Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Financial accounting

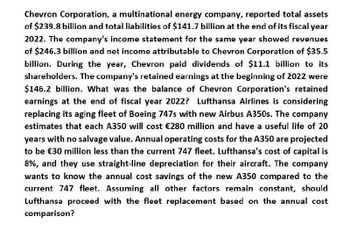

Transcribed Image Text:Chevron Corporation, a multinational energy company, reported total assets

of $239.8 billion and total liabilities of $141.7 billion at the end of its fiscal year

2022. The company's income statement for the same year showed revenues

of $246.3 billion and net income attributable to Chevron Corporation of $35.5

billion. During the year, Chevron paid dividends of $11.1 billion to its

shareholders. The company's retained earnings at the beginning of 2022 were

$146.2 billion. What was the balance of Chevron Corporation's retained

earnings at the end of fiscal year 2022? Lufthansa Airlines is considering

replacing its aging fleet of Boeing 747s with new Airbus A350s. The company

estimates that each A350 will cost €280 million and have a useful life of 20

years with no salvage value. Annual operating costs for the A350 are projected

to be €30 million less than the current 747 fleet. Lufthansa's cost of capital is

8%, and they use straight-line depreciation for their aircraft. The company

wants to know the annual cost savings of the new A350 compared to the

current 747 fleet. Assuming all other factors remain constant, should

Lufthansa proceed with the fleet replacement based on the annual cost

comparison?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Amazon.com, Inc. is preparing its financial statements for the fiscal year ending December 31, 2023. The company's preliminary income statement shows net sales of $514 billion, cost of sales of $320 billion, operating expenses of $160 billion, and other income of $2 billion. Amazon's effective tax rate for the year is 21%. The company had 10.2 billion weighted average shares outstanding during the year and 10.3 billion shares outstanding at year-end. Calculate Amazon's basic earnings per share (EPS) for the fiscal year 2023, and determine if it has improved from the previous year when the basic EPS was $1.25. The Walt Disney Company is evaluating its financial performance for the fiscal year ending September 30, 2023. The company reported total revenues of $82.7 billion, cost of revenues of $52.3 billion, and operating expenses of $21.5 billion. Disney's interest expense for the year was $1.2 billion, and its effective tax rate was 25%. The company had 1.83 billion weighted average…arrow_forwardProvide answerarrow_forwardSchaeffer Corporation reports $50 million accumulated other comprehensive income in its balance sheet as a component of shareholders’ equity. In a related statement reporting comprehensive income for the year, the company reveals net income of $400 million and other comprehensive income of $15 million. What was the balance in accumulated other comprehensive income in last year’s balance sheet?arrow_forward

- Reagan Corp. has reported a net income of $847,700 for the year. The company's share price is $13.19 and has 319,740 outstanding shares. Compute the firm's price-earnings ratio.arrow_forwardMacon Mills is a division of Bolin Products, Inc. During the most recent year, Macon had a net income of $43 million. Included in the income was interestexpense of $2,500,000. The company's tax rate was 40%. Total assets were $475 million, current liabilities were $108,000,000, and $69,000,000 of thecurrent liabilities are noninterest bearing.What are the invested capital and RO1 for Macon? Enter your answer in whole dollar. Round "ROI" answer to two decimal places. Invested Capital: ?ROI: ?arrow_forwardKeokuk Corp. had the following operating results for 2021 & 2020. Keokuk paid dividends of $100,000 per year for both years and made capital expenditures of $45,000 in both years. The company's stock price in 2021 was $12.00 and $10.00 in 2020. In 2021, the industry average earnings multiple was 10, the free cash flow multiple was 20 and sales multiple was 2.00. Thecompany is publicly owned and has 1,050,000 shares of outstanding stock at the end of 2021. A. Calculate the 2021 market value of the company. B. Compare Keokuk’s Equity Book Value to the Market Value. Discuss conceptually (not differences in the numerical calculations) the difference between these two amounts.arrow_forward

- Keokuk Corp. had the following operating results for 2021 & 2020. Keokuk paid dividends of $100,000 per year for both years and made capital expenditures of $45,000 in both years. The company's stock price in 2021 was $12.00 and $10.00 in 2020. In 2021, the industry average earnings multiple was 10, the free cash flow multiple was 20 and sales multiple was 2.00. Thecompany is publicly owned and has 1,050,000 shares of outstanding stock at the end of 2021. a. Calculate the 2021 value of the company using the earnings multiple. b. Calculate the 2021 value of the company using the free cash flow multiple c. Calculate the 2021 book value of the company's equity.arrow_forwardNNR Inc.'s balance sheet showed total current assets of $1,812,000 plus $4,379,000 of net fixed assets. All of these assets were required in operations. The firm's current liabilities consisted of $498,000 of accounts payable, $350,000 of 6% short-term notes payable to the bank, and $141,000 of accrued wages and taxes. Its remaining capital consisted of long-term debt and common equity. What was NNR's total investor-provided operating capital? Group of answer choices $5,829,600 $5,552,000 $4,719,200 $4,996,800 $6,107,200arrow_forwardThe most recent income statement of Marble Resurfacing, Inc. reported net sales of $23,600, EBIT of $6,836, taxable income of $5,260 and net income of $4,470. The firm paid $1,368 in dividends. The balance sheet reported current assets of $5,860, net fixed assets of $19,600, current liabilities of $2,470, long-term debt of $8,800, common stock of $10,000 and retained earnings of $4,190. The profit margin, the debt-equity ratio, and the dividend payout ratio for Marble Resurfacing are constant. Sales are expected to increase by $3,400 next year. What is the projected addition to retained earnings for next year?arrow_forward

- The 2021 and 2020 balance sheets for Sunset Industries are provided below. The company’s sales for 2021 were $1,320 million, and EBITDA was 15% of sales. Furthermore, depreciation amounted to 10% of net fixed assets, interest expense was $30 million, the corporate tax rate was 25%, and Sunset pays out 40% of its net income as dividends. Sunset had 25 million shares outstanding in 2021, the 12/31/21 stock price was $80 per share, and its after-tax cost of capital was 15%. Based upon this information, answer the following questions. Sunset Industries December 31 Balance Sheets (in thousands of dollars) 2021 2020 Assets Cash and cash equivalents $55,908 $44,000 Excess cash $5,992 $6,793 Accounts receivable $112,044 $92,370 Inventories $176,251 $157,488 Total current assets $350,195 $300,651 Net fixed assets $408,000 $324,000 Total assets $758,195 $624,651 Liabilities and equity Accounts payable $42,018 $30,420 Accruals $24,187 $18,981 Notes payable $38,500 $40,000 Total current…arrow_forwardNNR Inc.'s balance sheet showed total current assets of $1,875,000 plus $4,225,000 of net fixed assets. All of these assets were required in operations. The firm's current liabilities consisted of $475,000 of accounts payable, $375,000 of 6% short-term notes payable to the bank, and $150,000 of accrued wages and taxes. Its remaining capital consisted of long-term debt and common equity. What was NNR's total operating capital?arrow_forwardNNR Inc.'s balance sheet showed total current assets of $1,875,000 plus $4,225,000 of net fixed assets. All of these assets were required in operations. The firm's current liabilities consisted of $475,000 of accounts payable, $375,000 of 6% short-term notes payable to the bank, and $150,000 of accrued wages and taxes. Its remaining capital consisted of long-term debt and common equity. What was NNR's total operating capital?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning