Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Get solution

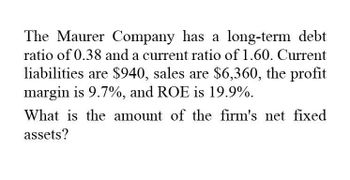

Transcribed Image Text:The Maurer Company has a long-term debt

ratio of 0.38 and a current ratio of 1.60. Current

liabilities are $940, sales are $6,360, the profit

margin is 9.7%, and ROE is 19.9%.

What is the amount of the firm's net fixed

assets?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Want Answer please provide it.arrow_forwardWant Right Answerarrow_forwardThe Maurer Company has a long-term debt ratio of .27 and a current ratio of 1.30. Current liabilities are $830, sales are $6,250, profit margin is 8.6 percent, and ROE is 18.8 percent. What is the amount of the firm’s net fixed assets? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

- Please provide Solutionsarrow_forwardThe Maurer Company has a long-term debt ratio of .70 and a current ratio of 1.60. Current liabilities are $930, sales are $5,145, profit margin is 9.40 percent, and ROE is 17.20 percent. What is the amount of the firm's net fixed assets? Multiple Choice O $10,302.67 $8,814.67 $3,514.75 $7,490.87 $6,560.87arrow_forwardWant Correct choicearrow_forward

- The lawrence company has a ratio of long term debt to long term debt plus equity of .25 and a current ratio of 1.5. current liabilities are 900, sales are 6230 , profit margin is 8.1 percent what is the amount of the firms net fixt assets ?arrow_forwardThe Lawrence Company has a ratio of long term debt to long term debt plus equity of .39 and a current ratio of 1.7. Current liabilities are 950, sales are 6370, profit margin is 9.8 percent, and ROE is 20 percent. What is the amount of the firms net fixed assets?arrow_forwardThe Lawrence Company has a ratio of long-term debt to long-term debt plus equity of .34 and a current ratio of 1.6. Current liabilities are $900, sales are $6,320, profit margin is 9.1 percent, and ROE is 19.5 percent. What is the amount of the firm's net fixed assets? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Net fixed assetsarrow_forward

- The Rossdale Company has a ratio of long-term debt to long-term debt plus equity of .34 and a current ratio of 1.29. Current liabilities are $1,450, sales are $7,380, profit margin is 8.1 percent, and ROE is 14.3 percent. What is the amount of the firm’s net fixed assets? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardThe Ashwood Company has a long-term debt ratio of .45 and a current ratio of 1.25. Current liabilities are $875, sales are $5,780, profit margin is 9.5 percent, and ROE is 18.5 percent. What is the amount of the firm's net fixed assets?arrow_forwardThe Mikado Company has a long-term debt ratio (i.e., the ratio of long-term debt to long-term debt plus equity) of .49 and a current ratio of 1.38. Current liabilities are $2,450, sales are $10,630, profit margin is 10 percent, and ROE is 15 percent. What is the amount of the firm’s net fixed assets?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning