FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

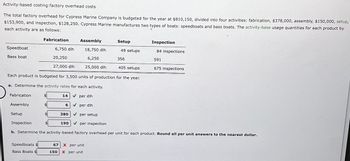

Transcribed Image Text:Activity-based costing:factory overhead costs

The total factory overhead for Cypress Marine Company is budgeted for the year at $810,150, divided into four activities: fabrication, $378,000, assembly, $150,000, setup,

$153,900, and inspection, $128,250. Cypress Marine manufactures two types of boats: speedboats and bass boats. The activity-base usage quantities for each product by

each activity are as follows:

Speedboat

Bass boat

Fabrication

Assembly

Setup

Fabrication

Inspection

Speedboats $

Bass Boats $

Each product is budgeted for 3,500 units of production for the year.

a. Determine the activity rates for each activity.

✓ per dlh

✓ per dlh

✔per setup

$

6,750 dlh

$

20,250

27,000 dlh

14

6

380

Assembly

18,750 dlh

6,250

25,000 dlh

190

Setup

49 setups

356

per inspection

b. Determine the activity-based factory overhead per unit for each product. Round all per unit answers to the nearest dollar.

405 setups

67 X per unit

150 X per unit

Inspection

84 inspections

591

675 inspections

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Activity Base Entry Dining Total Machine hours 5,320 4,710 10,030 Direct labor hours 4,570 6,860 11,430 Number of inspections 1,940 610 2,550 Number of setups 310 70 380 Number of loads 700 190 890 Units produced 10,600 5,300 15,900 a. Determine the activity rate for each activity. If required, round the rate to the nearest dollar. Activity Activity Rate Casting per machine hour Assembly per direct labor hour Inspecting 24 per inspection Setup per setup Materials handling per load b. Use the activity rates in (a) to determine the total and per-unit activity costs associated with each product. Round the per unit amounts to the nearest cent. Product Total Activity Cost Activity Cost Per Unit Entry Lighting Fixtures Dining Room Lighting Fixturesarrow_forwardActivity-Based Costing Zeus Industries manufactures two types of electrical power units, custom and standard, which involve four factory overhead activities—production setup, procurement, quality control, and materials management. An activity analysis of the overhead revealed the following estimated activity costs and activity bases for these activities: Activity Activity Cost Activity Base Production setup $ 44,000 Number of setups Procurement 13,500 Number of purchase orders (PO) Quality control 97,500 Number of inspections Materials management 84,000 Number of components Total $239,000 The activity-base usage quantities for each product are as follows: Setups PurchaseOrders Inspections Components Unit Volume Custom 290 760 1,200 500 2,000 Standard 110 140 300 200 2,000 Total 400 900 1,500 700 4,000 a. Determine an activity rate for each activity. Activity Rates Production Setup Procurement Quality Control…arrow_forwardActivity Rates and Product Costs using Activity-Based Costing Garfield Inc. manufactures entry and dining room lighting fixtures. Five activities are used in manufacturing the fixtures. These activities and their associated budgeted activity costs and activity bases are as follows: Activity BudgetedActivity Cost Activity Base Casting $560,000 Machine hours Assembly 75,000 Direct labor hours Inspecting 30,000 Number of inspections Setup 18,750 Number of setups Materials handling 14,000 Number of loads Corporate records were obtained to estimate the amount of activity to be used by the two products. The estimated activity-base usage quantities and units produced follow: Activity Base Entry Dining Total Machine hours 7,500 12,500 20,000 Direct labor hours 2,000 3,000 5,000 Number of inspections 500 250 750 Number of setups 150 100 250 Number of loads 400 300 700 Units produced 5,000 2,500 7,500 a.…arrow_forward

- Craftmore Machining reports the following budgeted overhead cost and related data for this year. Activity Assembly Product design Budgeted Activity Usage 13,000 Activity Cost Driver Direct labor hours (DLH) Engineering hours (EH) Machine hours (MH) Electricity 1,000 10,500 420 Setups Setup Total Budgeted Cost $ 409,500 63,000 21,000 52,500 $ 546,000 Required: 1. Compute a single plantwide overhead rate assuming the company allocates overhead cost based on 13,000 direct labor hours. 2. Job 31 used 220 direct labor hours and Job 42 used 500 direct labor hours. Allocate overhead cost to each job using the single plantwide overhead rate from part 1. 3. Compute an activity rate for each activity using activity-based costing. 4. Allocate overhead costs to Job 31 and Job 42 using activity-based costing. Activity Cost Driver Direct labor hours (DLH) Engineering hours (EH) Machine hours (MH) Setups Activity Usage Job 31 220 28 52 4 Job 42 500 34 62 6 Complete this question by entering your…arrow_forwardSilven Company has identified the following overhead activities, costs, and activity drivers for the coming year: Activity Expected Cost Activity Driver Activity Capacity $138,000 Number of setups 10,200 Number of orders 92,400 Machine hours 18,480 Receiving hours phones with the following expected activity demands: Setting up equipment Ordering materials Machining Receiving Silven produces two models of cell Model X 5,000 80 200 6,600 385 Units completed Number of setups Number of orders Machine hours Receiving hours Required: Model Y 10,000 40 400 4,950 770 120 600 11,550 1,155arrow_forwardMultiple Production Department Factory Overhead Rates The total factory overhead for Bardot Marine Company is budgeted for the year at $1,290,000, divided into two departments: Fabrication, $772,500, and Assembly, $517,500. Bardot Marine manufactures two types of boats: speedboats and bass boats. The speedboats require three direct labor hours in Fabrication and two direct labor hours in Assembly. The bass boats require one direct labor hour in Fabrication and four direct labor hours in Assembly. Each product is budgeted for 7,500 units of production for the year. If required, round all per unit answers to the nearest cent. a. Determine the total number of budgeted direct labor hours for the year in each department. Fabrication direct labor hours Assembly direct labor hours b. Determine the departmental factory overhead rates for both departments. Fabrication per dlh Assembly per dlh c. Determine the factory overhead allocated per unit for each product using the department factory…arrow_forward

- Palladium Inc. produces a variety of household cleaning products. Palladium's controller has developed standard costs for the following four overhead items: Overhead Item Total Fixed Cost Variable Rate per Direct Labor Hour Maintenance Power Indirect labor Rent $86,000 140,000 $0.20 0.45 2.10 35,000 Next year, Palladium expects production to require 88,000 direct labor hours Exercise 9-63 Flexible Budget for Various Levels of Activity Refer to the information for Palladium Inc. above. Required: 1. Prepare an overhead budget for the expected level of direct labor hours for the coming year. 2. Prepare an overhead budget that reflects production that is 15% higher than expected and for production that is 15% lower than expected.arrow_forwardMultiple production department factory overhead rates The total factory overhead for Cypress Marine Company is budgeted for the year at $567,500, divided into two Fabrication, $311,250, and Assembly, $256,250. Cypress Marine manufactures two types of boats: speedboats speedboats require two direct labor hours in Fabrication and three direct labor hours in Assembly. The bass boa labor hour in Fabrication and two direct labor hours in Assembly. Each product is budgeted for 5,000 units of pri If required, round all per unit answers to the nearest cent.arrow_forwardFactory depreciation Indirect labor Factory electricity Indirect materials Selling expenses Administrative expenses Total costs Tortilla chips Potato chips Factory overhead is allocated to the three products on the basis of processing hours. The products had the following production budget and processing hours per case: Budgeted Volume Processing Hours (Cases) Per Case Pretzels Total Tortilla chips Potato chips $24,012 59,508 6,000 6,000 1,200 13,200 Pretzels 6,786 14,094 33,408 18,792 $156,600 Total If required, round all per-case answers to the nearest cent. a. Determine the single plantwide factory overhead rate. per processing hour 0.12 0.15 b. Use the overhead rate in (a) to determine the amount of total and per-case overhead allocated to each of the three products under generally accepted accounting principles. Total Per-Case Factory Overhead Factory Overhead 0.10arrow_forward

- Activity Rates and Product Costs using Activity-Based Costing Lonsdale Inc. manufactures entry and dining room lighting fixtures. Five activities are used in manufacturing the fixtures. These activities and their associated budget activity costs and activity bases are as follows: Budgeted Activity Activity Cost Activity Base Casting $330,560 Machine hours Assembly 212,040 Direct labor hours Inspecting 26,100 Number of inspections Setup 39,000 Number of setups Materials handling 39,990 Number of loads Corporate records were obtained to estimate the amount of activity to be used by the two products. The estimated activity-base usage quantities and units produced follow: Activity Base Entry Dining Total Machine hours 5,470 4,860 10,330 Direct labor hours 4,710 7,070 11,780 Number of inspections 1,320 420 1,740 Number of setups 210 50 260 Number of loads 730 200 930 Units produced 10,800 5,400 16,200 a. Determine the activity rate for each activity. If required, round the rate to the…arrow_forwardProduct Costs and Product Profitability Reports, using a Single Plantwide Factory Overhead Rate Elliott Engines Inc. produces three products—pistons, valves, and cams—for the heavy equipment industry. Elliott Engines has a very simple production process and product line and uses a single plantwide factory overhead rate to allocate overhead to the three products. The factory overhead rate is based on direct labor hours. Information about the three products for 20Y2 is as follows: Budgeted Volume(Units) Direct LaborHours Per Unit Price PerUnit Direct MaterialsPer Unit Pistons 11,000 0.30 $46 $22 Valves 21,000 0.15 11 4 Cams 2,000 0.20 61 26 The estimated direct labor rate is $26 per direct labor hour. Beginning and ending inventories are negligible and are, thus, assumed to be zero. The budgeted factory overhead for Elliott Engines is $191,800. If required, round all per unit answers to the nearest cent. a. Determine the plantwide factory…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education