Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 19, Problem 4R

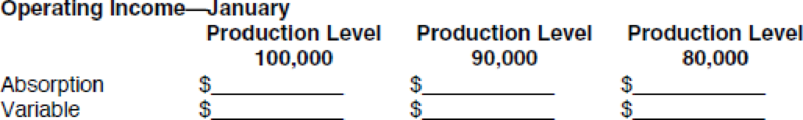

To determine the effect of different levels of production on the company’s income, move to cell B7 (Actual production). Change the number in B7 to the different production levels given in the table below. The first level, 100,000, is the current level. What happens to the operating income on both statements as production levels change? Enter the operating incomes in the following table.

Does the level of production affect income under either costing method? Explain your findings.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Compute the depreciation charge for 2016

For this year, Jackson Enterprises has $25,000 net earnings on the income statement and $10,000 net cash inflow from operating activities, $18,000 net cash outflow from investing activities, and $22,000 cash inflow from financing activities on the statement of cash flows. What is the accruals total reported for this period?

Hii expert please give me correct answer general accounting question

Chapter 19 Solutions

Excel Applications for Accounting Principles

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- True option? General accountingarrow_forwardAide Industries is a division of a major corporation. Data concerning the most recent year appears below: Sales Net operating income $18,310,000 $920,000 Average operating assets $6,300,000 The division's margin-is closest to:arrow_forwardHow much will regal enterprises record as goodwillarrow_forward

- What is the other comprehensive income?arrow_forwardCool Comfort currently sells 360 Class A spas, 520 Class C spas, and 230 deluxe model spas each year. The firm is considering adding a mid-class spa and expects that, if it does, it can sell 375 of them. However, if the new spa is added, Class A sales are expected to decline to 255 units while Class C sales are expected to decline to 240. The sales of the deluxe model will not be affected. Class A spas sell for an average of $13,500 each. Class C spas are priced at $7,200 and the deluxe model sells for $19,000 each. The new mid-range spa will sell for $11,000. What is the value of erosion? Financial Accountingarrow_forwardGoodwill if any is recorded atarrow_forward

- Inventory:25000, Accounts payable:16000arrow_forwardMenak Industries purchases a machine at the beginning of the year at a cost of $40,000. The machine is depreciated using the straight-line method. The machine's useful life is estimated to be 10 years with a $6,000 salvage value. The book value of the machine at the end of year 3 is _.helparrow_forwardWhat is the cost of goods manufactured?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Inspection and Quality control in Manufacturing. What is quality inspection?; Author: Educationleaves;https://www.youtube.com/watch?v=Ey4MqC7Kp7g;License: Standard youtube license