What is Overhead?

In cost accounting, overhead refers to those expenses which occur during the operating of a business. Overhead includes the fixed, variable, or semi-variable which is not directly involved with a company product or service. It is very important to analyze overhead expense as it helps the company in determining how much a company must charge for its products and services so that they can generate profit. Overhead expenses depend upon the nature of the business operations.

Overhead expenses are shown in the company’s income statement, where the amount of overhead expenses is deducted from its income to arrive at the net profit.

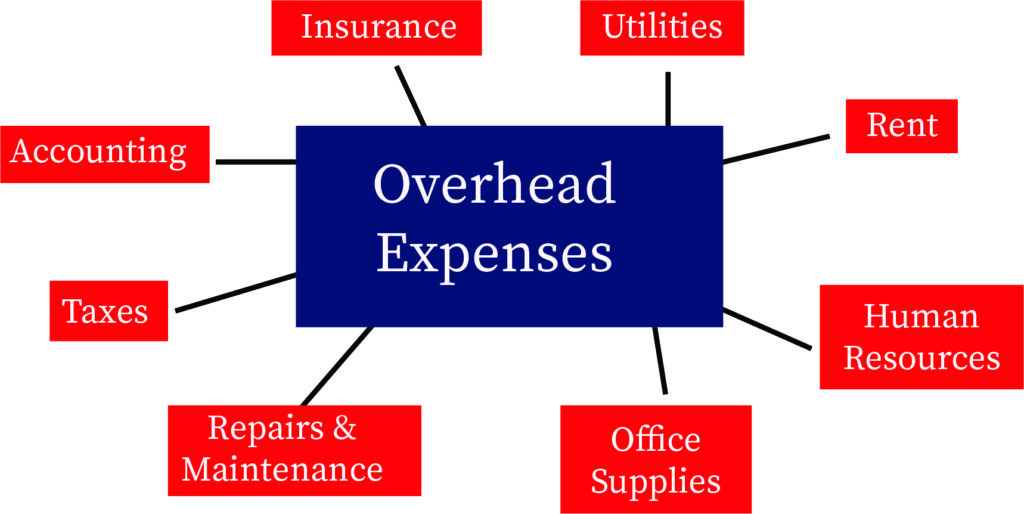

Examples of Overhead Expenses

The most common examples of overhead cost that are incurred in every business are,

1. Rent: Rent is the cost that is paid by the business for the premises or land they are using for operating the business. Rent may be paid by the business on a quarterly, monthly, or yearly basis, it depends upon the agreement that is done between the owner and tenant.

2. Insurance: To protect the business from any financial loss, the business incurs costs on insurance. The types of insurance that are taken by the business depend upon the risk that may cause loss to the business. For example: If the business wants to protect its business property or premises from any uncertain events like floods, thefts, etc. then, in this case, the business purchases property insurance.

3. Administrative Costs: Administrative costs refer to those costs which are incurred during the normal running of the business which includes costs like employees’ salaries, salaries paid to accountant, audit fees, legal fees. A business, if it wants can reduce its administrative costs by laying off some of its employees or by hiring employees on a contract basis, or by avoiding certain expenses like entertainment expenses.

4. Utilities: Utilities means the basic services that are an essential requirement of the business to support the main functions. Examples that are included under utilities are – power supply, high-speed internet, water supply, and telephone services.

5. Repairing and maintenance of machinery and motor vehicles: Repairs and maintenance expense is incurred in those businesses that use motor vehicles and machinery during the normal functioning of the business. Such business may include in the work of transporting service, parcel delivery, distributor, or may give the equipment on lease.So, there is a need for repairs and maintenance from time to time whenever they break down.

6. Sales and marketing: Sales and marketing expenses are incurred while the marketing or advertisement of the product and services of the companies. Examples of sales and marketing overhead are materials used for promotion like catalogs, posters. Paid advertisement, salaries of salesperson, commission given to sales staff. The reason for all these expenses on the marketing of the product is that to increase the demand for their companies’ products and services so that they become more popular among customers and the products can compete in the market with the similar products available.

Classifications of Overhead

Classifications of overhead are based on elements, Behavior, Functions.

1. Element wise classification

In element-wise classification, overheads are divided into 3 elements-

- Indirect material: Some parts of the material cost cannot belong to a particular product but it is absorbed by the cost units indirectly. Examples of indirect materials are – oil used for lubrication, fuel, etc.

- Indirect labor: When wages are paid to workers who are not engaged in the conversion of raw material into finished goods, that thing is called indirect material cost. As they are not directly related to the productions of goods but can be appropriated over products. Examples of indirect labor include the salary of foreman, overtime, or night shift bonus.

- Indirect Expenses: The expenses that cannot be allocated directly, but can be appropriated over products is called indirect expense cost. Examples of indirect expenses include – a depreciation of assets, rent of the premises, insurance.

2. Behavior-Wise Classification

The behavior-wise classification of overhead is categorized into three parts:

- Fixed Overhead: Fixed overhead refers to those costs which remain constant throughout the period. Fixed overhead does influence due to the change in the business activity levels. Examples of Fixed Overhead are salaries of a permanent employee, rent of the premises, depreciation of assets, licenses given by the government, property taxes.

- Variable Overhead: variable overheads refer to those overheads which vary with the production level of the business. It means when the production is high, the variable expenses will increase whereas when the production is low, the variable expense will decrease or it can be eliminated. Examples of variable overhead: sales and marketing expense, repairs and maintenance of the equipment, legal charges fees, shipping charges, etc.

- Semi-Variable Overheads: Semi-Variable costs include both fixed and variable overheads. It means they remain fixed at a certain level of output, while they vary with other levels of output. For example- the telephone charges, the rental elements are fixed, whereas charges for calls fall under variable overhead.

3. Function wise classification

In function wise classification of overhead, it is divided into 4 parts-

- Factory Overhead: Factory overhead refers to all the expenses other than direct material cost, direct wages, and direct expenses incurred in a factory in connection with manufacturing operations. Example of factory overhead includes: Rent of the factory premises, insurance related to the factory building, depreciation related to all fixed assets that are present in the factory, salary of a factory manager, salaries paid to factories’ staff, etc.

- Administration overhead: Administration overhead refers to all those overheads which are not directly related to the productions, sales, or marketing of the business. Examples of administration overhead: Salaries of general management, office rent, insurance related to the office building, depreciation of office furniture and machinery, office stationery, telephone charges of the office, etc.

- Selling overhead: Selling overhead refers to all the costs that are incurred while creating demand for the business goods and services in the market so that the product of the business can compete in the market. Examples of selling overhead include expenses related to the sales office, salary of sales manager, expenses of traveling agents, cost of training to a salesperson, etc.

- Distribution overhead: Distribution overhead refers to all those indirect expenses incurred from the time the product is ready in the factory till its delivery to its ultimate consumers. Examples of overhead include warehouse rent, insurance of warehouse, running and maintains of vehicles that are used for delivery, the salary of the driver, expense related to after-sale service, salary to the staff of the warehouse.

Context and Applications

This topic is significant in the professional exams for both undergraduate and graduate courses, especially for:

- BBA

- B.COM

- M.COM

Want more help with your accounting homework?

*Response times may vary by subject and question complexity. Median response time is 34 minutes for paid subscribers and may be longer for promotional offers.

Search. Solve. Succeed!

Study smarter access to millions of step-by step textbook solutions, our Q&A library, and AI powered Math Solver. Plus, you get 30 questions to ask an expert each month.

Overheads Homework Questions from Fellow Students

Browse our recently answered Overheads homework questions.

Search. Solve. Succeed!

Study smarter access to millions of step-by step textbook solutions, our Q&A library, and AI powered Math Solver. Plus, you get 30 questions to ask an expert each month.