Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need help

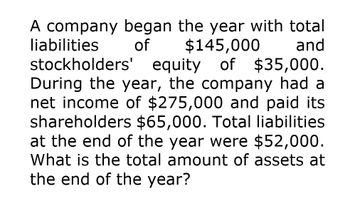

Transcribed Image Text:A company began the year with total

liabilities of $145,000 and

stockholders' equity of $35,000.

During the year, the company had a

net income of $275,000 and paid its

shareholders $65,000. Total liabilities

at the end of the year were $52,000.

What is the total amount of assets at

the end of the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: Note: Round answers to two decimal places. 1. Calculate the times-interest-earned ratio. 2. Calculate the debt ratio. 3. Calculate the debt-to-equity ratio.arrow_forwardWhat is the company's average total assets for the year on these general accounting question?arrow_forwardGreen Moose Company has the following end-of-year balance sheet: Green Moose Company Balance Sheet For the Year Ended on December 31 Assets Liabilities Current Assets: Current Liabilities: Cash and equivalents $150,000 Accounts payable $250,000 Accounts receivable 400,000 Accrued liabilities 150,000 Inventories 350,000 Notes payable 100,000 Total Current Assets $900,000 Total Current Liabilities $500,000 Net Fixed Assets: Long-Term Bonds 1,000,000 Net plant and equipment $2,100,000 Total Debt $1,500,000 (cost minus depreciation) Common Equity Common stock 800,000 Retained earnings 700,000 Total Common Equity $1,500,000 Total Assets $3,000,000 Total Liabilities and Equity $3,000,000 The firm is currently in the process of forecasting sales, asset requirements, and required funding for the coming year. In the year that just ended, Green Moose Company generated $350,000 net income on sales of $13,000,000. The firm…arrow_forward

- The year-end financial statements of Calloway Company contained the following elements and corresponding amounts: Assets = $34,000; Liabilities = ?; Common Stock = $6,400; Revenue = $13,800; Dividends = $1,450; Beginning Retained Earnings = $4,450; Ending Retained Earnings = $8,400.The amount of liabilities reported on the end-of-period balance sheet was:arrow_forwardThe year-end financial statements of Calloway Company contained the following elements and corresponding amounts: Assets = $36,000; Liabilities = ?; Common Stock = $6,600; Revenue = $14,200; Dividends = $1,550; Beginning Retained Earnings = $4,550; Ending Retained Earnings = $8,600.The amount of liabilities reported on the end-of-period balance sheet was: a. $29,400 b. $27,400 c. $24,850. d. $20,800.arrow_forwardFor the year just completed, Hanna Company had net income of $73,000. Balances in the company's current asset and current liability accounts at the beginning and end of the year were as follows: December 31 Current assets: Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Current liabilities: Accounts payable Accrued liabilities Income taxes payable End of Year $ 58,000 $ 170,000 $ 433,000 $ 12,500 $ 352,000 $ 8,500 $ 36,000 Beginning of Year $ 77,000 $ 196,000 $ 355,000 $ 13,500 $ 396,000 $ 12,000 $ 27,000 The Accumulated Depreciation account had total credits of $56,000 during the year. Hanna Company did not record any gains or losses during the year. Required: Using the indirect method, determine the net cash provided by operating activities for the year. (List any deduction in cash outflows as negative amounts.) Hanna Company Statement of Cash Flows-Indirect Method (partial) Net income Adjustments to convert net income to a cash basis: Decrease in accounts…arrow_forward

- A company reports the following income statement and balance sheet information for the current year: Net income $435,590 Interest expense 76,870 Average total assets 4,380,000 Determine the return on total assets. If required, round the answer to one decimal place. %arrow_forwardRosalind Company reported revenues of $111,500, expenses of $92,545, and net income of $18,955 for the year. Assets totaled $200,000 at the beginning of the year and $246,000 at the end of the year. The company's return on assets for the year (round the percent to one decimal) is:arrow_forward.arrow_forward

- The company had the following final balances after the Arst year af aperations: assets, $45,000, stockhalder equity, $25,000; dividends, $3,000; and net income, $10,000. What is the amount of the tompany liabilities? A $13,000. B $7,000. C $40,000. D $65,000.arrow_forwardFor the just completed year, Hanna Company had net income of $91,000. Balances in the company's current asset and current liability accounts at the beginning and end of the year were as follows: December 31 End of Beginning Year of Year Current assets: Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Current liabilities: Accounts payable Accrued liabilities Income taxes payable $ 60,000 $ 82,000 $166,000 $184,000 $445,000 $346,000 $ 11,500 $ 13,500 $356,000 $392,000 $ 7,500 $ 13,000 $ 35,000 $ 29,000 The Accumulated Depreciation account had total credits of $56,000 during the year. Hanna Company did not record any gains or losses during the year. Required: Using the indirect method, determine the net cash provided by operating activities for the year. (List any deduction in cash and cash outflows as negative amounts.) Hanna Company Statement of Cash Flows-Indirect Method (partial)arrow_forwardCold Duck Manufacturing Inc. has the following end-of-year balance sheet: Cold Duck Manufacturing Inc. Balance Sheet For the Year Ended on December 31 Assets Liabilities Current Assets: Current Liabilities: Cash and equivalents $150,000 Accounts payable $250,000 Accounts receivable 400,000 Accrued liabilities 150,000 Inventories 350,000 Notes payable 100,000 Total Current Assets $900,000 Total Current Liabilities $500,000 Net Fixed Assets: Long-Term Bonds 1,000,000 Net plant and equipment(cost minus depreciation) $2,100,000 Total Debt $1,500,000 Common Equity Common stock 800,000 Retained earnings 700,000 Total Common Equity $1,500,000 Total Assets $3,000,000 Total Liabilities and Equity $3,000,000 The firm is currently in the process of forecasting sales, asset requirements, and required funding for the coming year. In the year that just ended, Cold Duck Manufacturing Inc. generated $450,000 net income on sales of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning