SWFT Corp Partner Estates Trusts

42nd Edition

ISBN: 9780357161548

Author: Raabe

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Answer in step by step with explanation.

Don't use Ai and chatgpt

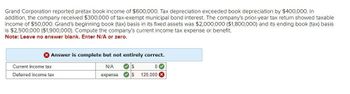

Transcribed Image Text:Grand Corporation reported pretax book income of $600,000. Tax depreciation exceeded book depreciation by $400,000. In

addition, the company received $300,000 of tax-exempt municipal bond interest. The company's prior-year tax return showed taxable

income of $50,000. Grand's beginning book (tax) basis in its fixed assets was $2,000,000 ($1,800,000) and its ending book (tax) basis

is $2,500,000 ($1,900,000). Compute the company's current income tax expense or benefit.

Note: Leave no answer blank. Enter N/A or zero.

Answer is complete but not entirely correct.

Current income tax

Deferred income tax

N/A

$

0

expense

$ 120,000 (

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In the current year, Madison Corporation had 50,000 of taxable income at a tax rate of 25%. During the year, Madison began offering warranties on its products and has a Warranty liability for financial reporting purposes of 5,000 at the end of the year. Warranty expenses are not deductible until paid for income tax purposes. Prepare the journal entry to record Madisons income taxes at the end of the year.arrow_forwardGrand Corporation reported pretax book income of $600,000. Tax depreciation exceeded book depreciation by $400,000. In addition, the company received $300,000 of tax-exempt municipal bond interest. The company's prior-year tax return showed taxable income of $50,000. Grand's beginning book (tax) basis in its fixed assets was $2,000,000 ($1,800,000) and its ending book (tax) basis is $2,500,000 ($1,900,000). Compute the company's current income tax expense or benefit. Note: Leave no answer blank. Enter N/A or zero. Answer is complete but not entirely correct. Current income tax Deferred income tax N/A $ 0 expense $ 120,000 (arrow_forwardGrand Corporation reported pretax book income of $600,000. Tax depreciation exceeded book depreciation by $400,000. In addition, the company received $300,000 of tax-exempt municipal bond interest. The company's prior-year tax return showed taxable income of $50,000. Grand's beginning book (tax) basis in its fixed assets was $2,000,000 ($1,800,000) and its ending book (tax) basis is $2,500,000 ($1,900,000). Compute the company's current income tax expense or benefit. Note: Leave no answer blank. Enter N/A or zero. Current income tax Deferred income tax N/A $ expensearrow_forward

- Grand Corporation reported pretax book income of $666,000. Tax depreciation exceeded book depreciation by $ 444,000. In addition, the company received $333,000 of tax-exempt municipal bond interest. The company's prior - year tax return showed taxable income of $55,500. Grand's beginning book (tax) basis in its fixed assets was $ 2,110,000 ($1,888,000) and its ending book (tax) basis is $2, 610,000 ($1,966, 000). Compute the company's current income tax expense or benefit.arrow_forwardGrand Corporation reported pretax book income of $624, 000. Tax depreciation exceeded book depreciation by $416,000. In addition, the company received $312,000 of tax-exempt municipal bond interest. The company's prior - year tax return showed taxable income of $52,000. Grand's beginning book (tax) basis in its fixed assets was $2,040, 000 ($1,832, 000) and its ending book (tax) basis is $2, 540,000 ($1,924, 000). Compute the company's current income tax expense or benefit. Note: Leave no answer blank. Enter N/A or zero.arrow_forwardGrand Corporation reported pretax book income of $660,000. Tax depreciation exceeded book depreciation by $440,000. In addition, the company received $330,000 of tax-exempt municipal bond interest. The company's prior-year tax return showed taxable income of $55,000. Grand's beginning book (tax) basis in its fixed assets was $2,100,000 ($1,880,000) and its ending book (tax) basis is $2,600,000 ($1,960,000). Compute the company's current income tax expense or benefit. Note: Leave no answer blank. Enter N/A or zero.arrow_forward

- Munabhaiarrow_forwardHarrison Corporation reported a pretax book income of $425,000. Tax depreciation exceeded book depreciation by $410,000. In addition, the company received $165,000 of tax-exempt municipal bond interest. The company's prior-year tax return showed a taxable income of $103,000. Assuming a tax rate of 34%, compute the company's deferred income tax expense or benefit.arrow_forwardGrand Corporation reported pretax book income of $621,000. Tax depreciation exceeded book depreciation by $414,000. In addition, the company received $310,500 of tax-exempt municipal bond interest. The company’s prior-year tax return showed taxable income of $51,750. Compute the company's current income tax expense or benefit. (Leave no answer blank. Enter N/A or zero.) Current income tax N/A $0 Deferred income tax Expense ?arrow_forward

- Burcham Corporation reported pretax book income of $600,000. The depreciation exceeded book depreciation by $400,000. In addition, the company received $300,000 of tax-exempt municipal bond interest. The company’s prior year tax return showed taxable income of $50,000. Compute the company’s book equivalent of taxable income. Use this number to compute the company’s total income tax provision or benefit.arrow_forwardGrand Corporation reported pretax book income of $600,000. Tax depreciation exceeded book depreciation by $400,000. In addition, the company received $300,000 of tax-exempt municipal bond interest. The company's prior-year tax return showed taxable income of $50,000. Compute the company's current or deferred income tax expense or benefit. Answer is complete but not entirely correct. 10,500 Deferred income tax benefitarrow_forwardGrand Corporation reported pretax book income of $805,000. Tax depreciation exceeded book depreciation by $535,000. In addition, the company received $330,000 of tax-exempt municipal bond interest. The company's prior-year tax return showed taxable income of $37,000. Compute the company's current and deferred income tax expense or benefit. (Leave no answer blank. Enter N/A or zero.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning