Concept explainers

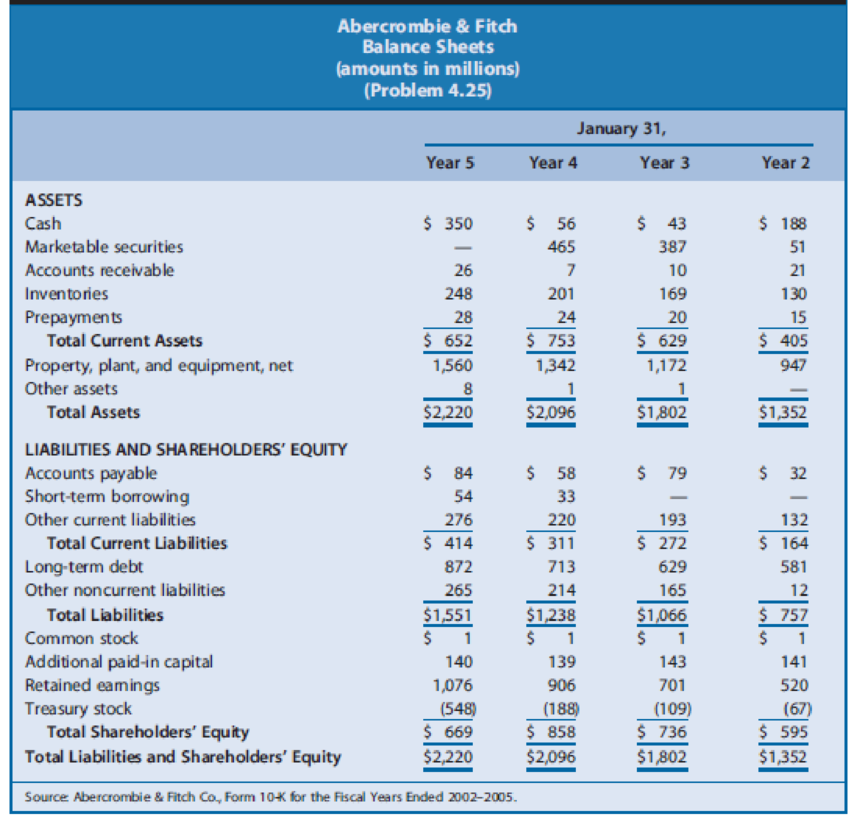

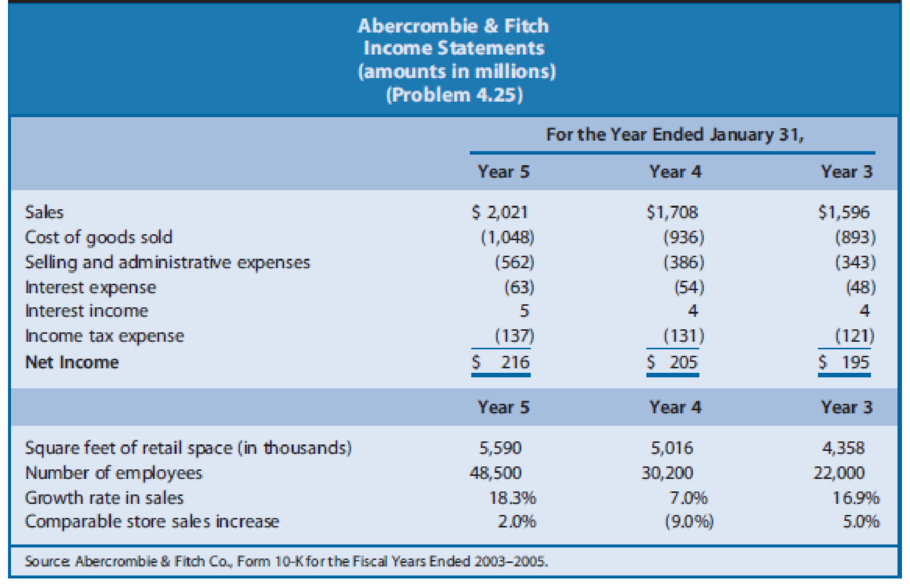

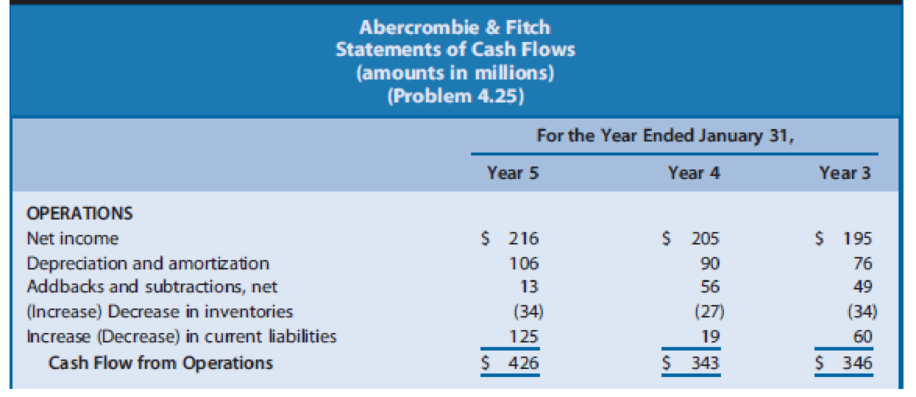

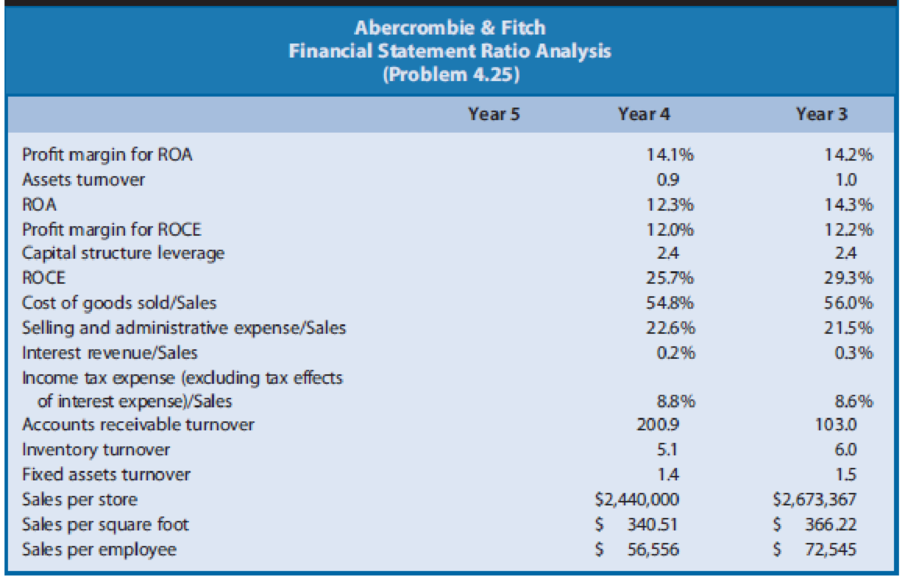

Fitch sells casual apparel and personal care products for men, women, and children through retail stores located primarily in shopping malls. Its fiscal year ends January 31 of each year. Financial statements for Abercrombie & Fitch for fiscal years ending January 31, Year 3, Year 4, and Year 5 appear in Exhibit 4.34 (balance sheets), Exhibit 4.35 (income statements), and Exhibit 4.36 (statements of cash flows). These financial statements reflect the capitalization of operating leases in property, plant, and equipment and long-term debt, a topic discussed in Chapter 6. Exhibit 4.37 (page 312) presents financial statement ratios for Abercrombie & Fitch for Years 3 and 4. Selected data for Abercrombie & Fitch appear here.

Exhibit 4.34

REQUIRED

- a. Calculate the ratios in Exhibit 4.37 for Year 5. The income tax rate is 35%.

- b. Analyze the changes in

ROA for Abercrombie & Fitch during the three-year period, suggesting possible reasons for the changes observed. - c. Analyze the changes in ROCE for Abercrombie & Fitch during the three-year period, suggesting possible reasons for the changes observed.

Exhibit 4.35

Exhibit 4.36

Exhibit 4.37

Trending nowThis is a popular solution!

Chapter 4 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

- The financial statements of Dandy Distributors Ltd. are shown on the "Fcl. Stmts." page. 1 Based on Dandy's financial statements, calculate ratios for the year ended December 31, 2020. Assume all sales are on credit. Show your work. 2 From these ratios, analyze the financial performance of Dandy.arrow_forwardHelp me pleasearrow_forwardABC Co. is a manufacturing company and its selected financial statements items are given as following. Net Sales 1 - equals to 32000 for the year 2020 and 28000 for the year 2019. COGS equals to 24000 and 21000 respectively for the year 2020 and 2019. Accounts Receivable for the year 2020 equals to 8500 and 7800 for the year 2019. Inventory equals to 7500 and 6800 respectively for the year 2020 and 2019. Accounts Payable for the year 2020 equals to 11000 and 9000 for the year 2019. (All numbers are in dollars). What is days sales outstanding for the year 2020? a) 83 b) S0137 93 103 d) 113arrow_forward

- Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity For Year Ended December 31 Sales Cost of goods sold Other operating expenses Exercise 13-11 (Algo) Analyzing profitability LO P3 Interest expense Income tax expense Total costs and expenses Net income Earnings per share For both the current year and one year ago, compute the following ratios: Current Year The company's income statements for the Current Year and 1 Year Ago, follow. $ 460,312 233,929 12,828 9,810 $ 34,590 97,275 124,801 11,139 312,664 $ 580,469 $ 143,091 106,946 162,500 167,932 $ 580,469 Compute the price-earnings ratio for each year.…arrow_forwardAudio City, Incorporated, is developing its annual financial statements at December 31. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income statement are summarized below: Balance Sheet at December 31 Cash Accounts Receivable Inventory Equipment Accumulated Depreciation-Equipment Total Assets Accounts Payable Salaries and Wages Payable Notes Payable (long-term) Common Stock Retained Earnings Total Liabilities and Stockholders' Equity Income Statement Sales Revenue Cost of Goods Sold Other Expenses Net Income Additional Data: a. Bought equipment for cash, $67,000. b. Paid $12,000 on the long-term notes payable. c. Issued new shares of stock for $24,000 cash. Current Year $ 45,100 12,600 18,400 211,000 (51,000) $ 236,100 JA OPOFF00 $ 7,400 2,100 57,000 88,000 81,600 $ 236,100 $ 182,000 84,000 51,000 $ 47,000 Previous Year $ 51,800 17,000 17,000 144,000 (39,000) $ 190,800 $ 17,800 1,000 69,000 64,000 39,000 $ 190,800 d.…arrow_forwardYou are asked to provided a comparative financial statement analysis of Star Corporation and Moon Stores Inc. for the the current year. Your junior accountant has collected the following data for you. Star Corp. Moon Stores Income Statement Net Sales 61,471 374,526 Cost of Goods Sold 41,895 286,515 Sell and Administrative expenses 16,200 70,847 Interest Expense Other income (expense) Income tax expense 647 1,798 1,896 4,273 1,776 $ 6,908 Net Income 2,849 $ 12,731 Balance Sheet Current Assets 18,906 47,585 Long-term Assets Total Assets 25,654 $ 44,560 115,929 163,514 Current Liabilities Long-term debt Total stockholders equity Total liabilities and equity 58,454 40,452 64,608 11,782 17,471 15,307 $ 44,560 $ 163,514 Beginning of the year balances Total assets 37,349 151,587 Total equity Current liabilities 15,633 61, 11,117 52,148 Total liabilities 21,716 90,014 Other data Average net accounts receivable Average inventory Net cash provided by operating activities 7,124 3,247 6,517 34,433…arrow_forward

- The following are relevant information pertaining to the results of the business operations for Maisarah Islamic Window for the year 2020: Income from Operations2600000Expenses from Operations1180000Indirect Income (Fee Based)300000Indirect Expenses260000The above profit from operation is prior to the distribution of profit to mudharabah depositors. The agreed profit sharing ratio between the Bank and mudharabah depositors is 60:40 respectively.Required:Assuming that the Separate Investment Account Method SIAM is used, calculate the net profit/loss to the Islamic Bank (Before Tax and Zakat)arrow_forwardAnalyze and compare Abercrombie & Fitch and The Gap Abercrombie & Fitch Co. (ANF) and The Gap, Inc. (GPS) are two U.S. apparel retailers. The current assets and current liabilities for each company from recent balance sheets are as follows (in thousands): Abercrombie Current assets: Cash Accounts receivable Inventories Other current assets Total current assets Current liabilities: Accounts payable Other current liabilities Total current liabilities & Fitch The Gap $823,139 $877,000 69,102 525,864 3,018,000 89,654 1,270,000 $1,507,759 $5,165,000 $374,829 640,411 $1,015,240 $1,951,000 2,126,000 $4,077,000 Required: a. Compute the working capital for each company. 492,519 thousand Abercrombie: $ The Gap: $ 1,088,000 thousand b. Compute the current ratio for each company. Round your answers to one decimal place. Abercrombie: 1.5 The Gap: 1.3 c. Compute the quick ratio for each company. Round your answers to one decimal place. Abercrombie: The Gap: x d. Which company appears to have the…arrow_forwardThe following are relevant information pertaining to the results of the business operations for Maisarah Islamic Window for the year 2020: Income from Operations 3600000 Expenses from Operations 1300000 Indirect Income (Fee Based) 200000 Indirect Expenses 360000 The above profit from operation is prior to the distribution of profit to mudharabah depositors. The agreed profit sharing ratio between the Bank and mudharabah depositors is 60:40 respectively. Required Assuming that the pooling Method is used, calculate the net profit/loss to the Islamic Bank (Before Tax and Zakat)arrow_forward

- ces Given the following information, complete the balance sheet shown next. Collection period Days' sales in cash Current ratio Inventory turnover Liabilities to assets Payables period Assets Current assets: Cash Accounts receivable Inventory Total current assets Net fixed assets Total assets (All sales are on credit. All calculations assume a 365-day year. The payables period is based on cost of goods sold.) Note: Round your answers to the nearest whole dollar. Liabilities and shareholders' equity Current liabilities: 71 days 33 days 2.2 times Accounts payable Short-term debt Total current liabilities Long-term debt Shareholders' equity Total liabilities and equity 5 65% 35 days $ $ 1,300,000 2,000,000 7,000,000arrow_forwardThe following information relates to SE10-5 through SE10-7: (in millions) Net sales... Cost of goods sold SE10-7. Gross profit. Selling and administrative expenses Income from operations Interest expense.. EVANS & SONS, INC. Income Statement For Years Ended December 31, 2019 and 2018 Income before income taxes Income tax expense. Net income (in millions) Assets Current assets Cash and cash equivalents Accounts receivable Inventory.. Other current assets. Total current assets Property, plant, & equipment (net) Other assets. Total Assets Liabilities and Stockholders' Equity Current liabilities. Long-term liabilities. Total liabilities.. EVANS & SONS, INC. Balance Sheet December 31, 2019 and 2018 Stockholders' equity - common. Total Liabilities and Stockholders' Equity.. 2019 9,800 (5,500) 4,300 (2,800) 1,500 (300) $ 1,200 2019 100 900 500 400 2018 1,900 2,600 5,700 $10,200 9,300 (5,200) 4,100 (2,700) (220) (200) $980 $950 1,400 $ (250) 1,150 2018 300 800 650 250 2,000 2,500 5,900 $10,400…arrow_forwardA Comparison of Firm Performance 1 2 2013 Financials 3 Net operating revenues 4 Cost of goods sold 5 Gross profit 6 Selling, general, and administrative expense 7 Other costs 8 Operating income 9 Interest expense 10 Other income (loss) - net 11 Income before income taxes 12 Income taxes 13 Net income 14 Assets 15 Cash and cash equivalents 16 Net receivables 17 Inventories 18 Prepaid expenses and other 19 Total current assets 20 Property, plant and equipment 21 Goodwill 22 Other assets 23 Total assets 24 Liabilities and Stockholder Equity 25 Accounts payable 26 Short-term debt 27 Total current liability 28 Long-term debt 29 Other liabilities 30 Total liabilities 31 Stockholder equity 32 B Walmart 469,162 352,488 116,674 88,873 27,801 2,251 187 25,737 7,981 17,756 7,781 6,768 43,803 1,588 59,940 116,681 20,497 5,987 203,105 59,099 12,719 71,818 41,417 113,235 89,870 C Macy's 27,931 16,725 11,206 8,440 88 2,678 388 (134) 2,156 767 1,389 1,836 371 5,308 361 7,876 8,196 3,743 1,176 20,991…arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage