Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

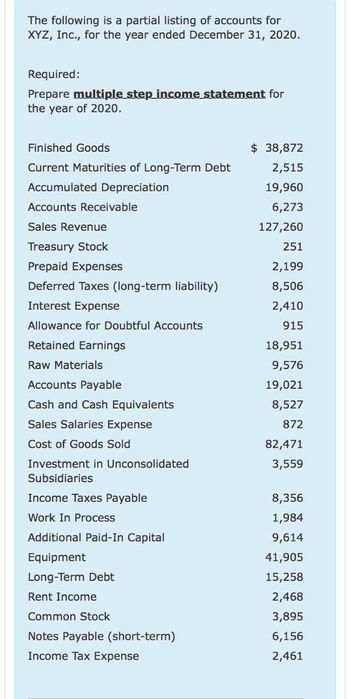

Transcribed Image Text:The following is a partial listing of accounts for

XYZ, Inc., for the year ended December 31, 2020.

Required:

Prepare multiple step income statement for

the year of 2020.

Finished Goods

Current Maturities of Long-Term Debt

Accumulated Depreciation

Accounts Receivable

$ 38,872

2,515

19,960

Sales Revenue

6,273

127,260

Treasury Stock

251

Prepaid Expenses

2,199

Deferred Taxes (long-term liability)

8,506

Interest Expense

2,410

Allowance for Doubtful Accounts

915

Retained Earnings

18,951

Raw Materials

9,576

Accounts Payable

19,021

Cash and Cash Equivalents

8,527

Sales Salaries Expense

872

Cost of Goods Sold

82,471

Investment in Unconsolidated

3,559

Subsidiaries

Income Taxes Payable

8,356

Work In Process

1,984

Additional Paid-In Capital

9,614

Equipment

41,905

Long-Term Debt

15,258

Rent Income

2,468

Common Stock

3,895

Notes Payable (short-term)

6,156

Income Tax Expense

2,461

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Need help provide correct answer general accountingarrow_forwardThe accounting records of Nettle Distribution show the following assets and liabilities as of December 31,2018 and 2019.December 31 2018 2019Cash . . . . . . . . . . . . . . . . . . . . . . . . $ 64,300 $ 15,640Accounts receivable . . . . . . . . . . . 26,240 19,100Office supplies . . . . . . . . . . . . . . . . 3,160 1,960Office equipment . . . . . . . . . . . . . . 44,000 44,000Trucks . . . . . . . . . . . . . . . . . . . . . . . 148,000 157,000December 31 2018 2019Building . . . . . . . . . . . . . . . . . . . . . $ 0 $80,000Land . . . . . . . . . . . . . . . . . . . . . . . . 0 60,000Accounts payable . . . . . . . . . . . . . 3,500 33,500Note payable . . . . . . . . . . . . . . . . . 0 40,000Required1. Prepare balance sheets for the business as of December 31, 2018 and 2019. Hint: Report only total equityon the balance sheet and remember that total equity equals the difference between assets and liabilities.2. Compute net income for 2019 by comparing total equity amounts for these…arrow_forwardPlease show proper steps and explain the steps also.arrow_forward

- The following information is from the accounts of Neway Ltd for the years 2018 and 2019 Neway Ltd Summary of the statement of comprehensive income 2019 2018 $m $m Sales revenue 650 615 COGS 305 295 Gross profit Interest expense Other expenses (including depreciation) Profit 320 (13) (100) 345 (15) (120) 210 207 63 Depreciation expense Accounts payable at the end of the period Accounts receivable at the end of the period |Inventory held at the end of the period 85 30 25 34 46 65 57 Required: a) Prepare a statement of cash flows from operations for Neway Ltd. b) Prepare a statement that reconciles the profit with the cash flows from operations.arrow_forwardCalculate the inventory turnover for 2019.arrow_forwardPlease provide correct answer accounting questionarrow_forward

- subject; accountingarrow_forwardThe following financial information is for Annapolis Corporation for the fiscal years ending 2018 and 2019 (all balances are normal): Cost of Accounts Net Sales Net Item/Account Inventory Goods Receivable (all credit) Income Sold 2019 2018 $44,000 $42,000 $410,000 $154,000 $27,200 $34,000 $38,000 $350,000 $152,000 $24,800 Use this information to determine the accounts receivable average collection period for FY 2019. (Use 365 days a year. Round your answers to one decimal place.)arrow_forwardThe following data were obtained from the books of JOYFUL CORPORATION: Accounts receivable, March 31, 2021 – P110,000; Accounts receivable, September 30, 2021 – P130,000; Purchases, March to September 2021 – P450,000; Inventory, March 31, 2021 – P180,000; Average gross profit rate – 40%; Accounts receivable turnover – 6 to 1. The Inventory at September 30, 2021 should be ______. A. 198,000B. 150,000C. 120,000arrow_forward

- The following data were obtained from the books of JOYFUL CORPORATION: Accounts receivable, March 31, 2021 – P110,000; Accounts receivable, September 30, 2021 – P130,000; Purchases, March to September 2021 – P450,000; Inventory, March 31, 2021 – P180,000; Average gross profit rate – 40%; Accounts receivable turnover – 6 to 1. The Inventory at September 30, 2021 should be ______. A. 198,000B. 150,000C. 120,000d. None of thesearrow_forwardThe current ratio for the following is ..... Group of answer choices .43 .23 .73 .53arrow_forwardThe following are the financial statement JNC Ltd. for the year ended 31 March 2020: JNC Ltd. Income statement For the year ended 31 March 2020 $”M” Revenue 1276.50 Cost of sales (907.00) 369.50 Distribution costs (62.50) Administrative expenses (132.00) 175.00 Interest received 12.50 Interest paid (37.50) 150.00 Tax (70.00) Profit after tax 80.00 JNC Ltd. Statement of financial position as at 31 March 2020 2019 $”M” $”M” ASSETS: Non- current assets: Property, plant and equipment 190 152.5 Intangible assets 125 100 Investments 12.5 Current assets: Inventories 75 51 Receivables 195 157.5 Short-term investment 25 Cash in hand 1 0.5 Total assets 611 474 Equity and liabilities: Equity: Share capital (10 million ordinary shares of $ 10 per value) 100 75 Share premium 80 75 Revolution reserve 50 45.5 Retained earnings 130 90 Non-current liabilities: Loan 85 25…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning