Concept explainers

Problem 1-21A Effect of product versus period costs on financial statements

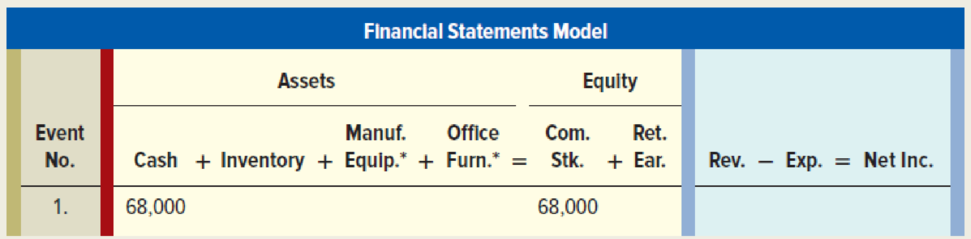

Sinclair Manufacturing Company experienced the following accounting events during its first year of operation. With the exception of the

1. Acquired $68,000 cash by issuing common stock.

2. Paid $8,700 for the materials used to make its products, all of which were started and completed during the year.

3. Paid salaries of $4,500 to selling and administrative employees.

4. Paid wages of $10,000 to production workers.

5. Paid $9,600 for furniture used in selling and administrative offices. The furniture was acquired on January 1. It had a $1,600 estimated salvage value and a four-year useful life.

6. Paid $16,000 for manufacturing equipment. The equipment was acquired on January 1. It had a $1,000 estimated salvage value and a five-year useful life.

7. Sold inventory to customers for $35,000 that had cost $14,000 to make.

Required

Explain how these events would affect the

*Record

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Survey Of Accounting

- Transaction Analysis Adams Company is a manufacturer that completed numerous transactions during the month, some of which are shown below: a. Manufacturing overhead costs incurred on account, $80,000. b. Depreciation was recorded for the month, $35,000 (80% related to factory equipment, and the remainder related to selling and administrative equipment). c. Prepaid insurance expired during the month, $2,500 (75% related to production, and 25% related to selling and administration). d. Applied $115,000 of manufacturing overhead to production during the month. e. Closed $5,125 of overapplied overhead to cost of goods sold. Required: The table shown below includes a subset of Adams Company’s balance sheet accounts. Record each of the above transactions using the accounts that are given. If a transaction increases an account balance, then record the amount as a positive number. If it decreases an account balance, then record the amount in parentheses.arrow_forwardIII Froblems Problem 1 (Flow of an accounting for the manufacturing company) The following events took place at the Barton Manufacturing Corporation for the current year: 1. Purchased P80,000 in direct materials. 2 Incurred labor costs as followS a Direct labor, P42,000. b. Supervisory labor, PI1,500 (part of manufacturing overhead). 3. Purchased manufacturing equipment for P67,200. 4. Other manufacturing overhead was P80,500, excluding supervisory labor. 5. Transferred 70 percent of the materials purchased to work in process. 6. Completed work on 60 percent of the goods in process. Costs are assigned equally across all work in process. 7. Sold 90 percent of the completed goods. There were no beginning balances in the inventory accounts. All costs incurred were debited to the appropriate account and credited to accounts payable. Required: 1. Prepare jourmal entries to reflect these events. 2. Prepare T-accounts to show these events. 3. Prepare a cost of goods sold statement from the…arrow_forwardFinancial accountingarrow_forward

- Question 1.1 The following information was taken from the accounting records of Dunbar Mifflin Company in 2018. Beginning of 2018 135,000 Ending of 2018 Direct materials inventory Work-in-process inventory Finished-goods inventory 83,000 185,000 154,000 255,000 216,000 Purchases of direct materials 270,000 Direct manufacturing labor Indirect manufacturing labor 225,000 103,000 Plant insurance 11,000 Depreciation-plant, building, and equipment 48,000 Plant utilities 29,500 Repairs and maintenance-plant Equipment leasing costs Marketing, distribution, and customer-service costs 13,500 66,800 129,500 General and administrative costs 72,500 Required: 1. Prepare a schedule of cost of goods manufactured.arrow_forwardprepare an income statementarrow_forwardQuestion 2 The Anthony Company, a sole proprietorship, reports the following information pertaining to its operating activities: During the year, the company purchased $40,000 of direct materials and incurred $21,000 of direct labor costs. Total manufacturing overhead costs for the year amounted to $18,000. Selling and administrative expenses amounted to $60,000, and the company’s annual sales amounted to $250,000. Prepare Anthony’s schedule of the cost of finished goods manufactured. Prepare Anthony’s income statement (ignore income taxes).arrow_forward

- Nonearrow_forwardprovide journal entries for the transaction letters: J, K, Larrow_forwardView Policies Current Attempt in Progress The following data has been taken from the accounting records of Curtis Manufacturing Company for the current year: Sales Purchases of direct materials Direct labor cost during period Manufacturing overhead applied during period Direct Materials Inventory, beginning Direct Materials Inventory, ending Work in Process Inventory, beginning Work in Process Inventory, ending Finished Goods Inventory, beginning Finished Goods Inventory, ending (a) Direct materials used in production eTextbook and Media $600,000 Save for Later 350,000 120,000 60,000 20,000 25,000 47,000 32,000 Compute the cost of direct materials moved into production during the period. 75,000 82,000 Attempts: 0 of 4 used Submit Answer (b) The parts of this question must be completed in order. This part will be available when you complete the part above. (c) The parts of this question must be completed in order. This part will be available when you complete the part above.arrow_forward

- Need experts solutionarrow_forwardCompute the Cost of Goods Manufactured and Cost of Goods Sold for West Nautical Company for the most recent year using the amounts described in the picture. Assume that the Raw Materials Inventory contains only direct materials.arrow_forwardanswer with explanation/solutionarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning