Managerial Accounting: Creating Value in a Dynamic Business Environment

12th Edition

ISBN: 9781260417074

Author: HILTON, Ronald

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 22E

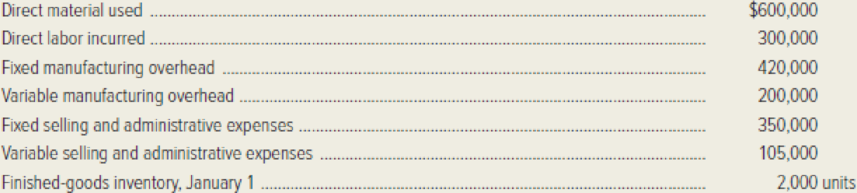

Easton Pump Company’s planned production for the year just ended was 20,000 units. This production level was achieved, and 21,000 units were sold. Other data follow:

The cost per unit remained the same in the current year as in the previous year. There were no work-in-process inventories at the beginning or end of the year.

Required:

- 1. What would be Easton Pump Company’s finished-goods inventory cost on December 31 under the variable-costing method?

- 2. Which costing method, absorption or variable costing, would show a higher operating income for the year? By what amount?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A manufacturer reports the following costs to produce 21,000 units in its first year of operations: Direct materials, $21 per unit, Direct labor, $17 per unit, Variable overhead, $231,000, and Fixed overhead, $357,000. Of the 21,000 units produced, 20,100 were sold, and 900 remain in inventory at year-end. Under variable costing, the value of the inventory is:

Sierra Company incurs the following costs to produce and sell a single product.

(picture1)

During the last year, 25,000 units were produced and 22,000 units were sold. The Finished Goodsinventory account at the end of the year shows a balance of $72,000 for the 3,000 unsold units.Required:1. Is the company using absorption costing or variable costing to cost units in the Finished Goods inventory account? Show computations to support your answer.2. Assume that the company wishes to prepare financial statements for the year to issue to its stockholders.a. Is the $72,000 figure for Finished Goods inventory the correct amount to use on these statements for external reporting purposes? Explain.b. At what dollar amount should the 3,000 units be carried in the inventory for externalreporting purposes?

During the most recent year, ABC Company reported the following data. During the year 10,000 units were produced and 9,000 units were sold. There were no units in beginning inventory. The following costs were incurred: direct materials = $8 per unit; direct labor = $5 per unit; variable overhead = $4 per unit; fixed overhead per unit = $5 per unit. Fixed selling and administrative expenses = $100,000 in total. Calculate cost of ending inventory under absorption costing.

Group of answer choices

$23,000

$26,000

$22,000

$32,000

Chapter 8 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 8 - Briefly explain the difference between absorption...Ch. 8 - Timing is the key in distinguishing between...Ch. 8 - The term direct costing is a misnomer. Variable...Ch. 8 - When inventory increases, will absorption-costing...Ch. 8 - Why do many managers prefer variable costing over...Ch. 8 - Explain why some management accountants believe...Ch. 8 - Prob. 7RQCh. 8 - Why do proponents of absorption costing argue that...Ch. 8 - Why do proponents of variable costing prefer...Ch. 8 - Which is more consistent with cost-volume-profit...

Ch. 8 - Explain how the accounting definition of an asset...Ch. 8 - List and define four types of product quality...Ch. 8 - Explain the difference between observable and...Ch. 8 - Prob. 14RQCh. 8 - What is meant by a products grade, as a...Ch. 8 - Prob. 16RQCh. 8 - Prob. 17RQCh. 8 - Explain three strategies of environmental cost...Ch. 8 - Prob. 19RQCh. 8 - Manta Ray Company manufactures diving masks with a...Ch. 8 - Information taken from Tuscarora Paper Companys...Ch. 8 - Easton Pump Companys planned production for the...Ch. 8 - Pandora Pillow Companys planned production for the...Ch. 8 - Bianca Bicycle Company manufactures mountain bikes...Ch. 8 - Refer to the data given in the preceding exercise...Ch. 8 - Prob. 26ECh. 8 - Prob. 27ECh. 8 - The following costs were incurred by Osaka Metals...Ch. 8 - San Mateo Circuitry manufactures electrical...Ch. 8 - Prob. 31ECh. 8 - Skinny Dippers, Inc. produces nonfat frozen...Ch. 8 - Yellowstone Company began operations on January 1...Ch. 8 - Outback Corporation manufactures tactical LED...Ch. 8 - Great Outdoze Company manufactures sleeping bags,...Ch. 8 - Dayton Lighting Company had operating income for...Ch. 8 - Prob. 37PCh. 8 - Chataqua Can Company manufactures metal cans used...Ch. 8 - Advanced Technologies (AT) produces two...Ch. 8 - Laser News Technology, Inc. manufactures...Ch. 8 - Prob. 42CCh. 8 - Refer to the information given in the preceding...Ch. 8 - Prob. 44C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Click the Chart sheet tab. On the screen is a column chart showing ending inventory costs. During a deflationary period, which bar (A, B, or C) represents FIFO costing, which represents LIFO costing, and which represents weighted average? Explain your reasoning. On January 4 following year-end, Rio Enterprises received a shipment of 60 units of product costing 580 each. These units had been ordered by Del in December and had been shipped to him on December 27. They were shipped FOB shipping point. Revise the FIFOLIFO3 worksheet to include this shipment. Preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Save the completed file as FIFOLIFOT. Using the FIFOLIFO3 file, prepare a 3-D bar (stacked) chart showing the cost of goods sold and ending inventory under each of the four inventory cost flow assumptions. No Chart Data Table is needed. Use the values in the Calculations Section of the worksheet for your chart. Enter your name somewhere on the chart. Save the file again as FIFOLIFO3. Print the chart.arrow_forwardPattison Products, Inc., began operations in October and manufactured 40,000 units during the month with the following unit costs: Fixed overhead per unit = 280,000/40,000 units produced = 7. Total fixed factory overhead is 280,000 per month. During October, 38,400 units were sold at a price of 24, and fixed marketing and administrative expenses were 130,500. Required: 1. Calculate the cost of each unit using absorption costing. 2. How many units remain in ending inventory? What is the cost of ending inventory using absorption costing? 3. Prepare an absorption-costing income statement for Pattison Products, Inc., for the month of October. 4. What if November production was 40,000 units, costs were stable, and sales were 41,000 units? What is the cost of ending inventory? What is operating income for November?arrow_forwardAt the end of the first year of operations, 21,500 units remained in the finished goods inventory. The unit manufacturing costs during the year were as follows: Determine the cost of the finished goods inventory reported on the balance sheet under (a) the absorption costing concept and (b) the variable costing concept.arrow_forward

- Chassen Company, a cracker and cookie manufacturer, has the following unit costs for the month of June: A total of 100,000 units were manufactured during June, of which 10,000 remain in ending inventory. Chassen uses the first-in, first-out (FIFO) inventory method, and the 10,000 units are the only finished goods inventory at June 30. Under the absorption costing concept, the value of Chassens June 30 finished goods inventory would be: a. 50,000. b. 70,000. c. 85,000. d. 145,000.arrow_forwardUsing the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forwardLast year, Orsen Company produced 25,000 juicers and sold 26,500 juicers for 60 each. The actual variable unit cost is as follows: Fixed overhead was 320,000. Fixed selling expenses consisted of advertising copayments totaling 110,000. Fixed administrative expenses were 236,000. There were no beginning and ending work-in-process inventories. Beginning finished goods inventory was 148,000 for 4,000 juicers. The value of ending inventory reported on the financial statements was Refer to the information in 2.24. The gross margin percentage for last year was a. 12.57% b. 55.67% c. 28.95% d. 38.33%arrow_forward

- Ellerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Refer to Exercise 2.21. Last calendar year, Ellerson recognized revenue of 1,312,000 and had selling and administrative expenses of 204,600. Required: 1. What is the cost of goods sold for last year? 2. Prepare an income statement for Ellerson for last year.arrow_forwardThe following information pertains to Vladamir, Inc., for last year: There are no work-in-process inventories. Normal activity is 100,000 units. Expected and actual overhead costs are the same. Costs have not changed from one year to the next. Required: 1. How many units are in ending inventory? 2. Without preparing an income statement, indicate what the difference will be between variable-costing income and absorption-costing income. 3. Assume the selling price per unit is 29. Prepare an income statement using (a) variable costing and (b) absorption costing.arrow_forwardFor each of the following independent situations, calculate the missing values: 1. The Belen plant purchased 78,300 of direct materials during June. Beginning direct materials inventory was 2,500, and direct materials used in production were 73,500. What is ending direct materials inventory? 2. Forster Company produced 14,000 units at an average cost of 5.90 each. The beginning inventory of finished goods was 3,422. (The average unit cost was 5.90.) Forster sold 14,120 units. How many units remain in ending finished goods inventory? 3. Beginning work in process (WIP) was 116,000, and ending WIP was 117,300. If total manufacturing costs were 349,000, what was the cost of goods manufactured? 4. If the conversion cost is 84 per unit, the prime cost is 55, and the manufacturing cost per unit is 105, what is the direct materials cost per unit? 5. Total manufacturing costs for August were 412,000. Prime cost was 64,000, and beginning WIP was 76,000. The cost of goods manufactured was 434,000. Calculate the cost of overhead for August and the cost of ending WIP.arrow_forward

- Last year, Orsen Company produced 25,000 juicers and sold 26,500 juicers for 60 each. The actual variable unit cost is as follows: Fixed overhead was 320,000. Fixed selling expenses consisted of advertising copayments totaling 110,000. Fixed administrative expenses were 236,000. There were no beginning and ending work-in-process inventories. Beginning finished goods inventory was 148,000 for 4,000 juicers. The value of ending inventory reported on the financial statements was a. 55,500 b. 92,500 c. 66,500 d. 39,900arrow_forwardOn April 30, the end of the first month of operations, Joplin Company prepared the following income statement, based on the absorption costing concept: If the fixed manufacturing costs were 450,000 and the fixed selling and administrative expenses were 165,000, prepare an income statement according to the variable costing concept.arrow_forwardThe following data were adapted from a recent income statement of Caterpillar Inc. (CAT) for the year ended December 31: Assume that 8,500 million of cost of goods sold and 4,000 million of selling, administrative, and other expenses were fixed costs. Inventories at the beginning and end of the year were as follows: Also, assume that 30% of the beginning and ending inventories were fixed costs. a. Prepare an income statement according to the variable costing concept for Caterpillar Inc. Round numbers to nearest million. b. Explain the difference between the amount of operating income reported under the absorption costing and variable costing concepts. Round numbers to nearest million.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License