Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

all this solve NO

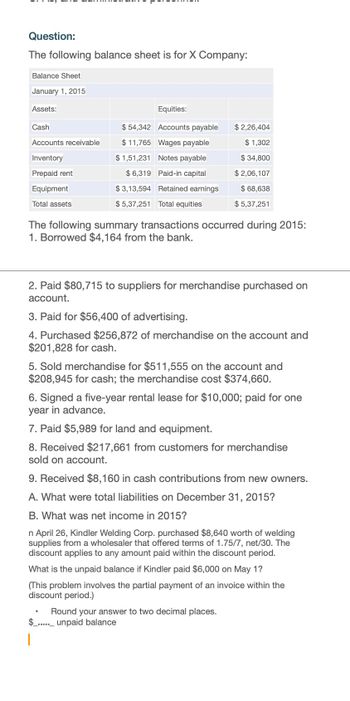

Transcribed Image Text:Question:

The following balance sheet is for X Company:

Balance Sheet

January 1, 2015

Assets:

Equities:

Cash

Accounts receivable

Inventory

Prepaid rent

Equipment

$54,342 Accounts payable

$11,765 Wages payable

$1,51,231 Notes payable

$6,319 Paid-in capital

$3,13,594 Retained earnings

$ 2,26,404

$1,302

$ 34,800

$2,06,107

$ 68,638

Total assets

$5,37,251

$ 5,37,251 Total equities

The following summary transactions occurred during 2015:

1. Borrowed $4,164 from the bank.

2. Paid $80,715 to suppliers for merchandise purchased on

account.

3. Paid for $56,400 of advertising.

4. Purchased $256,872 of merchandise on the account and

$201,828 for cash.

5. Sold merchandise for $511,555 on the account and

$208,945 for cash; the merchandise cost $374,660.

6. Signed a five-year rental lease for $10,000; paid for one

year in advance.

7. Paid $5,989 for land and equipment.

8. Received $217,661 from customers for merchandise

sold on account.

9. Received $8,160 in cash contributions from new owners.

A. What were total liabilities on December 31, 2015?

B. What was net income in 2015?

n April 26, Kindler Welding Corp. purchased $8,640 worth of welding

supplies from a wholesaler that offered terms of 1.75/7, net/30. The

discount applies to any amount paid within the discount period.

What is the unpaid balance if Kindler paid $6,000 on May 1?

(This problem involves the partial payment of an invoice within the

discount period.)

Round your answer to two decimal places.

$unpaid balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- Use the following information for questions 2-9 Category Accounts payable Accounts receivable Accruals 2016 2017 34,500 37,500 96,000 102,000 13,500 11,250 Additional paid in capital Cash Common Stock@par value COGS Depreciation expense 187,500 204,000 6,000 16,800 10,500 11,550 109,500 144,000 18.000 19,500 Interest expense 13,500 13,800 Inventories 93,000 96,000 Long-term debt 112,500 116,250 Net fixed assets 315,000 ??? Notes payable 49,500 54,000 Operating expenses (excl. depr.) 42,000 52,500 Retained earnings Sales Taxes Net fixed assets in 2017 were $ 1) 331,750 2) 332,750 102,000 114,000 213,000 282,000 8,250 15,750 3) 333,750 4) 344,750 5) 345,750arrow_forwardCash Accounts receivable (net) Inventories Total current assets Noncurrent assets Current liabilities Long-term liabilities Shareholders' equity Net income Interest expense Income tax expense Sanchez Corporation Selected Financial Information The debt to equity ratio for 2016 is: OA) 0.80 OB) 0.44 Oc) 0.67 OD) 0.13 12/31/16 $ 20,000 100,000 190,000 310,000 230,000 200,000 40,000 300,000 $40,000 10,000 20,000arrow_forwardPlease show calculationarrow_forward

- Use the common-size financial statements found here: ommon-Size Balance Sheet 2016Cash and marketable securities $ 480 1.5 %Accounts receivable 6,030 18.2Inventory 9,540 28.8Total current assets $ 16,050 48.5 %Net property, plant, and equipment 17,020 51.5Total assets $33,070 100.0 %Accounts payable $ 7,150 21.6 %Short-term notes 6,850 20.7Total current liabilities $ 14,000 42.3 %Long-term liabilities 7,010 21.2Total liabilities $ 21,010 63.5 %Total common shareholders’ equity 12,060 36.5Total liabilities and shareholders’ equity $33,070 100.0 %Common-Size Income Statement 2016Revenues $ 30,000 100.0 %Cost of goods sold (20,050) 66.8Gross profit $ 9,950 33.2 %Operating expenses (7,960) 26.5Net operating income $ 1,990 6.6 %Interest expense (940) 3.1Earnings before taxes $ 1,050 3.5 %Income taxes (382) 1.3Net income $668 2.2 % Specifically, write up a brief narrative that responds to the following questions: a. How much cash does Patterson have on hand relative to its total…arrow_forwardCalculate the dividend payout ratio.arrow_forwardCurrent Position Analysis The following items are reported on a company's balance sheet: Cash $354,100 Marketable securities 276,700 Accounts receivable (net) 297,400 Inventory 178,500 Accounts payable 357,000 Determine (a) the current ratio and (b) the quick ratio. Round to one decimal place.arrow_forward

- The following data are available for XYZ Corporation for years 2014 and 2013. XYZ Corporation Statement of Financial Position As of December 31 Change Peso % 2013 2014 Assets Cash and equivalents Receivables Inventories Prepayments and others Total Current Assets 14,000 28,800 54,000 4,800 101,600 16,000 55,600 85,600 _7,400 164,600 2,000 26,800 ? 93.06% ? 2,600 54.17% 62.01% Property, Plant & Equipment - net of depreciation Total Assets 43,200 73,400 238,000 143.05% 30,200 131.800 Liabilities and Equity Notes payable to banks Accounts payable Accrued liabilities Income taxes payable Total current liabilities Share capital Retained earnings Total equity Total liabilities and equity 10,000 31,600 4,200 _ 5,800 51,600 44,600 35.600 80,200 131,800 54,000 55,400 6,800 7,000 123,200 44,600 70,200 44,000 23,800 2,600 .? ? 440.00% 61.90% 0.00% 34,600 34,600 43,14% 114,800 238.000 XYZ Corporation Income Statement Years ended December 31 (P thousands) Change Peso 2013 2014 266,400 191,400…arrow_forwardGiven the data in the following table, the entry for Inventories on the 2023 common-sized balance sheet was %.arrow_forwardCrane Company has these comparative balance sheet data: CRANE COMPANYBalance SheetsDecember 31 2022 2021 Cash $ 27,105 $ 54,210 Accounts receivable (net) 126,490 108,420 Inventory 108,420 90,350 Plant assets (net) 361,400 325,260 $623,415 $578,240 Accounts payable $ 90,350 $ 108,420 Mortgage payable (15%) 180,700 180,700 Common stock, $10 par 252,980 216,840 Retained earnings 99,385 72,280 $623,415 $578,240 Additional information for 2022: 1. Net income was $27,900. 2. Sales on account were $382,300. Sales returns and allowances amounted to $29,000. 3. Cost of goods sold was $207,500. 4. Net cash provided by operating activities was $57,000. 5. Capital expenditures were $28,900, and cash dividends were $17,900. Compute the following ratios at December 31, 2022. (Round current ratio and inventory turnover to 2 decimal…arrow_forward

- Ch: Analyzing Financial Statements The current year financial statement for sand and Juffair companies are presented below. Balance sheet at 31 Dec 2019 Item Cash Account receivable (net) Inventory Property & equipment (net) Other assets Total assets Current liabilities Long-term debt (interest rate: 10%) Capital stock ($10 par value) Additional paid-in capital Retained earnings Total liabilities and stockholders' equity Income statement at 31 Dec 2019 item Sales revenue (1/3 on credit) (-) Cost of goods sold (-) Operating expenses Net income Other data item Per share stock price at end of current year Average income tax rate Dividends declared and paid in current year Sand 45000 45000 95000 160000 90000 435000 95000 75000 155000 40000 70000 435000 Sand 440000 230000 159000 51000 Sand 23 30% 34000 Juffair 22000 35000 45000 415000 320000 837000 65000 65000 522000 110000 75000 837000 Juffair 800000 399000 315000 86000 Juffair 25 30% 153000 Both companies are in the fish catching and…arrow_forwardAssets: Cash Accounts receivable Inventories Total current assets Net fixed assets Total assets Liabilities and equity: Accounts payable Notes payable Total current liabilities Long-term debt Common stock Retained earnings Total common equity Total liabilities and equity $ $ $ $ $ $ $ 2015 200,000 864,000 2,000,000 3,064,000 6,000,000 9,064,000 1,400,000 1,600,000 3,000,000 2,400,000 3,000,000 664,000 3,664,000 9,064,000 2014 170,000 700,000 1,400,000 $2,270,000 5,600,000 $7,870,000 $ $1,090,000 1,800,000 $2,890,000 2,400,000 2,000,000 580,00 $2,580,000 $7,870,000 If a firm has EBIT = 1,350,000 and 40% Tax rate, calculate Free Cash Flow.arrow_forwardSuppose the following financial data were reported by 3M Company for 2021 and 2022 (dollars in millions). Current assets 3M Company Balance Sheets (partial) Cash and cash equivalents Accounts receivable, net Inventories Other current assets Total current assets Current liabilities Screenshot Current ratio Working capital 2022 $ $3,180 3,600 2,738 1,932 $11,450 $4,830 2021 $1,836 3,180 3,019 1,590 Suppose that at the end of 2022, 3M management used $183 million cash to pay off $183 million of accounts payable. How would its current ratio and working capital have changed? (Round current ratio to 2 decimal places, e.g. 1.25: 1. Enter working capital answer to million.) $9,625 $5,887 :1 million Donearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning