Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Solve this one

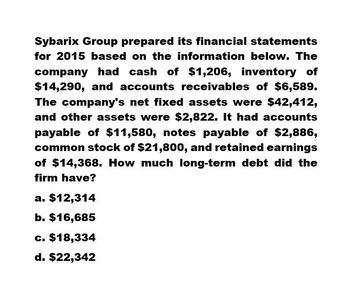

Transcribed Image Text:Sybarix Group prepared its financial statements

for 2015 based on the information below. The

company had cash of $1,206, inventory of

$14,290, and accounts receivables of $6,589.

The company's net fixed assets were $42,412,

and other assets were $2,822. It had accounts

payable of $11,580, notes payable of $2,886,

common stock of $21,800, and retained earnings

of $14,368. How much long-term debt did the

firm have?

a. $12,314

b. $16,685

c. $18,334

d. $22,342

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Birtle Corporation reports the following statement of financial position information for 2017 and 2018. BIRTLE CORPORATION2017 and 2018 Statement of Financial Position Assets Liabilities and Owners’ Equity 2017 2018 2017 2018 Current assets Current liabilities Cash $ 9,279 $ 11,173 Accounts payable $ 41,060 $ 43,805 Accounts receivable 23,683 25,760 Notes payable 16,157 16,843 Inventory 42,636 46,915 Total $ 75,598 $ 83,848 Total $ 57,217 $ 60,648 Long-term debt $ 40,000 $ 35,000 Fixed assets Owners’ equity Net plant and equipment $ 272,047 $ 297,967 Common stock and paid-in surplus $ 50,000 $ 50,000 Retained earnings 200,428 236,167 Total $ 250,428 $ 286,167 Total assets $ 347,645 $ 381,815 Total liabilities…arrow_forwardConsider the following financial data for Nguyen Industries: Statement of Financial Position as of December 31, 2018 Cash $ 232,500 Accounts payable $ 86,500 Accts. receivable 357,500 Short-term bank note 254,000 Inventories 150,500 Accrued wages & taxes 80,000 Total current assets $ 740,500 Total current liabilities $ 420,500 Long-term debt 566,000 Net fixed assets 774,500 Common equity 528,500 Total assets $ 1,515,000 Total liab. & equity $ 1,515,000 Profit & Loss Statement for 2018 Industry Average Ratios Net sales $ 1,894,000 Current ratio 1.4× Cost of goods sold 1,382,500 Quick ratio 1.0× Gross profit $ 511,500 Days sales outstanding 63 days Operating expenses 373,000 Inventory turnover 9.5× EBIT $ 138,500 Total asset turnover 1.5× Interest expense 64,000 Net…arrow_forwardFollowing is the balance sheet for 3M Company. At December 31 2015 2014 Cash and cash equivalents $ 1,798 $ 1,897 Marketable securities-current 118 1,439 Accounts receivable, net 4,154 4,238 Inventories 3,518 3,706 Other current assets 1,398 1,023 Total current assets 10,986 12,303 Marketable securities-noncurrent 126 117 Property, plant and equipment--net 8,515 8,489 Goodwill 9,249 7,050 Intangible assets-net 2,601 1,435 Prepaid pension benefits 188 46 1,053 $32,718 1,769 $31,209 Other assets Total assets $ $ Short-term debt & current portion of LT debt Accounts payable 2,044 106 1,694 1,807 Accrued payroll 644 732 Accrued income taxes 332 435 Other current liabilities 2,404 2,884 Total current liabilities 7,118 5,964 Long-term debt 8,753 6,705 Pension and postretirement benefits 3,520 3,843 Other liabilities 1,580 1,555 Total liabilities 20,971 18,067 3M Company shareholders' equity: Common stock 9. Additional paid-in capital Retained earnings 4,791 4,379 36,575 34,317 Treasury stock…arrow_forward

- The 2021 income statement of Adrian Express reports sales of $18,957,000, cost of goods sold of $11,971,500, and net income of $1,690,000. Balance sheet information is provided in the following table. Assets Current assets: Cash Accounts receivable Inventory Long-term assets. Total assets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and stockholders' equity ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 Average collection period Average days in inventory Current ratio Debt to equity ratio Industry averages for the following four risk ratios are as follows: Risk Ratios Average collection period Average days in inventory Current ratio Debt to equity ratio 25 days 60 days. 2 to 1 50% 2021 $ 690,000 1,580,000 1,980,000 4,890,000 $9, 140,000 365.0 days days to 1 % 2020 $ 850,000 1,090,000 1,490,000 4,330,000 $7,760,000 Required: 1. Calculate the four risk ratios listed above for Adrian Express in…arrow_forwardUse the following information to prepare a classified balance sheet for Alpha Co. at the end of 2016. $26,500 Accounts receivable Accounts payable 12,200 Cash 20,500 Common stock 30,000 Land 10,000 Long-term notes payable 17,500 26,300 Merchandise inventory Retained earnings 23,600arrow_forwardConsider the following financial data for Terry Enterprises: Balance Sheet as of December 31, 2018 Cash $ 86,000 Accounts payable $ 15,500 Accts. receivable 91,500 Notes payable 93,500 Inventories 65,500 Accruals 19,500 Total current assets $ 243,000 Total current liabilities $ 128,500 Long-term debt 162,500 Net plant & equip. 419,500 Common equity 371,500 Total assets $ 662,500 Total liab. & equity $ 662,500 Statement of Earnings for 2018 Industry Average Ratios Net sales $ 642,500 Current ratio 2.2× Cost of goods sold 482,000 Quick ratio 1.7× Gross profit $ 160,500 Days sales outstanding 44 days Operating expenses 119,500 Inventory turnover 6.7× EBIT $ 41,000 Total asset turnover 0.6× Interest expense 14,500 Net profit margin 7.2% Pre-tax earnings $ 26,500…arrow_forward

- On June 30, 2018, Streeter Company reported the following account balances: Receivables $ 51,700 Current liabilities $ (10,400 ) Inventory 87,000 Long-term liabilities (56,000 ) Buildings (net) 83,700 Common stock (90,000 ) Equipment (net) 34,000 Retained earnings (100,000 ) Total assets $ 256,400 Total liabilities and equities $ (256,400 ) On June 30, 2018, Princeton Company paid $309,500 cash for all assets and liabilities of Streeter, which will cease to exist as a separate entity. In connection with the acquisition, Princeton paid $17,300 in legal fees. Princeton also agreed to pay $61,100 to the former owners of Streeter contingent on meeting certain revenue goals during 2019. Princeton estimated the present value of its probability adjusted expected payment for the contingency at $20,300. In determining its offer, Princeton noted the following pertaining to Streeter: It holds a building with a fair value…arrow_forwardSelected information from the comparative financial statements of Barcelona Company for the year ended December 31 appears below: 2017 2016 Accounts receivable (net) $200,000 175,000 Inventory 170,000 130,000 Total assets 1,100,000 800,000 Current liabilities 140,000 110,000 Long-term debt 300,000 410,000 Net credit sales 900,000 700,000 Cost of goods sold 530,000 600,000 Interest expense 40,000 25,000 Income tax expense 60,000 29,000 Net income 120,000 85,000 Net cash provided by operating activities 250,000 135,000 Instructions Answer the following questions relating to the year ended December 31, 2017. Show computations. 1. The inventory turnover for 2017 is 2. The number of times interest earned in 2017 is 3. The accounts receivable turnover for 2017 is 4. The return on assets for 2017 isarrow_forwardThe following selected accounts from the Culver Corporation’s general ledger are presented below for the year ended December 31, 2017: Advertising expense $ 61,600 Interest revenue $ 33,600 Common stock 280,000 Inventory 75,040 Cost of goods sold 1,215,200 Rent revenue 26,880 Depreciation expense 140,000 Retained earnings 599,200 Dividends 168,000 Salaries and wages expense 756,000 Freight-out 28,000 Sales discounts 9,520 Income tax expense 78,400 Sales returns and allowances 45,920 Insurance expense 16,800 Sales revenue 2,688,000 Interest expense 78,400 Prepare a multiple-step income statement. CULVER CORPORATIONIncome Statementchoose the accounting period select an opening name for section one enter an income statement item $enter…arrow_forward

- The asset side of the 2017 balance sheet for the Corporation is below. The company reported total revenues of $37,728 million in 2017 and $37,047 million in 2016. in millions May 31, 2017 May 31, 2016 Current assets: Cash and cash equivalents $ 21,784 $ 20,152 Marketable securities 44,294 35,973 Trade receivables, net of allowances for doubtful accounts of $319 and $327 as of May 31, 2017 and May 31, 2016, respectively 5,300 5,385 Inventories 300 212 Prepaid expenses and other current assets 2,837 2,591 Total current assets 74,515 64,313 Non-current assets: Property, plant and equipment, net 5,315 4,000 Intangible assets, net 7,679 4,943 Goodwill, net 43,045 34,590 Deferred tax assets 1,143 1,291 Other assets 3,294 3,043 Total non-current assets 60,476 47,867 Total assets $134,991 $112,180 How do I figure what the company’s gross amount…arrow_forwardBirtle Corporation reports the following statement of financial position information for 2017 and 2018. Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Assets 2017 $9,279 23,683 42,636 $ 75,598 $272,047 $347,645 BIRTLE CORPORATION 2017 and 2018 Statement of Financial Position 2018 $ 11,173 25,760 46,915 $ 83,848 $297,967 $381,815 Current liabilities Accounts payable Notes payable Liabilities and Owners? Equity Total Long-term debt Owners' equity Common stock and paid-in surplus Retained earnings Total Total liabilities and owners' equity 2017 $ 41,060 16,157 $57,217 $ 40,000 $,50,000 200,428 $250,428 $347,645 2018 $ 43,805 16,843 $ 60,648 $ 35,000 $ 50,000 236,167 $286,167 $381,815 For each account on Birtle Corporation's statement of financial position, show the change in the account during 2018 and note whether this change was a source or use of cash. (If there is no action select "None" from the dropdown options. Do not leave…arrow_forwardThe following information is taken Aiello Corporation's fiscal 2016 annual report. Selected Balance Sheet Data 2016 2015 Inventories........................ $221,418 $226,893 Accounts Receivable........... $121,333 $122,087 Assume that Aiello Corporation had $1,003,881 sales on credit during fiscal year 2016. What amount did the company collect from credit customers during the year? a. $1,003,881 b. $1,004,635 c. $1,003,127 d. $1,247,301arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning