Concept explainers

a.

The total product cost and average cost per unit.

a.

Explanation of Solution

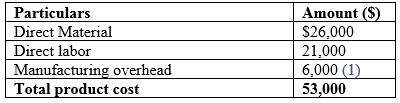

Product cost:

It is the cost incurred by the company during the process of manufacturing the product.

Given information:

- The raw material is $26,000.

- The wages for production workers are $21,000.

- Manufacturing equipment is $40,000, its salvage value is $4,000, and an expected life is 6 years.

- The completed production of Company S is 10,000 units.

The calculation of total product cost for the year 2018 is as follows:

Hence, the total cost of the product for the year 2018 is $53,000.

The calculation average cost per unit for the year 2018 is as follows:

Hence, the average cost per unit for the year 2018 is $5.30.

Working notes:

The calculation of manufacturing overheads is as follows:

Hence, the manufacturing overheads are $6,000.

(1)

b.

The cost of goods sold that appears in 2018 income statement.

b.

Explanation of Solution

Cost of goods sold

The cost of goods sold is the accumulation of all the direct costs incurred in the process of producing a product. It excludes the indirect expenses.

Given information:

- The total number of units sold by Company S is 8,000 units.

The calculation of total cost of goods sold for the year 2018 is as follows:

Hence, the total cost of goods sold is $41,400.

c.

The cost of ending inventory that appears on 31st December 2018 balance sheet.

c.

Explanation of Solution

Inventory:

It is the term for products that are ready for sale and raw materials that are used in the making of the final product.

Given information:

- The total number of units sold by Company S is 8,000 units.

- The completed production of Company S is 10,000 units.

The calculation of ending inventory for the year 2018 is as follows:

Hence, the ending inventory for the year 2018 is $10,600.

d.

The total amount of net income for the year 2018.

d.

Explanation of Solution

Financial statement:

The financial statement which reports the revenues and expenses from business operations and the result of those operations as the net income or net loss for a particular time period is referred to as an income statement.

Given information:

- The raw material is $26,000.

- The wages for production workers is $21,000.

- Manufacturing equipment is $40,000, its salvage value is $4,000, and an expected life is 6years.

- The total number of units sold by Company S is 8,000 units at cost of $9 per unit.

- The completed production of Company S is 10,000 units.

- The common stock of the Company S is $89,000.

- The purchased furniture for office at $32,000 and an expected life is 8years.

- The Company pays $12,000 as salary and $21,000 as wages for the production purpose.

- Company S pays 26,000 for the raw materials.

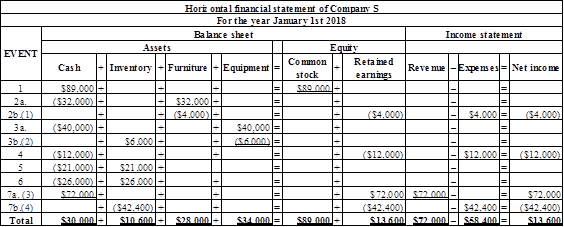

The calculation of net income of the Company S for the year 2018 is as follows:

Table (2)

Hence, the net income of the Company for the year 2018 is $13,600.

Working note:

The calculation of

Hence, the depreciation value of furniture is $4,000.

(1)

The calculation of depreciation value for manufacturing equipment’s:

Hence, the depreciation value of the manufacturing equipment is $6,000.

(2)

The calculation of total units sold at the rate of $9 per unit.

The total units sold by the Company S are 72,000.

(3)

The calculation of total inventory at the average cost per unit.

The total inventory at the average cost is 42,400.

(4)

e.

The total amount of net income for the year 2018.

e.

Explanation of Solution

Financial statement:

The financial statement which reports the revenues and expenses from the business operations and the result of those operations as net income or net loss for a particular time period is referred to as an income statement.

Given information:

- The raw material is 26,000.

- The wages for production workers is $21,000.

- Manufacturing equipment is $40,000, its salvage value is $4,000, and an expected life is 6years.

- The total number of units sold by Company S is 8,000 units at cost of $9 per unit.

- The completed production of Company S is 10,000 units.

- The common stock of the Company S is $89,000.

- The purchased furniture for office at $32,000 and an expected life is 8 years.

- The Company pays $12,000 as salary and $21,000 as wages for the production purpose.

- Company S pays 26,000 for raw materials.

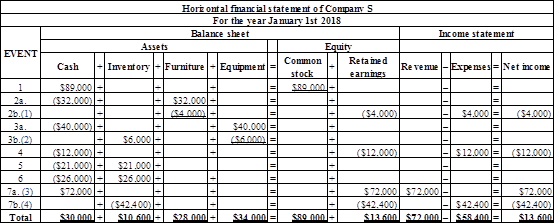

The calculation of

Table (3)

Hence, the net income of the Company for the year 2018 is $13,600.

Working note:

The calculation of depreciation value for furniture:

Hence, the depreciation value of furniture is $4,000.

(1)

The calculation of depreciation value for manufacturing equipment’s:

Hence, the depreciation value of manufacturing equipment is $6,000.

(2)

The calculation of total units sold at the rate of $9 per unit.

The total units sold by the Company S are 72,000.

(3)

The calculation of total inventory at the average cost per unit.

The total inventory at the average cost is 42,400.

(4)

f.

The total assets that appears on the balance sheet.

f.

Explanation of Solution

Financial statement:

The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as an income statement.

Given information:

- The raw material is $26,000.

- The wages for production workers is $21,000.

- Manufacturing equipment is $40,000, its salvage value is $4,000 and an expected life is 6years.

- The total number of units sold by Company S is 8,000 units at cost of $9 per unit.

- The completed production of Company S is 10,000 units.

- The common stock of the Company S is $89,000.

- The purchased furniture for office at $32,000 and an expected life is 8 years.

- The Company pays $12,000 as salary and $21,000 as wages for the production purpose.

- Company S pays 26,000 for raw materials.

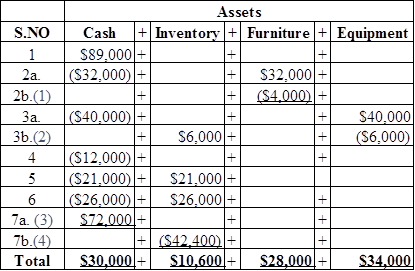

The table showing calculation of assets:

Table (4)

The calculation of total assets is as follows:

Hence, the total amount of assets of the Company for the year 2018 is $102,600.

Working note:

The calculation of depreciation value for furniture:

Hence, the depreciation value of furniture is $4,000.

(1)

The calculation of depreciation value for manufacturing equipment’s:

Hence, the depreciation value of manufacturing equipment is $6,000.

(2)

The calculation of total units sold at the rate of $9 per unit.

The total units sold by the Company S are 72,000.

(3)

The calculation of total inventory at the average cost per unit.

The total inventory at the average cost is 42,400.

(4)

Want to see more full solutions like this?

Chapter 10 Solutions

Survey Of Accounting

- Exercise 10-1 (Algo) Cost of plant assets LO C1 Rizio Company purchases a machine for $13,400, terms 1/10, n/60, FOB shipping point. Rizio paid within the discount period and took the $134 discount. Transportation costs of $303 were paid by Rizio. The machine required mounting and power connections costing $926. Another $437 is paid to assemble the machine, and $40 of materials are used to get it into operation. During installation, the machine was damaged and $320 worth of repairs were made. Complete the below table to calculate the cost recorded for this machine.arrow_forwardProblem #1 Assumptions: ABC Machine Corp. buys a specialty lathe for its metal products with an original equipment purchase price of $27,850. The lathe has an estimated economic life of six (6) years and an assumed salvage value of $1,390. Expected production over economic life of the lathe is 126,000 units in the following pattern: Yr 1 = 15,000 units; Yrs 2-6 = 22,200 units per year Calculate annual depreciation for the specialty lathe, using each of the four depreciation methods: Year 1 Year 3 Year 4 Method Straight line Units of production Sum-of-years'-digits Double declining balance Year 2 Year 5 Year 6 Totalsarrow_forwardQuestion Two Pass-Well Company Limited produces a product that passes through two processes, Process 1 and Process 2. Details of activities for the month of December, 2020 is as follows; Process 2 Process 1 @GHC200.00 Material introduced (4,000 units) Material added GHC25,000.00 Labour Costs (@GHC400 per hour) Output in units Scrap value of normal loss Note; i. Overhead is absorbed at 80% of labour costs. ii. Normal loss is estimated at 10% for both process. iii. No opening and closing stocks 200hrs 600hrs 3,500units GHC20 per unit 3,150units GHC40 per unit a. You are required to prepare the relevant accounts b. You are required to prepare the relevant Accounts With practical example, differentiate between cost assignment and cost apportionment; product cost and period costs; direct cost and indirect costarrow_forward

- Exercise 10-1 Cost of plant assets LO C1 Rizio Co. purchases a machine for $10,900, terms 1/10, n/60, FOB shipping point. Rizio paid within the discount period and took the $109 discount. Transportation costs of $246 were paid by Rizio. The machine required mounting and power connections costing $754. Another $355 is paid to assemble the machine and $40 of materials are used to get it into operation. During installation, the machine was damaged and $220 worth of repairs were made. Complete the below table to calculate the cost recorded for this machine.arrow_forwardProblem 11-02 The cost of equipment purchased by Skysong, Inc., on June 1, 2020, is $107,100. It is estimated that the machine will have a $6,300 salvage value at the end of its service life. Its service life is estimated at 7 years, its total working hours are estimated at 50,400, and its total production is estimated at 630,000 units. During 2020, the machine was operated 6,420o hours and produced 58,850 units. During 2021, the machine was operated 5,885 hours and produced 51,300 units. Compute depreciation expense on the machine for the year ending December 31, 2020, and the year ending December 31, 2021, using the following methods. (Round depreciation per unit to 2 decimal places, e.g. 15.25 and final answers to 0 decimal places, e.g. 45,892.) 2020 2021 (a) Straight-line (b) Units-of-output (c) Working hours $1 (d) Sum-of-the-years'-digits (e) Double-declining-balance (twice the straight-line rate) Click if you would like to Show Work for this question: Open Show Workarrow_forwardExercise 10-24 On December 31, 2020, Vaughn Inc. has a machine with a book value of $1,353,600. The original cost and related accumulated depreciation at this date are as follows. Machine $1,872,000 Less: Accumulated depreciation 518,400 Book value $1,353,600 Depreciation is computed at $86,400 per year on a straight-line basis.Presented below is a set of independent situations. For each independent situation, indicate the journal entry to be made to record the transaction. Make sure that depreciation entries are made to update the book value of the machine prior to its disposal. Your answer is partially correct. Try again. A fire completely destroys the machine on August 31, 2021. An insurance settlement of $619,200 was received for this casualty. Assume the settlement was received immediately. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If…arrow_forward

- Problem 5 A company manufactures product A, B and C. The actual joint expenses of manufacture for a period were RO 63,000. It was estimated that profits on each product as a percentage of sales would be 30%, 25% and 15% respectively. Subsequent expenses were: A B Material RO 1000 RO 750 RO 250 Direct wages RO 2000 RO 1250 RO 500 Overheads RO 1500 RO 1250 RO 750 Total RO 4500 RO 3250 RO 1500 Sales RO 60,000 RO 40,000 RO 25,000 Prepare a statement showing the apportionment of joint expenses. Product Estimated Estimated Actual Joint Actual Total Actual I Profit Total Estimated Subsequent Cost Cost Prorated on Estimated Profit Sales Value Total Cost Processing Cost Joint Cost Joint Costs (1) (2) (3) (4) (5)=(2-4) (6) (7) (8) (9) = 6+9 (2)-(9)arrow_forwardProblem 1 Purchase price of raw materials P100,000 Rebates on raw material purchases Import taxes Local taxes paid in relation to the purchase 1,500 Freight-in 12% VAT on the purchase price Interest expense related to the purchase 3,200 Utilities used on factories to 0, Wages of factory personnel Salaries of accountants 000 Depreciation of factory equipment Depreciation of the head office 00 00 2,800 Normal losses during production Abnormal losses during production General and administrative expenses Storage costs of work-in-process inventories Storage costs of finished goods inventories 00 00 Shipping costs on sale of finished goods How much is the total cost of inventories?arrow_forwardProblem 1-27A Importance of cost classification Campbell Manufacturing Company (CMC) was started when it acquired $80,000 by issuing common stock. During the first year of operations, the company incurred specifically identifiable product costs (materials, labor, and overhead) amounting to $75,000. CMC also incurred $60,000 of engineering design and planning costs. There was a debate regarding how the design and planning costs should be classified. Advocates of Option 1 believe that the costs should be classified as general, selling, and administrative costs. Advocates of Option 2 believe it is more appropriate to classify the design and planning costs as product costs. During the year, CMC made 5,000 units of product and sold 4,000 units at a price of $35 each. All transactions were cash transactions. Required 4. Assume a 30 percent income tax rate. Determine the amount of income tax expense under each of the two options. Identify the option that minimizes the amount of the company’s…arrow_forward

- Problem 1-27A Importance of cost classification Campbell Manufacturing Company (CMC) was started when it acquired $80,000 by issuing common stock. During the first year of operations, the company incurred specifically identifiable product costs (materials, labor, and overhead) amounting to $75,000. CMC also incurred $60,000 of engineering design and planning costs. There was a debate regarding how the design and planning costs should be classified. Advocates of Option 1 believe that the costs should be classified as general, selling, and administrative costs. Advocates of Option 2 believe it is more appropriate to classify the design and planning costs as product costs. During the year, CMC made 5,000 units of product and sold 4,000 units at a price of $35 each. All transactions were cash transactions. Required Prepare a GAAP-based income statement and balance sheet under each of the two options. Identify the option that results in financial statements that are more likely to leave…arrow_forwardProblem 1Purchase price of raw materials P100,000Rebates on raw material purchases 2,000Import taxes 17,000Local taxes paid in relation to the purchase 1,500Freight-in 5,00012% VAT on the purchase price 12,000Interest expense related to the purchase 3,200Utilities used on factories…arrow_forwardnabled: Midterm 2 Fall 2021 i Saved Help Submit In its first year of operations a company produced and sold 70,000 units of Product A at a selling price of $20 per unit and 17,500 units of P Bat a selling price of $40 per unit. Additional information relating to the company's only two products is shown below: Product A Product B Total Direct materials $ 436,300 $ 200,000 $ 249,500 $ 104,000 $ 685,800 304,000 608,000 $ 1,597,800 Direct labor Manufacturing overhead Cost of goods sold The company created an activity-based costing system that allocated its manufacturing overhead costs to four activities as follows: Manufacturing Activity Activity Cost Pool (and Activity Measure) Machining (machine-hours) Setups (setup hours) Product design (number of products) Other (organization-sustaining costs) Product A 90,000 75 Overhead Total Product B 62,500 300 $ 213,500 157,500 120,000 117,000 152,500 375 1 2 NA NA NA Total manufacturing overhead cost $608,000 The company's ABC implementation team…arrow_forward

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,