1.

Provide a multi-step income statement for the year 2016.

1.

Explanation of Solution

Multi step income statement: A multiple step income statement refers to the income statement that shows the operating and non-operating activities of the business under separate head. In different steps of the multi-step income statement, principal operating activities are reported that starts from the record of sales revenue with all contra sales revenue account like sales returns, allowances and sales discounts.

Provide a multi-step income statement for the year 2016.

| Company R | ||

| Multi-Step Income Statement | ||

| For the Year Ended December 31, 2016 | ||

| Particulars | Amount | Amount |

| ($) | ($) | |

| Sales revenue | $200,000 | |

| Less: Cost of goods sold | ($121,120) | |

| Gross profit | $78,880 | |

| Less: Operating expenses | ||

| Selling expenses | ($26,000) | |

| Administrative expenses | ($16,000) | |

| ($7,000) | ||

| Operating expenses | ($49,000) | |

| Operating income | $29,880 | |

| Other revenues and expenses: | ||

| Interest revenue | $1,000 | |

| Interest expense | ($4,880) | |

| Loss due to flood | ($8,000) | ($11,880) |

| Income before taxes | $18,000 | |

| Less: Income taxes @30% | ($5,400) | |

| Net income | $12,600 | |

| Components of income | Earnings per common share | |

| Net income | $2.52 | |

Table (1)

2.

Provide a schedule that discloses the revenues, profits, and assets of divisions 1 and 2 and the remaining operating segments.

2.

Explanation of Solution

Provide a schedule that discloses the revenues, profits, and assets of divisions 1 and 2 and the remaining operating segments.

| Company R | ||||

| Industry Segment Financial Results | ||||

| For the Year Ended December 31, 2016 | ||||

| Particulars | Reportable Operating Segments | All Other Segments | Totals | |

| 1 | 2 | |||

| Total revenues (Sales) | 98,000 | 60,000 | 42,000 | 200,000 |

| Segment profit (Pretax) | 17,100 | 10,830 | 9,750 | 37,680 |

| General corporate expenses | -7,800 | |||

| Interest revenue | 1,000 | |||

| Interest expense | -4,880 | |||

| Loss due to flood | -8,000 | |||

| Income before taxes | 18,000 | |||

| Identifiable asset | 135,000 | 87,000 | 54,000 | 276,000 |

| General corporate assets | 24,000 | |||

Table (2)

Working note (1):

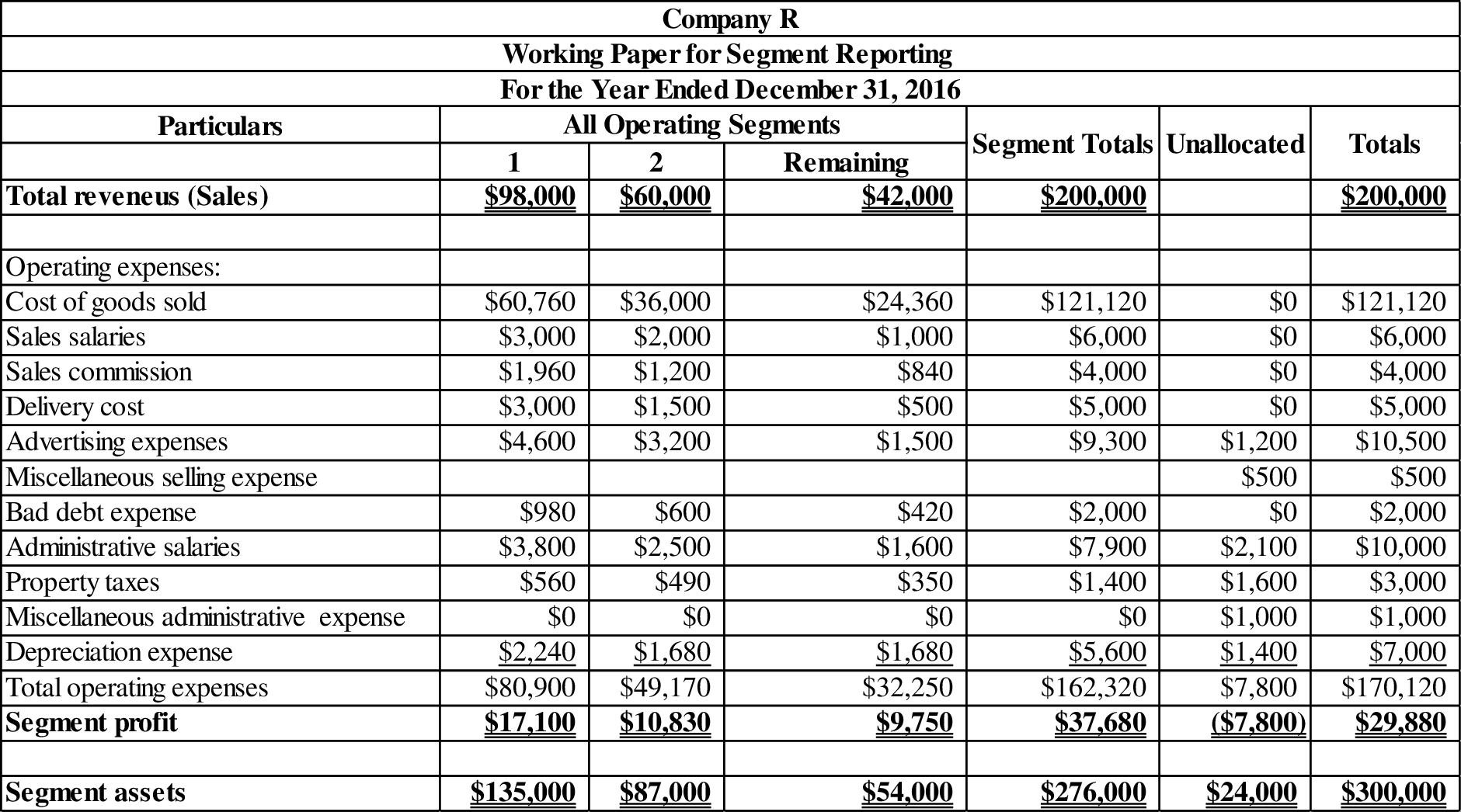

Prepare a working paper for segment reporting:

Table (3)

3.

Provide a suitable segment notes related to depreciation, profit, and capital expenditures.

3.

Explanation of Solution

In the calculation of segment profit none on the following item has been added or subtracted. Formula for segment profit is as follows:

Depreciation expenses for Division 1 and 2 are $2,240 and $1,680 respectively.

In the year of 2016, capital expenditure amount of $25,000 placed in Division 1 and $6,000 placed in Division 2.

4.

Compute the profit margin before income taxes and pretax return on identifiable assets for Divisions 1 and 2 and for other divisions and evaluate the ratios.

4.

Explanation of Solution

Compute the profit margin before income taxes for Division 1:

Calculate profit margin before income taxes for Division 2:

Calculate profit margin before income taxes for other division:

Hence, the profit margin before income taxes for Division 1, 2 and other division is

Calculate pretax return on identifiable assets for Division 1:

Calculate pretax return on identifiable assets for Division 2:

Calculate pretax return on identifiable assets for other division:

Hence, the pretax return on identifiable assets Division 1, 2 and other division is

These ratios expose that the profit margin before income taxes for other division has higher margin of 23.21%.

This ratio expose that the other operating divisions have a higher pretax profit margin and pretax return on identifiable assets than the two reportable divisions. This reveals that the economic resources are used lesser in the reportable divisions.

Want to see more full solutions like this?

Chapter 5 Solutions

Intermediate Accounting: Reporting and Analysis

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning