Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN: 9780357033609

Author: Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Calculate this Question

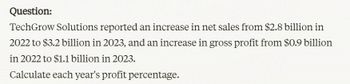

Transcribed Image Text:Question:

TechGrow Solutions reported an increase in net sales from $2.8 billion in

2022 to $3.2 billion in 2023, and an increase in gross profit from $0.9 billion

in 2022 to $1.1 billion in 2023.

Calculate each year's profit percentage.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Nonearrow_forwardComputing trend analysis Grand Oaks Realty’s net revenue and net income for the following five—year period, using 2015 as the base year, follow: Requirements Compute a trend analysis for net revenue and net income. Round to the nearest full percent. Which grew faster during the period, net revenue or net income?arrow_forwardUsing data available in the case, calculate the annual growth rate from 2020 to 2021 (in percentages). All calculations should be rounded to two decimals (e.g., 12.77%). > Answer is complete but not entirely correct. 2021 2020 2020-2021 Revenue 2,057,622 1,736,432 18.50 % Cost of Goods Sold 1,259,830 921,980 36.64 % Gross Profit 797,792 814,452 (1.02) % Operating Expenses 789,795 570,245 38.50 % Operating Income 7,997 244,207 2,953.73% Net Income 14,553 191,960 (92.42) %arrow_forward

- need help please provide answer of this questionarrow_forwardCalculating trend analysis Muscateer Corp reported the following revenues and net income amounts: Requirements Calculate Muscateer’s trend analysis for revenues and net income Use 2016 as the base year and round to the nearest percent. Which measure increased at a higher rate during 2017-2019?arrow_forwardGiven the historical income statement of Mega Trade Inc., how much would be added to the company's retained earning for the year 2016 (in millions)? Income Statement ( $ Million) Year End 2015 2016 2017 2019 Sales 1, 234.90 1,251.70 1,300.40 1,334.40 Cost of Sales -679.1 -659 -681.3 -667 Gross Operating Income Selling & Administration -339.7 -348.6 -351.2 -373.3 Depreciation -47.5 -52 -55.9 -75.2 Other Income / Expenses 11.8 7.6 7 8.2 Earnings Before Interest and Taxes Interest Income 1.3 1.4 1.7 2 Interest Expense -16.2 -15.1 -20.5 -23.7 Pre Tax Income Income Taxes -56.8 -64.2 -67.5 -72.6 Net Income Dividends -38.3 -38.7 -39.8 -40.1arrow_forward

- A company reported an increase in net sales from $ 4.3 billion in 2014 to $ 4.6 billion in 2015, and an increase in gross profit from $1.3 billion in 2014 to $1.5 billion in 2015. Calculate each year's profit percentage.arrow_forwardIn 2027 marigold corporation reported net income solve this questionarrow_forwardUse historic growth in total revenues from 2017 to 2017 to show the total revenue for 2019. Use historic rate of the total cost of revenue to total revenue to show total cost of revenue.arrow_forward

- 不 Net sales, net income, and total assets for Alex Shipping, Inc., for a five-year period follow: (Click the icon to view the data.) Read the requirements. Requirement 1. Calculate trend percentages for each item for 2018 through 2021. Use 2017 as the base year and round to the nearest percent. Alex Shipping, Inc. - Trend Percentages Net sales Net income Total assets 2021 2020 2019 2018 2017 199 % 161 % 115% 99% 100% 100 % 146 % 100% 123% 34 % 94% 100% 124 % 108 % 100% Requirement 2. Calculate the rate of return on net sales for 2019 through 2021, rounding to the nearest one-tenth percent. Explain what this means. Begin by selecting the rate of return on net sales (return on sales) formula and enter the amounts to calculate the percentages. (Enter amounts in thousands as provided to you in the problem statement. Complete all input fields. Enter "O" for any zero amounts and enter the return on sales amounts as percentages rounded to one-tenth percent, XX%.) ) 2019 2020 2021 ( ( Net…arrow_forwardZoobilee Inc. reported the following sales and net income amounts: (in thousands) 2020 2019 2018 2017 9,180 $ 8,990 $ 8,770 $ 8,550 Net income 520 500 460 400 Show Zoobilee's trend percentages for sales and net income. Use 2017 as the base year. Sales.... $ (Round your answers to the nearest percent.) Sales.. Net income.. 2020 % % 2019 % % 2018 % % 2017 100 % 100 %arrow_forwardWhat is the year-over-year revenue change percent? Use the attached financial data to calculate the ratios for 2022. Round to the nearest decimal. Abercrombie & Fitch Co (ANF) Financial Data Revenues Cost of Sales Total Operating Expenses Interest Expense Income Tax Expense Diluted Weighted Shares Outstanding Cash + Equivalents Accounts Receivable Inventories Total Current Assets Total Assets Accounts Payable Total Current Liabilities Total Stockholders' Equity ANF Stock Price = $10.30 Select one O A. 5.3% B. 14.4% C. -1.4% O D. -3.5% 2022 $3,659.3 $1,545.9 $2,026.9 $28.5 $37.8 52.8 $257.3 $108.5 $742.0 $1,220.4 $2,694.0 $322.1 $935.5 $656.1 2021 $3,712.8 $1,400.8 $1,968.9 $34.1 $38.9 62.6 $823.1 $69.1 $525.9 $1,507.8 $2,939.5 $374.8 $1,015.2 $826.1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning