FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

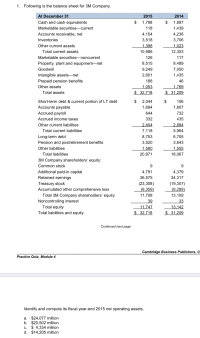

Transcribed Image Text:Following is the balance sheet for 3M Company.

At December 31

2015

2014

Cash and cash equivalents

$

1,798

$

1,897

Marketable securities-current

118

1,439

Accounts receivable, net

4,154

4,238

Inventories

3,518

3,706

Other current assets

1,398

1,023

Total current assets

10,986

12,303

Marketable securities-noncurrent

126

117

Property, plant and equipment--net

8,515

8,489

Goodwill

9,249

7,050

Intangible assets-net

2,601

1,435

Prepaid pension benefits

188

46

1,053

$32,718

1,769

$31,209

Other assets

Total assets

$

$

Short-term debt & current portion of LT debt

Accounts payable

2,044

106

1,694

1,807

Accrued payroll

644

732

Accrued income taxes

332

435

Other current liabilities

2,404

2,884

Total current liabilities

7,118

5,964

Long-term debt

8,753

6,705

Pension and postretirement benefits

3,520

3,843

Other liabilities

1,580

1,555

Total liabilities

20,971

18,067

3M Company shareholders' equity:

Common stock

9.

Additional paid-in capital

Retained earnings

4,791

4,379

36,575

34,317

Treasury stock

Accumulated other comprehensive loss

(23,308)

(19,307)

(6,359)

(6,289)

Total 3M Company shareholders' equity

Noncontrolling interest

Total equity

11,708

13,109

39

33

11.747

13,142

Total liabilities and equity

$32,718

$31,209

Continued next page

Cambridge Business Publishe

actice Quiz, Module 4

Identify and compute its fiscal year-end 2015 net operating assets.

a. $24,077 million

b. $20,502 million

$ 4,334 million

d. $14,205 million

С.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Consider the following financial data for Terry Enterprises: Balance Sheet as of December 31, 2018 Cash $ 86,000 Accounts payable $ 15,500 Accts. receivable 91,500 Notes payable 93,500 Inventories 65,500 Accruals 19,500 Total current assets $ 243,000 Total current liabilities $ 128,500 Long-term debt 162,500 Net plant & equip. 419,500 Common equity 371,500 Total assets $ 662,500 Total liab. & equity $ 662,500 Statement of Earnings for 2018 Industry Average Ratios Net sales $ 642,500 Current ratio 2.2× Cost of goods sold 482,000 Quick ratio 1.7× Gross profit $ 160,500 Days sales outstanding 44 days Operating expenses 119,500 Inventory turnover 6.7× EBIT $ 41,000 Total asset turnover 0.6× Interest expense 14,500 Net profit margin 7.2% Pre-tax earnings $ 26,500…arrow_forwardGulf Shipping Company Balance Sheet As of January 24, 2023 (amounts in thousands) Cash 14,300 Accounts Payable Accounts Receivable 4,100 Inventory 5,800 Property Plant & Equipment 14,800 Other Assets 700 1,900 3,200 4,000 9,100 7,700 22,900 30,600 39,700 Total Liabilities & Equity 39,700 Debt Other Liabilities Total Liabilities Paid-In Capital Retained Earnings Total Equity Total Assets Record the transactions in a journal, transfer the journal entries to T-accounts, compute closing amounts for the T-accounts, and construct a balance sheet to answer the question. Jan 25. Sell, deliver, and receive payment of $25,000 for service Jan 26. Consume good or service and pay expense of $1,000 Jan 27. Sell product for $30,000 in cash with historical cost of $24,000 What is the final amount in Total Liabilities & Equity?arrow_forwardHelp | System Announcements Balance Sheet As of 12/31/19 Assets: Liabilities and Equity: Cash and marketable securities $28,987 Accounts payable and accruals $154,807 Accounts receivable $142,845 Short-term notes payable $21,639 Inventory $212,722 Total current liabilities $176,446 Total current assets $384,554 Long term debt $155,510 Net plant and equipment $602,309 Total liabilities $331,956 Goodwill and cther assets $42,422 Common stock $314,932 Retained earnings $382,397 Total assets $1,029,285 Total liabilities and equity $1,029,285 In addition, it was reported that the firm had a net income of: $158,531 and net sales of: $4,338,283 Calculate the following ratios for this firm (Use 365 days for calculation. Round answers to 2 decimal places, e.g. 52.75.): Current Ratio times Quick Ratio times Average Collection Period days Total Asset Turnever times Fixed Asset Turnover times Questionarrow_forward

- The financial statements of Clearwater Furniture Company include the following items: Cash OA. 0.12 OB. 0.27 OC. 0.21 Short-term Investments Net Accounts Receivable Merchandise Inventory Total Assets Total Current Liabilities Long term Note Payable 2017 $63,500 28,000 94,000 157,000 531,000 234,000 62,000 2016 $51,000 17,000 106,000 143,000 544,000 217,000 52,000 Using the following formula, what is 2017 cash ratio? (Round your answer to two decimal places.). FORMULA: Cash ratio (Cash + Cash equivalents)/Total current liabilitiesarrow_forwardInformation for questions 12 and 13 The following are extracts from the financial statements of a company for the two years ended 31 December 2016 and 2017. Statement of financial position as at 31 December Inventory Trade receivables Cash and bank balances Bank overdraft Trade payables 2016 £000 590 275 25 200 1,218 1,536 2017 £000 465 425 76 450 710 2,728 Non-Current assets Non-Current liabilities 0 300 Issued £1 Ordinary Shares 5,000 5,500 The income statement for the year ended 31 December 2017 shows an operating profit of c) £1,265,000 d) £1,815,000 £1,500,000 after charging depreciation of £600,000 and a profit on disposal of a non-current asset of £52,000. Q12. The change in the company's cash and cash equivalents for the year ended 31 December 2017 was: a) Outflow £199,000 b) Inflow £1 16,000 c) Outflow £89,000 d) Inflow £51,000 Q13. The cash flow from operations of the company for the year ended 31 December 2017 was: a) £1,515,000 b) £1,619,000arrow_forwardHow do I determine the NNO for 2014? Dec. 31, 2016 Dec. 31, 2015 Dec. 31, 2014 Operating Assets 1,447,869 1,513,139 Operating liabilities 1,094,173 1,158,007 Net operating assets (NOA) 353,696 355,132 $ 397,299.00 NNO $ 490,548 $ 473,323 Equity $ 844,244 $ 828,455 $ 726,328.00 NOA= NNO + Equity $ 1,334,792 $ 1,301,778arrow_forward

- Use the information below for Harding Company to answer the question that follow. Harding Company Accounts payable $35,479 Accounts receivable 69,658 Accrued liabilities 6,342 Cash 21,866 Intangible assets 40,636 Inventory 81,299 Long-term investments 116,464 Long-term liabilities 78,760 Marketable securities 34,728 Notes payable (short-term) 21,173 Property, plant, and equipment 607,986 Prepaid expenses 2,827 Based on the data for Harding Company, what is the amount of quick assets? a.$56,594 b.$126,252 c.$1,510,965 d.$745,879arrow_forwardThe asset side of the 2017 balance sheet for the Corporation is below. The company reported total revenues of $37,728 million in 2017 and $37,047 million in 2016. in millions May 31, 2017 May 31, 2016 Current assets: Cash and cash equivalents $ 21,784 $ 20,152 Marketable securities 44,294 35,973 Trade receivables, net of allowances for doubtful accounts of $319 and $327 as of May 31, 2017 and May 31, 2016, respectively 5,300 5,385 Inventories 300 212 Prepaid expenses and other current assets 2,837 2,591 Total current assets 74,515 64,313 Non-current assets: Property, plant and equipment, net 5,315 4,000 Intangible assets, net 7,679 4,943 Goodwill, net 43,045 34,590 Deferred tax assets 1,143 1,291 Other assets 3,294 3,043 Total non-current assets 60,476 47,867 Total assets $134,991 $112,180 How do I figure what the company’s gross amount…arrow_forwardAssets Line Item Description Amount Cash and short-term investments $42,572 Accounts receivable (net) 33,774 Inventory 37,691 Property, plant, and equipment 215,705 Total assets $329,742 Liabilities and Stockholders’ Equity Line Item Description Amount Current liabilities $68,960 Long-term liabilities 98,919 Common stock, $10 par 64,740 Retained earnings 97,123 Total liabilities and stockholders’ equity $329,742 Income Statement Line Item Description Amount Sales $91,805 Cost of goods sold (41,312) Gross profit $50,493 Operating expenses (28,002) Net income $22,491 Number of shares of common stock 6,474 Market price of common stock $28 What is the current ratio?arrow_forward

- The following are taken from the financial statements of Curry Company as of December 2021. Assets: Cash 341,600 Account Receivable 200,000 Inventory 308,400 Property, Plant, Equipment 500,000 Liabilities: Notes payable 280,000 Accounts Payable 781,700 Bonds payable 2,000,000 6. What is the company's current ratio? a. 0.80 b. 0.51 c. 0.21 d. 3.03 7. What is the company's quick ratio? a. 0.51 b. 0.80 c. 1.93 d. 0.32arrow_forwardABCD Corp Balance Sheet and Income Statement for the period as at December 31, 2014 Balance Sheet Assets RM Cash 72,000 Accounts receivable 439,000 Inventories 894,000 Total current assets1,405,000 Fixed Assets 431,000 Total Assets1,836,000 Liabilities Accounts and Notes payable 432,000 Accruals 170,000 Total Current Liabilities 602,000 Long term debt 404,290 Common stock 575,000 Retained Earnings 254,710 Total Liabilities & Equity1,836,000 Income Statement Sales 4,290,000 Cost of goods sold 3,580,000 Selling, general, and administrative expenses 370,320 Depreciation 159,000 Earnings before taxes (EBT) 180,680 Taxes (40%) 72,272 Net Income 108,408 Per Share Data EPS RM4.71 Cash dividends per share RM0.95 P/E ratio 5 x Market Price (average) RM23.57 Number of Shares Outstanding 23,000 INDUSTRY FINANCIAL RATIO 1. Quick ratio 1.0x 2. Current ratio 2.7x 3. Inventory turnover 7.0x 4. Days sales outstanding 32 days 5. Fixed asset turnover 13.0x 6.…arrow_forwardThe current assets and current liabilities sections of the balance sheet of Sunland Co. appear as follows. Sunland Co.Balance Sheet (Partial)As of December 31, 2017 Cash $ 17,900 Accounts payable $ 29,500 Accounts receivable $ 39,600 Notes payable 15,400 Less: Allowance for doubtful accounts 3,200 36,400 Unearned revenue 3,800 Inventory 61,100 Total current liabilities $ 48,700 Prepaid expenses 7,400 Total current assets $ 122,800 The following errors in the corporation’s accounting have been discovered: 1. Keane collected $ 5,200 on December 20, 2017 as a down payment for services to be performed in January, 2018. The company’s controller recorded the amount as revenue. 2. The inventory amount reported included $ 2,300 of merchandise that had been received on December 31, 2017 but for which no purchase invoices had been received or entered. Of this amount, $ 1,600 had been received on…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education