Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

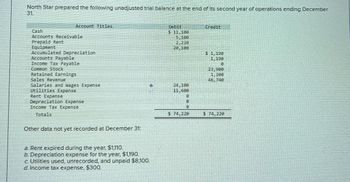

Transcribed Image Text:North Star prepared the following unadjusted trial balance at the end of its second year of operations ending December

31.

Account Titles,

Cash

Accounts Receivable

Prepaid Rent

Equipment

Accumulated Depreciation

Accounts Payable

Income Tax Payable

Debit

$ 11,100

Credit

5,100

2,228

20,100

$1,198

1,198

Retained Earnings

Sales Revenue

Salaries and Wages Expense

0

Utilities Expense

24.100

11,600

B

Rent Expense

Depreciation Expense

Income Tax Expense

Totals

Other data not yet recorded at December 31:

a. Rent expired during the year, $1,110.

b. Depreciation expense for the year, $1,190.

c. Utilities used, unrecorded, and unpaid $8,100.

d. Income tax expense, $300.

1,280

46,740

$ 74,228

$ 74,220

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following information was taken from the accounts receivable records of Sarasota Corporation as at December 31, 2020: OutstandingBalance Percentage Estimatedto be Uncollectible 0 – 30 days outstanding $160,000 0.5% 31 – 60 days outstanding 66,000 2.5% 61 – 90 days outstanding 40,200 4.0% 91 – 120 days outstanding 20,600 6.5% Over 120 days outstanding 5,600 10.0% (a) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a credit balance of $1,200 prior to the adjustment (b) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a debit balance of $3,880 prior to the adjustment.arrow_forwardThe following information was taken from the accounts receivable records of Monty Corporation as at December 31, 2020: OutstandingBalance Percentage Estimatedto be Uncollectible 0 – 30 days outstanding $156,000 0.5% 31 – 60 days outstanding 65,400 2.5% 61 – 90 days outstanding 40,000 4.0% 91 – 120 days outstanding 20,800 6.5% Over 120 days outstanding 5,100 10.0% (a) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a credit balance of $1,280 prior to the adjustment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit (b) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a debit balance of $4,010 prior to the…arrow_forwardCurrent Assets Dorothy Corporation had the following accounts in its year-end adjusted trial balance: Inventories, $23,800; Accounts Receivable, $7,000; Accounts Payable, $7,200; Prepaid Rent, $2,400; Marketable Securities, $3,000; Allowance for Doubtful Accounts, $1,100; and Cash, $1,200. Prepare the current assets section of Dorothy's year-end balance sheet. Current Assets Cash Marketable securities Accounts receivable Less: Allowance for doubtful accounts Inventories Prepaid rent Total current assets Dorothy Corporation Partial Balance Sheet Feedback 7,000 ✓ 1,100✔ 1,200 3,000 ✓ 5,900 23,800 2,400 ✓arrow_forward

- Current Assets Dorothy Corporation had the following accounts in its year-end adjusted trial balance: Inventories, $23,000; Accounts Receivable, $7,500; Accounts Payable, $7,200; Prepaid Rent, $2,400; Marketable Securities, $3,000; Allowance for Doubtful Accounts, $1,100; and Cash, $1,800. Prepare the current assets section of Dorothy's year-end balance sheet. Current Assets Cash Marketable securities Accounts receivable Less: Allowance for doubtful accounts Inventories Prepaid rent Dorothy Corporation Partial Balance Sheet Total current assets 000arrow_forwardComplete a Vertical analysis of the "Unearned revenue" account using the balance sheet as at 30/06/2021. Round the percentage change to one decimal placearrow_forwardThe following information was taken from the accounts receivable records of Pina Colada Corporation as at December 31, 2020: OutstandingBalance Percentage Estimatedto be Uncollectible 0 – 30 days outstanding $154,000 0.5% 31 – 60 days outstanding 63,200 2.5% 61 – 90 days outstanding 39,100 4.0% 91 – 120 days outstanding 21,600 6.5% Over 120 days outstanding 5,300 10.0% (a) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a credit balance of $1,170 prior to the adjustment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit (b) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a debit balance of $3,990 prior to…arrow_forward

- A year end review of Accounts Receivable and estimated uncollectible percentages revealed the following: attached in ss below thankas gwroiwrnioarrow_forwardA recent annual report for RVC contained the following information (dollars in thousands) at the end of its fiscal year: Year 2 Year 1 Accounts receivable $ 9,077,000 $ 8,620,000 Allowance for doubtful accounts (1,020,000 ) (552,000 ) $ 8,057,000 $ 8,068,000 A footnote to the financial statements disclosed that uncollectible accounts amounting to $816,000 and $426,000 were written off as bad debts during year 2 and year 1, respectively. Assume that the tax rate for RVC was 35 percent. Required: 1. Determine the bad debt expense for year 2 based on the preceding facts.(Hint: Use the Allowance for Doubtful Accounts T-account to solve for the missing value.) (Enter your answers in thousands not in dollars.) 2. Working capital is defined as current assets minus current liabilities. Would the working capital be affected by the write-off of an uncollectible account? 3. Would the net income be affected by the $816,000 write-off during year…arrow_forwardPlease help mearrow_forward

- Tantrum Company provided the following information in relation to accounts receivable at year-end: Days outstanding estimated amount %uncollectible www M 1% 1,200,000 900,000 0-60 61-120 2% 1,000,000 3,100,000\ During the current year, the entity wrote off P70,000 in accounts receivable and recovered P20,000 that had been written off in prior years. At the beginning of current year, the allowance for uncollectible accounts was Over 120 6% P60,000. Under the aging method, what amount of uncollectible accounts expense should be reported for the current year?arrow_forwardSelected accounts from Lue Co.’s adjusted trial balance for the year ended December 31 follow. Prepare aclassified balance sheet. Total equity. . . . . . . . . . . . . . . . . . . . . . . . . . . $30,000 Employee federal income taxes payable . . . . . . . . $9,000Equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . 40,000 Federal unemployment taxes payable . . . . . . . . . . 200Salaries payable . . . . . . . . . . . . . . . . . . . . . . 34,000 FICA—Medicare taxes payable . . . . . . . . . . . . . . . . 725Accounts receivable . . . . . . . . . . . . . . . . . . . 5,100 FICA—Social Security taxes payable . . . . . . . . . . . . 3,100Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50,000 Employee medical insurance payable . . . . . . . . . . 2,000Current portion of long-term debt . . . . . . . . 4,000 State unemployment taxes payable . . . . . . . . . . . . 1,800Notes payable (due in 6 years) . . . . . . . . . . . 10,000 Sales tax payable (due in 2 weeks)…arrow_forwardMaxwell Inc. analyzed its accounts receivable balances at December 31, and arrived at the aged balances listed below, along with the percentage that is estimated to be uncollectible: % Considered Age Group Balance Uncollectible 0-30 days past due $100,000 1% 31-60 days past due 18,000 3% 61-120 days past due 20,000 6% 121-180 days past due 7,000 10% Over 180 days past due 2,000 20% $147,000 The company handles credit losses using the allowance method.The credit balance of the Allowance for Doubtful Accounts is $840 on December 31, before any adjustments.a. Determine the amount of the adjustment for estimated credit losses on December 31.$Answerb. Determine the financial statement effect of a write off of Porter Company’s account on the following May 12, in the amount of $480.Use negative signs with answers, when appropriate.If a transaction increases and decreases the same Balance Sheet category, enter the increase amount in the first row and the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub