FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:Flutes

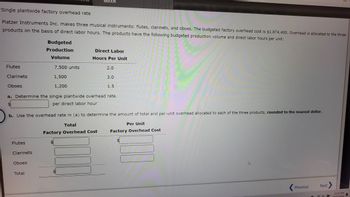

Single plantwide factory overhead rate

Platzer Instruments Inc. makes three musical instruments: flutes, clarinets, and oboes. The budgeted factory overhead cost is $1,874,400. Overhead is allocated to the three

products on the basis of direct labor hours. The products have the following budgeted production volume and direct labor hours per unit:

Clarinets

Oboes

Flutes

Clarinets

Budgeted

Production

Volume

Oboes

7,500 units

1,500

1,200

Total

eBook

a. Determine the single plantwide overhead rate.

$

per direct labor hour

Direct Labor

Hours Per Unit

b. Use the overhead rate in (a) to determine the amount of total and per-unit overhead allocated to each of the three products, rounded to the nearest dollar.

Total

Factory Overhead Cost

$

SA

2.0

3.0

1.5

Per Unit

Factory Overhead Cost

4

Previous

C

Next

11:17 PM

1/25/2024

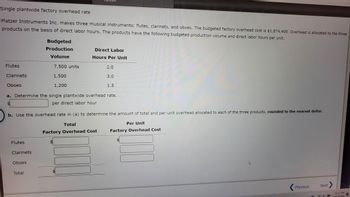

Transcribed Image Text:Single plantwide factory overhead rate

Platzer Instruments Inc. makes three musical instruments: flutes, clarinets, and oboes. The budgeted factory overhead cost is $1,874,400. Overhead is allocated to the three

products on the basis of direct labor hours. The products have the following budgeted production volume and direct labor hours per unit:

Flutes

Clarinets

Oboes

$

LA

Flutes

Clarinets

Budgeted

Production

Volume

a. Determine the single plantwide overhead rate.

per direct labor hour

Oboes

7,500 units

1,500

1,200

Total

Direct Labor

Hours Per Unit

b. Use the overhead rate in (a) to determine the amount of total and per-unit overhead allocated to each of the three products, rounded to the nearest dollar.

Total

Factory Overhead Cost

2.0

$

3.0

1.5

Per Unit

Factory Overhead Cost

Previous

Next

11:17 PM

2/25/2024

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps with 1 images

Knowledge Booster

Similar questions

- single Plantwide Factory Overhead Rate Salty Sensations Snacks Company manufactures three types of snack foods: tortita chips, potato chips, and pretzels. The company has budgeted the following costs for the upcoming period: Factory depreciation Indirect labor Factory electricity tndirect materials selling expenses Administrative expenses Total costs $31,360 78,400 7,840 35,400 25,000 18,000 $196,000 Factory overhead is allocated to the three products on the basis of processing hours. The products had the following production budget and processing hours per case: If required, round all per unit ansyers to the nearest cent. a. Determine the single plantwide factory overhead rate. x per processing hour b. Use the factory overhead rate in (a) to determine the amount of total and per-case factory overhead allocated to each of the three products under generally accepted accounting principles. Total Per Casearrow_forwardSingle plantwide factory overhead rate Bach Instruments Inc. makes three musical instruments: flutes, clarinets, and oboes. The budgeted factory overhead cost is $105,000. Overhead is allocated to the three products on the basis of direct labor hours. The products have the following budgeted production volume and direct labor hours per unit: Budgeted Production Volume Direct Labor Hours Per Unit Flutes 2,300 units 0.6 Clarinets 700 1.6 Oboes 1,000 1.0 If required, round all per unit answers to the nearest cent. a. Determine the single plantwide overhead rate.$fill in the blank 1 per direct labor hour b. Use the overhead rate in (a) to determine the amount of total and per-unit overhead allocated to each of the three products. TotalFactory Overhead Cost Per UnitFactory Overhead Cost Flutes $fill in the blank 2 $fill in the blank 3 Clarinets fill in the blank 4 fill in the blank 5 Oboes fill in the blank 6 fill in the blank 7 Total…arrow_forwardSingle plantwide factory overhead rate Spotted Cow Dairy Company manufactures three products-whole milk, skim milk, and cream-in two production departments, Blending and Packing. The factory overhead for Spotted Cow Dairy is $403,200. The three products consume both machine hours and direct labor hours in the two production departments as follows: Direct Labor Blending Department Whole milk Skim milk Cream Subtotal Packing Department Whole milk Skim mik Cream Sub total Total Direct labor hour overhead rate Machine hour everhead rate s Hours 360 390 Direct labor hours Machine hours 310 1,060 400 760 220 1,460 7,570 Machine Hours 970 100 350 2,200 Required: 1. Determine the single plantwide factory overhead rate, using each of the following location bases: (a) direct labor hours and (b) machine hours. If required, round all amounts to the nearest dollar. 600 210 1,400 3,600 per direct labor hour per machine hour 2. Determine the product factory overhead costs, wing (a) the direct labior…arrow_forward

- Multiple Production Department Factory Overhead Rates The total factory overhead for Bardot Marine Company is budgeted for the year at $1,290,000, divided into two departments: Fabrication, $772,500, and Assembly, $517,500. Bardot Marine manufactures two types of boats: speedboats and bass boats. The speedboats require three direct labor hours in Fabrication and two direct labor hours in Assembly. The bass boats require one direct labor hour in Fabrication and four direct labor hours in Assembly. Each product is budgeted for 7,500 units of production for the year. If required, round all per unit answers to the nearest cent. a. Determine the total number of budgeted direct labor hours for the year in each department. Fabrication direct labor hours Assembly direct labor hours b. Determine the departmental factory overhead rates for both departments. Fabrication per dlh Assembly per dlh c. Determine the factory overhead allocated per unit for each product using the department factory…arrow_forwardMultiple production department factory overhead rates The total factory overhead for Cypress Marine Company is budgeted for the year at $567,500, divided into two Fabrication, $311,250, and Assembly, $256,250. Cypress Marine manufactures two types of boats: speedboats speedboats require two direct labor hours in Fabrication and three direct labor hours in Assembly. The bass boa labor hour in Fabrication and two direct labor hours in Assembly. Each product is budgeted for 5,000 units of pri If required, round all per unit answers to the nearest cent.arrow_forwardNarrow_forward

- Factory depreciation Indirect labor Factory electricity Indirect materials Selling expenses Administrative expenses Total costs Tortilla chips Potato chips Factory overhead is allocated to the three products on the basis of processing hours. The products had the following production budget and processing hours per case: Budgeted Volume Processing Hours (Cases) Per Case Pretzels Total Tortilla chips Potato chips $24,012 59,508 6,000 6,000 1,200 13,200 Pretzels 6,786 14,094 33,408 18,792 $156,600 Total If required, round all per-case answers to the nearest cent. a. Determine the single plantwide factory overhead rate. per processing hour 0.12 0.15 b. Use the overhead rate in (a) to determine the amount of total and per-case overhead allocated to each of the three products under generally accepted accounting principles. Total Per-Case Factory Overhead Factory Overhead 0.10arrow_forwardRequlred Information Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z Estimated Overhead Cost $ 242,400 $114,400 86,000 $ 302,400 Expected Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machine-hours Number of setups Number of products Direct labor-hours 12,000 MHs 220 setups 2 products 12,000 DLHS Activity Measure Machining, Number of setups Number of products Direct labor-hours Product Y 8,200 40 1. 8,200 Product Z 3,800 180 1. 3,800 Required: 1. What is the company's plantwide overhead rate? (Round your enswer to 2 declmal places.) Predetermined overhead rate, per DLH of 15 甜…arrow_forwardmultiple production department factory i=overhead rate method perfomance Gloves,Inc. produces three size of sports gloves:small,medium and large.A glove pattern is first stenciled onto leather in the Pattern Department,where the gloves is cut and sewed together. Perfomance Gloves uses the multiple production department factiey overhead rate methid of allocating factory overhead costs.Its factory overhead costs were budgeted as follows: The direct labor estimated for each production department was as follows: Direct labor hours are used to allocate the production department overhead to the products.The direct labor hours per unit for each product for eacg production department were obtained from the engineering records as follows: a) Determine the two production department factory overhead rates. b) Use the two production department factory rates to detrmine the factory overhead per unit for each product.arrow_forward

- Product Costs and Product Profitability Reports, using a Single Plantwide Factory Overhead Rate Elliott Engines Inc. produces three products—pistons, valves, and cams—for the heavy equipment industry. Elliott Engines has a very simple production process and product line and uses a single plantwide factory overhead rate to allocate overhead to the three products. The factory overhead rate is based on direct labor hours. Information about the three products for 20Y2 is as follows: Budgeted Volume(Units) Direct LaborHours Per Unit Price PerUnit Direct MaterialsPer Unit Pistons 11,000 0.30 $46 $22 Valves 21,000 0.15 11 4 Cams 2,000 0.20 61 26 The estimated direct labor rate is $26 per direct labor hour. Beginning and ending inventories are negligible and are, thus, assumed to be zero. The budgeted factory overhead for Elliott Engines is $191,800. If required, round all per unit answers to the nearest cent. a. Determine the plantwide factory…arrow_forwardPls sir correct on ownarrow_forwardGail Cleaners produces a commercial cleaning compound known as Carpex. The direct materials and direct labour standards for one unit of Carpex follow: Direct materials Direct labour Variable overhead Standard Quantity or Hours 4.10 kilograms 0.40 hour 0.40 hour Standard Price or Rate $ 2.20 per kilogram $10.00 per hour $ 1.30 per hour Standard Cost $9.02 4.00 0.52 The budgeted fixed overhead cost is $14,614 per month. The denominator activity level of the allocation base is 800 direct labour- hours. Materials price variance Materials quantity variance During the most recent month, the following activity was recorded: a. 9,900 kilograms of material were purchased at a cost of $2.22 per kilogram. b. A total of 850 hours of direct labour time was recorded at a total labour cost of $9,110. c. The variable overhead cost was $1,580, and the fixed overhead cost was $14,704. Assume that the company produced 1,600 units during the month, using 6,600 kilograms of material in the production…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education