

11

9

5

500,000 units

Lillibridge & Friends, Incorporated provides you with the following data for its single product:

Sales price per unit

Fixed costs (per quarter):

Selling, general, and administrative (SG&A)

Manufacturing overhead

Variable costs (per unit):

Direct labor

Direct materials

Manufacturing overhead

SG&A

Number of units produced per quarter

a. Prime cost per unit

b. Contribution margin per unit

c. Gross margin per unit

d. Conversion cost per unit

e. Variable cost per unit

f. Full absorption cost per unit

g. Variable production cost per unit

h. Full cost per unit

Required:

Compute the amounts for each of the following assuming that the production levels are within the relevant range if the number of units

is 500,000 per quarter. Also calculate if the number of units increases to 600,000 per quarter.

Note: Do not round intermediate calculations. Round your answers to 2 decimal places.

$

$

$ 160

1,500,000

4,500,000

500,000 units 600,000 units

41.00 $

41.00

83.00

$

$

$

$

19

22

20

16

500,000 units…

Chapter 6 Solutions

Managerial Accounting

Ch. 6 - Identify and briefly describe the assumptions of...Ch. 6 - Why should managers create a CVT graph?Ch. 6 - When considering a CVP graph, how is the...Ch. 6 - Your supervisor has requested that you prepare a...Ch. 6 - Why is it important for a company to know its...Ch. 6 - Explain the difference between unit contribution...Ch. 6 - A Company’s Cost structure can have a high...Ch. 6 - Prob. 8QCh. 6 - Prob. 9QCh. 6 - Bert Company and Ernie Company are competitors in...

Ch. 6 - Prob. 11QCh. 6 - Explain margin of safety. Why is important for...Ch. 6 - Give an example of a company to which margin of...Ch. 6 - Explain how a decision to automate a manufacturing...Ch. 6 - Explain degree of operating leverage and how it...Ch. 6 - Prob. 16QCh. 6 - Why is sales mix important to multiproduct CVP...Ch. 6 - Prob. 18QCh. 6 - Prob. 19QCh. 6 - Prob. 20QCh. 6 - Prob. 21QCh. 6 - Prob. 22QCh. 6 - Which of the following is not an assumption of CVP...Ch. 6 - Prob. 2MCCh. 6 - Prob. 3MCCh. 6 - Prob. 4MCCh. 6 - Prob. 5MCCh. 6 - Prob. 6MCCh. 6 - Prob. 7MCCh. 6 - Prob. 8MCCh. 6 - Prob. 9MCCh. 6 - Prob. 10MCCh. 6 - Prob. 1MECh. 6 - Prob. 2MECh. 6 - Prob. 3MECh. 6 - Prob. 4MECh. 6 - Prob. 5MECh. 6 - Calculating Break-Even Point After Cost Structure...Ch. 6 - Prob. 7MECh. 6 - Prob. 8MECh. 6 - Prob. 9MECh. 6 - Prob. 10MECh. 6 - Prob. 11MECh. 6 - Prob. 12MECh. 6 - Prob. 13MECh. 6 - Prob. 14MECh. 6 - Prob. 15MECh. 6 - Analyzing Multiproduct CVP Refer to the...Ch. 6 - Prob. 17MECh. 6 - Prob. 18MECh. 6 - Prob. 19MECh. 6 - Prob. 2ECh. 6 - Determining Break-Even Point, target Profit....Ch. 6 - Analyzing Changes in Price, Cost Structure, Degree...Ch. 6 - Prob. 5ECh. 6 - Prob. 6ECh. 6 - Matching Terms to Definitions Match the...Ch. 6 - Analyzing Break-Even Point, Preparing CVP Graph,...Ch. 6 - Calculating Contribution Margin, Contribution...Ch. 6 - Prob. 10ECh. 6 - Calculating Target Profit, Margin of Safety,...Ch. 6 - Prob. 12ECh. 6 - Prob. 13ECh. 6 - Prob. 14ECh. 6 - Prob. 15ECh. 6 - Analyzing Multiproduct CVP Biscayne’s Rent-A-Ride...Ch. 6 - Prob. 17ECh. 6 - Prob. 18ECh. 6 - Prob. 19ECh. 6 - Prob. 20ECh. 6 - Prob. 21ECh. 6 - Prob. 22ECh. 6 - Prob. 1.1GAPCh. 6 - Prob. 1.2GAPCh. 6 - Prob. 1.3GAPCh. 6 - Prob. 1.4GAPCh. 6 - Prob. 2.1GAPCh. 6 - Prob. 2.2GAPCh. 6 - Prob. 2.3GAPCh. 6 - Prob. 2.4GAPCh. 6 - Prob. 3.1GAPCh. 6 - Prob. 3.2GAPCh. 6 - Prob. 3.3GAPCh. 6 - Prob. 3.4GAPCh. 6 - Prob. 3.5GAPCh. 6 - Calculating Contribution Margin, Contribution...Ch. 6 - Prob. 4.1GAPCh. 6 - Analyzing Break-Even Point, Target Profit, Degree...Ch. 6 - Prob. 4.3GAPCh. 6 - Prob. 4.4GAPCh. 6 - Prob. 4.5GAPCh. 6 - Prob. 4.6GAPCh. 6 - Prob. 4.7GAPCh. 6 - Prob. 4.8GAPCh. 6 - Analyzing Multiproduct CVP, Break-Even Point,...Ch. 6 - Prob. 5.2GAPCh. 6 - Prob. 5.3GAPCh. 6 - Prob. 5.4GAPCh. 6 - Prob. 6.1GAPCh. 6 - Prob. 6.2GAPCh. 6 - Prob. 6.3GAPCh. 6 - Prob. 6.4GAPCh. 6 - Prob. 6.5GAPCh. 6 - Prob. 6.6GAPCh. 6 - Prob. 7.1GAPCh. 6 - Prob. 7.2GAPCh. 6 - Prob. 7.3GAPCh. 6 - Prob. 1.1GBPCh. 6 - Prob. 1.2GBPCh. 6 - Prob. 1.3GBPCh. 6 - Prob. 1.4GBPCh. 6 - Prob. 2.1GBPCh. 6 - Prob. 2.2GBPCh. 6 - Prob. 2.3GBPCh. 6 - Prob. 2.4GBPCh. 6 - Prob. 3.1GBPCh. 6 - Prob. 3.2GBPCh. 6 - Prob. 3.3GBPCh. 6 - Prob. 3.4GBPCh. 6 - Prob. 3.5GBPCh. 6 - Prob. 3.6GBPCh. 6 - Prob. 4.1GBPCh. 6 - Prob. 4.2GBPCh. 6 - Prob. 4.3GBPCh. 6 - Prob. 4.4GBPCh. 6 - Prob. 4.5GBPCh. 6 - Prob. 4.6GBPCh. 6 - Prob. 4.7GBPCh. 6 - Prob. 4.8GBPCh. 6 - Prob. 5.1GBPCh. 6 - Prob. 5.2GBPCh. 6 - Prob. 5.3GBPCh. 6 - Prob. 5.4GBPCh. 6 - Prob. 6.1GBPCh. 6 - Prob. 6.2GBPCh. 6 - Prob. 6.3GBPCh. 6 - Prob. 6.4GBPCh. 6 - Prob. 6.5GBPCh. 6 - Prob. 6.6GBPCh. 6 - Prob. 7.1GBPCh. 6 - Prob. 7.2GBPCh. 6 - Prob. 7.3GBP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lillibridge & Friends, Incorporated provides you with the following data for its single product: Sales price per unit Fixed costs (per quarter): Selling, general, and administrative (SG&A) Manufacturing overhead Variable costs (per unit): Direct labor Direct materials Manufacturing overhead SG&A Number of units produced per quarter a. Prime cost per unit b. Contribution margin per unit c. Gross margin per unit d. Conversion cost per unit e. Variable cost per unit f. Full absorption cost per unit Required: Compute the amounts for each of the following assuming that the production levels are within the relevant range if the number of units is 500,000 per quarter. Also calculate if the number of units increases to 600,000 per quarter. Note: Round your answers to 2 decimal places. g. Variable production cost per unit h. Full cost per unit 500,000 units $ $ S $ 50 1,500,000 4,500,000 600,000 units $ 19.00 17.00 $ 13.00 $ 8 11 9 5 500,000 units 19.00 17.00 14.50arrow_forwardComplete the table below for contribution margin per unit, total contribution margin, and contribution margin ratio: LOADING... (Click the icon to view the table.) Compute the missing information, starting with scenario A, then for scenarios B and C. (Enter the contribution margin ratio to nearest percent, X%.) A Number of units 2,833 units Sale price per unit $200 Variable costs per unit 80 Calculate: Contribution margin per unit Total contribution margin Contribution margin ratio % Data Table A B C Number of units 2,833 units 3,100 units 5,600 units Sale price per unit $200 $3,000 $125 Variable costs per unit 80 1,500 100 Calculate: Contribution margin per unit Total contribution margin Contribution margin ratioarrow_forwardContribution margin by segment The following information is for LaPlanche Industries Inc.: Determine the contribution margin for (A) Product YY and (B) West Region.arrow_forward

- Manufacturing builds and sells switch harnesses for glove boxes. The sales price and variable cost for each follows: Their sales mix is reflected in the ratio 4:4:1. What is the overall unit contribution margin for JJ Manufacturing with their current product mix?arrow_forwardComplete the table below for contribution margin per unit, total contribution margin, and contribution margin ratio: (Click the icon to view the table.) Compute the missing information, starting with scenario A, then for scenarios B and C. (Enter the contribution margin ratio to nearest percent, X%.) A B C 1,290 units 14,390 units 3,600 units 1,400 4,400 $ 1,250 700 880 625 Number of units Sale price per unit Variable costs per unit Calculate: 700 Contribution margin per unit Total contribution margin 903,000 Contribution margin ratio 50% 3520 50,652,800 80% %arrow_forwardProduct Profitability Analysis PowerTrain Sports Inc. manufactures and sells two styles of All Terrain Vehicles (ATVS), the Mountain Monster and Desert Dragon, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit information is available for the two products: Mountain Monster Desert Dragon Sales price $6,000 $4,000 Variable cost of goods sold 3,780 2,680 Manufacturing margin $2,220 $1,320 Variable selling expenses 1,260 480 Contribution margin $960 $840 Fixed expenses 450 340 Income from operations $510 $500 In addition, the following sales unit volume information for the period is as follows: Mountain Monster Desert Dragon Sales unit volume 3,000 2,300 a. Prepare a contribution margin by product report. Calculate the contribution margin ratio for each product as a whole percent.arrow_forward

- Use a cost-volume graph to determine the type of cost behavior exhibited in Groups A, B, and C. In the graph, volume should range from 0 to 24,000 units (in 4,000 unit increments), and cost should range from $0 to $35,000 (in $5,000 increments). Volume Group A Group B Group C (applicable to each group) Costs Costs Costs 2,000 12,000 16,000 20,000 $2,600 $1,000 $2,400 12,600 6,000 2,400 16,600 8,000 2,400 20,600 10,000 2,400 1. Identify the cost behavior (fixed, mixed, or variable) in the three groups. Group Cost behavior A B C 2. What is the expected total cost for Group B if volume is 0? $ 3. What is the expected total cost for Group C if volume is 0? Checkarrow_forwardCost Relationships The following costs are for Optical View Inc., a contact lens manufacturer:Output in Units Fixed Costs Variable Costs Total Costs250 $4,750 $ 7,500 $12,250 300 4,750 9,000 13,750350 4,750 10,500 15,250400 4,750 12,000 16,750Required1. Calculate and graph total costs, total variable cost, and total fixed cost.2. For each level of output calculate the per-unit total cost, per-unit variable cost, and per-unit fixed cost.3. Using the results from requirement 2, graph the per-unit total cost, per-unit variable cost, and per-unitfixed cost, and discuss the behavior of the per-unit costs over the given output levels.arrow_forwarda) Determine the variable cost per unit and the fixed cost using the high-low method.b) What is the equation of the total mixed cost function?c) Prepare the scatter diagram and insert the trendline or line of best-fit. Use a scaleof 2 cm to represent 1,000 units on the x-axis & 2 cm to represent $50,000 on the yaxis.arrow_forward

- Strategic Cost Management Give what is required of the problem. What is the correct answer to numbers 1, 2 and 3 ?arrow_forwardProblem 3-17A (Algo) Determining the break-even point and preparing a contribution margin income statement LO 3-1 Ritchie Manufacturing Company makes a product that it sells for $150 per unit. The company incurs variable manufacturing costs of $76 per unit. Variable selling expenses are $14 per unit, annual fixed manufacturing costs are $352.000, and fixed selling and administrative costs are $266,000 per year. Required Determine the break-even point in units and dollars using each of the following approaches: a. Use the equation method. b. Use the contribution margin per unit approach. c. Use the contribution margin ratio approach. d. Prepare a contribution margin income statement for the break-even sales volume.arrow_forwardUse a cost-volume graph to determine the type of cost behavior exhibited in Groups A, B, and C. In the graph, volume should range from 0 to 38, 400 units (in 4,000 unit increments), and cost should range from $0 to $49,000 (in $5,000 increments). Volume Group A Group B Group C (applicable to each group) Costs Costs Costs 3,200 $3,640 $1,400 $ 3,360 19,200 17,640 8,400 3,360 25,600 23,240 11,200 3, 360 32,000 28,840 14,000 3,3601. Identify the cost behavior (fixed, mixed, or variable) in the three groups. Group Cost behavior A B C 2. What is the expected total cost for Group B if volume is 0? $Answer 3. What is the expected total cost for Group C if volume is 0?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

How to Estimate Project Costs: A Method for Cost Estimation; Author: Online PM Courses - Mike Clayton;https://www.youtube.com/watch?v=YQ2Wi3Jh3X0;License: Standard Youtube License