1.

Prepare rate of change analyses for the income statements and balance sheets of Company C for 2016 and 2017 using the year to year approach.

1.

Explanation of Solution

Balance Sheet: Balance Sheet is one of the financial statements which summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

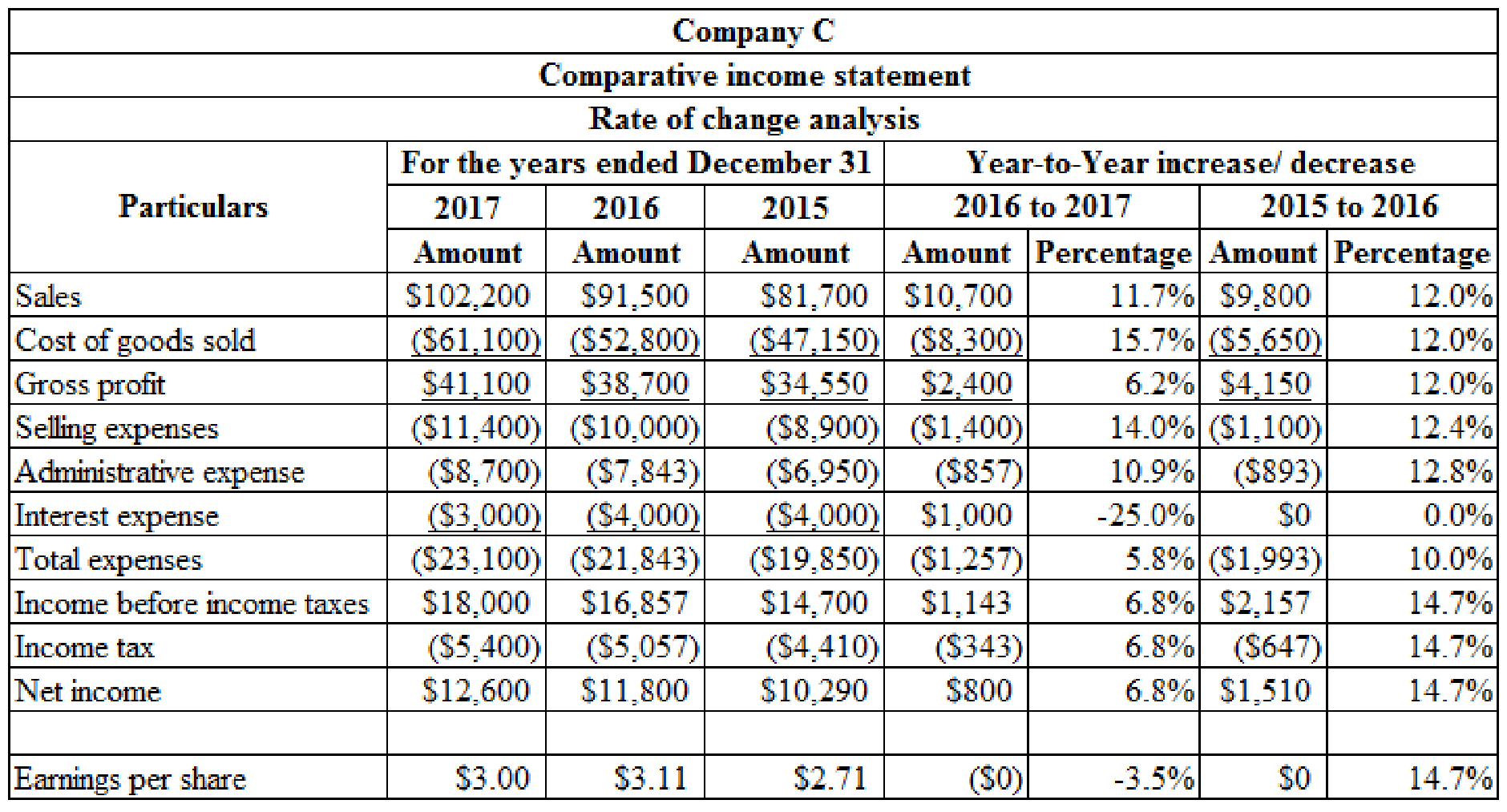

Prepare rate of change analyses for the income statements of Company C for 2016 and 2017 using the year to year approach:

Table (1)

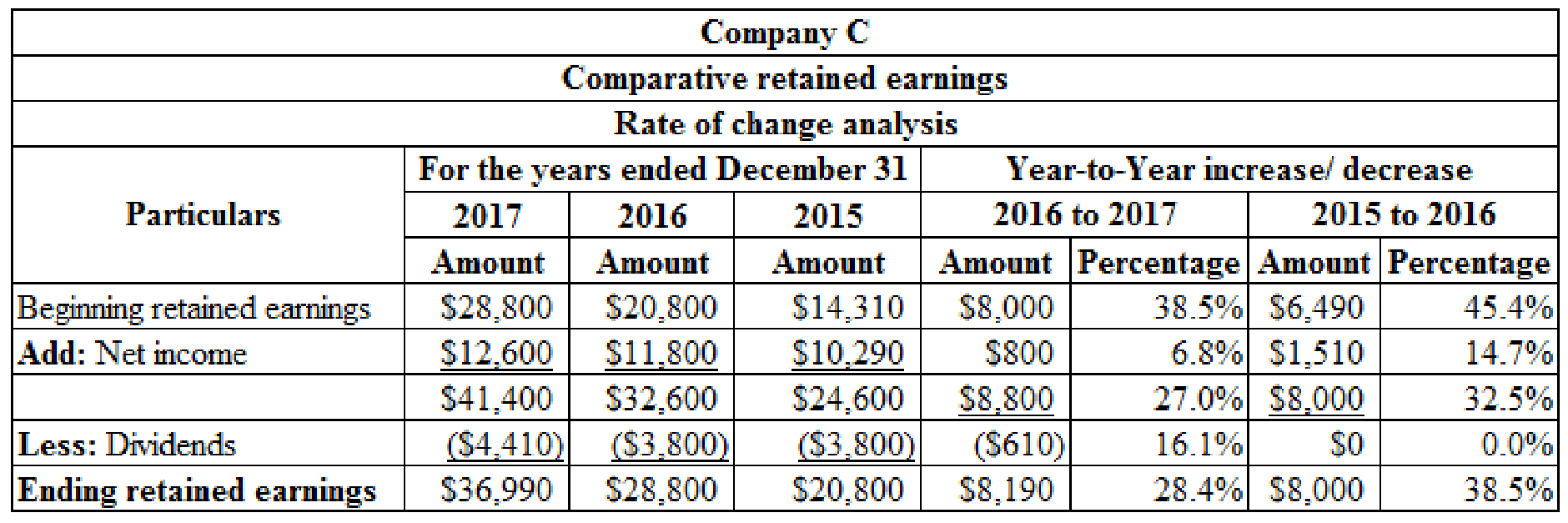

Prepare rate of change analyses for the

Table (2)

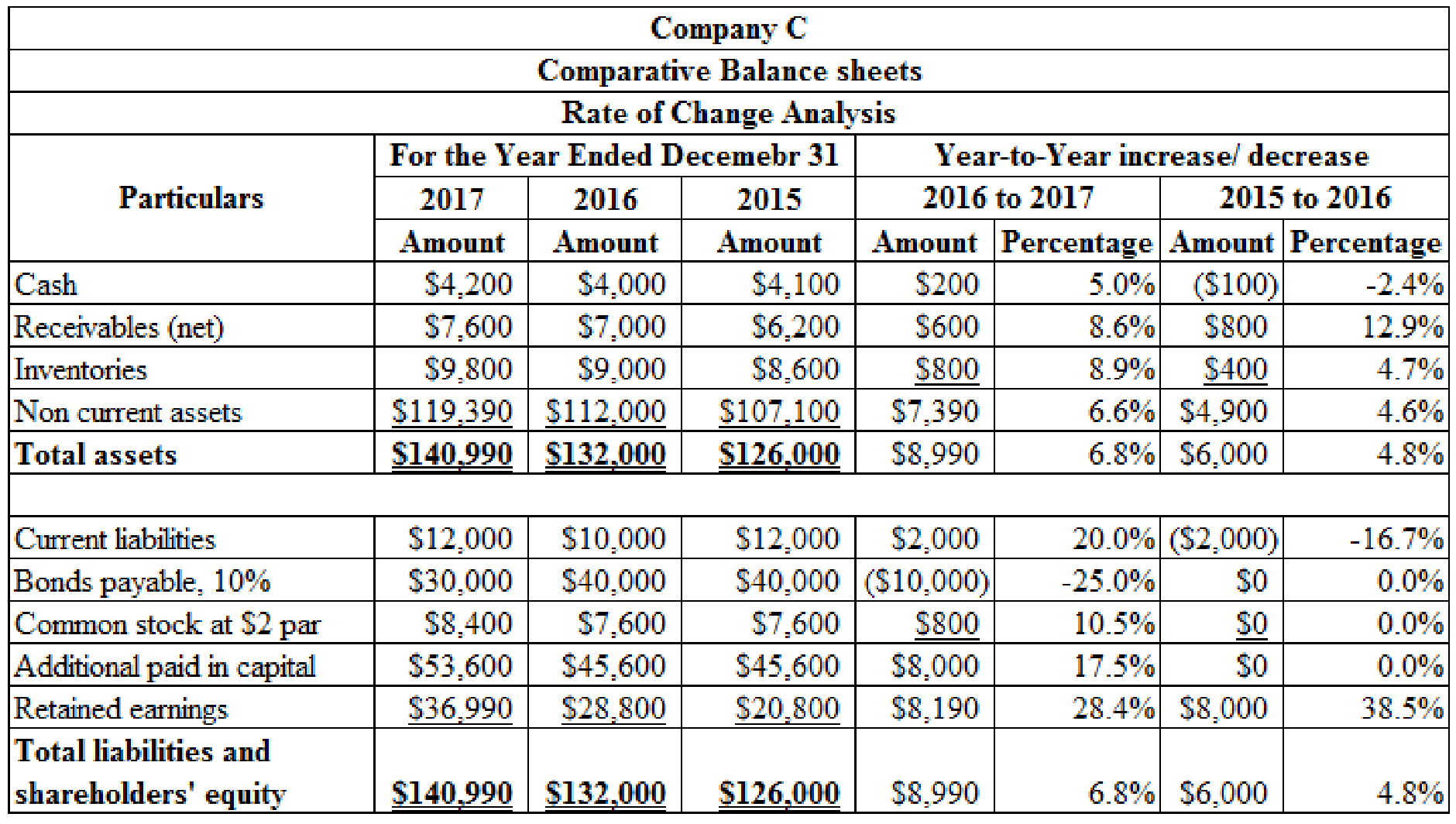

Prepare rate of change analyses for the balance sheets of Company C for 2016 and 2017 using the year to year approach:

Table (3)

2. (a)

Compute

2. (a)

Explanation of Solution

Current ratio: Current ratio is one of the

Current ratio=Current AssetsCurrent Liabilities

Compute current ratio for 2016 and 2017:

| Ratios and Formula | 2017 | 2016 |

|

Current ratio: Current AssetsCurrent Liabilities | =[(Cash + Receivables + Inventories)Current liabilities]=($4,200+$7,600+$9,800)($12,000)=1.8:1 | =[(Cash + Receivables + Inventories)Current liabilities]=($4,000+$7,000+$9,000)($10,000)=2:1 |

Table (4)

2. (b)

Compute inventory turnover for 2016 and 2017.

2. (b)

Explanation of Solution

Inventory Turnover Ratio: This ratio is a financial metric used by a company to quantify the number of times inventory is used or sold during the accounting period. It is calculated by using the formula:

Inventory turnover=Cost of goods soldAverage inventory

Compute inventory turnover for 2016 and 2017:

| Ratios and Formula | 2017 | 2016 |

|

Inventory turnover: Cost of goods soldAverage inventory Average inventory: (Ending Inventory)+(Beginning Inventory)2 |

=$61,100$9,400=6.5 times =[($9,000+$9,800)2]=$9,400 |

=$52,800$8,800=6 times =[($6,600+$9,000)2]=$8,800 |

Table (5)

2. (c)

Compute receivable turnover for 2016 and 2017.

2. (c)

Explanation of Solution

Receivables turnover ratio: Receivables turnover ratio is mainly used to evaluate the collection process efficiency. It helps the company to know the number of times the

Receivables turnover=Net credit salesAverage accounts receivables

Compute receivable turnover for 2016 and 2017:

| Ratios and Formula | 2017 | 2016 |

|

Receivables turnover: Net credit sales(Average accounts receivables) Average accounts receivable: (Ending Net Receivables)+(Beginning Net Receivables)2 |

=$102,200×.60$7,300=8.4 times =[($7,000+$7,600)2]=$7,300 |

=$91,500×.65$6,600=9.01 times =[($6,200+$7,000)2]=$6,600 |

Table (6)

2. (d)

Compute net profit margin for 2016 and 2017.

2. (d)

Explanation of Solution

Net profit margin: It is one of the profitability ratios. Profit margin ratio is used to measure the percentage of net income that is being generated per dollar of revenue or sales.

Net margin=Net incomeNet sales

Compute net profit margin for 2016 and 2017:

| Ratios and Formula | 2017 | 2016 |

|

Net profit margin: Net incomeNet sales | =( $12,600$102,200×100)=12.33% | =($11,800$91,500×100)=12.90% |

Table (7)

2. (e)

Compute earnings per share for 2016 and 2017.

2. (e)

Explanation of Solution

Earnings per Share: Earnings per share help to measure the profitability of a company. Earnings per share are the amount of profit that is allocated to each share of outstanding stock.

Earnings per share=Net earnings available for common stockAverage number of outstanding common shares

Compute earnings per share for 2016 and 2017:

| Ratios and Formula | 2017 | 2016 |

|

Earnings per share: Net income−Preferred dividend[Average common shares outstanding] | =( $12,600$8,400$2×100)=$3 | =( $11,800$7,600$2×100)=$3.11 |

Table (8)

2. (f)

Compute return on total assets ratio for 2016 and 2017.

2. (f)

Explanation of Solution

Return on total assets: Return on investments (assets) is the financial ratio which determines the amount of net income earned by the business with the use of total assets owned by it. It indicates the magnitude of the company’s earnings with relative to its total assets.

Return on asset=( Net income +(Interest expense×After tax rate))Average total assets×100

Compute return on total assets for 2016 and 2017:

| Ratios and Formula | 2017 | 2016 |

|

Return on total assets: [( Net income + (Interest expense×After tax rate))Average total assets×100] Average total assets: (Ending total assets)+(Beginning total assets)2 |

=[($12,600+($3,000×.7))$136,495×100]=[($12,600+$2,100)$136,495×100]=10.8% =($132,000 +$140,990)2=$136,495 |

=[($11,800+($4,000×.7))$129,000×100]=[($11,800+$2,800)$129,000×100]=11.3% =($126,000 +$132,000)2=$129,000 |

Table (9)

Working note: 1 Determine the after tax rate:

| Ratios and Formula | 2017 | 2016 |

|

After tax rate: [1−( Income tax amount Income before tax)] | =[1−($5,400$18,000)]=1−.30=0.7 | =[1−($5,057$16,857)]=1−.30=0.7 |

Table (10)

2. (g)

Compute return on common stockholders’ equity for 2016 and 2017.

2. (g)

Explanation of Solution

Return on common stockholders’ equity ratio: It is a profitability ratio that measures the profit generating ability of the company from the invested money of the shareholders. The formula to calculate the return on equity is as follows:

Return on common stockholders' equity}= Net incomeAverage stockholders' equity×100

Compute return on common stockholders’ equity for 2016 and 2017:

| Ratios and Formula | 2017 | 2016 |

|

Return on common stockholders’ equity: Net income [Average stockholders' equity] Average stockholders’ equity: (Ending stockholders' equity)+(Beginning stockholders' equity)2 |

=($12,600$90,495×100)=13.9% =[($98,990+$82,000)2]=$90,495 |

=($11,800$78,000×100)=15.1% =[($82,000+$74,000)2]=$78,000 |

Table (11)

2. (h)

Compute debt to assets for 2016 and 2017.

2. (h)

Explanation of Solution

Debt to assets ratio: The debt to asset ratio shows the relationship between total asset and the total liability of the company. Debt ratio reflects the financial strategy of the company. It is used to measure the percentage of company’s assets that are financed by long term debts. Debt to assets ratio is calculated by using the formula:

Debt-to-assets ratio=Total LiabilitiesTotal Assets

Compute debt to assets for 2016 and 2017:

| Ratios and Formula | 2017 | 2016 |

|

Debt to assets ratio: Total liabilities Total assets | =$12,000+$30,000$140,990×100=29.8% | =$10,000+$40,000$132,000×100=37.9% |

Table (12)

3.

Explain the possible reasons for the decrease in the market price per share in 2017.

3.

Explanation of Solution

The probable reason for the decrease in the market price per share in 2017:

- The current ratio, receivable turnover ratio, net profit margin ratio, return on total assets, return on shareholders’ equity and earnings per share ratio in year 2017 are less than the result provided in the year of 2016.

- The financial condition of the company is not as strong as it was in 2016 because earnings per share of Company C have decreased from $3.11(2016) to $3 (2017) and the debt to assets ratio has also decreased from 37.9% (2016) to $29.8% (2017).

Want to see more full solutions like this?

Chapter 5 Solutions

Intermediate Accounting: Reporting and Analysis

- Wilson Corporation acquires Greatbatch Company for $80 million cash in a merger. The balance sheets of both companies at the date of acquisition are as follows: Balance Sheet (in millions) Wilson Greatbatch Current assets $96 $8 Property and equipment 800 144 Intangibles 32 4.8 Total assets $928 $156.8 Current liabilities $40 $3.2 Long-term debt 640 104 Capital stock 80 19.2 Retained earnings 192 24 Accumulated other comprehensive income (loss) (24) 6.4 Total liabilities and equity $928 $156.8 Greatbatch's property and equipment is overvalued by $48 million, its reported intangibles are undervalued by $32 million, and it has unreported intangibles, in the form of customer databases and marketing agreements, valued at $11.2 million. Required Prepare Wilson's balance sheet immediately following the merger. Use a negative sign with your answer for AOCI if the balance is a loss.arrow_forwardNot use ai solution given correct answerarrow_forwardGeneral Accounting questionarrow_forward

- Provide answer general Accountingarrow_forwardCompare and contrast experiences you have had with your own and other people’s monochromic time orientation and polychronic time orientation and how you can account for any differences in time orientation in your workplace communications in the future.arrow_forwardI need this question answer general Accountingarrow_forward

- Financial accounting questionarrow_forwardAns?? Financial accounting questionarrow_forwardYour career is expanding with an opportunity to support your company's growth in a non-U.S. country. Choose a country that you believe is a viable expansion option. Support your choice for this country by learning about the country's political, economic, and legal system. Share this information with your classmates by summarizing how these areas would contribute to the successful expansion project.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT