Managerial Accounting: Creating Value in a Dynamic Business Environment

12th Edition

ISBN: 9781260417074

Author: HILTON, Ronald

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 32P

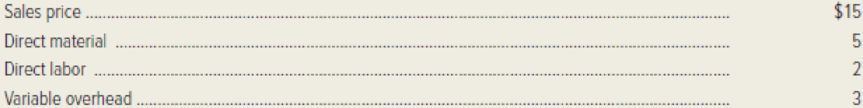

Skinny Dippers, Inc. produces nonfat frozen yogurt. The product is sold in five-gallon containers, which have the following price and variable costs.

Budgeted fixed

Required:

- 1. Compute the product cost per container of frozen yogurt under (a) variable costing and (b) absorption costing.

- 2. Prepare operating income statements for 20x1 using (a) absorption costing and (b) variable costing.

- 3. Reconcile the operating income reported under the two methods by listing the two key places where the income statements differ.

- 4. Reconcile the operating income reported under the two methods using the shortcut method.

- 5. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how the solution will change if the following information changes: the selling price and direct-material cost per unit are $16.00 and $4.50, respectively.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

CABADBARAN CORP., produces non-fat yogurt which it sells to restaurants and ice cream shops. The

product is sold in 10-gallon containers, which have the following price and variable costs.

Sales price

Direct materials

Direct labor

Variable overhead

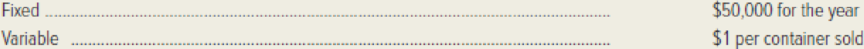

Budgeted fixed overhead in 2019, the company's first year of operations, was P600,000. Actual

production was 150,000 10-gallon containers, of which 125,000 were sold. CABADBARAN incurred the

following selling and administrative expenses.

Fixed

Variable

REQUIREMENTS:

(a) Compute the unit product cost per container of frozen yogurt under variable costing and

absorption costing, respectively.

(b)

2.

P30

10

4

P100,000 for the year

P2 per container sold

Prepare the operating income statements for 2019 using absorption costing and variable costing.

Reconcile the operating income reported under the two methods.

(c)

(d)

Compute the throughput margin and income under throughput costing.

Chandler Packaged Treats (CPT) sells a specialty pet food to pet stores. CPT management prides itself on its scientific management

methods. Applying those methods, the controller estimates the following monthly costs based on 10,000 units (produced and sold):

Direct material

Direct labor

Manufacturing overhead

Selling, general, and administrative

Total

Required:

a. Compute CPT's unit selling price that will yield a profit of $200,000, given sales of 10,000 units.

b. What dollar sales does CPT need to achieve to generate a 15 percent profit on sales, assuming variable costs per unit are 55

percent of the selling price per unit and fixed costs are $188,100.

c. Management believes that a selling price of $100.00 per unit is reasonable given current market conditions. How many units must

CPT sell to generate the revenues (dollar sales) determined in requirement (b)?

Total Annual Costs

(10,000 units)

$ 128,000

60,000

132,000

100,000

$ 420,000

Complete this question by entering your answers…

Oat Treats manufactures various types of cereal bars featuring oats. Simmons Cereal Company has approached Oat Treats with a

proposal to sell the company its top selling oat cereal bar at a price of $27,500 for 20,000 bars. The costs shown are associated with

production of 20,000 oat bars currently:

Direct material

Direct labor

Manufacturing overhead

Total

The manufacturing overhead consists of $3,000 of variable costs with the balance being allocated to fixed costs.

PLEASE NOTE: Costs per unit are rounded to two decimal places and shown with "$" and commas as needed (i.e. $1,234.56). All

other dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345).

1. What is Oat Treats' relevant cost?

$14,000

6,000

8,000

$28,000

2. What does Simmons Cereal's offer cost?

3. If Oat Treats accepts the offer, what will the effect on profit be?

o Incremental dollar amount =

o Increase or Decrease?

no quotes.

Please note: Your answer is either "Increase" or…

Chapter 8 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 8 - Briefly explain the difference between absorption...Ch. 8 - Timing is the key in distinguishing between...Ch. 8 - The term direct costing is a misnomer. Variable...Ch. 8 - When inventory increases, will absorption-costing...Ch. 8 - Why do many managers prefer variable costing over...Ch. 8 - Explain why some management accountants believe...Ch. 8 - Prob. 7RQCh. 8 - Why do proponents of absorption costing argue that...Ch. 8 - Why do proponents of variable costing prefer...Ch. 8 - Which is more consistent with cost-volume-profit...

Ch. 8 - Explain how the accounting definition of an asset...Ch. 8 - List and define four types of product quality...Ch. 8 - Explain the difference between observable and...Ch. 8 - Prob. 14RQCh. 8 - What is meant by a products grade, as a...Ch. 8 - Prob. 16RQCh. 8 - Prob. 17RQCh. 8 - Explain three strategies of environmental cost...Ch. 8 - Prob. 19RQCh. 8 - Manta Ray Company manufactures diving masks with a...Ch. 8 - Information taken from Tuscarora Paper Companys...Ch. 8 - Easton Pump Companys planned production for the...Ch. 8 - Pandora Pillow Companys planned production for the...Ch. 8 - Bianca Bicycle Company manufactures mountain bikes...Ch. 8 - Refer to the data given in the preceding exercise...Ch. 8 - Prob. 26ECh. 8 - Prob. 27ECh. 8 - The following costs were incurred by Osaka Metals...Ch. 8 - San Mateo Circuitry manufactures electrical...Ch. 8 - Prob. 31ECh. 8 - Skinny Dippers, Inc. produces nonfat frozen...Ch. 8 - Yellowstone Company began operations on January 1...Ch. 8 - Outback Corporation manufactures tactical LED...Ch. 8 - Great Outdoze Company manufactures sleeping bags,...Ch. 8 - Dayton Lighting Company had operating income for...Ch. 8 - Prob. 37PCh. 8 - Chataqua Can Company manufactures metal cans used...Ch. 8 - Advanced Technologies (AT) produces two...Ch. 8 - Laser News Technology, Inc. manufactures...Ch. 8 - Prob. 42CCh. 8 - Refer to the information given in the preceding...Ch. 8 - Prob. 44C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sardi Incorporated is considering whether to continue to make a component or to buy it from an outside supplier. The company uses 12,600 of the components each year. The unit product cost of the component according to the company's cost accounting system is given as follows: Direct materials $ 8.40 Direct labor 5.40 Variable manufacturing overhead 1.20 Fixed manufacturing overhead 3.20 Unit product cost $ 18.20 Assume that direct labor is a variable cost. Of the fixed manufacturing overhead, 35% is avoidable if the component were bought from the outside supplier. In addition, making the component uses 1 minutes on the machine that is the company's current constraint. If the component were bought, time would be freed up for use on another product that requires 2 minutes on this machine and that has a contribution margin of $4.80 per unit. When deciding whether to make or buy the component, what cost of making the component should be compared to the price of buying the…arrow_forwardPUGNA CORP. is a company specializing in manufacturing and selling customized and specialized neck pillows. The selling price of each pillow is P750 per unit. On its first month of operations, 3,500 units were produced where 2,500 units were sold. Actual fixed costs are the same as budgeted fixed costs. The company is using a denominator level of activity of 4,000 units. Information on its costs was as follows: Variable costs: Direct materials 500,000 Direct labor 600,000 300,000 200,000 90,000 Manufacturing overhead Selling costs Administrative costs Fixed costs: 50,000 250,000 400,000 Selling costs Administrative costs Manufacturing overhead .If the company is using variable costing, how much is cost of goods sold and volume variance, respectively? P1,000,000; 50,000 F b. C. P1,000,000; 50,000 UF d. None; None а. P1,000,000; None 3. If the company is using absorption costing, how much is net income or (loss) for the first month of operations? P 85,000 b. P 35,000 с. а. (P10,000) d.…arrow_forwardOat Treats manufactures various types of cereal bars featuring oats. Simmons Cereal Company has approached Oat Treats with a proposal to sell the company its top selling oat cereal bar at a price of $27,500 for 20,000 bars. The costs shown are associated with production of 20,000 oat bars currently: The manufacturing overhead consists of $3,000 of variable costs with the balance being allocated to fixed costs. PLEASE NOTE: Costs per unit are rounded to two decimal places and shown with "$" and commas as needed (i.e. $1,234.56). All other dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). What is Oat Treats' relevant cost? What does Simmons Cereal's offer cost? If Oat Treats accepts the offer, what will the effect on profit be? Incremental dollar amount = _________ Increase or Decrease? . ___________ Please note: Your answer is either "Increase" or "Decrease" - capital first letters and no quotes.arrow_forward

- Sardi Inc. is considering whether to continue to make a component or to buy it from an outside supplier. The company uses 13,100 of the components each year. The unit product cost of the component according to the company's cost accounting system is given as follows: Direct materials $ 8.90 Direct labor 5.90 Variable manufacturing overhead 1.70 Fixed manufacturing overhead 3.70 Unit product cost $ 20.20 Assume that direct labor is a variable cost. Of the fixed manufacturing overhead, 20% is avoidable if the component were bought from the outside supplier. In addition, making the component uses 2 minutes on the machine that is the company's current constraint. If the component were bought, time would be freed up for use on another product that requires 4 minutes on this machine and that has a contribution margin of $5.30 per unit. When deciding whether to make or buy the component, what cost of making the component should be compared to the…arrow_forwardPalladium Inc. produces a variety of household cleaning products. Palladium’s controller has developed standard costs for the following four overhead items: Overhead Item Total Fixed Cost Variable Rate per DirectLabor Hour Maintenance $ 86,000 $0.20 Power 0.45 Indirect labor 140,000 2.10 Rent 35,000 Next year, Palladium expects production to require 90,000 direct labor hours. Required: 1. Prepare an overhead budget for the expected level of direct labor hours for the coming year. Palladium Inc. Overhead Budget For the Coming Year Variable costs: Rate per Hour Activity Level 90,000 Hours Maintenance $ $ Power Indirect labor Total variable cost $ Fixed costs: Maintenance $ Indirect labor Rent Total fixed costs $ Total overhead costs $ 2. Prepare an overhead budget that reflects…arrow_forwardAs the newly appointed Controller of Lynbrook, Inc. you have been asked to evaluate several scenarios that management is considering to improve the overall profitability of the company. Lynbrook manufactures and sells a product called a Wren, its only product. The company normally produces and sells 60,000 Wrens each year at a selling price of $32 per unit. The company's unit costs at this level of activity are included below: Direct materials $10.00 Direct labor 4.50 Variable manufacturing 2.30 overhead Fixed manufacturing overhead 5.00 ($300,000 total) Variable selling expenses 1.20 Fixed selling expenses 3.50 ($210,000 total) Total cost per unit $26.50 The CFO of Lynbrook would like your response to the following three (3) independent situations to present to the management team early next week. Situation #1 Assume that Lynbrook has sufficient capacity to produce 90,000 Wrens each year without any increase in fixed manufacturing overhead costs. The company could increase its unit…arrow_forward

- Berghof Foods manufactures various gourmet ethnic food products. Production of its specialty hummus requires a half pound of material per container, which costs $12 per pound and requires 45 minutes (i.e., 0:75 hour) of direct labor. Direct labor costs $20 per hour; the variable overhead rate is $10 per direct labor hour; and the fixed overhead rate is $6 per direct labor hour. What is the standard cost for each container of specialty hummus produced? Select one: O O O O O a. $21.00 per container b. $28.50 per container c. $33.00 per container d. $48.00 per container e. None of the abovearrow_forwardDance Creations manufactures authentic Hawallan hula skirts that are purchased for traditional Hawallan celebrations, costume parties, and other functions. During its first year of business, the company incurred the following costs: variable Cost per Hula skirt Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expenses Fixed Costs per Month $ 9.75 3.55 Fixed manufacturing overhead Fixed selling and administrative expenses Dance Creations charges $31 for each skirt that it sells. During the first month of operation, it made 1,540 skirts and sold 1,420. 1.20 0.60 Required 1 Required 2 Required: 1. Assuming Dance Creations uses variable costing, calculate the variable manufacturing cost per unit for last month. 2. Complete a contribution margin income statement for the last month. 3. Assuming Dance Creations uses full absorption costing, calculate the full manufacturing cost per unit for the last month. 4. Complete a full absorption costing…arrow_forwardMartinez Products manufactures a line of desk chairs. Martinez's production operations are divided into two departments — Department 1 and Department 2. The company uses a process costing system. Martinez incurred the following costs during the year to produce 25,700 chairs: Department 1 $863,500 Department 2 $287,000 If Martinez sells 22,600 chairs during the year, what will be the cost per chair produced? (Round your answer to two decimal places.) A. $38.21 B. $44.77 C. $33.60 D. $50.91arrow_forward

- Zion Manufacturing had always made its components in-house. However, Bryce Component Works had recently offered to supply one component, K2, at a price of $11 each. Zion uses 4,900 units of Component K2 each year. The cost per unit of this component is as follows: Direct materials $7.23 Direct labor 2.14 Variable overhead 1.29 Fixed overhead 4.00 Total $14.66 1. What are the alternatives facing Zion Manufacturing with respect to List the relevant costs for each alternative. If required, round your answers to the nearest cent. Total Relevant Cost Make $ per unit Buy $ per unit Differential Cost to Make $ per unit If Zion decides to purchase the component from Bryce, by how much will operating income increase or decrease? $ 3. Conceptual Connection: Which alternative is better?arrow_forwardVision Company is preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the amount of overhead that should be allocated to the individual product lines from the information provided below. Wall Mirrors Specialty Windows Units Produced 40 20 Material moves per product line 15 Direct labor hours per product line 200 300 Budgeted material handling costs: 50,000 Under a traditional costing system that allocates overhead on the basis of direct labor hours, the materials handling costs allocated to one unit of wall mirrors would be: a.RM1,000 BRM500 c.RM2,000 d.RM5,000arrow_forwardMartinez Products manufactures a line of desk chairs. Martinez's production operations are divided into two departments — Department 1 and Department 2. The company uses a process costing system. Martinez incurred the following costs during the year to produce 26,300 chairs: Department 1 $860,500 Department 2 $295,000 If Martinez sells 22,700 chairs during the year, what will be the cost per chair produced? (Round your answer to two decimal places.) A. $37.91 B. $50.90 C. $43.94 D. 32.72arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY