a.

The total amount of upstream cost.

a.

Explanation of Solution

Upstream cost: This cost is incurred before starting the manufacturing process such as research and development, and product design.

The given information:

- Fashion design cost is $20,000.

- Research and development cost is $30,000.

The calculation of upstream cost is as follows:

Hence, the upstream cost is $50,000.

b.

The total amount of downstream cost.

b.

Explanation of Solution

Downstream: This cost is incurred after starting the manufacturing process such as marketing, distribution, and customer service

The given information:

- Advertisement cost is $25,000.

- Administrative cost is $45,000.

The calculation of downstream cost is as follows:

Hence, the downstream cost is $70,000.

c.

The total amount of midstream cost.

c.

Explanation of Solution

Mid-stream: It is a cost incurred in making a product. It includes direct labor, direct materials, and manufacturing overheads.

The given information:

- Direct materials are $15.

- Direct labor is $17

- Manufacturing overheads are $8.

- Total production is 4,000 units.

The calculation of midstream cost is as follows:

Hence, the midstream cost is $160,000.

d.

The total amount of sales price.

d.

Explanation of Solution

The given information:

- Direct materials are $15.

- Direct labor is $17

- Manufacturing overheads are $8.

- Total production is 4,000 units.

- 150% on GAPP defined product.

The calculation of sales price is as follows:

Hence, the sales price is $60.

e.

The income statement based on GAPP.

e.

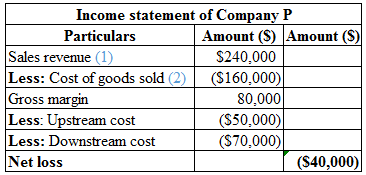

Answer to Problem 25P

The calculation of income statement of Company D is as follows:

Hence, the company has a net loss of $40,000.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

The given information:

- Direct materials are $15.

- Direct labor is $17

- Manufacturing overheads are $8.

- Total production is 4,000 units.

- Fashion design cost is $20,000.

- Research and development cost is $30,000.

- Advertisement cost is $25,000.

- Administrative cost is $45,000.

The sales revenue is calculated as follows:

Hence, the sales revenue is $240,000.

(1)

The cost of goods sold is calculated as follows:

Hence, the cost of goods sold is $160,000.

(2)

f.

Explain the reason for the net loss.

f.

Explanation of Solution

The management failed to consider the cost of downstream and upstream while pricing the product. Only the cost of GAPP based prices were considered. The selling price of the product is $60 and the total cost price of the product is $70 (3). Therefore, the selling price is less than the cost per unit and this explains why the company is facing loss.

Working notes:

The total cost per unit is calculated as follows:

Hence, the total cost per unit is $70.

Want to see more full solutions like this?

Chapter 10 Solutions

Survey Of Accounting

- Question 10 Cheyenne, Inc. has recently started the manufacture of Tri-Robo, a three-wheeled robot that can scan a home for fires and gas leaks and then transmit this information to a smartphone. The cost structure to manufacture 19,400 Tri-Robos is as follows. Cost Direct materials ($49 per robot) $950,600 Direct labor ($37 per robot) 717,800 Variable overhead ($6 per robot) 116,400 Allocated fixed overhead ($31 per robot) 600,000 Total $2,384,800 Cheyenne is approached by Tienh Inc., which offers to make Tri-Robo for $112 per unit or $2,172,800.Following are independent assumptions.arrow_forwardQuestion Content Area Make-or-Buy Decision Pizana Computer Company has been purchasing carrying cases for its portable computers at a purchase price of $55 per unit. The company, which is currently operating below full capacity, charges factory overhead to production at the rate of 42% of direct labor cost. The unit costs to produce comparable carrying cases are expected to be as follows: Line Item Description Amount Direct materials $27.00 Direct labor 21.00 Factory overhead (42% of direct labor) 8.82 Total cost per unit $56.82 If Pizana Computer Company manufactures the carrying cases, fixed factory overhead costs will not increase and variable factory overhead costs associated with the cases are expected to be 13% of the direct labor costs. Question Content Area a. Prepare a differential analysis dated May 31 to determine whether the company should make (Alternative 1) or buy (Alternative 2) the carrying case. Round your answers to two decimal places. If an…arrow_forwardProblem 3 Omantex Co. produces 5,000 units of its new product. The following costs were incurred for that level of production: Direct materials RO 55,000 Direct labor 160,000 Variable overhead 75,000 Fixed overhead 175,000 If Omantex buys the part from Fanja Co. who offers a unit price of RO 68, should the company make or buy the product?arrow_forward

- Question 1.2 Alejandro Kirk Manufacturing produces two types of entry doors: Deluxe and Standard. The assignment basis for support costs has been direct labour dollars. For 2021, Alejandro Kirk the following data for the two products: Deluxe Standard Sales units 50,000 400,000 Sales price per unit $650.00 $475.00 Direct material and labour costs per unit $180.00 $130.00 Manufacturing support costs per unit $80.00 $120.00 Last year, Alejandro Kirk Manufacturing purchased an expensive robotics system to allow for more decorative door products in the deluxe product line. The CFO suggested that an ABC analysis could be valuable to help evaluate a product mix and promotion strategy for the next sales campaign. She obtained the following ABC information: Activity Cost Driver Cost Total Deluxe Standard Setups # of setups $500,000 500 400 100 Machine related # of machine hours…arrow_forwardCurrent Attempt in Progress Pharoah Corporation manufactures two products with the following characteristics. Unit Contribution Margin Machine Hours Required for Production Product 1 $36 0.15 hours Product 2 $32 0.10 hours If Pharoah's machine hours are limited to 2,000 per month, determine which product it should produce. Contribution margin per unit of limited resource Pharoah Corporation should produce eTextbook and Media Product 1 $ +A Product 2arrow_forwardVariable costs and activity bases in decision making The owner of Dawg Prints, a printing company, is planning direct labor needs for the upcoming year. The owner has provided you with the following information for next year's plans: Each color on the banner must be printed one at a time. Thus, for example, a four-color banner will need to be run through the printing operation four separate times. The total production volume last year was 600 banners, as shown below. The four-color banner is a new product offering for the upcoming year. The owner believes that the expected 600-unit increase in volume from last year means that direct labor expenses should increase by 100% (600 + 600). What do you think?arrow_forward

- What is the conversion cost to manufacture insulated travel cups if the costs are: direct materials, $17,000; direct labor, $33,000; and manufacturing overhead, $70,000? A. $16,000 B. $50,000 C. $103,000 D. $120000arrow_forwardBountiful Manufacturing produces two types of bike frames (Frame X and Frame Y). Frame X passes through four processes: cutting, welding, polishing, and painting. Frame Y uses three of the same processes: cutting, welding, and painting. Each of the four processes employs 10 workers who work eight hours each day. Frame X sells for 40 per unit, and Frame Y sells for 55 per unit. Materials is the only unit-level variable expense. The materials cost for Frame X is 20 per unit, and the materials cost for Frame Y is 25 per unit. Bountifuls accounting system has provided the following additional information about its operations and products: Bountifuls management has determined that any production interruptions can be corrected within two days. Required: 1. Assuming that Bountiful can meet daily market demand, compute the potential daily profit. Now, compute the minutes needed for each process to meet the daily market demand. Can Bountiful meet daily market demand? If not, where is the bottleneck? Can you derive an optimal mix without using a graphical solution? If so, explain how. 2. Identify the objective function and the constraints. Then, graph the constraints facing Bountiful. Determine the optimal mix and the maximum daily contribution margin (throughput). 3. Explain how a drum-buffer-rope system would work for Bountiful. 4. Suppose that the Engineering Department has proposed a process design change that will increase the polishing time for Frame X from 15 to 23 minutes per unit and decrease the welding time from 15 minutes to 10 minutes per unit (for Frame X). The cost of process redesign would be 10,000. Evaluate this proposed change. What step in the TOC process does this proposal represent?arrow_forwardQuestion 1 Easy Efforts Company is in the process of setting a target price for its coffee mug heaters and portable hard drives. The marketing department has projected impressive sales as soon as they launch. Cost data relating to the coffee mug heaters and portable hard drives at a budgeted volume of 4,000 units is as follows: Unit Cost Direct Materials $120 Direct Labour $150 Variable Manufacturing overhead cost $25 Variable selling and Administrative expenses $15 Total Cost Fixed manufacturing overhead cost $650,000 Fixed…arrow_forward

- 10 points 04:41:39 Waterway Engine Incorporated produces engines for the watercraft industry. An outside manufacturer has offered to supply several component parts used in the engine assemblies, which are currently being produced by Waterway. The supplier will charge Waterway $620 per engine for the set of parts. Waterway's current costs for those part sets are direct materials, $360; direct labor, $180; and manufacturing overhead applied at 100% of direct labor. Variable manufacturing overhead is considered to be 30% of the total, and fixed overhead will not change if the part sets are acquired from the outside supplier. Required: a. What would be the net cost advantage or disadvantage if Waterway decided to purchase the parts? b. Should Waterway Engine continue to make the part sets or accept the offer to purchase them for $620?arrow_forwardQUESTION 3 Afiza Group manufactures customized equipment for local market. The data for the period were as follows: Budgeted overhead Actual direct labour hours Budgeted direct labour hours Direct material: Direct labour: A B Actual machine hours 6,200 hours 4,700 hours Budgeted machine hours' 5,700 hours 5,300 hours An order is received from Encik Fahim to manufacture an equipment for his personal use. The data related to the costs of the equipment were as follows: Machining Finishing Machining department RM50,000 Hire of special machine Administrative expenses Machine hours: 5,000 hours 5,400 hours Finishing department RM65,000 RM 1,500 RM2,100 6,000 hours 5,800 hours 500 hours @ RM2.50 per hour 450 hours @ RM3.20 per hour RM1,200 15% of factory costs Machining Finishing 321 hours 670 hours Profit 25% of total cost Overhead absorption is based on machine hour for the Machining department and direct labour hour for Finishing department. Required: a) Prepare a Job Cost Sheet showing…arrow_forwardSage Corporation manufactures two products with the following characteristics. Product 1 Product 2 Unit Contribution Margin $47.25 $36.70 Machine Hours Required for Production Contribution margin per unit of limited resource Sage Corporation should produce. 0,15 hours If Sage's machine hours are limited to 2,000 per month, determine which product it should produce. 0.10 hours $ Product 11 Product 2arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College