FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

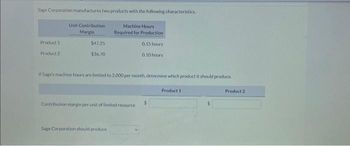

Transcribed Image Text:Sage Corporation manufactures two products with the following characteristics.

Product 1

Product 2

Unit Contribution

Margin

$47.25

$36.70

Machine Hours

Required for Production

Contribution margin per unit of limited resource

Sage Corporation should produce.

0,15 hours

If Sage's machine hours are limited to 2,000 per month, determine which product it should produce.

0.10 hours

$

Product 11

Product 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 9arrow_forwardPlease do not give solution in image format thankuarrow_forwardRelevant Range and Fixed and Variable Costs Vogel Inc. manufactures memory chips for electronic toys within a relevant range of 100,800 to 158,400 memory chips per year. Within this range, the following partially completed manufacturing cost schedule has been prepared: Components produced 100,800 123,200 158,400 Total costs: Total variable costs . . . . . . . . . $40,320 (d) (j) Total fixed costs . . . . . . . . . . . . 44,352 (e) (k) Total costs . . . . . . . . . . . . . . . . . $84,672 (f) (l) Cost per unit: Variable cost per unit . . . . . . . (a) (g) (m) Fixed cost per unit . . . . . . . . . . (b) (h) (n) Total cost per unit . . . . . . . . . . (c) (i) (o) Complete the cost schedule below. When computing the cost per unit, round to two decimal places. Round all other values to the nearest dollar. Cost Report Components produced 100,800 123,200 158,400 Total costs: Total variable costs $40,320 (d)…arrow_forward

- 9arrow_forwardExercises 4 Event Company produces a single product with the following characteristics: price per unit, $30.00; variable material cost per unit, $9.20; variable labor cost per unit, $4.40; variable overhead cost per unit, $2.20; and fixed overhead cost per unit, $3.00. Event Company's manufacturing fixed costs are $5 million, and selling, general, and administration fixed costs are $1.5 million. What dollar sales are required for Event Company to earn a target profit of $600,000? Exercises 5 The following information pertains to Torasic Company's budgeted income statement for the month of June: Sales (1,500 units at $300) $450,000 Variable cost 200,000 250,000 280,000 $(30,000) Contribution margin Fixed cost Net loss Required a) Determine the company's breakeven point in both units and dollars. b) The sales manager believes that a $25,000 increase in the monthly advertising expenses will result in a considerable increase in sales. How much of an increase in sales must result from…arrow_forwardCost Volume Profit Total Company produces one type of machine with the following costs and revenues for the year: Total revenues $4,200,000 Total fixed costs $1,400,000 Total variable costs $2,800,000 Total units produced and sold 700,000 a calculate the breakeven in unit b calculate the quantity that would produce an operating profit of $100000 c calculate the quantity that would produce an operating profit of 10 percent of sales dollars d calculate the breakeven quantity if sales increased by 20 perc ent e calculate the operating margin if 50000 unit are soldarrow_forward

- Relevant Range and Fixed and Variable Costs Vogel Inc. manufactures memory chips for electronic toys within a relevant range of 61,600 to 100,800 memory chips per year. Within this range, the following partially completed manufacturing cost schedule has been prepared: Components produced 61,600 79,200 100,800 Total costs: Total variable costs . . . . . . . . . $19,712 (d) (j) Total fixed costs . . . . . . . . . . . . 22,176 (e) (k) Total costs . . . . . . . . . . . . . . . . . $41,888 (f) (l) Cost per unit: Variable cost per unit . . . . . . . (a) (g) (m) Fixed cost per unit . . . . . . . . . . (b) (h) (n) Total cost per unit . . . . . . . . . . (c) (i) (o) Complete the cost schedule below. When computing the cost per unit, round to two decimal places. Round all other values to the nearest dollar. Cost Report Components produced 61,600 79,200 100,800 Total costs: Total variable costs $19,712 (d)…arrow_forwardQuestion 6 Amundsen Company makes 60,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows: Direct Materials Direct Labor Variable Manufacturing Overhead Fixed Manufacturing Overhead Variable Selling Fixed Selling Total $ 10.10 $17.40 $ 2.70 $15.00 $ 2.75 $ 3.25 $51.20 An outside supplier has offered to sell the company all of these parts it needs. If the company accepts this offer, the facilities now being used to make the part would be idle and fixed manufacturing overhead would be reduced by 80% of current cost. The variable selling costs would be reduced to 40% of current cost. Required: What is the maximum amount the company should be willing to pay an outside supplier per unit for the part?arrow_forwardAssume a company makes only three products, A, B, and C. Product A Product B Product C Estimated customer demand in units Selling price per unit 800 700 $ 80 $ 45 Variable cost per unit $ 35 $ 20 Machine-hours per unit 2.5 1.25 The company has only 2.850 machine-hours available. What is the highest total contribution margin that the company can earn if it makes optimal use of its constrained resource? Multiple Choice O O $52.800 $59,800 $55,000 $57,800 600 $ 65 $ 26 3.0arrow_forward

- Problem Set: Module 4 1. EX.06.01 2. PR.06.02A.ALGO 3. BE.06.02.ALGO 4. BE.06.03.ALGO engagenow.com + 40 Contribution Margin Harry Company sells 36,000 units at $40 per unit. Variable costs are $34.00 per unit, and fixed costs are $103,700. Determine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) operating income. a. Contribution margin ratio (Enter as a whole number.) b. Unit contribution margin (Round to the nearest cent.) c. Operating income $ : % per unit ?arrow_forwardSubject:- accountingarrow_forwardPlease answer first two subparts only 1 2arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education