a.

Classify the items that will come under the product cost and calculate the amount of cost of goods sold for the year 2017 income statement.

a.

Answer to Problem 2ATC

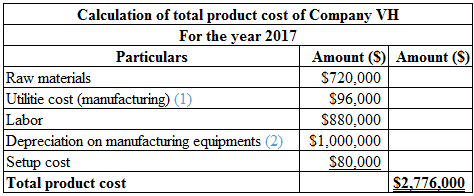

The items that will be classified under the product cost are as follows:

Table (1)

Hence, the total product cost of Company VH is $2,776,000.

The calculation of cost of goods sold is as follows:

Hence, the cost of goods sold is $2,400,000.

Explanation of Solution

The cost of goods sold:

The cost of goods sold is the total of all the expenses incurred by a company to sell the goods during the given period.

Working notes:

Calculate the per square foot as follows:

Hence, the per square foot value is $1.60.

Calculate the utility cost for manufacturing as follows:

Hence, the utility cost for manufacturing is $96,000.

(1)

Calculate the

Hence, the depreciation cost is $1,000,000.

(2)

Calculate the cost per unit as follows:

Hence, the cost per unit is $40.

(3)

Classify the items that will come under the upstream cost and calculate the amount of upstream cost expensed for the year 2017 income statement.

Answer to Problem 2ATC

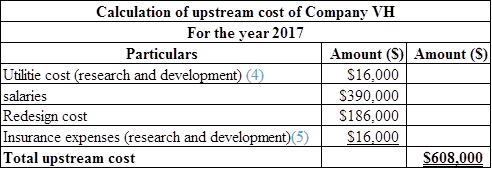

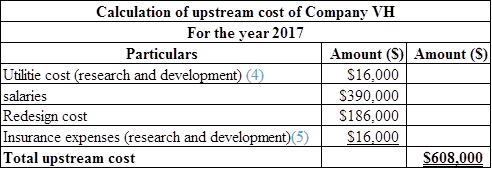

The items that will be classified under the upstream cost are as follows:

Table (2)

Hence, the total upstream expenses are $608,000.

Explanation of Solution

Upstream cost:

This cost is incurred before starting the manufacturing process. For example: research and development, and product design.

Working notes:

Calculate the per square foot as follows:

Hence, the per square foot value is $1.60.

Calculate the utility cost for manufacturing as follows:

Hence, the utility cost for manufacturing is $16,000

(4)

Calculate the amount of prepaid insurance as follows:

Hence, the prepaid insurance is $48,000.

Calculate the rate for insurance expenses as follows:

Hence, the rate for insurance expenses per employee is $4,000.

Calculate the insurance expenses on research and development as follows:

Hence, the insurance expenses on research and development is $16,000.

(5)

Note:

The accrued engineer’s salary $10,000 comes under the upstream cost but it is not considered for calculating the upstream cost because it is previous year’s cost.

Classify the items that will come under the downstream cost and calculate the amount of downstream cost expensed for the year 2017 income statement.

Answer to Problem 2ATC

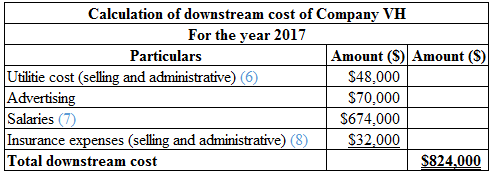

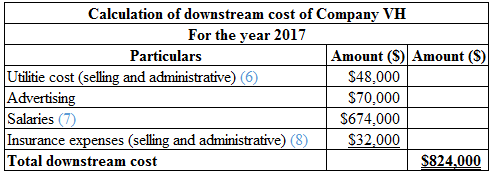

The items that will be classified under the downstream cost are as follows:

Table (3)

Hence, the total downstream expenses are $824,000.

Explanation of Solution

Downstream:

This cost is incurred after starting the manufacturing process. For example: marketing, distribution, and customer service.

Working notes:

Calculate the per square foot as follows:

Hence, the per square foot value is $1.60.

Calculate the utility cost for selling and administrative as follows:

Hence, the utility cost for selling and administrative cost is $48,000.

(6)

Calculate the amount of prepaid insurance as follows:

Hence, the prepaid insurance is $48,000.

Calculate the total salary as follows:

Hence, the total salary is $674,000.

(7)

Calculate the rate for insurance expenses as follows:

Hence, the rate for insurance expenses per employee is $4,000.

Calculate the insurance expenses on selling and administrative as follows:

Hence, the insurance expenses on selling and administrative is $32,000.

(8)

b.

Prepare the income statement.

b.

Answer to Problem 2ATC

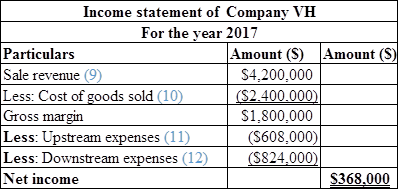

The calculation of the income statement is as follows:

Table (4

Hence, the net income of Company VH is $368,000.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Working notes:

Calculate the revenue as follows:

Hence, the revenue is $4,200,000.

(9)

Calculate the cost of goods sold as follows:

The calculation of cost of goods sold is as follows:

Hence, the cost of goods sold is $2,400,000.

(10)

Calculate the upstream expenses as follows:

Table (5)

Hence, the total upstream expenses are $608,000.

(11)

Calculate the downstream expenses as follows:

Table (6)

Hence, the total downstream expenses are $824,000.

(12)

Want to see more full solutions like this?

Chapter 10 Solutions

Survey Of Accounting

- What affect would closing an OVERAPPLIED Manufacturing Overhead account to Cost of Goods Sold have on the accounting records? Group of answer choices A. Cost of Goods Sold would increase B. Net Income would decrease C. Cost of Goods Sold would decrease Both A & Barrow_forward1. Which one of the following could not be used to describe a summary of a company's assets, liabilities, and capital at a specific date?a. Profit and loss accountb. Balance sheetc. Position statementd. Statement of financial condition 2. All indirect factory costs are recorded under the costing head?a. Prime costb. FOH costc. Direct labor costd. None of the abovearrow_forwardWhich of the following is a product cost? A) Sales commissions B) CEO's salary C) Delivery van depreciation D) Depreciation on production equipmentarrow_forward

- To determine the effect of different levels of production on the company’s income, move to cell B7 (Actual production). Change the number in B7 to the different production levels given in the table below. The first level, 100,000, is the current level. What happens to the operating income on both statements as production levels change? Enter the operating incomes in the following table. Does the level of production affect income under either costing method? Explain your findings.arrow_forwardUsing the data in P4-2 and Microsoft Excel: 1. Separate the variable and fixed elements. 2. Determine the cost to be charged to the product for the year. 3. Determine the cost to be charged to factory overhead for the year. 4. Determine the plotted data points using Chart Wizard. 5. Determine R2. 6. How do these solutions compare to the solutions in P4-2 and P4-3? 7. What does R2 tell you about this cost model?arrow_forwardStatement of cost of goods manufactured and income statement for a manufacturing company The following information is available for Robstown Corporation for 20Y8: Instructions 1. Prepare the 20Y8 statement of cost of goods manufactured. 2. Prepare the 20Y8 income statement.arrow_forward

- Which of the following relate(s) to gross profit margin? O a. the profit margin after subtracting variable manufacturing costs O b, a term often used in manufacturing businesses Oc a through c O d. the profit margin after subtracting direct costs. from wholesale revenue O e. a and barrow_forwardPart 1 Question #1 Describe the flow of costs through a product costing system for inventory valuation purposes (i.e., excluding non-manufacturing overhead costs). Address the following in your answer: The three types of inventory accounts and the three components of product costs. Classification of product costs as an asset and then as an expense. Make reference to the definition of an asset in the 2018 New Zealand Conceptual Frameworkarrow_forwardStatement 1: Cost Accounting relates to the conventional costing methods and techniques in accumulating the cost of a product, process, project or service, including both product and period cost in accumulating cost.Statement 2: Cost Accounting aims to reflect the correct complete financial picture/information of the entity to the different shareholders. a. Statement 1 is False, Statement 2 is True b. Statement 1 is True, Statement 2 is False c. Both statements are true d. Both statements are falsearrow_forward

- E4-1 Classifying fixed and variable costs Classify each of the following items of factory overhead as either a fixed or a variable cost. (Include any costs that you consider to be semivariable within the variable category. Remember that variable costs change in total as the volume of production changes.) a. Indirect labor b. Indirect materials c. Insurance on building d. Overtime premium pay e. Depreciation of building (straight-line method) f. Polishing compounds g. Depreciation of machinery (units-of-production method) h. Employer’s payroll taxes i. Property taxes j. Machine lubricants k. Employees’ hospital insurance (paid by employer) l. Labor for machine repairs m. Vacation pay n. Janitor’s wages o. Rent p. Small tools q. Plant manager’s salary r. Factory electricity s. Product inspector’s wagesarrow_forward6.Discuss the components in detail of the following financial statements for a manufacturing PLC:a. Statement of Profit or Loss (Income Statement)b. Statement of Financial Position (Balance Sheet)c. Statement of Changes in Owners’ Equityd. Statement of Cash Flows7. Explain cost accounting and its functions as well the distinguishing features of cost accounting systems for (a) job order costing, and (b) process costingarrow_forwardA-1 complete the table under the current cost system. A-2 determine which products, if any, should be dropped. C-1 Assume that CBI drops the product(s) identified in requirement (a) above. Calculate the gross profit margin percentage for the remaining products. Assume that CBI can sell all products that it manufactures and that it will use the excess capacity from dropping a product to produce more of the most profitable product.arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College