FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

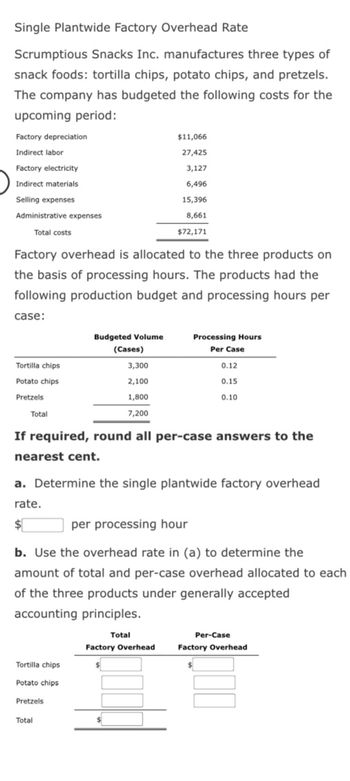

Transcribed Image Text:Single Plantwide Factory Overhead Rate

Scrumptious Snacks Inc. manufactures three types of

snack foods: tortilla chips, potato chips, and pretzels.

The company has budgeted the following costs for the

upcoming period:

Factory depreciation

Indirect labor

Factory electricity

Indirect materials

Selling expenses

Administrative expenses

Total costs

Factory overhead is allocated to the three products on

the basis of processing hours. The products had the

following production budget and processing hours per

case:

Tortilla chips

Potato chips

Pretzels

Total

3,300

2,100

1,800

7,200

If required, round all per-case answers to the

nearest cent.

Budgeted Volume

(Cases)

Tortilla chips

Potato chips

Pretzels

$11,066

27,425

3,127

6,496

15,396

8,661

$72,171

a. Determine the single plantwide factory overhead

rate.

$

Total

per processing hour

b. Use the overhead rate in (a) to determine the

amount of total and per-case overhead allocated to each

of the three products under generally accepted

accounting principles.

Processing Hours

Per Case

Total

0.12

0.15

0.10

Factory Overhead

Per-Case

Factory Overhead

Expert Solution

arrow_forward

Step 1 Introduction

Factory Overhead Rate: A manufacturing overhead rate is the typical amount of factory overhead costs that are charged to each individual unit of output. Accounting on an accrual basis requires this information in order to attribute manufacturing overhead expenses to units that have been sold as well as units that are kept in inventory.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dawson Company manufactures small table lamps and desk lamps. The following shows the activities per product and the total overhead information: Units Setups Inspections Assembly (dlh) 3,400 3,600 8,800 7,200 Small table lamps Desk lamps 8,400 14,000 43,200 43,200 Total Activity-Base Usage Budgeted Activity Cost 10,800 $109,080 22,400 114,240 75,600 340,200 Activity Setups Inspections Assembly (dlh) The total factory overhead (rounded to the nearest cent) to be allocated to each unit of small table lamps is O a. $80.47 O b. $136.80 O c. $48.28 O d. $104.61arrow_forwardBlackwelder Factory produces two similar products: small table lamps and desk lamps. The total factory overhead budget is $615,000 with 478,000 estimated direct labor hours. It is further estimated that small table lamp production will require 261,000 direct labor hours, and desk lamp production will need 125,000 direct labor hours. Using a single plantwide factory overhead rate with an allocation base of direct labor hours, the factory overhead that Blackwelder Factory will allocate to small table lamp production if actual direct labor hours for the period for small table lamp production is 183,000 would be a.$518,641 b.$877,131 c.$236,070 d.$739,700arrow_forwardSilven Company has identified the following overhead activities, costs, and activity drivers for the coming year: Activity Expected Cost Activity Driver Activity Capacity $138,000 Number of setups 10,200 Number of orders 92,400 Machine hours 18,480 Receiving hours phones with the following expected activity demands: Setting up equipment Ordering materials Machining Receiving Silven produces two models of cell Model X 5,000 80 200 6,600 385 Units completed Number of setups Number of orders Machine hours Receiving hours Required: Model Y 10,000 40 400 4,950 770 120 600 11,550 1,155arrow_forward

- Multiple Production Department Factory Overhead Rates The total factory overhead for Bardot Marine Company is budgeted for the year at $1,290,000, divided into two departments: Fabrication, $772,500, and Assembly, $517,500. Bardot Marine manufactures two types of boats: speedboats and bass boats. The speedboats require three direct labor hours in Fabrication and two direct labor hours in Assembly. The bass boats require one direct labor hour in Fabrication and four direct labor hours in Assembly. Each product is budgeted for 7,500 units of production for the year. If required, round all per unit answers to the nearest cent. a. Determine the total number of budgeted direct labor hours for the year in each department. Fabrication direct labor hours Assembly direct labor hours b. Determine the departmental factory overhead rates for both departments. Fabrication per dlh Assembly per dlh c. Determine the factory overhead allocated per unit for each product using the department factory…arrow_forwardPalladium Inc. produces a variety of household cleaning products. Palladium's controller has developed standard costs for the following four overhead items: Overhead Item Total Fixed Cost Variable Rate per Direct Labor Hour Maintenance Power Indirect labor Rent $86,000 140,000 $0.20 0.45 2.10 35,000 Next year, Palladium expects production to require 88,000 direct labor hours Exercise 9-63 Flexible Budget for Various Levels of Activity Refer to the information for Palladium Inc. above. Required: 1. Prepare an overhead budget for the expected level of direct labor hours for the coming year. 2. Prepare an overhead budget that reflects production that is 15% higher than expected and for production that is 15% lower than expected.arrow_forwardEclipse Motor Company manufactures two types of specialty electric motors, a commercial motor and a residential motor, through two production departments, Assembly and Testing. Presently, the company uses a single plantwide factory overhead rate for allocating factory overhead to the two products. However, management is considering using the multiple production department factory overhead rate method. The following factory overhead was budgeted for Eclipse: Assembly Department $280,000 Testing Department 800,000 Total $1,080,000 Direct machine hours were estimated as follows: Assembly Department 4,000 hours Testing Department 5,000 Total 9,000 hours In addition, the direct machine hours (dmh) used to produce a unit of each product in each department were determined from engineering records, as follows: Commercial Residential Assembly Department 2.0 dmh 3.0 dmh Testing Department 6.0 1.5 Total machine hours per unit 8.0 dmh 4.5 dmh…arrow_forward

- Activity-Based Costing: Factory Overhead Costs The total factory overhead for Bardot Marine Company is budgeted for the year at $1,347,400, divided into four activities: fabrication, $660,000; assembly, $276,000; setup, $224,400; and inspection, $187,000. Bardot Marine manufactures two types of boats: speedboats am bass boats. The activity-base usage quantities for each product by each activity are as follows: Fabrication Assembly Setup Inspection Speedboat 11,000 dlh 34,500 dlh 79 setups 138 inspections Bass boat 33,000 11,500 581 962 44,000 dlh 46,000 dlh 660 setups 1,100 inspections Each product is budgeted for 6,500 units of production for the year. a. Determine the activity rates for each activity. Fabrication per direct labor hour Assembly %$4 per direct labor hour Setup %$4 per setup Inspection per inspection b. Determine the activity-based factory overhead per unit for each product. Round to the nearest whole dollar. Speedboat per unit Bass boat %$4 per unitarrow_forwardProduct Costs and Product Profitability Reports, using a Single Plantwide Factory Overhead Rate Elliott Engines Inc. produces three products—pistons, valves, and cams—for the heavy equipment industry. Elliott Engines has a very simple production process and product line and uses a single plantwide factory overhead rate to allocate overhead to the three products. The factory overhead rate is based on direct labor hours. Information about the three products for 20Y2 is as follows: Budgeted Volume(Units) Direct LaborHours Per Unit Price PerUnit Direct MaterialsPer Unit Pistons 11,000 0.30 $46 $22 Valves 21,000 0.15 11 4 Cams 2,000 0.20 61 26 The estimated direct labor rate is $26 per direct labor hour. Beginning and ending inventories are negligible and are, thus, assumed to be zero. The budgeted factory overhead for Elliott Engines is $191,800. If required, round all per unit answers to the nearest cent. a. Determine the plantwide factory…arrow_forwardActivity-Based Costing: Factory Overhead Costs The total factory overhead for Bardot Marine Company is budgeted for the year at $1,207,500, divided into four activities: fabrication, $595,000; assembly, $266,000; setup, $189,000; and inspection, $157,500. Bardot Marine manufactures two types of boats: speedboats and bass boats. The activity-base usage quantities for each product by each activity are as follows: Inspection Speedboat Bass boat Fabrication Assembly 462 525 setups Each product is budgeted for 7,500 units of production for the year. a. Determine the activity rates for each activity. 17 per direct labor hour 7 per direct labor hour Setup Inspection Fabrication 8,750 dlh $ $ Speedboat Bass boat Assembly Setup 28,500 dlh 9,500 38,000 dlh 26,250 35,000 dlh 63 setups 360 per setup 180 per inspection b. Determine the activity-based factory overhead per unit for each product. Round to the nearest whole dollar. $ per unit $ per unit 109 inspections 766 875 inspectionsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education