FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

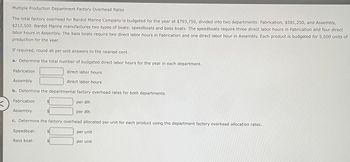

Transcribed Image Text:Multiple Production Department Factory Overhead Rates

The total factory overhead for Bardot Marine Company is budgeted for the year at $793,750, divided into two departments: Fabrication, $581,250, and Assembly,

$212,500. Bardot Marine manufactures two types of boats: speedboats and bass boats. The speedboats require three direct labor hours in Fabrication and four direct

labor hours in Assembly. The bass boats require two direct labor hours in Fabrication and one direct labor hour in Assembly. Each product is budgeted for 5,000 units of

production for the year.

If required, round all per unit answers to the nearest cent.

a. Determine the total number of budgeted direct labor hours for the year in each department.

Fabrication

Assembly

b. Determine the departmental factory overhead rates for both departments.

per dlh

per dlh

Fabrication

Assembly

direct labor hours

direct labor hours

c. Determine the factory overhead allocated per unit for each product using the department factory overhead allocation rates.

Speedboat:

Bass boat:

per unit

per unit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kata Systems allocates manufacturing overhead based on machine hours. Each connector should require 10 machine hours. According to the static budget, Kata expected to incur the following: 1,000 machine hours per month (100 connectors × 10 machine hours per connector) $8,500 in variable manufacturing overhead costs $9,450 in fixed manufacturing overhead costs During August, Kata actually used 800 machine hours to make 130 connectors and spent $5,200 in variable manufacturing costs and $7,800 in fixed manufacturing overhead costs. Kata's standard variable manufacturing overhead allocation rate is A. $17.95 per machine hour. B. $9.45 per machine hour. C. $10.63 per machine hour. D. $8.50 per machine hour.arrow_forwardThe total factory overhead for Magnum Corporation is budgeted for the year at $500,000. This is divided into three activity pools: fabrication, $246,000; assembly, $144,000, and setup, $110,000. Magnum manufactures two types of kayaks: Basic and Deluxe. The activity-based usage quantities for each project by activity are as follows: Fabrication Assembly Setup Basic 2,000 dlh 8,000 dlh 5 setups Deluxe 10,000 dlh 24,000 dlh 15 setups Total activity-base usage 12,000 dlh 32,000 dlh 20 setups Each product is budgeted for 2,500 units of production for the year.What is the activity-based factory overhead per unit for the Deluxe kayak? a.$41.80 b.$158.20 c.$100.00 d.$154.54arrow_forwardHannibal Steel Company's Transport Services Department provides trucks to haul ore from the company's mine to its two steel mills-the Northern Plant and the Southern Plant. Budgeted costs for the Transport Services Department total $283,800 per year, consisting of $0.17 per ton variable cost and $233,800 fixed cost. The level of fixed cost is determined by peak-period requirements. During the peak period, the Northern Plant requires 58% of the Transport Services Department's capacity and the Southern Plant requires 42%. During the year, the Transport Services Department actually hauled 127,000 tons of ore to the Northern Plant and 61,200 tons to the Southern Plant. The Transport Services Department incurred $356,000 in cost during the year, of which $53,200 was variable and $302,800 was fixed. Required: 1. How much of the Transport Services Department's variable costs should be charged to each plant? 2. How much of the Transport Services Department's fixed costs should be charged to…arrow_forward

- The Kaumajet Factory produces two products - table lamps and desk lamps. It has two separate departments - Finishing and Production. The overhead budget for the Finishing Department is $550,000, using 500,000 direct labor hours. The overhead budget for the Production Department is $400,000 using 80,000 direct labor hours.If the budget estimates that a desk lamp will require 1 hours of finishing and 2 hours of production, what is the total amount of factory overhead the Kaumajet Factory will allocate to desk lamps using the multiple production department factory overhead rate method with an allocation base of direct labor hours, if 26,000 units are produced? a.$288,600 b.$475,000 c.$540,000 d.$187,200arrow_forwardSleep Tight, Inc. manufactures bedding sets. The budgeted production is for 37,100 comforters this year. Each comforter requires 1.5 hours to cut and sew the material. The cost of cutting and sewing labor is $15.60 per hour. Determine the direct labor budget for this year.arrow_forwardPatel and Sons Inc. uses a standard cost system to apply factory overhead costs to units produced. Practical capacity for the plant is defined as 51,600 machine hours per year, which represents 25,800 units of output. Annual budgeted fixed factory overhead costs are $258,000 and the budgeted variable factory overhead cost rate is $2.50 per unit. Factory overhead costs are applied on the basis of standard machine hours allowed for units produced. Budgeted and actual output for the year was 19,500 units, which took 40,600 machine hours. Actual fixed factory overhead costs for the year amounted to $251,600 while the actual variable overhead cost per unit was $2.40. Assume that at the end of the year, management of Patel and Sons decides that the overhead cost variances should be allocated to WIP Inventory, Finished Goods Inventory, and Cost of Goods Sold (CGS) using the following percentages: 10%, 20%, and 70%, respectively. Provide the proper journal entry to close out the…arrow_forward

- Yammy Company currently produces ultimate discs in an automated process. Expected production per month is 80,000 units. The required direct materials costs $0.20 per unit and labor costs $0.10 per unit. Manufacturing fixed overhead costs are $5,000 per month. Manufacturing overhead is allocated based on units of production. What is the flexible budget total product costs for 80,000 and 40,000 units, respectively?arrow_forwardHannibal Steel Company's Transport Services Department provides trucks to haul ore from the company's mine to its two steel mills- the Northern Plant and the Southern Plant. Budgeted costs for the Transport Services Department total $237,500 per year, consisting of $0.22 per ton variable cost and $187,500 fixed cost. The level of fixed cost is determined by peak-period requirements. During the peak period, the Northern Plant requires 64% of the Transport Services Department's capacity and the Southern Plant requires 36% During the year, the Transport Services Department actually hauled 126,000 tons of ore to the Northern Plant and 67,900 tons to the Southern Plant. The Transport Services Department Incurred $363,000 In cost during the year, of which $54,000 was variable and $309,000 was fixed. Required: 1. How much of the Transport Services Department's variable costs should be charged to each plant? 2. How much of the Transport Services Department's fixed costs should be charged to…arrow_forwardPackaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for the Production Department are based on the following formulas, where q is the number of labor-hours worked in a month: Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory administration Direct labor Indirect labor Utilities Supplies Equipment depreciation Cost Formulas The Production Department planned to work 4,300 labor-hours in March; however, it actually worked 4,100 labor-hours during the month. Its actual costs incurred in March are listed below: Factory rent Property taxes Factory administration $16.509 $4,400 $2.00q $5,000 + $0.50q $1,300+ $0.109 $18,500 + $2.60q $8,200 $2,400 $13,500+ $0.50q Actual Cost Incurred in March $ 69,270 $ 12,180 $ 7,540 $ 1,940 $ 29,160 $ 8,600 $ 2,400 $ 14,880 Required: 1. Prepare the Production…arrow_forward

- Packaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for the Production Department are based on the following formulas, where q is the number of labor-hours worked in a month: Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes. Factory administration The Production Department planned to work 4,200 labor-hours in March; however, it actually worked 4,000 labor-hours during the month. Its actual costs incurred in March are listed below: Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory administration Cost Formulas $16.20g $4,200+ $1.50g $5,700+ $0.60g $1,500+ $0.10g $18,300+ $2.60g $8,600 $2,500 $13,300+ $0.90g Actual Cost Incurred in March $ 66,360 $ 9,680 $ 8,610 $ 2,130 $ 28,700 $ 9,000 $ 2,500 $ 16,310 Required: 1. Prepare the Production…arrow_forwardThe total factory overhead for Big Light Company is budgeted for the year at $2,201,190. Big Light manufactures two different products: night lights and desk lamps. Night lights are budgeted for 18,000 units. Each night light requires 2 hours of direct labor. Desk lamps are budgeted for 18,700 units. Each desk lamp requires 3 hours of direct labor. a. Determine the total number of budgeted direct labor hours for the year.fill in the blank direct labor hours b. Determine the single plantwide factory overhead rate using direct labor hours as the allocation base. Round your answer to two decimal places.fill in the blank per direct labor hour c. Determine the factory overhead allocated per unit for each product using the single plantwide factory overhead rate determined in (b). Round your answers to two decimal places.Night lights fill in the blank per unitDesk lamps fill in the blank per unitarrow_forwardThe total factory overhead for Garment Heater Company is budgeted for the year at $300,000. Garment Heater Company manufactures two types of furnaces: Red Deluxe and Energy Green. The Red Deluxe requires 10 direct labor hours for manufacture. The Energy Green requires 5 direct labor hours for manufacture Each product is budgeted for 200 units of production for the year. Determine (a) total number of budgeted direct labor hours for the year (b) the single plant wide factory overhead rate (c) the factory overhead allocated per unit for each product using the single plantwide factory overhead rate.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education