Intermediate Accounting: Reporting and Analysis

2nd Edition

ISBN: 9781285453828

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 4E

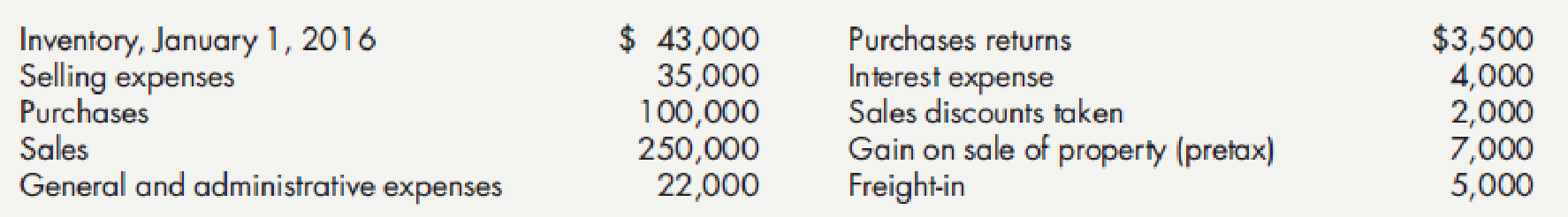

Cost of Goods Sold and Income Statement Schuch Company presents you with the following account balances taken from its December 31, 2016, adjusted

Additional data:

Additional data:

- 1. A physical count reveals an ending inventory of $22,500 on December 31, 2016.

- 2. Twenty-five thousand shares of common stock have been outstanding the entire year.

- 3. The income tax rate is 30% on all items of income.

Required:

- 1. As a supporting document for Requirements 2 and 3, prepare a separate schedule for Schuch’s cost of goods sold.

- 2. Prepare a 2016 multiple-step income statement.

- 3. Prepare a 2016 single-step income statement.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

owing income statement accounts in the popup window, E

t for the year.

ow for the year.

Data Table

nt for the year.

at below. (Round to the nearest dollar.

(Click on the following icon in order to copy its contents into a spreadsheet.)

ncome Statement

Income Statement Accounts for the Year Ending 2017

Balance

nding December 31, 2017

Account

Cost of goods sold

Interest expense

Taxes

Revenue

Selling, general, and administrative expenses

Depreciation

$341,000

$75,000

59,600

S743,000

$62,000

$116,000

Print

Done

%24

%24

%24

Accounting

Compute for the net sales that would be

reported in LIVA company's Income Statement.

You are to be assigned to prepare the financial

statement of LIVA Company for the year 2021.

The following data were made available for you:

Ending Inventory at Cost - 739, 160

Goods Available for Sale at retail - 3, 930, 000

Sales Discount - 16, 000

Net markdowns - 48, 500

Net markups - 30, 000

Beginning inventory at retail - 1, 450, 000

Purchases at retail - 2, 422, 000

The company adopts the average cost approach

to estimate the value of its inventory and the

cost ratio is computed at 68%.

Prepare an income statement for Hansen Realty for the year ended December 31, 2023. Beginning inventory was $1,248. Ending inventory was $1,600.

Note: Input all amounts as positive values.

Sales

$ 34,900

Sales returns and allowances

1,092

Sales discount

1,152

Purchases

10,512

Purchase discounts

540

Depreciation expense

115

Salary expense

5,200

Insurance expense

2,600

Utilities expense

210

Plumbing expense

250

Rent expense

180

Prepare an income statement for Hansen Realty for the year ended December 31, 2023. Beginning inventory was $1,248. Ending inventory was $1,600.

Note: Input all amounts as positive values.

Sales

$ 34,900

Sales returns and allowances

1,092

Sales discount

1,152

Purchases

10,512

Purchase discounts

540

Depreciation expense

115

Salary expense

5,200

Insurance expense

2,600

Utilities expense

210

Plumbing expense

250

Rent expense

180

Chapter 5 Solutions

Intermediate Accounting: Reporting and Analysis

Ch. 5 - In general, how does the income statement help...Ch. 5 - Prob. 2GICh. 5 - Define income under the capital maintenance...Ch. 5 - Prob. 4GICh. 5 - What is net income?Ch. 5 - What three things must a company determine to...Ch. 5 - Prob. 7GICh. 5 - Prob. 8GICh. 5 - Prob. 9GICh. 5 - Give an example and explanation for each of the...

Ch. 5 - Define expenses. What do expenses measure?Ch. 5 - Prob. 12GICh. 5 - Define gains and losses. Give examples of three...Ch. 5 - Prob. 14GICh. 5 - What items are included in a companys income from...Ch. 5 - How are unusual or infrequent gains or losses...Ch. 5 - What is interperiod tax allocation?Ch. 5 - Prob. 18GICh. 5 - Prob. 19GICh. 5 - Prob. 20GICh. 5 - Prob. 21GICh. 5 - Prob. 22GICh. 5 - Prob. 23GICh. 5 - Prob. 24GICh. 5 - Prob. 25GICh. 5 - Prob. 26GICh. 5 - Prob. 27GICh. 5 - Prob. 28GICh. 5 - Prob. 29GICh. 5 - Prob. 30GICh. 5 - Prob. 31GICh. 5 - Prob. 32GICh. 5 - What is the rate of return on common equity? What...Ch. 5 - Prob. 34GICh. 5 - Prob. 35GICh. 5 - Which of the following is expensed under the...Ch. 5 - The following information is available for Cooke...Ch. 5 - The following information is available for Wagner...Ch. 5 - Prob. 4MCCh. 5 - A loss from the sale of a component of a business...Ch. 5 - In a statement of cash flows, receipts from sales...Ch. 5 - Brandt Corporation had sales revenue of 500,000...Ch. 5 - Refer to RE5-1. Prepare a single-step income...Ch. 5 - Shaquille Corporation began the current year with...Ch. 5 - Dorno Corporation incurred expenses during the...Ch. 5 - Niler Corporation reported the following after-tax...Ch. 5 - Jordan Corporation reported retained earnings of...Ch. 5 - Prob. 7RECh. 5 - Prob. 8RECh. 5 - Amelias Bookstore reported net income of 62,000...Ch. 5 - Prob. 10RECh. 5 - Prob. 1ECh. 5 - Prob. 2ECh. 5 - Prob. 3ECh. 5 - Cost of Goods Sold and Income Statement Schuch...Ch. 5 - Prob. 5ECh. 5 - Prob. 6ECh. 5 - Prob. 7ECh. 5 - Prob. 8ECh. 5 - Prob. 9ECh. 5 - Prob. 10ECh. 5 - Prob. 11ECh. 5 - Prob. 12ECh. 5 - Prob. 13ECh. 5 - Prob. 14ECh. 5 - Prob. 15ECh. 5 - Prob. 16ECh. 5 - Prob. 17ECh. 5 - Classifications Where would each of the following...Ch. 5 - Prob. 19ECh. 5 - Common-Size Analyses Meagley Company presents the...Ch. 5 - Prob. 21ECh. 5 - Prob. 22ECh. 5 - Prob. 23ECh. 5 - Prob. 24ECh. 5 - Prob. 25ECh. 5 - Prob. 26ECh. 5 - Prob. 1PCh. 5 - Prob. 2PCh. 5 - Prob. 3PCh. 5 - Prob. 4PCh. 5 - Financial Statement Violations of U.S. GAAP The...Ch. 5 - Rox Corporations multiple-step income statement...Ch. 5 - Prob. 7PCh. 5 - Prob. 8PCh. 5 - Prob. 9PCh. 5 - The following is an alphabetical list of accounts...Ch. 5 - Financial Statement Deficiencies The following is...Ch. 5 - Prob. 12PCh. 5 - Prob. 13PCh. 5 - Prob. 14PCh. 5 - Prob. 15PCh. 5 - Prob. 16PCh. 5 - Prob. 17PCh. 5 - Prob. 18PCh. 5 - Prob. 19PCh. 5 - Prob. 20PCh. 5 - Prob. 21PCh. 5 - Prob. 22PCh. 5 - Prob. 23PCh. 5 - Prob. 1CCh. 5 - Prob. 2CCh. 5 - Prob. 3CCh. 5 - Prob. 4CCh. 5 - Nonrecurring Items Lynn Company sells a component...Ch. 5 - Prob. 6CCh. 5 - Accrual Accounting GAAP requires the use of...Ch. 5 - Prob. 8CCh. 5 - Prob. 9CCh. 5 - Prob. 10CCh. 5 - Prob. 12C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cost of Goods Sold, Income Statement. and Statement of Comprehensive Income Gaskin Company derives the following items from its adjusted trial balance as of December 31, 2019: The following; additional information is also available. The December 31, 2019, ending inventory is 14,700. During 2019, 4,200 shares of'common stock were outstanding the entire year. The income tax rate 30% on all items of income. Required: 1. As a supporting document for Requirements 2 and 3, prepare a separate schedule for Gaskins cost of goods sold. 2. Prepare a 2019 single-step income statement. 3. Prepare a 2019 multiple-step income statement. 4. Prepare a 2019 statement of comprehensive income.arrow_forwardThe following selected information is taken from the financial statements of Arnn Company for its most recent year of operations: During the year, Arnn had net sales of 2.45 million. The cost of goods sold was 1.3 million. Required: Note: Round all answers to two decimal places. 1. Compute the current ratio. 2. Compute the quick or acid-test ratio. 3. Compute the accounts receivable turnover ratio. 4. Compute the accounts receivable turnover in days. 5. Compute the inventory turnover ratio. 6. Compute the inventory turnover in days.arrow_forwardInventory Analysis Singleton Inc. reported the following information for the current year: Required: Compute Singletons (a) gross profit ratio, (b) inventory turnover ratio, and (c) average days to sell inventory. (Note: Round all answers to two decimal places.)arrow_forward

- Reid Company uses the periodic inventory system. On January 1, it had an inventory balance of 250,000. During the year, it made 613,000 of net purchases. At the end of the year, a physical inventory showed it had ending inventory of 140,000. Calculate Reid Companys cost of goods sold for the year.arrow_forwardFinancial Statement Analysis The financial statements for Nike, Inc., are presented in Appendix C at the end of the text. The following additional information (in thousands) is available: Instructions 1. Determine the following measures for the fiscal years ended May 31, 2013 (fiscal 2012), and May 31, 2012 (fiscal 2011), rounding to one decimal place. a. Working capital b. Current ratio c. Quick ratio d. Accounts receivable turnover e. Number of days sales in receivables f. Inventory turnover g. Number of days sales in inventory h. Ratio of liabilities to stockholders equity i. Ratio of sales to assets j. Rate earned on total assets, assuming interest expense is 23 million for the year ending May 31, 2013, and 31 million for the year ending May 31, 2012 k. Rate earned on common stockholders equity l. Price-earnings ratio, assuming that the market price was 61.66 per share on May 31, 2013, and 53.10 per share on May 31, 2012 m. Percentage relationship of net income to sales 2. What conclusions can be drawn from these analyses?arrow_forwardJudon Corp. provides the following information from its annual report. Assume all revenues are credit sales. The cost of revenues can be used as an approximation of the company's purchases for the year. Revenues $ 546,190 Cost of revenues $ 340,275 Inventories as of 31 January 2022 $44,064 Inventories as of 31 January 2021 $41,020 Accounts payable as at 31 January 2022 $58,600 Accounts payable as at 31 January 2021 $51,800 Accounts receivable as at 31 January 2022 $7,482 Accounts receivable as at 31 January 2021 $5,434 Compute the following financial ratios for Judon Corp for 2022 1. Account Receivable Turnover Ratio (Times)? 2. Collection Interval (DSO) / Days? 3. Inventory Turnover Ratio (Times) ? 4. Holding Interval (Days) ? 5. Account Payable Turnover Ratio (Times)? 6.Payment Interval (Days)? 7. Does Judon Corp need short-term financing?arrow_forward

- Judon Corp. provides the following information from its annual report. Assume all revenues are credit sales. The cost of revenues can be used as an approximation of the company's purchases for the year. Revenues $ 546,190 Cost of revenues $ 340,275 Inventories as of 31 January 2022 $44,064 Inventories as of 31 January 2021 $41,020 Accounts payable as at 31 January 2022 $58,600 Accounts payable as at 31 January 2021 $51,800 Accounts receivable as at 31 January 2022 $7,482 Accounts receivable as at 31 January 2021 $5,434 Compute the following financial ratios for Judon Corp for 2022 1. Account Receivable Turnover Ratio (Times)? 2. Collection Interval (DSO) / Days? 3. Inventory Turnover Ratio (Times) ? 4. Holding Interval (Days) ? 5. Account Payable Turnover Ratio (Times)? 6.Payment Interval (Days)? 7. Does Judon Corp need short-term financing? 8. Using the information provided, compute the change in operating working captialarrow_forwardThe adjusted trial balance of Bramble Corp. shows these data pertaining to sales at the end of its fiscal year, October 31, 2022: Sales Revenue $908,400; Freight-Out $12,800; Sales Returns and Allowances $20,600; and Sales Discounts $15,100.Prepare the sales section of the income statement. Bramble Corp.Income Statement (Partial)choose the accounting period For the Month Ended October 31, 2022October 31, 2022For the Year Ended October 31, 2022 select an opening section name Retained Earnings, November 1, 2021Net Income / (Loss)Retained Earnings, October 31, 2022Total RevenuesSalesTotal ExpensesNet SalesExpensesDividends enter an income statement item $enter a dollar amount select between addition and deduction AddLess : enter an income statement item $enter a dollar amount enter an income statement item enter a dollar amount enter a subtotal of the two previous amounts select a…arrow_forwardThe adjusted trial balance of Sarasota Corporation shows these data pertaining to sales at the end of its fiscal year, October 31, 2018: Sales $ 980,300; Freight-out $ 11,800; Sales Returns and Allowances $ 17,300; and Sales Discounts $ 14,500.Prepare the sales revenues section of the income statement.arrow_forward

- The adjusted trial balance of Kingbird, Inc. shows these data pertaining to sales at the end of its fiscal year, October 31, 2022 Sales Revenue $902,300; Freight-Out $12,700; Sales Returns and Allowances $19,000; and Sales Discounts $13,900. Prepare the sales section of the income statement. Kingbird, Inc. Income Statement (Partial) 11arrow_forwardStatements The following data relate to Masuerte Corporation for the year ended December 31, 2018. Assume an income tax rate of 30%. 9. Sales Purchases Purchase Returns and Allowances Sales Returns and Allowances Sales Salaries and Commissions Office Salaries Advertising Utilities Taxes and Licenses' Delivery Expense Depreciation Expense - Store Equipment Depreciation Expense - Office Equipment Insurance Expense Repairs and Maintenance Uncollectible Accounts Expense Miscellaneous Selling Expenses Miscellaneous Administrative Expenses Interest Expense Gain on Sale of Equipment Additional information: P3,348,000 2,150,000 70,000 95,000 185,000 202,000 78,000 56,000 44,000 35,000 30,000 36,000 12,000 14,000 23,000 16,000 5,000 46,000 30,000 Inventories from the beginning of the year to the end of the year increased by P80,000. a. Required: (a) Show computations for the following: (1) Cost of goods sold (2) Gross profit (3) Total selling expenses (4) Total administrative expenses (5)…arrow_forwardThe following is a partial listing of accounts for XYZ, Inc., for the year ended December 31, 2020. Required: Prepare multiple step income statement for the year of 2020. Finished Goods Current Maturities of Long-Term Debt Accumulated Depreciation Accounts Receivable $ 38,872 2,515 19,960 Sales Revenue 6,273 127,260 Treasury Stock 251 Prepaid Expenses 2,199 Deferred Taxes (long-term liability) 8,506 Interest Expense 2,410 Allowance for Doubtful Accounts 915 Retained Earnings 18,951 Raw Materials 9,576 Accounts Payable 19,021 Cash and Cash Equivalents 8,527 Sales Salaries Expense 872 Cost of Goods Sold 82,471 Investment in Unconsolidated 3,559 Subsidiaries Income Taxes Payable 8,356 Work In Process 1,984 Additional Paid-In Capital 9,614 Equipment 41,905 Long-Term Debt 15,258 Rent Income 2,468 Common Stock 3,895 Notes Payable (short-term) 6,156 Income Tax Expense 2,461arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License