Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

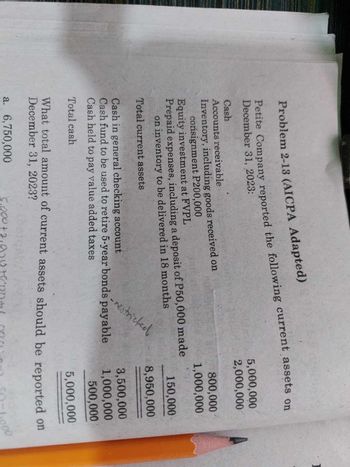

Transcribed Image Text:Problem 2-13 (AICPA Adapted)

Petite Company reported the following current assets on

December 31, 2023:

5,000,000

2,000,000

Cash

Accounts receivable

Inventory, including goods received on

800,000

consignment P200,000

1,000,000

Equity investment at FVPL

on inventory to be delivered in 18 months

Prepaid expenses, including a deposit of P50,000 made

150,000

Total current assets

Cash in general checking account

-restricted

8,950,000

3,500,000

Cash fund to be used to retire 5-year bonds payable

1,000,000

Cash held to pay value added taxes

500,000

5,000,000

Total cash

What total amount of current assets should be reported on

December 31, 2023?

a. 6,750,000

5,000+2,0

2,00076

200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- PROBLEM 1 BHEVERLYNN CORPORATIONSTATEMENTS OF FINANCIAL POSITIONAS AT MARCH 31,2021 AND 2020 (in peso)2021 2020 ASSETS Noncurrent AssetsProperty, Plant and equipment 1,125,000 742,000 Intangible assets 320,000 150,000 Financial asset at amortized cost 289,600 294,000 Investment in associate 144,000 120,000 Total noncurrent Assets 1,878,600 1,306,000 Current AssetsInventories 390,000 237,000 Prepaid expenses 23,000 15,000 Trade receivables 284,000 319,000 Financial assets at fair value through profit or loss (FVPL) 175,000 325,000 Temporary investments 148,000 46,000 Cash 54,000 102,000 Total current assets 1,074,000 1,044,000TOTAL ASSETS 2,952,600 2,350,000 EQUITY AND LIABILITIES Equity Share capital – P1 ordinary shares 550,000 400,000 Share premium 300,000 100,000 Revaluation surplus 130,000 60,000 Retained earnings 321,000 264,000 Retained earnings appropriated 250,000 100,000 Treasury shares (17,500) (25,000) Total equity 1,533,600 899,000 Noncurrent Liabilities Long-term loans…arrow_forward(in millions of euros) Operating activities Note Year ended December 31, 2019 2018 EBIT 4 1,381 1,182 Adjustments 21 779 432 Content investments, net (676) (137) Gross cash provided by operating activities before income tax paid 1,484 1,477 Other changes in net working capital 67 (28) Net cash provided by operating activities before income tax paid 1,551 1,449 Income tax (paid)/received, net 6.2 (283) (262) Net cash provided by operating activities 1,268 1,187 Investing activities Capital expenditures 3 (413) (351)arrow_forwardHh1.arrow_forward

- Problem 27-16 (AICPA Adapted) Ambitious Company showed the following schedule of depreciable assets on January 1, 2020. Accumulated depreciation Acquisition date Residual Asset Cost 4,000,000 2,000,000 2,800,000 2,560,000 1,440,000 1,344,000 2018 2017 2017 400,000 200,000. 560,000 The useful life of each asset is 5 years. The entity takes a full depreciation in the year of acquisition and no depreciation in the year of disposition. Asset C was sold for P1,700,000 on June 3ọ, 2020. O on Asset A is depreciated under the double declining method. 1: What is the depreciation of Asset A for 2020? 1,600,000 b. а. 1,440,000 416,000 576,000 с. d. 2. What is the depreciation of Asset B for 2020 ansuming same method in prior years? а. 240,000 b. 480,000 c. 360,000 d. 400,000 3. What is the gain on sale of Asset C? a. 244,000 b. 464,000 c. 356,000 d. 804,000 CS Scanned with CamScanner ABCarrow_forwardRefer to the information for Cox Inc. above. What amount would Cox record as depreciation expense for 2019 if the units-of-production method were used ( Note: Round your answer to the nearest dollar)? a. $179,400 b. $184,000 c. $218,400 d. $224,000arrow_forwardOn July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was estimated at 2,000. The equipment will be depreciated over 10 years using the double-declining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depredation expense of: a. 7,680 b. 9,000 c. 9,600 d. 10,000arrow_forward

- Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.arrow_forwardRequired information P8-8 (Algo) Determining Financial Statement Effects of Activities Related to Various Long-Lived Assets LO8-2, 8-3, 8-6 [The following information applies to the questions displayed below.] During the current year ending on December 31, BSP Company completed the following transactions: a. On January 1, purchased a patent for $29,000 cash (estimated useful life, five years). b. On January 1, purchased the assets (not detailed) of another business for $153,000 cash, including $14,000 for goodwill. The company assumed no liabilities. Goodwill has an indefinite life. c. On December 31, constructed a storage shed on land leased from D. Heald. The cost was $29,600. The company uses straight-line depreciation. The lease will expire in six years. (Amounts spent to enhance leased property are capitalized as intangible assets called Leasehold Improvements.) d. Total expenditures for ordinary repairs and maintenance were $5,300 during the current year. e. On December 31 of the…arrow_forwardWhat is the net book value of assetarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning