FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

None

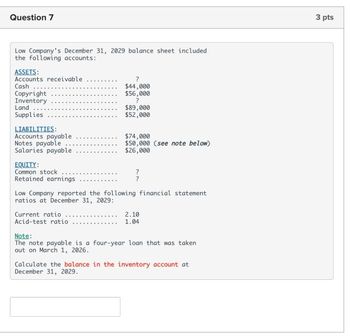

Transcribed Image Text:Question 7

Low Company's December 31, 2029 balance sheet included

the following accounts:

ASSETS:

Accounts receivable

Cash

?

Copyright

Inventory

Land

Supplies

LIABILITIES:

Notes payable

Accounts payable

Salaries payable

EQUITY:

Common stock

Retained earnings

$44,000

$56,000

?

$89,000

$52,000

$74,000

$50,000 (see note below)

$26,000

?

?

Low Company reported the following financial statement

ratios at December 31, 2029:

Current ratio

Acid-test ratio

Note:

2.10

1.04

The note payable is a four-year loan that was taken

out on March 1, 2026.

Calculate the balance in the inventory account at

December 31, 2029.

3 pts

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- P14arrow_forwardProblem 84 (LAA) Summa Company revealed the following account balances on December 31, 2020 Accota payable Accounta receivable, net of allowance for doubtful accounts PS0.000 Accrued taxes Aecrued interest receivable Autherined sbare capital, 60,000 aharea. P100 par Building, net ofaccumulated depreciation of P500,000 3,000.000 Cash on hand Cash in bank Bond sinking fund Furniture and equipment, net ofaccumulated depreciation of P900,000 Iaventory Investment property Land Deferred tax liability Bonds payable due June 30, 2021 Notes payable Notes reoeivable Patent Ocher accrued liabilities Prepaid expenses Share premium Retained earninge appropristed for contingencies Retained eantings Share ubecription receivable Subscribed share capital E000 shares Unianoed share capital 1000,000 50.000 30,000 5,000.000 50.000 650.000 2000.000 1,500,000 1,200,000 700.000 1,000,000 650.000 2.000.000 850.000 200,000 370,000 150,000 100,000 300,000 200,000 2.700,000 500,000 L000,000 2.000,000 Required:…arrow_forwardNeed help filling in the blank area'sarrow_forward

- Category Prior Year Current Year Accounts payable ??? Accounts receivable 320,715 397,400 Accruals 40,500 33,750 Additional paid in capital 500,000 541,650 Cash 17,500 47,500 Common Stock 94,000 105,000 COGS 328,500 431,516.41 Current portion long-term debt 33,750 35,000 Depreciation expense 54,000 55,946.66 Interest expense 40,500 41,874.31 Inventories 279,000 288,000 Long-term debt 336,467.85 401,942.46 Net fixed assets 946,535 999,000 Notes payable 148,500 162,000 Operating expenses (excl. depr.) 126,000 161,499.58 Retained earnings 306,000 342,000 Sales 639,000 854,554.01 Taxes 24,750 48,384.56 ??? What is the current year's return on equity (ROE)? Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign re rounded to 4 decimal places (ex: 0.0924))arrow_forwardThe financial statements for Barrington Service Company include the following items: 2025 2024 $44,500 33,000 52,000 Cash Short-term Investments Net Accounts Receivable. Merchandise Inventory Total Assets Accounts Payable Salaries Payable Long-term Note Payable OA. 0.86 OB. 6.60 OC. 3.82 OD. 1.17 164,000 535,000 126,500 24,000 61,000 $44,000 20,000 56,000 49,000 554,000 128,000 17,000 50,000arrow_forwardLife-Positive’s Account Balances 2021 ($) 2022 ($) Accounts Payable 24,600.00 21,250.00 Accounts receivable 15,700.00 12,340.00 Cash 23,450.00 28,600.00 Cost of goods sold 19,700.00 23,000.00 Depreciation 3,090.00 4,590.00 Dividends 5,800.00 10,800.00 Interest 2,340.00 2,890.00 Inventory 7,050.00 8,640.00 Long-term debt 28,000.00…arrow_forward

- Please do not give solution in image format thankuarrow_forwardperience p....pptm ^ Type here to search w X # 3 E Coronado Company's condensed financial statements provide the following information. C Cash Accounts receivable (net) Short-term investments Inventory Prepaid expenses Total current assets Property, plant, and equipment (net) Total assets Current liabilities ACC341-2022-Ho....xlsx $ 4 Bonds payable R F % 5 O CORONADO COMPANY BALANCE SHEET T At O+ 6 V B ▶ music 2.jpeg n H & 7 Dec. 31, 2020 $52,100 197,700 80,800 442,700 3,000 $776,300 849,900 $1,626,200 237,700 401,800 U 20 8 J Dec. 31, 2019 $60,200 O 80,800 39,600 N M 360,200 $547,700 849,900 $1,397,600 6,900 155,700 ( 401,800 9 W K F11 ) O 0 888 P Home End C Rair Insearrow_forwardUse the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Balance Sheets for 2020 & 2021.arrow_forward

- Category Prior Year Current Year Accounts payable ??? ??? Accounts receivable 320,715 397,400 Accruals 40,500 33,750 Additional paid in capital 500,000 541,650 Cash 17,500 47,500 Common Stock 94,000 105,000 COGS 328,500 428,571.00 Current portion long-term debt 33,750 35,000 Depreciation expense 54,000 54,035.00 Interest expense 40,500 42,155.00 Inventories 279,000 288,000 Long-term debt 339,577.00 401,377.00 Net fixed assets 946,535 999,000 Notes payable 148,500 162,000 Operating expenses (excl. depr.) 126,000 162,171.00 Retained earnings 306,000 342,000 Sales 639,000 849,094.00 Taxes 24,750 47,192.00 What is the current year's entry for long-term debt on a common-sized balance sheet? (ROUND TO 4 DECIMAL PLACES.)arrow_forwardThe stockholders' equity section of Cheyenne Corp. at December 31, 2019, included the following: 5% preferred stock, $100 par value, cumulative, 19,600 shares authorized, 14,300 shares issued and outstanding Common stock, $10 par value, 250,000 shares authorized, 240,000 shares issued and outstanding $1,430,000 $2,400,000 Dividends were not declared on the preferred stock in 2019 and are in arrears. On September 15, 2020, the board of directors of Cheyenne Corp. declared dividends on the preferred stock to stockholders of record on October 1, 2020, payable on October 15, 2020. On November 1, 2020, the board of directors declared a $1 per share dividend on the common stock, payable November 30, 2020, to stockholders of record on November 15, 2020. Prepare the journal entries that should be made by Cheyenne Corp. on the dates indicated below: September 15, 2020 November 1, 2020 October 1, 2020 November 15, 2020 October 15, 2020 November 30, 2020arrow_forwardPlease help me with all answers thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education