FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

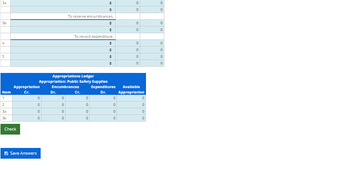

Transcribed Image Text:3a

3b

4

5

=

0

0

0

0

To reserve encumbrances.

=

÷

To record expenditure.

DO

0

0

0

÷

0

0

=

0

0

÷

0

0

÷

0

0

Appropriation

Appropriations Ledger

Appropriation: Public Safety Supplies

Encumbrances

Expenditures Available

Item

Cr.

Dr.

Cr.

Dr.

Appropriation

1

0

0

0

0

0

2

°

0

0

0

0

За

°

0

0

0

0

зь

0

0

0

0

0

Check

Save Answers

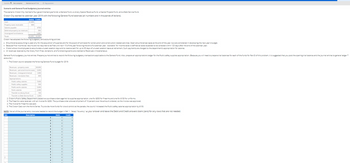

Transcribed Image Text:Question 1 Not complete

Marked out of 7.14

Flag question

Scenario and General Fund budgetary journal entries

The scenario: Croton City maintains four governmental-type funds: a General Fund, a Library Special Revenue Fund, a Capital Projects Fund, and a Debt Service Fund.

Croton City started its calendar year 2019 with the following General Fund balances (all numbers are in thousands of dollars).

Cash

Property taxes receivable

Debits Credits

$1,800

800

Salaries payable

Deferred property tax revenues

Unassigned fund balance

Totals

$700

300

1,600

$2,600

$2,600

Croton has adopted the following budgetary and accounting policies:

• Encumbrance accounting is used only for the acquisition of supplies and for the award of contracts for construction and construction-related activities. Open encumbrances lapse at the end of the year, but are considered in developing the next year's budget.

Because final income tax returns are not required to be filed until April 15 of the year following the end of a calendar year, "available" for income taxes is defined as taxes expected to be collected within 120 days after the end of the calendar year.

• Croton allows its employees to accumulate unused vacation days and to receive cash for up to 30 days of unused vacation leave at retirement. Such payments are charged to the department's appropriation for salarie

• All revenues received by the library from fines, donations, and fundraising events are credited to Revenues-miscellaneous.

General Fund budgetary journal entries: Prepare journal entries to record the following budgetary transactions applicable to the General Fund. Also, prepare an appropriations ledger for the Public safety supplies appropriation. (Because you will need to prepare trial balances for each of the funds for Part D of this problem, it is suggested that you post the opening trial balance and the journal entries to general ledger T

accounts.)

1. The Croton council adopted the following General Fund budget for 2019:

Revenues-property taxes

Revenues-personal income taxes

$9,000

Revenues-intergovernmental

1,000

Revenues-recreation fees

Appropriations:

Public safety salaries

Public safety supplies

500

Public works salaries

Parks salaries

Transfer to Library Fund

Transfer to Debt Service Fund

1,200

2. Croton's Public Safety Department placed two purchase orders against its supplies appropriation, one for $300 for firearms and one for $150 for uniforms.

3. The firearms were received, with an invoice for $330. The purchase order allowed shipment of 10 percent over the amount ordered, so the invoice was approved.

4. The invoice for firearms was paid.

5. The Croton Cats won the World Series. To provide more funds for crowd control at the parade, the council increased the Public safety salaries appropriation by $100.

NOTE: Not all of the journal entry rows are needed to record the budget in Ref. 1. Select "No entry" as your answer and leave the Debit and Credit answers blank (zero) for any rows that are not needed.

Ref.

Description

Debit

=

0

0

=

0

0

=

0

0

=

0

0

=

0

0

.

0

0

A

0

0

수

0

0

÷

0

0

÷

0

0

÷

0

0

÷

0

0

=

0

0

0

0

0

0

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Prepare a preclosing trial balance for the General Fund as of December 31, 2021.arrow_forwardPrepare a balance sheet and a statement of revenues, expenditures, and changes in fund balance for the General Fund for the year ended December 31, 2021.arrow_forwardRelationship between budgetary fund balance and actual fund balance The Village of Albert’s Alley recorded the following budgetary journal entry at the beginning of fiscal 2022: Estimated revenue 5,000,000 Appropriations 4,950,000 Budgetary fund balance 50,000 At the end of fiscal 2022, what would be the effect on the ending actual fund balance, assuming the following: a. Actual revenues are $3,000 less than estimated revenues, and actual expenditures are $2,000. The actual ending fund balance would increase by?arrow_forward

- Prepare the necessary closing entries for the General Fund for the year ended December 31, 2021.arrow_forward5arrow_forwardReview problem affecting reporting on General Fund As the recently appointed chief accountant of the City of York, you asked the bookkeeper for a trialbalance of the General Fund as of December 31, 2022. York uses only a General Fund to recordall its transactions. This is what you received: City of York General Fund Trial Balance December 31, 2022 Debits Credits Cash $20,800 Short-term investments 180,000 Accounts receivable 11,500 Taxes receivable—current 30,000 Tax anticipation notes payable $58,000 Appropriations 927,000 Expenditures 795,200 Estimated revenues 927,000 Revenues 750,000 General city property 98,500 General obligation bonds payable 52,000 Unassigned fund balance 380,000 $2,115,000 $2,115,000 After reviewing the trial balance, you realize that the inexperienced bookkeeper made errors onsome transactions and merely guessed at the correct accounting treatment of other transactions.This is what you found…arrow_forward

- Miscellaneous scenarios requiring journal entries The following transactions and events pertain to Bean County’s General Fundfor the calendar year 2022:1. The entity receives invoices in early January 2023 for $25,000 for professional servicesobtained in 2022, and $32,000 for December 2022 utility services.2. The entity borrows $500,000 on August 1, 2022, in anticipation of thecollection of property taxes. The borrowed amount is due to be repaid onJanuary 31, 2023, with interest at the rate of 1.5 percent per annum.3. The entity invests $300,000 cash in a CD on November 1, 2022, at an interest rateof 1 percent per annum. The CD will mature on January 31, 2023.4. In September 2022, the entity receives and accepts supplies that had beenordered in August. The amount that had been encumbered was $40,000,but the amount of the approved invoice was $42,000.Prepare journal entries for the transactions and events listed above.Enter 0 or leave the field blank if no entry is required for calendar…arrow_forwardFocarrow_forwardHaradevarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education