FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

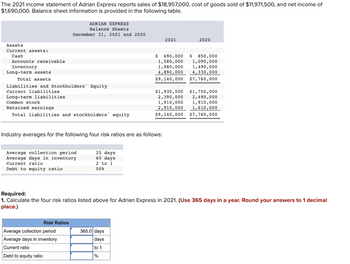

Transcribed Image Text:The 2021 income statement of Adrian Express reports sales of $18,957,000, cost of goods sold of $11,971,500, and net income of

$1,690,000. Balance sheet information is provided in the following table.

Assets

Current assets:

Cash

Accounts receivable

Inventory

Long-term assets.

Total assets

Liabilities and Stockholders' Equity

Current liabilities

Long-term liabilities

Common stock

Retained earnings

Total liabilities and stockholders' equity

ADRIAN EXPRESS

Balance Sheets

December 31, 2021 and 2020

Average collection period

Average days in inventory

Current ratio

Debt to equity ratio

Industry averages for the following four risk ratios are as follows:

Risk Ratios

Average collection period

Average days in inventory

Current ratio

Debt to equity ratio

25 days

60 days.

2 to 1

50%

2021

$ 690,000

1,580,000

1,980,000

4,890,000

$9, 140,000

365.0 days

days

to 1

%

2020

$

850,000

1,090,000

1,490,000

4,330,000

$7,760,000

Required:

1. Calculate the four risk ratios listed above for Adrian Express in 2021. (Use 365 days in a year. Round your answers to 1 decimal

place.)

$1,930,000 $1,750,000

2,390,000 2,490,000

1,910,000 1,910,000

2,910,000 1,610,000

$9,140,000 $7,760,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ratio AnalysisPresented below are summary financial data from Pompeo’s annual report: Amounts in millions Balance Sheet Cash and Cash Equivalents $1,865 Marketable Securities 19,100 Accounts Receivable (net) 9,367 Total Current Assets 39,088 Total Assets 123,078 Current Liabilities 39,255 Long-Term Debt 7,279 Shareholders’ Equity 68,278 Income Statement Interest Expense 375 Net Income Before Taxes 14,007 Calculate the following ratios:(Round to 2 decimal points) a. Times-interest-earned ratio Answer b. Quick ratio Answer c. Current ratio Answer PreviousSave AnswersNextarrow_forwardConsider the following financial data for Terry Enterprises: Balance Sheet as of December 31, 2018 Cash $ 86,000 Accounts payable $ 15,500 Accts. receivable 91,500 Notes payable 93,500 Inventories 65,500 Accruals 19,500 Total current assets $ 243,000 Total current liabilities $ 128,500 Long-term debt 162,500 Net plant & equip. 419,500 Common equity 371,500 Total assets $ 662,500 Total liab. & equity $ 662,500 Statement of Earnings for 2018 Industry Average Ratios Net sales $ 642,500 Current ratio 2.2× Cost of goods sold 482,000 Quick ratio 1.7× Gross profit $ 160,500 Days sales outstanding 44 days Operating expenses 119,500 Inventory turnover 6.7× EBIT $ 41,000 Total asset turnover 0.6× Interest expense 14,500 Net profit margin 7.2% Pre-tax earnings $ 26,500…arrow_forwarduse the following information to make a Common size income statementarrow_forward

- The balance sheet for Altoid Company is shown below. ALTOID COMPANY Balance Sheet December 31, 2024 Assets: Cash Short-term investments Accounts receivable (net) Inventory Property, plant, and equipment (net) Total assets Liabilities and shareholders' equity: Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and shareholders' equity $ 250 700 800 950 1,170 $ 3,870 $ 950 1,100 650 1,170 $ 3,870 Selected 2024 income statement information for Altoid Company includes: Net Sales Operating expenses $ 8,700 7,770 Income before interest and tax 930 130 Income tax expense 240 Net income $ 560 Interest expense Required: Compute Altoid Company's long-term debt to equity ratio for 2024 Note: Round your answer to 2 decimal places. Long-term debt to equityarrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forwardConsider the following company’s balance sheet and income statement. Number of days in inventory. Debt-to-asset ratio. Cash-flow-to-debt ratio.arrow_forward

- Given the data in the following table, the entry for Inventories on the 2023 common-sized balance sheet was %.arrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forwardRatio Analysis Presented below are summary financial data from Porter's annual report: Amounts in millions Balance Sheet Cash and Cash Equivalents Marketable Securities Accounts Receivable (net) Total Current Assets Total Assets Current Liabilities Long-Term Debt- Shareholders' Equity Income Statement Interest Expense Net Income Before Taxes b. Quick ratio $1,850 19,100 9,367 39,088 123,078 38,450 7,279 68,278 Calculate the following ratios: (Round to 2 decimal points) a. Times-interest-earned ratio c. Current ratio 400 14,007arrow_forward

- The financial statements for Armstrong and Blair companies for the current year are summarized below: Blair Company Statement of Financial Position Cash Accounts receivable (net) Inventory Property, plant, and equipment (net) Other non-current assets Total assets Current liabilities. Long-term debt (10%) Share capital Contributed surplus Retained earnings Total liabilities and shareholders' equity Statement of Earnings Sales revenue (1/3 on credit) Cost of sales Expenses (including interest and income tax) Net earnings Accounts receivable (net) Inventory Long-term debt Other data: Share price year-end Income tax rate Dividends declared and paid Shares Outstanding $ Selected data from the financial statements for the previous year follows: Blair Company Armstrong Company 30,000 82,000 94,000 $ 50,000 28,000 86,000 $ $ 18 30% 46,000 15,000 Armstrong Company $ 36,000 $ 32,000 30,000 40,000 205,000 35,000 170,000 95,000 $ 536,000 $ 125,000 94,000 180,000 40,000 97,000 $ 536,000 $ 550,000…arrow_forwardPlease solve for PART A (liquidity’s current ratio, account receivables turnover, and inventory turnover/profitability’s profit margin, asset turnover, return on assets, and earnings per share) and PART B (return on common stockholder’s equity, debt to assets ratio, and price earnings ratio)arrow_forwardN1. Account Calculate the following ratios for Lake of Egypt Marina, Inc. as of year-end 2021. (Use sales when computing the inventory turnover and use total stockholders' equity when computing the equity multiplier. Round your answers to 2 decimal places. Use 365 days a year.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education