CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

Give true answer

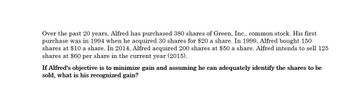

Transcribed Image Text:Over the past 20 years, Alfred has purchased 380 shares of Green, Inc., common stock. His first

purchase was in 1994 when he acquired 30 shares for $20 a share. In 1999, Alfred bought 150

shares at $10 a share. In 2014, Alfred acquired 200 shares at $50 a share. Alfred intends to sell 125

shares at $60 per share in the current year (2015).

If Alfred's objective is to minimize gain and assuming he can adequately identify the shares to be

sold, what is his recognized gain?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In 2017, Marvin bought 100 shares of ABC stock. He decided to sell the stock on March 30, 2022. Marvin’s original cost for the stock was $15,065 plus an additional $55 in broker’s fees. When he sold the stock, he received gross proceeds of $9,757. What is the net gain or loss from his transaction? Is it a long- or short-term capital gain or loss?arrow_forwardPlease helparrow_forwardSam owns 1,500 shares of Eagle, Inc. stock that he purchased over 10 years ago for $80,000. Although the stock has a current market value of $52,000, Sam still views the stock as a solid long-term investment. He has sold other stock during the year with overall gains of $30,000, so he would like to sell the Eagle stock and offset the $28,000 loss against these gains—but somehow keep his Eagle investment. He has devised a plan to keep his Eagle investment by using funds in his traditional IRA to purchase 1,500 Eagle shares immediately after selling the shares he currently owns. Evaluate Sam’s treatment of these stock transactions. Can his plan work?arrow_forward

- Sam Scurry bought several hundred shares of annable.com at a price of $41.40 about 5 years ago that sold for $64.20 per share today. Sam pays capital gains tax at the rate of 19% and pays tax on dividends at the rate of 27%. Suppose that annable.com elects not to pay a dividend this year and that Sam sells 19 shares of stock. How much of the total amount of proceeds from the sale will Sam get to keep?arrow_forwardAjit owns 1,500 shares of Eagle, Inc. stock that he purchased over 10 years ago for $80,000. Although the stock has a current market value of $52,000, Ajit still views the stock as a solid long-term investment. He has sold other stock during the year with overall gains of $30,000, so he would like to sell the Eagle stock and offset the $28,000 loss against these gains, but somehow keep his Eagle investment. He has devised a plan to keep his Eagle investment by using funds in his traditional IRA to purchase 1,500 Eagle shares immediately after selling the shares he currently owns. Evaluate Ajit's treatment of these stock transactions. Can his plan work?arrow_forwardNot use ai please don'tarrow_forward

- Sheila’s mother purchased 100 shares of Apple stock in 1992. The original sale price was $26 per share for a total value of $2,600. She kept those 100 stocks until her death in June 2022. By the time of her death, the Apple stock value is $190 per share for a total value of $19,000. Sheila will not owe taxes for capital gains on the $16,400 increase in value. Why do you think the gains and losses should be separated from sheila's other gains and losses?arrow_forwardJames bought a beachfront house in March 2011 for $140,000. After renting the house out for 3 years, he moved into the house in 2013 and it became his main residence for the next 7 years. He sold the house in March 2021 for $260,000. James has prior year net capital losses of $4,000 and current year capital losses of $6,000 from the sale of shares. What is James' net capital gain for the 2021 income year? a. $26,000 b. $13,000 c. $260,000 d. $120,000arrow_forwardJohn Dufresne purchased 100 shares of Louisiana Power and Light on January 3, 2004 at a total cost of $1,983. On December 29, 2005, he sold these shares and netted $2,689, after commissions. Mr. Dufresne has a marginal tax rate of 25% and an average tax rate of 17%. To the nearest dollar, what is the effect on Marty's tax bill from the sale of these shares? A. $0.00 OB. $177 OC. $106 D. $120arrow_forward

- Need helparrow_forwardChristopher regularly invests in internet company stocks, hoping to become wealthy by making an early investment in the next high-tech phenomenon. In 2012, Christopher purchased 3,000 shares of FlicksNet, a film rental company, for 15 per share shortly after the company went public. Because Christopher purchased the shares in their initial offering, the shares are qualified small business stock. In 2019, Christopher sold 800 of the shares (at 325 per share) so that he could purchase a reservation for a seat on 1-lon Musks first human mission to Mars. What regular income tax consequences and AMT consequences arise for Christopher as a result of the sale of these shares?arrow_forwardMary purchased 1,000 shares of Lucky Boots for $500 per share in 2010. Since then, Lucky Boots has had two stock splits: 2-for-1 in 2015 and 3-for-1 in 2020. What are the number and price of shares Mary owns today? Assume no capital gains. Mary owns 500 shares for $250 each Mary owns 450 shares for $750 each Mary owns 167 shares for $1000 each Mary owns 6,000 shares for $83.33 eacharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT