College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

None

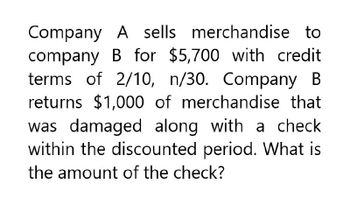

Transcribed Image Text:Company A sells merchandise to

company B for $5,700 with credit

terms of 2/10, n/30. Company B

returns $1,000 of merchandise that

was damaged along with a check

within the discounted period. What is

the amount of the check?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Prepare journal entries for the following sales and cash receipts transactions. (a) Merchandise is sold on account for 300 plus 3% sales tax, with 2/10, n/30 cash discount terms. (b) Part of the merchandise sold in transaction (a) for 70 plus sales tax is returned for credit. (c) The balance on account for the merchandise sold in transaction (a) is paid in cash within the discount period.arrow_forwardCompany U sells merchandise to company P for $7,300 with credit terms of 3/10, n/30. Company P returns $1,400 of merchandise that was damaged along with a check within the discounted period. What is the amount of the check? Need helparrow_forwardCompany U sells merchandise to company P for $7,300 with credit terms of 3/10, n/30. Company P returns $1,400 of merchandise that was damaged along with a check within the discounted period. What is the amount of the check? Questionarrow_forward

- Company U sells merchandise to company P for $7,300 with credit terms of 3/10, n/30. Company P returns $1,400 of merchandise that was damaged along with a check within the discounted period. What is the amount of the check? Correct Answerarrow_forwardWhat is the answer?arrow_forwardPharoah Company sells merchandise on account for $3500 to Riverbed Company with credit terms of 2/15, n/30. Riverbed Company returns $150 of merchandise that was damaged, along with a check to settle the account within the discount period. What is the amount of the check?arrow_forward

- company A sells $1,500 of merchandise on account to company B with credit terms of 2/10, n/30. If company B remits a check taking advantage of the discount offered, what is the amount of Company B's check?? -$1,470 -$1,050 -$1,200 -$1,350arrow_forwardBall Company sells merchandise on account for $1,500 to Edds Company with credit terms of 2/10, n/30. Edds Company returns $300 of merchandise that was damaged, along with a check to settle the account within the discount period. What is the amount of the check? Question 9 options: A) $1,470 B) $1,476 C) $1,176 D) $1,200arrow_forwardOriole Company sells merchandise on account for $7800 to Sunland Company with credit terms of 2/13, n/30. Sunland Company returns $1200 of merchandise that was damaged, along with a check to settle the account within the discount period. What is the amount of the check? $6468 $7668 $7644 $6600arrow_forward

- Company Crane sells $ 800 of merchandise on account to Company Blossom with credit terms of 1/15, n/30. If Company Blossom remits a check taking advantage of the discount offered, what is the amount of Company Blossom's check? O S710 O $792 O $530 O $620arrow_forwardWhat is the amount of the check for this accounting question?arrow_forwardMerchandise subject to the credit terms 2/10, n/30, FOB shipping point, is sold to a customer on account for $20,125. The seller issued a credit memorandum for $4,600 prior to payment. What is the amount of the cash discount allowable if the payment is made within 10 days of the invoice date?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,