EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Give me answer please

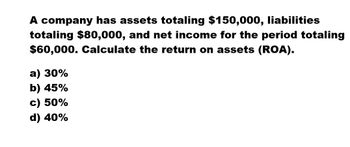

Transcribed Image Text:A company has assets totaling $150,000, liabilities

totaling $80,000, and net income for the period totaling

$60,000. Calculate the return on assets (ROA).

a) 30%

b) 45%

c) 50%

d) 40%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- If current assets are $112,000 and current liabilities are $56,000, what is the current ratio? A. 200 percent B. 50 percent C. 2.0 D. $50,000arrow_forwardA return on assets of 5.15% means that a company is earning: a.a $5.15 return on every $100 invested in long-term assets. b.a $5.15 return on every $100 of total assets. c.a $5.15 return on every $100 of assets minus liabilities. d.a $5.15 return on every $100 of current assets.arrow_forwardA return on assets of 5.15% means that a company is earning: O a. a $5.15 return on every $100 of assets minus liabilities. O b. a $5.15 return on every $100 of total assets. O c. a $5.15 return on every $100 of current assets. O d. a $5.15 return on every $100 invested in long-term assets.arrow_forward

- Landvision Inc. had net income in 2020 for $120,000. Here are some of the extra financial ratios from the annual report Profit margin 20%, Return on Assets 35%, Debt to Asset Ratio30% Please calculate the ROE ratio O A. 70% B. 60% O C. 50% O D. 25%arrow_forwardHello Expert Please Provide answerarrow_forwardAnswer this Financial Accountingarrow_forward

- A company has the following items for the fiscal year 2020: Revenue = 10 million EBIT = 4 million Net income = 2 million Total Equity = 15 million Total Assets = 30 million Calculate the company’s net profit margin, asset turnover, equity multiplier and ROEarrow_forwardWhat is the return on assets? General accountingarrow_forwardThe balance sheet of Mi-T-M reports total assets of $400,000 and $450,000 at the beginning and end of the year, respectively. The return on assets for the year is 10%. What is Mi-T-M's net income for the year? A. $42,500 B. $85,000 C. $45,000 D. $4,250,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College