a.

Prepare an income statement and the cost of unused books.

a.

Answer to Problem 29P

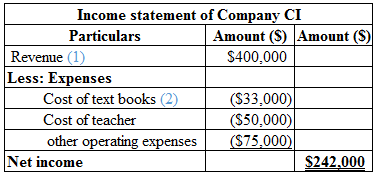

Calculation of income statement of the Company CI is as follows:

Table (1)

Hence, the net income is $242,000.

Calculation of cost of unused books is as follows:

Hence, the cost of waste associated with the unused books is $3,000.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Working notes:

Calculate the revenue:

Hence, the revenue is $400,000.

(1)

Calculate the total cost of textbooks:

Hence, the cost of textbooks is $33,000.

(2)

Note:

The company would normally make 10% more that the enrolled order.

Calculate the total number of books ordered:

Hence, the total number of books ordered is $220.

(3)

b.

Prepare an income statement and determine the amount of profit that is lost from the incapability of serving the 5 additional students.

b.

Answer to Problem 29P

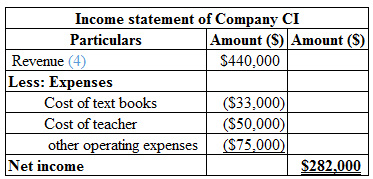

Calculation of income statement of the Company CI in case of 220 student is as follows:

Table (2)

Hence, the net income is $282,000.

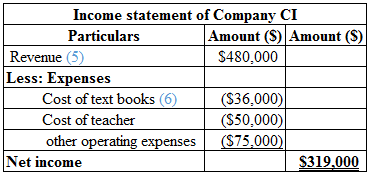

Calculation of income statement of the Company CI in case of 240 student is as follows:

Table (3)

Calculation of lost profit is as follows:

Hence, the lost profit by rejecting additional students is $37,000.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Working notes:

Note:

240 students attempted to register but only 220 students could be accepted.

Calculate the revenue for 220 students:

Hence, the revenue is $440,000.

(4)

Calculate the revenue for 240 students:

Hence, the revenue is $480,000.

(5)

Calculate the total cost of textbooks:

Hence, the cost of textbooks is $36,000.

(6)

c.

Prepare an income statement under the process of just in time system for 200 students, compare the income statement with requirement a., and comment how this system would affect the profitability.

c.

Answer to Problem 29P

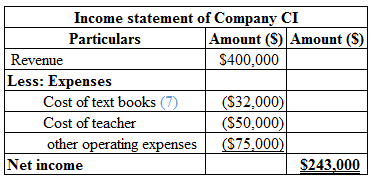

Calculation of income statement of the Company CI under just in time system for 200 students is as follows:

Table (4)

Hence, the net income is $243,000.

Comparison and comment on the income statement is as follows:

The expenses on the cost of textbooks will come down by using just in time inventory system than traditional inventory system used in requirement a. The revenue remains the same, but just in time inventory system will bring greater net income than traditional inventory system.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Just in time:

Just in time is a management strategy used by the organizations to decrease waste and increase the efficiency by receiving goods that are required for production which decreases the inventory cost.

Working notes:

Calculate the total cost of textbooks:

Hence, the cost of textbooks is $32,000.

(7)

d.

Prepare an income statement under the process of just in time system for 240 students, compare the income statement with requirement b., and comment how this system would affect the profitability.

d.

Answer to Problem 29P

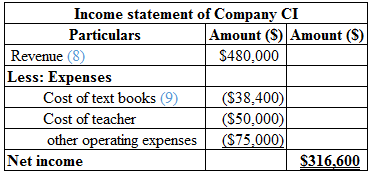

Calculation of income statement of the Company CI under just in time system for 240 students is as follows:

Table (5)

Hence, the net income is $243,000.

Comparison and comment on the income statement is as follows:

The extra revenue from 20 students would increase the cost of books under just in time inventory system. Therefore, it results in greater net income than the traditional inventory system.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Just in time:

Just in time is a management strategy used by the organizations to decrease waste and increase the efficiency by receiving goods that are required for production which decreases the inventory cost.

Working notes:

Calculate the revenue for 240 students:

Hence, the revenue is $480,000.

(8)

Calculate the total cost of textbooks:

Hence, the cost of textbooks is $38,400.

(9)

e.

Discuss the probable effects of the just in time inventory system on the level of customer satisfaction.

e.

Explanation of Solution

Just in time:

Just in time is a management strategy used by the organizations to decrease waste and increase the efficiency by receiving goods that are required for production which decreases the inventory cost.

The probable effect of just in time inventory system on the level of customer satisfaction is as follows:

Students who are deprived of from the enrollment might create a negative impression on the Company CI. This negative image can be spread easily among the public. The just in time system could help the company to improve the customer satisfaction level and increase their net income.

Want to see more full solutions like this?

Chapter 10 Solutions

Survey Of Accounting

- MASTERY PROBLEMBarry Bird opened the Barry Bird Basketball Camp for children ages 10through 18. Campers typically register for one week in June or July,arriving on Sunday and returning home the following Saturday. Collegeplayers serve as cabin counselors and assist the local college and high school coaches who run the practice sessions. The registration feeincludes a room, meals at a nearby restaurant, and basketballinstruction. In the off-season, the facilities are used for weekend retreatsand coaching clinics. Bird developed the following chart of accounts forhis service business: The following transactions took place during the month of June:June 1 Bird invested cash in the business, $10,000.1 Purchased basketballs and other athletic equipment, $3,000. 2 Paid Hite Advertising for flyers that had been mailed to prospectivecampers, $5,000.2 Collected registration fees, $15,000.2 Rogers Construction completed work on a new basketball court thatcost $12,000. Arrangements were made to…arrow_forwardA edugen.wileyplus.com Forsyth Tech - Community College Content WileyPLUS PLUS Davis, Managerial Accounting, 3e Help | System Announcements PRINTER VERSION NEXT CALCULATOR 1 BACK URCES Problem 3-29 Briggs Herrera, president of Ivanhoe Recreation Products, Inc., is concerned about declines that he is beginning to see in the demand for the company's line of old school logo basketballs as new competitors enter the market. At a current contribution margin of $10, the company must sell 84,750 basketballs to generate the desired $200,000 in annual operating income. Based on a recent market research report, Briggs thinks the company can expect annual sales of only 70,625 basketballs in the future.arrow_forwardQUESTION 38 Last month, Jeff applied to three colleges (X, Y, and Z). Before applying he and his family had visited the all three colleges. Jeff has received admissions from Colleges X and Y. He is trying to decide which college he will attend. The following information is available: College X College Y (1) Cost of attendance $30,000 $21,000 (2) Program quality Excellent Average (3) Campus visit cost $900 $300 (4) Location big city big city (5) Scholarship $10,000 $10,000 Select the items that are relevant to Jeff's decision. A. (2), (4) only B. (1), (2), (3) only C. (1), (2) only D. (1), (3), (5) only E. (1), (3) onlyarrow_forward

- hUrl=https%253A%252F%252F sive Problems - 10% semester grade i Saved Fill in the missing amounts in each of the eight case situations below. Each case is independent of the others. Required: a. Assume that only one product is being sold in each of the four following case situations: b. Assume that more than one product is being sold in each of the four following case situations: Complete this question by entering your answers in the tabs below. Required A Required B Assume that more than one product is being sold in each of the four following case situations: (Loss amounts should be indicated by a minus sign.) Case #1 Case #2 Case #3 Case #4 Sales 442,000 198,000 306,000 Variable expenses 128,700 82,620 Fixed expenses 57,000 470,000 Net operating income (loss) $ 42,120 87 740 $. 5,380 Contribution margin ratio (percent) 36 % 79 % 0. Required A %24 %24 %24 %24arrow_forwardMastery Problem Barry Bird opened the Barry Bird Basketball Camp for children ages 10 through 18. Campers typically register for one week in June or July, arriving on Sunday and returning home the following Saturday. College players serve as cabin counselors and assist the local college and high school coaches who run the practice sessions. The registration fee includes a room, meals at a nearby restaurant, and basketball instruction. In the off-season, the facilities are used for weekend retreats and coaching clinics. Bird developed the following chart of accounts for his service business: Chart of Accounts Assets 101 Cash 142 Office Supplies 183 Athletic Equipment 184 Basketball Facilities Liabilities 202 Accounts Payable Owner’s Equity 311 Barry Bird, Capital 312 Barry Bird, Drawing Revenues 401 Registration Fees Expenses 511 Wages Expense 512 Advertising Expense 524 Food Expense 525 Phone Expense 533 Utilities Expense…arrow_forwardComprehensive Problem 5 Part B: Note: This section is a continuation from Part A of the comprehensive problem. Be sure you have completed Part A before attempting Part B. You may have to refer back to data presented in Part A and use answers from Part A when completing this section. Genuine Spice Inc. began operations on January 1 of the current year. The company produces eight- ounce bottles of hand and body lotion called Eternal Beauty. The lotion is sold wholesale in 12-bottle cases for $100 per case. There is a selling commission of $20 per case. The January direct materials, direct labor, and factory overhead costs are as follows: DIRECT MATERIALS Cost Behavior Units per Case Cost per Unit Direct Materials Cost per Case Cream base Variable 100 ozs. $0.02 $2.00 Natural oils Variable 30 ozs. 0.30 9.00 Bottle (8-oz.) Variable 12 bottles 0.50 6.00 $17.00 DIRECT LABOR Department Cost Behavior Time per Case Labor Rate per Hour Direct…arrow_forward

- (Appendix 11A) Cycle Time and Velocity, Manufacturing Cycle Efficiency A company like Kicker performs warranty repair work on speakers in a manufacturing cell. The typical warranty repair involves taking the defective speaker apart, testing the components, and replacing the defective components. The maximum capacity of the cell is 1,000 repairs per month. There are 500 production hours available per month. Required: 1. Compute the theoretical velocity (per hour) and the theoretical cycle time (minutes per unit repaired). 2. Speaker repair uses 4 minutes of move time, 10 minutes of wait time, and 6 minutes of inspection time. Calculate the MCE. 3. Using the information from Requirement 2, calculate the actual cycle time and the actual velocity for speaker repair.arrow_forwardWork Assignment AEST Part 2 of 6 Ever Lawn, a manufacturer of lawn mowers, predicts that it will purchase 324,000 spark plugs next year. Ever Lawn estimates that 27,000 spark plugs will be required each month. A supplier quotes a price of $13 per spark plug. The supplier also offers a special discount option: If all 324,000 spark plugs are purchased at the start of the year, a discount of 2% off the $13 price will be given. Ever Lawn can invest its cash at 8% per year. It costs Ever Lawn $130 to place each purchase order. Required 1. What is the opportunity cost of interest forgone from purchasing all 324,000 units at the start of the year instead of in 12 monthly purchases of 27,000 units per order? 2. Would this opportunity cost be recorded in the accounting system? Why? 3. Should Ever Lawn purchase 324,000 units at the start of the year or 27,000 units each month? Show your calculations. Requirement 1. What is the opportunity cost of interest forgone from purchasing all 324,000…arrow_forwardeBook Question Content Area Lean Principles Bright Night, Inc., manufactures light bulbs. Its purchasing policy requires that the purchasing agents place each quarter’s purchasing requirements out for bid. This is because the Purchasing Department is evaluated solely by its ability to get the lowest purchase prices. The lowest bidder receives the order for the next quarter (90 working days). To make its bulb products, Bright Night requires 57,600 pounds of glass per quarter. Bright Night received two glass bids for the third quarter, as follows: Central Glass Company: $28.00 per pound of glass. Delivery schedule: 57,600 (640 lbs. x 90 days) pounds at the beginning of July to last for 3 months. Ithaca Glass Company: $28.15 per pound of glass. Delivery schedule: 640 pounds per working day (90 days in the quarter). Bright Night accepted Central Glass Company’s bid because it was the low-cost bid. Considering only inventory financing costs, what is the additional cost per pound…arrow_forward

- Problem 2-19A (Algo) Context-sensitive nature of cost behavior classifications LO 2-1 Vernon Bank's start-up division establishes new branch banks. Each branch opens with three tellers. Total teller cost per branch is $96,000 per year. The three tellers combined can process up to 85,000 customer transactions per year. If a branch does not attain a volume of at least 55,000 transactions during its first year of operations, it is closed. If the demand for services exceeds 85,00O transactions, an additional teller is hired and the branch is transferred from the start-up division to regular operations. Required a. What is the relevant range of activity for new branch banks? b. Determine the amount of teller cost in total and the average teller cost per transaction for a branch that processes 55,000, 65,000, 75,000, or 85,000 transactions. In this case (the activity base is the number of transactions for a specific branch), is the teller cost a fixed or a variable cost? c. Determine the…arrow_forwardProblem 2-19A (Algo) Context-sensitive nature of cost behavior classifications LO 2-1 Vernon Bank's start-up division establishes new branch banks. Each branch opens with three tellers. Total teller cost per branch is $96,000 per year. The three tellers combined can process up to 85,000 customer transactions per year. If a branch does not attain a volume of at least 55,000 transactions during its first year of operations, it is closed. If the demand for services exceeds 85,00O transactions, an additional teller is hired and the branch is transferred from the start-up division to regular operations. Required a. What is the relevant range of activity for new branch banks? b. Determine the amount of teller cost in total and the average teller cost per transaction for a branch that processes 55,000, 65,000, 75,000, or 85,000 transactions. In this case (the activity base is the number of transactions for a specific branch), is the teller cost a fixed or a variable cost? c. Determine the…arrow_forwardQuestion 2 Capital University, a midsized university in a capital city recently received an offer from BrainTrust Teaching Services to teach all of the first year accounting courses at the university. There are currently 10 sections of 1st year accounting taught at Capital University. Cost per section are as follows: Description Cost Professors Classroom/building Teaching Assistants $20,000 $4,000 $2,000 Notes Half of these costs can be avoided by laying off staff This space can not be used for other purposes All costs can be avoided As well, it is estimated that fixed administrative costs are $1,000 per section. BrainTrust has proposed that they can teach all of the sections for a total cost of $105,000 Should Capital accept this special offer? (include both qualitative and quantitative analysis)arrow_forward

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT