FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

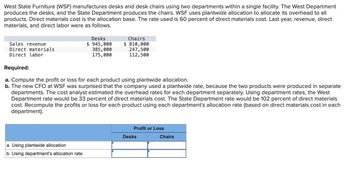

Transcribed Image Text:West State Furniture (WSF) manufactures desks and desk chairs using two departments within a single facility. The West Department

produces the desks, and the State Department produces the chairs. WSF uses plantwide allocation to allocate its overhead to all

products. Direct materials cost is the allocation base. The rate used is 60 percent of direct materials cost. Last year, revenue, direct

materials, and direct labor were as follows.

Sales revenue

Direct materials

Direct labor

Required:

Desks

$ 945,000

385,000

175,000

Chairs

$ 810,000

247,500

112,500

a. Compute the profit or loss for each product using plantwide allocation.

b. The new CFO at WSF was surprised that the company used a plantwide rate, because the two products were produced in separate

departments. The cost analyst estimated the overhead rates for each department separately. Using department rates, the West

Department rate would be 33 percent of direct materials cost. The State Department rate would be 102 percent of direct materials

cost. Recompute the profits or loss for each product using each department's allocation rate (based on direct materials cost in each

department).

a. Using plantwide allocation

b. Using department's allocation rate

Profit or Loss

Desks

Chairs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Octogon, Inc. has three operating departments: Cutting, Assembling, and Finishing. The data below are provided for the current year: Assembling Dept # workers 4,000 Cutting Dept Finishing Dept 5,000 1,000 Square ft occupied 15,000 sq ft 12,000 sq ft 23,000 sq ft Total Maintenance costs of $220,000 are allocated to each department based on the number of square feet. Determine the Maintenance costs to be allocated to each department. Check figure: Finishing Dept $101,200arrow_forwardAdirondack Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. Total DLH per Product Direct Overhead Labor Hours B Painting Dept. $248,400 10,300 Finishing Dept. 65,700 10,000 6 Totals $314,100 20,300 11 12 The single plantwide factory overhead rate for Adirondack Marketing Inc. is Oa. $6.57 per dlh Ob. $15.47 per dlh Oc. $2.09 per dlh Od. $24.12 per dlharrow_forwardRedfern Audio produces audio equipment including headphones. At the Campus Facility, it produces two wireless models, Standard and Enhanced, which differ both in the materials and components used and in the labor skill required. Data for the Campus Plant for the third quarter follow. Units produced Machine-hours Direct labor-hours Direct materials costs Direct labor costs Manufacturing overhead Total costs Standard 29,700 17,820 22,275 $ 594,000 356,400 Predetermined overhead rate Enhanced 9,900 11,880 22,275 $ 891,000 757,350 Total Required: Compute the predetermined overhead rate assuming that Redfern Audio uses direct labor costs to allocate overhead costs. Note: Round your answer to 2 decimal places. % of direct labor cost 39,600 29,700 44,550 $ 1,485,000 1,113,750 730, 620 $ 3,329,370arrow_forward

- sarrow_forwardSilven Company has identified the following overhead activities, costs, and activity drivers for the coming year: Activity Expected Cost Activity Driver Activity Capacity $138,000 Number of setups 10,200 Number of orders 92,400 Machine hours 18,480 Receiving hours phones with the following expected activity demands: Setting up equipment Ordering materials Machining Receiving Silven produces two models of cell Model X 5,000 80 200 6,600 385 Units completed Number of setups Number of orders Machine hours Receiving hours Required: Model Y 10,000 40 400 4,950 770 120 600 11,550 1,155arrow_forwardAdvanced Miniature Development manufactures computer graphics cards (GPUs). Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 4,160 GPUs were as follows: Cost Driver Direct materials Direct labor Factory overhead Instructions Determine the: Each GPU requires 0.5 hour of direct labor. f. Standard Costs 110,000 lbs. at $6.30 2,080 hours at $15.80 Rates per direct labor hr., based on 100% of normal capacity of 2,000 direct labor hrs.: Variable cost, $4.25 Fixed cost, $6.00 a. direct materials price variance b. direct materials quantity variance c. total direct materials cost variance d. direct labor rate variance direct labor time variance total direct labor cost variance g. the variable factory overhead controllable variance h. fixed factory overhead volume variance i. total factory overhead cost variance. Actual Costs 115,000 lbs. at $6.50 2,000 hours at $15.40 $8,200 variable cost $12,000 fixed costarrow_forward

- Activity-Based Costing: Factory Overhead Costs The total factory overhead for Bardot Marine Company is budgeted for the year at $1,347,400, divided into four activities: fabrication, $660,000; assembly, $276,000; setup, $224,400; and inspection, $187,000. Bardot Marine manufactures two types of boats: speedboats am bass boats. The activity-base usage quantities for each product by each activity are as follows: Fabrication Assembly Setup Inspection Speedboat 11,000 dlh 34,500 dlh 79 setups 138 inspections Bass boat 33,000 11,500 581 962 44,000 dlh 46,000 dlh 660 setups 1,100 inspections Each product is budgeted for 6,500 units of production for the year. a. Determine the activity rates for each activity. Fabrication per direct labor hour Assembly %$4 per direct labor hour Setup %$4 per setup Inspection per inspection b. Determine the activity-based factory overhead per unit for each product. Round to the nearest whole dollar. Speedboat per unit Bass boat %$4 per unitarrow_forwardDuring the past month, the following costs were incurred in the three production departments and two service departments of Kim & Co.: Supplying Department Administration Factory support Direct cost From: Service department costs Administration Factory support Total allocations Administration Direct costs Total costs 0.10 $ 640,000 Using Department Factory Support Fabrication 0.40 0.30 0.20 $1,720,000 $1,330,000 Required: Allocate service department costs to Fabrication, Assembly, and Finishing using the reciprocal method, and determine the total costs of Fabrication, Assembly, and Finishing after this allocation. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your final answers to the nearest whole dollar amounts.) Assembly 0.20 0.20 $284,000 Administration Factory Support Finishing 0.10 0.50 $254,000 Cost Allocation To: Fabrication Assembly Finishingarrow_forwardSpacely, Corp. makes sprockets in two models: regular and professional, and wants to refine its costing system by allocating overhead using departmental rates. The estimated $843,100 of manufacturing overhead has been divided into two cost pools: Assembly Department and Packaging Department.The following data has been compiled: Spacely, Corp. Assembly Department Packaging Department Total Overhead costs $550,000 $293,100 $843,100 Machine Hours: Regular Model 153,000 35,100 188,100 Professional Model 352,400 12,600 365,000 Direct Labor Hours: Regular Model 40,300 80,600 120,900 Professional Model 322,700 413,400 736,100 (Round your answers to two decimal places when needed and use rounded answers for all future calculations).1. Compute the predetermined overhead allocation rates using machine hours as the allocation base for the Assembly Department and direct labor hours for the Packaging Department.arrow_forward

- Domesticarrow_forwardVikramarrow_forwardActivity-Based Costing: Factory Overhead Costs The total factory overhead for Bardot Marine Company is budgeted for the year at $1,207,500, divided into four activities: fabrication, $595,000; assembly, $266,000; setup, $189,000; and inspection, $157,500. Bardot Marine manufactures two types of boats: speedboats and bass boats. The activity-base usage quantities for each product by each activity are as follows: Inspection Speedboat Bass boat Fabrication Assembly 462 525 setups Each product is budgeted for 7,500 units of production for the year. a. Determine the activity rates for each activity. 17 per direct labor hour 7 per direct labor hour Setup Inspection Fabrication 8,750 dlh $ $ Speedboat Bass boat Assembly Setup 28,500 dlh 9,500 38,000 dlh 26,250 35,000 dlh 63 setups 360 per setup 180 per inspection b. Determine the activity-based factory overhead per unit for each product. Round to the nearest whole dollar. $ per unit $ per unit 109 inspections 766 875 inspectionsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education