Managerial Accounting: Creating Value in a Dynamic Business Environment

12th Edition

ISBN: 9781260417074

Author: HILTON, Ronald

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 8, Problem 38P

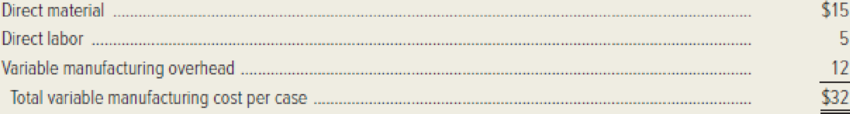

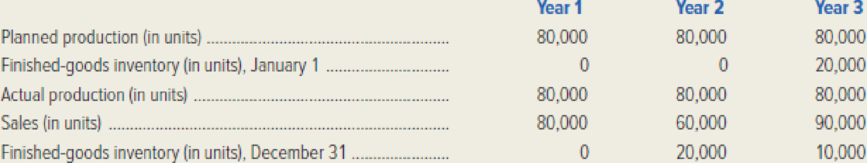

Chataqua Can Company manufactures metal cans used in the food-processing industry. A case of cans sells for $50. The variable costs of production for one case of cans are as follows:

Variable selling and administrative costs amount to $1 per case. Budgeted fixed manufacturing

Actual costs were the same as the budgeted costs.

Required:

- 1. Prepare operating income statements for Chataqua Can Company for its first three years of operations using:

- a. Absorption costing.

- b. Variable costing.

- 2. Reconcile Chataqua Can Company’s operating income reported under absorption and variable costing for each of its first three years of operation. Use the shortcut method.

- 3. Suppose that during Chataqua’s fourth year of operation actual production equals planned production, actual costs are as expected, and the company ends the year with no inventory on hand.

- a. What will be the difference between absorption-costing income and variable-costing income in year 4?

- b. What will be the relationship between total operating income for the four-year period as reported under absorption and variable costing? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Paney Company makes and sells calendars. The information on the cost per unit is as follows:

Direct materials

$1.50

Direct labor

1.20

Variable overhead

0.90

Variable marketing expense

0.40

The fixed marketing expense totaled $13,000, and the fixed administrative expense totaled $35,000. The price per calendar is $10. How many calendars must Paney sell next year to earn an operating income of $24,600?

Paney Company makes and sells calendars. The information on the cost per unit is as follows:

Direct materials

$1.50

Direct labor

1.20

Variable overhead

0.90

Variable marketing expense

0.40

The fixed marketing expense totaled $13,000, and the fixed administrative expense totaled $35,000. The price per calendar is $10. What is the variable product expense per unit?

a.$1.30

b.$3.60

c.$5.00

d.$4.60

e.$4.00

Andretti Company has a single product called a Dak. The company normally produces and sells 85,000 Daks each year at a selling

price of $58 per unit. The company's unit costs at this level of activity are given below:

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Variable selling expenses

Fixed selling expenses

Total cost per unit

A number of questions relating to the production and sale of Daks follow. Each question is independent.

Required:

1-a. Assume that Andretti Company has sufficient capacity to produce 106,250 Daks each year without any increase in fixed

manufacturing overhead costs. The company could increase its unit sales by 25% above the present 85,000 units each year if it were

willing to increase the fixed selling expenses by $130,000. What is the financial advantage (disadvantage) of investing an additional

$130,000 in fixed selling expenses?

1-b. Would the additional investment be justified?

2. Assume again that Andretti…

GOLD Company has a single product called a Goof. The company normally produces and sells 60,000 Goofs each year at a selling price of $33 per unit. The company’s unit costs at this level of activity are:

Direct materials

$10.00

Direct labour

4.25

Variable manufacturing overhead

2.20

Fixed manufacturing overhead

5.00

Variable selling expenses

1.25

Fixed selling expenses

3.50

Total cost per unit

$26.50

A number of questions relating to the production and sale of Goofs follow. Consider each question separately.

Required:

Assume that GOLD Company has sufficient capacity to produce 90,000 Goofs every year without any increase in fixed manufacturing overhead costs. The company could increase its sales by 20% above the present 60,000 units each year if it were willing to increase the fixed selling expenses by $82,000. Would the increased fixed expenses be justified? Show your calculations.

Chapter 8 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 8 - Briefly explain the difference between absorption...Ch. 8 - Timing is the key in distinguishing between...Ch. 8 - The term direct costing is a misnomer. Variable...Ch. 8 - When inventory increases, will absorption-costing...Ch. 8 - Why do many managers prefer variable costing over...Ch. 8 - Explain why some management accountants believe...Ch. 8 - Prob. 7RQCh. 8 - Why do proponents of absorption costing argue that...Ch. 8 - Why do proponents of variable costing prefer...Ch. 8 - Which is more consistent with cost-volume-profit...

Ch. 8 - Explain how the accounting definition of an asset...Ch. 8 - List and define four types of product quality...Ch. 8 - Explain the difference between observable and...Ch. 8 - Prob. 14RQCh. 8 - What is meant by a products grade, as a...Ch. 8 - Prob. 16RQCh. 8 - Prob. 17RQCh. 8 - Explain three strategies of environmental cost...Ch. 8 - Prob. 19RQCh. 8 - Manta Ray Company manufactures diving masks with a...Ch. 8 - Information taken from Tuscarora Paper Companys...Ch. 8 - Easton Pump Companys planned production for the...Ch. 8 - Pandora Pillow Companys planned production for the...Ch. 8 - Bianca Bicycle Company manufactures mountain bikes...Ch. 8 - Refer to the data given in the preceding exercise...Ch. 8 - Prob. 26ECh. 8 - Prob. 27ECh. 8 - The following costs were incurred by Osaka Metals...Ch. 8 - San Mateo Circuitry manufactures electrical...Ch. 8 - Prob. 31ECh. 8 - Skinny Dippers, Inc. produces nonfat frozen...Ch. 8 - Yellowstone Company began operations on January 1...Ch. 8 - Outback Corporation manufactures tactical LED...Ch. 8 - Great Outdoze Company manufactures sleeping bags,...Ch. 8 - Dayton Lighting Company had operating income for...Ch. 8 - Prob. 37PCh. 8 - Chataqua Can Company manufactures metal cans used...Ch. 8 - Advanced Technologies (AT) produces two...Ch. 8 - Laser News Technology, Inc. manufactures...Ch. 8 - Prob. 42CCh. 8 - Refer to the information given in the preceding...Ch. 8 - Prob. 44C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bobcat uses a traditional cost system and estimates next years overhead will be $800.000, as driven by the estimated 25,000 direct labor hours. It manufactures three products and estimates the following costs: If the labor rate is $30 per hour, what is the per-unit cost of each product?arrow_forwardColonels uses a traditional cost system and estimates next years overhead will be $480,000, with the estimated cost driver of 240,000 direct labor hours. It manufactures three products and estimates these costs: If the labor rate is $25 per hour, what is the per-unit cost of each product?arrow_forwardRoper Furniture manufactures office furniture and tracks cost data across their process. The following are some of the costs that they incur. Classify these costs as fixed or variable costs, and as product costs or period costs. Wood used to produce desks ($125,00 per desk) Production labor used to produce desks ($15 per hour) Production supervisor salary ($45,000 per year) Depreciation on factory equipment ($60,000 per year) Selling and administrative expenses ($45,000 per year) Rent on corporate office ($44,000 per year) Nails, glue, and other materials required to produce desks (varies per desk) Utilities expenses for production facility Sales staff commission (5% of gross sales)arrow_forward

- Krouse Company produces two products, forged putter heads and laminated putter heads, which are sold through specialty golf shops. The company is in the process of developing itsoperating budget for the coming year. Selected data regarding the companys two products areas follows: Manufacturing overhead is applied to units using direct labor hours. Variable manufacturing overhead Ls projected to be 25,000, and fixed manufacturing overhead is expected to be15,000. The estimated cost to produce one unit of the laminated putter head is: a. 42. b. 46. c. 52. d. 62.arrow_forwardBox Springs, Inc., makes two sizes of box springs: twin and double. The direct material for the twin is $25 per unit and $40 s used in direct labor, while the direct material for the double is $40 per unit, and the labor cost is $50 per unit. Box Springs estimates it will make 5,000 twins and 9,000 doubles in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forwardHatch Manufacturing produces multiple machine parts. The theoretical cycle time for one of its products is 65 minutes per unit. The budgeted conversion costs for the manufacturing cell dedicated to the product are 12,960,000 per year. The total labor minutes available are 1,440,000. During the year, the cell was able to produce 0.6 units of the product per hour. Suppose also that production incentives exist to minimize unit product costs. Required: 1. Compute the theoretical conversion cost per unit. 2. Compute the applied conversion cost per minute (the amount of conversion cost actually assigned to the product). 3. Discuss how this approach to assigning conversion cost can improve delivery time performance. Explain how conversion cost acts as a performance driver for on-time deliveries.arrow_forward

- Cadre, Inc., sells a single product with a selling price of $120 and variable costs per unit of $90. The companys monthly fixed expenses are $180,000. What is the companys break-even point in units? What is the companys break-even point in dollars? Prepare a contribution margin income statement for the month of October when they will sell 10,000 units. How many units will Cadre need to sell in order to realize a target profit of $300,000? What dollar sales will Cadre need to generate in order to realize a target profit of $300,000? Construct a contribution margin income statement for the month of August that reflects $2,400,000 in sales revenue for Cadre, Inc.arrow_forwardBox Springs. Inc., makes two sizes of box springs: queen and king. The direct material for the queen is $35 per unit and $55 is used in direct labor, while the direct material for the king is $55 per unit, and the labor cost is $70 per unit. Box Springs estimates it will make 4,300 queens and 3,000 kings in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forwardCarsen Company produces handcrafted pottery that uses two inputs: materials and labor. During the past quarter, 24,000 units were produced, requiring 96,000 pounds of materials and 48,000 hours of labor. An engineering efficiency study commissioned by the local university revealed that Carsen can produce the same 24,000 units of output using either of the following two combinations of inputs: The cost of materials is 8 per pound; the cost of labor is 12 per hour. Required: 1. Compute the output-input ratio for each input of Combination F1. Does this represent a productivity improvement over the current use of inputs? What is the total dollar value of the improvement? Classify this as a technical or an allocative efficiency improvement. 2. Compute the output-input ratio for each input of Combination F2. Does this represent a productivity improvement over the current use of inputs? Now, compare these ratios to those of Combination F1. What has happened? 3. Compute the cost of producing 24,000 units of output using Combination F1. Compare this cost to the cost using Combination F2. Does moving from Combination F1 to Combination F2 represent a productivity improvement? Explain.arrow_forward

- Ottis, Inc., uses 640,000 plastic housing units each year in its production of paper shredders. The cost of placing an order is 30. The cost of holding one unit of inventory for one year is 15.00. Currently, Ottis places 160 orders of 4,000 plastic housing units per year. Required: 1. Compute the economic order quantity. 2. Compute the ordering, carrying, and total costs for the EOQ. 3. How much money does using the EOQ policy save the company over the policy of purchasing 4,000 plastic housing units per order?arrow_forwardRose Company has a relevant range of production between 10,000 and 25.000 units. The following cost data represents average cost per unit for 15,000 units of production. Using the cost data from Rose Company, answer the following questions: If 10,000 units are produced, what is the variable cost per unit? If 18,000 units are produced, what is the variable cost per unit? If 21,000 units are produced, what are the total variable costs? If 11,000 units are produced, what are the total variable costs? If 19,000 units are produced, what are the total manufacturing overhead costs incurred? If 23,000 units are produced, what are the total manufacturing overhead costs incurred? If 19,000 units are produced, what are the per unit manufacturing overhead costs incurred? If 25,000 units are produced, what are the per unit manufacturing overhead costs incurred?arrow_forwardKerr Manufacturing sells a single product with a selling price of $600 with variable costs per unit of $360. The companys monthly fixed expenses are $72,000. What is the companys break-even point in units? What is the companys break-even point in dollars? Prepare a contribution margin income statement for the month of January when they will sell 500 units. How many units will Kerr need to sell in order to realize a target profit of $120,000? What dollar sales will Kerr need to generate in order to realize a target profit of $120,000? Construct a contribution margin income statement for the month of June that reflects $600,000 in sales revenue for Kerr Manufacturing.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Job Costing and Spoilage | Topic 2 | Spoilage, Re-work, and Scrap; Author: Samantha Taylor;https://www.youtube.com/watch?v=VP55_W2oXic;License: CC-BY