Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Required:

Draw up the petty cash journal for the month with analysis columns for petty cash, input VAT, stationery,

petrol and sundries.

Use the below table format and round off answers to the nearest rand.

Show all calculations.

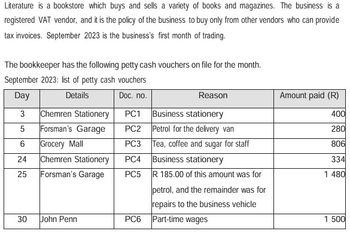

Transcribed Image Text:Literature is a bookstore which buys and sells a variety of books and magazines. The business is a

registered VAT vendor, and it is the policy of the business to buy only from other vendors who can provide

tax invoices. September 2023 is the business's first month of trading.

The bookkeeper has the following petty cash vouchers on file for the month.

September 2023: list of petty cash vouchers

Day

Details

Doc. no.

Reason

3

Chemren Stationery

PC1

Business stationery

5

Forsman's Garage

PC2

Petrol for the delivery van

6

Grocery Mall

PC3

Tea, coffee and sugar for staff

24

Chemren Stationery

PC4 Business stationery

25

Forsman's Garage

PC5

R 185.00 of this amount was for

30

John Penn

PC6

petrol, and the remainder was for

repairs to the business vehicle

Part-time wages

Amount paid (R)

400

280

806

334

1 480

1 500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Helparrow_forwardTake me to the text On May 1, 2019, Street Design set up a petty cash fund for $300. At the end of the first week, the petty c Cash on hand Receipt for the purchase of office supplies Receipt for the delivery charges Receipt for the purchase of stamps Receipt for travel to a client meeting $42 Receipt for the payment of newspaper advertising $79 Required Do not enter dollar signs or commas in the input boxes. a) Calculate any cash overage or shortage. Cash is Short ✔ by $13 b) Prepare the journal entries for setting up, and replenishing the petty cash fund. For transactions with more than one debit, enter the debit accounts in alphabetical order. Account Title and Explanation Debit Credit Date 2019 May 1 May 7 Petty Cash Cash Set up the petty cash fund Advertising Expense Cash Over and Short ✓ Travel Expense ✔ ✓ ✔ V 300 To replenish the petty cash fund 79 Delivery Expense Office Supplies Expense ✔ 34 Stamps Expense ✔ 14 13 $100 $34 $14 $18 18 42 < 300 200arrow_forwardHelp please, thank you.arrow_forward

- Nakashima Gallery had the following petty cash transactions in February of the current year. Feb. 2 Wrote a $340 check, cashed it, and gave the proceeds and the petty cashbox to Chloe Addison, the petty cashier. 5 Purchased bond paper for the copier for $16.55 that is immediately used. 9 Paid $44.50 COD shipping charges on merchandise purchased for resale, terms FOB shipping point. Nakashima uses the perpetual system to account for merchandise inventory. 12 Paid $8.75 postage to express mail a contract to a client. 14 Reimbursed Adina Sharon, the manager, $74 for business mileage on her car. 20 Purchased stationery for $68.77 that is immediately used. 23 Paid a courier $23 to deliver merchandise sold to a customer, terms FOB destination. 25 Paid $11.10 COD shipping charges on merchandise purchased for resale, terms FOB shipping point. 27 Paid $51 for postage expenses. 28 The fund had $22.81 remaining in…arrow_forwardNakashima Gallery had the following petty cash transactions in February of the current year. Feb. 2 Wrote a $340 check, cashed it, and gave the proceeds and the petty cashbox to Chloe Addison, the petty cashier. 5 Purchased bond paper for the copier for $16.55 that is immediately used. 9 Paid $44.50 COD shipping charges on merchandise purchased for resale, terms FOB shipping point. Nakashima uses the perpetual system to account for merchandise inventory. 12 Paid $8.75 postage to express mail a contract to a client. 14 Reimbursed Adina Sharon, the manager, $74 for business mileage on her car. 20 Purchased stationery for $68.77 that is immediately used. 23 Paid a courier $23 to deliver merchandise sold to a customer, terms FOB destination. 25 Paid $11.10 COD shipping charges on merchandise purchased for resale, terms FOB shipping point. 27 Paid $51 for postage expenses. 28 The fund had $22.81 remaining in…arrow_forwardNakashima Gallery had the following petty cash transactions in February of the current year. Feb. 2 Wrote a $340 check, cashed it, and gave the proceeds and the petty cashbox to Chloe Addison, the petty cashier. 5 Purchased bond paper for the copier for $16.55 that is immediately used. 9 Paid $44.50 COD shipping charges on merchandise purchased for resale, terms FOB shipping point. Nakashima uses the perpetual system to account for merchandise inventory. 12 Paid $8.75 postage to express mail a contract to a client. 14 Reimbursed Adina Sharon, the manager, $74 for business mileage on her car. 20 Purchased stationery for $68.77 that is immediately used. 23 Paid a courier $23 to deliver merchandise sold to a customer, terms FOB destination. 25 Paid $11.10 COD shipping charges on merchandise purchased for resale, terms FOB shipping point. 27 Paid $51 for postage expenses. 28 The fund had $22.81 remaining in…arrow_forward

- Nakashima Gallery had the following petty cash transactions in February of the current year. Feb. 2 Wrote a $340 check, cashed it, and gave the proceeds and the petty cashbox to Chloe Addison, the petty cashier. 5 Purchased bond paper for the copier for $16.55 that is immediately used. 9 Paid $44.50 COD shipping charges on merchandise purchased for resale, terms FOB shipping point. Nakashima uses the perpetual system to account for merchandise inventory. 12 Paid $8.75 postage to express mail a contract to a client. 14 Reimbursed Adina Sharon, the manager, $74 for business mileage on her car. 20 Purchased stationery for $68.77 that is immediately used. 23 Paid a courier $23 to deliver merchandise sold to a customer, terms FOB destination. 25 Paid $11.10 COD shipping charges on merchandise purchased for resale, terms FOB shipping point. 27 Paid $51 for postage expenses. 28 The fund had $22.81 remaining in…arrow_forwardses E7-4 The following control procedures are used in Bunny's Boutique Shoppe for cash disbursements. 1. Each week, 100 company checks are left in an unmarked envelope on a shelf behind the cash register. 2. The store manager personally approves all payments before she signs and issues checks. 3. The store purchases used goods for resale from people that bring items to the store. Since that can occur anytime that the store is open, all employees are authorized to purchase goods for resale by disbursing cash from the register. The purchase is docu- mented by having the store employee write on a piece of paper a description of the item that was purchased and the amount that was paid. The employee then signs the paper and puts it in the register. 4. After payment, bills are “filed" in a paid invoice folder. 5. The company accountant prepares the bank reconciliation and reports any discrepan- cies to the owner. Instructions (a) For each procedure, explain the weakness in internal control…arrow_forwardOn July 1, 2024, Cromartie Furniture established a $150 petty cash fund. A check for $150 was made out to the petty cash custodian. During July, the petty cash custodian paid the following bills from the petty cash fund: Office supplies $ 36 Postage 22 Delivery charges 40 Bottled water 28 Total $ 126 At the end of July the petty cash fund was replenished. The journal entry to establish the petty cash fund includes:arrow_forward

- This is all the information for the question included in this picture.arrow_forwardOn June 1, Meadow Salad Dressings creates a petty cash fund with an imprest balance of $300. During June, Sunny Lewis, the fund custodian, signs the following petty cash tickets: (Click the icon to view the petty cash tickets.) On June 30, prior to replenishment, the fund contains these tickets plus cash of $55. The accounts affected by petty cash payments are Office Supplies, Travel Expense, Delivery Expense, Entertainment Expense, and Merchandise Inventory. Requirements 1. Explain the characteristics and the internal control features of an imprest fund. 2. On June 30, how much cash should the petty cash fund hold before it is replenished? 3. Journalize all required entries to create the fund and replenish it. Include explanations. -X 4. Make the July 1 entry to increase the fund balance to $400. Include an explanation, and briefly describe what the custodian does. Data table Petty Cash Ticket Number Ticket No. 101 Ticket No. 102 Ticket No. 103 Ticket No. 104 Ticket No. 105 Item…arrow_forwardOn March 20, Novak's petty cash fund of $118 is replenished when the fund contains $20 in cash and receipts for postage $47, supplies $19, and travel expense $32. Prepare the journal entry to record the replenishment of the petty cash fund. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Date Account Titles and Explanation Mar. 20 Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning  College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,