Concept explainers

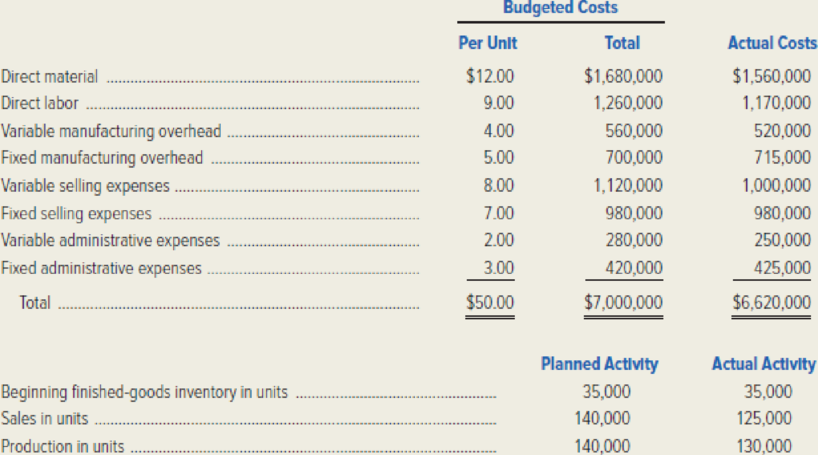

Outback Corporation manufactures tactical LED flashlights in Brisbane, Australia. The firm uses an absorption costing system for internal reporting purposes; however, the company is considering using variable costing. Data regarding Outback’s planned and actual operations for 20x1 follow:

The budgeted per-unit cost figures were based on Outback producing and selling 140,000 units in 20x1. Outback uses a predetermined

Required: Was Outback’s 20x1 operating income higher under absorption costing or variable costing? Why? Compute the following amounts.

- 1. The value of Outback Corporation’s 20x1 ending finished-goods inventory under absorption costing.

- 2. The value of Outback Corporation’s 20x1 ending finished-goods inventory under variable costing.

- 3. The difference between Outback Corporation’s 20x1 reported operating income calculated under absorption costing and calculated under variable costing.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Eclipse Motor Company manufactures two types of specialty electric motors, a commercial motor and a residential motor, through two production departments, Assembly and Testing. Presently, the company uses a single plantwide factory overhead rate for allocating factory overhead to the two products. However, management is considering using the multiple production department factory overhead rate method. The following factory overhead was budgeted for Eclipse: Direct machine hours were estimated as follows: In addition, the direct machine hours (dmh) used to produce a unit of each product in each department were determined from engineering records, as follows: a. Determine the per-unit factory overhead allocated to the commercial and residential motors under the single plantwide factory overhead rate method, using direct machine hours as the allocation base. b. Determine the per-unit factory overhead allocated to the commercial and residential motors under the multiple production department factory overhead rate method, using direct machine hours as the allocation base for each department. c. Recommend to management a product costing approach, based on your analyses in (a) and (b). Support your recommendation.arrow_forwardEvans, Inc., has a unit-based costing system. Evanss Miami plant produces 10 different electronic products. The demand for each product is about the same. Although they differ in complexity, each product uses about the same labor time and materials. The plant has used direct labor hours for years to assign overhead to products. To help design engineers understand the assumed cost relationships, the Cost Accounting Department developed the following cost equation. (The equation describes the relationship between total manufacturing costs and direct labor hours; the equation is supported by a coefficient of determination of 60 percent.) Y=5,000,000+30X,whereX=directlaborhours The variable rate of 30 is broken down as follows: Because of competitive pressures, product engineering was given the charge to redesign products to reduce the total cost of manufacturing. Using the above cost relationships, product engineering adopted the strategy of redesigning to reduce direct labor content. As each design was completed, an engineering change order was cut, triggering a series of events such as design approval, vendor selection, bill of materials update, redrawing of schematic, test runs, changes in setup procedures, development of new inspection procedures, and so on. After one year of design changes, the normal volume of direct labor was reduced from 250,000 hours to 200,000 hours, with the same number of products being produced. Although each product differs in its labor content, the redesign efforts reduced the labor content for all products. On average, the labor content per unit of product dropped from 1.25 hours per unit to one hour per unit. Fixed overhead, however, increased from 5,000,000 to 6,600,000 per year. Suppose that a consultant was hired to explain the increase in fixed overhead costs. The consultants study revealed that the 30 per hour rate captured the unit-level variable costs; however, the cost behavior of other activities was quite different. For example, setting up equipment is a step-fixed cost, where each step is 2,000 setup hours, costing 90,000. The study also revealed that the cost of receiving goods is a function of the number of different components. This activity has a variable cost of 2,000 per component type and a fixed cost that follows a step-cost pattern. The step is defined by 20 components with a cost of 50,000 per step. Assume also that the consultant indicated that the design adopted by the engineers increased the demand for setups from 20,000 setup hours to 40,000 setup hours and the number of different components from 100 to 250. The demand for other non-unit-level activities remained unchanged. The consultant also recommended that management take a look at a rejected design for its products. This rejected design increased direct labor content from 250,000 hours to 260,000 hours, decreased the demand for setups from 20,000 hours to 10,000 hours, and decreased the demand for purchasing from 100 component types to 75 component types, while the demand for all other activities remained unchanged. Required: 1. Using normal volume, compute the manufacturing cost per labor hour before the year of design changes. What is the cost per unit of an average product? 2. Using normal volume after the one year of design changes, compute the manufacturing cost per hour. What is the cost per unit of an average product? 3. Before considering the consultants study, what do you think is the most likely explanation for the failure of the design changes to reduce manufacturing costs? Now use the information from the consultants study to explain the increase in the average cost per unit of product. What changes would you suggest to improve Evanss efforts to reduce costs? 4. Explain why the consultant recommended a second look at a rejected design. Provide computational support. What does this tell you about the strategic importance of cost management?arrow_forwardBrees, Inc., a manufacturer of golf carts, has just received an offer from a supplier to provide 2,600 units of a component used in its main product. The component is a track assembly that is currently produced internally. The supplier has offered to sell the track assembly for 66 per unit. Brees is currently using a traditional, unit-based costing system that assigns overhead to jobs on the basis of direct labor hours. The estimated traditional full cost of producing the track assembly is as follows: Prior to making a decision, the companys CEO commissioned a special study to see whether there would be any decrease in the fixed overhead costs. The results of the study revealed the following: 3 setups1,160 each (The setups would be avoided, and total spending could be reduced by 1,160 per setup.) One half-time inspector is needed. The company already uses part-time inspectors hired through a temporary employment agency. The yearly cost of the part-time inspectors for the track assembly operation is 12,300 and could be totally avoided if the part were purchased. Engineering work: 470 hours, 45/hour. (Although the work decreases by 470 hours, the engineer assigned to the track assembly line also spends time on other products, and there would be no reduction in his salary.) 75 fewer material moves at 30 per move. Required: 1. Ignore the special study, and determine whether the track assembly should be produced internally or purchased from the supplier. 2. Now, using the special study data, repeat the analysis. 3. Discuss the qualitative factors that would affect the decision, including strategic implications. 4. After reviewing the special study, the controller made the following remark: This study ignores the additional activity demands that purchasing would cause. For example, although the demand for inspecting the part on the production floor decreases, we may need to inspect the incoming parts in the receiving area. Will we actually save any inspection costs? Is the controller right?arrow_forward

- Outback Corporation manufactures tactical LED flashlights in Brisbane, Australia. The firm uses an absorption costing system for internal reporting purposes; however, the company is considering using variable costing. Data regarding Outback's planned and actual operations for 20x1 follow: Budgeted Costs Per Unit Total Actual Costs Direct material Direct labor $1,687,500 1,323,000 607,500 12.50 $1,562,500 9.80 Variable manufacturing overhead Fixed manufacturing overhead Variable selling expenses Fixed selling expenses Variable administrative expenses Fixed administrative expenses 1,225,000 562,500 671,500 877,500 972,000 292,500 4.50 4.90 661,500 1,012,500 972,000 337,500 7.50 7.20 2.50 2.20 297,000 305,000 Total 51.10 $6,898,500 $6,468,500 Planned Activity 36,000 135,000 135,000 Actual Activity Beginning finished-goods inventory in units Sales in units 36,000 117,000 125,000 Production in units The budgeted per-unit cost figures were based on Outback producing and selling 135,000 units…arrow_forwardMoistner, Inc., manufactures and sells two products: Product E6 and Product W9. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Expected Production Direct Labor-Hours Per Unit Total Direct Labor-Hours Product E6 700 7.0 4,900 Product W9 100 5.0 500 Total direct labor-hours 5,400 The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Estimated Expected Activity Activity Cost Pools Activity Measures Overhead Cost Product E6 Product W9 Total Labor-related DLHs $ 233,604 4,900 500 5,400 Machine setups setups 30,942 500 400 900 Order size MHs 712,045 4,200 4,300 8,500 $ 976,591 If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of…arrow_forwardThe Bangor Manufacturing Company makes mechanical toy robots that are typically produced in batches of 250 units. Prior to the current year, the company’s accountants used a standard cost system with a simplified method of assigning manufacturing support (i.e., overhead) costs to products: All such costs were allocated to outputs based on the standard machine hours allowed for output produced. You have recently joined the accounting team and are developing a proposal that the company adopt an ABC system for both product-costing and control purposes. To illustrate the benefit of such a system in terms of the latter, you decide to put together an analysis of batch-related overhead costs. You chose these costs because a previous investigation indicated that there is both a variable component to these costs (materials plus power) plus a fixed component (depreciation and salaries). Last year’s budget indicated that the variable overhead cost per setup hour was $20.00 and that the fixed…arrow_forward

- Gigabyte, Inc. manufactures three products for the computer industry: Gismos (product G): annual sales, 8,000 units Thingamajigs (product T): annual sales, 15,000 units Whatchamacallits (product W): annual sales, 4,000 units The company uses a traditional, volume-based product-costing system with manufacturing over-head applied on the basis of direct-labor dollars. The product costs have been computed as follows: Product G Product T Product W Raw material ..........................$ 35.00 $52.50 $17.50 Direct labor 16(.8 hr.at $20) 12(.6 hr at $20) 8(.4 hr at $20) Manufacturing overhead* ......140.00 105.00 70.00 Total product cost ..................$191.00 $169.50 $95.50 *Calculation of predetermined overhead rate: Manufacturing overhead budget: Machine setup...................................................................................$…arrow_forwardCRAZY Co, is a major producer of beauty products. The company uses a standard cost system to help control costs. Manufacturing overhead is applied to production on the basis of standard direct labor-hours. The company has a standard of 10 labor hours per unit. According to the company's planning budget, the following manufacturing overhead costs should be incurred at an activity level of 17,500 labor-hours (the denominator activity level): Variable manufacturing overhead cost . Fixed manufacturing overhead cost Total manufacturing overhead cost $ 175,000 $420,000 $595,000 During the most recent year, the following operating results were recorded: Activity: Actual Production. . 1,600 15,000 Total Actual labor-hours worked Cost: Actual variable manufacturing overhead cost incurred. Actual fixed manufacturing overhead cost incurred $156,000 $418,800 Required: 1. Calculate the standard fixed manufacturing overhead rate and variable manufacturing overhead rate. 2. Compute spending and…arrow_forwardHakara Company has been using direct labor costs as the basis for assigning overhead to its many products. Under this allocation system, product A has been assigned overhead of $26.87 per unit, while product B has been assigned $7.62 per unit. Management feels that an ABC system will provide a more accurate allocation of the overhead costs and has collected the following cost pool and cost driver information: Cost Pools Activity Costs $ 415,000 120,000 44,000 The following cost information pertains to the production of A and B, just two of Hakara's many products: Machine setup Materials handling Electric power Number of units produced Direct materials cost Direct labor cost Number of setup hours Pounds of materials used Kilowatt-hours Product A Product B A 5,000 $ 22,000 $ 39,000 Cost per Unit Cost Drivers Setup hours Pounds of materials Kilowatt-hours 200 2,000 4,000 B 20,000 $ 26,000 $ 37,000 Activity Driver Consumption 5,000 15,000 22,000 200 2,000 4,000 Required: 1. Use…arrow_forward

- XYZ Company manufactures and distributes two products, M and XY. Overhead costs are currently allocated using the number of units produced as the allocation base. The controller has recommended changing to an activity-based costing (ABC) system. She has collected the following information: Activity Cost Driver Amount M XY Production setups Number of setups $ 82,000 8 12 Material handling Number of parts 48,000 56 24 Packaging costs Number of units 130,000 50,000 80,000 $ 260,000 What is the total overhead per unit allocated to Product M using activity-based costing (ABC)? Select one:a. none of the given answer.b. $2.33.c. $1.79.d. $1.83.e. $2.27.arrow_forwardThe management of ?Nova Industries Inc. manufacturing gasoline and diesel engines through two production departments, Fabrication and Assembly. Management needs accurate product cost information in order to guide product strategy. Presently, the company uses a single plantwide factory overhead rate for allocating factory overhead to the two products. However, management is considering the multiple production department factory overhead rate method. The following factory overhead was budgeted for Nova: In addition, the direct labor hours (dlh) used to produce a unit of each product in each epartment were determined from engineering records, as follows: a. Determine the per unit factory overhead allocated to the gasoline and diesel enignes under the single plantwide factory overhead rate method, using direct labor hours as the activity base. b. Determine the per-unit factory overhead allocated to the gasoline and diesel engines under the multiple production department factory overhead…arrow_forwardJones Inc. is a manufacturer that uses traditional costing system to allocate overhead cost where they use direct labor cost as the allocation basis. Lately, the CFO of the company had become increasingly aware because of the imbalance between product’s budgeted and actual cost. Horfield Inc. makes four products: Round, Rectangular, Square and Triangle The costs for Direct Labor, Direct Material and Overhead are as of below: Round Rectangular Square Triangle Units Produced 800 1500 800 1200 DM, $ 100,000 200,000 150,000 250,000 DL Hour 10,000 30,000 40,000 20,000 Avg Cost per DL hour $10/ per hour Overhead Cost 200% of DL cost Overhead Cost Driver Allocation Base Total Cost Cost Driver Quantity Depreciation 300,000 Machine Hour 3,000 Setup 700,000 Setup Hour 1,000 Rent 1,000,000 Square Feet 100,000 Resource used by Products Cost Driver Round…arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning