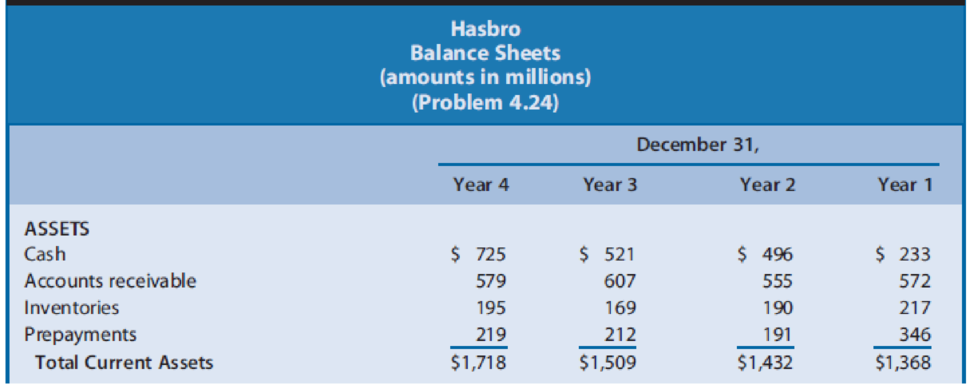

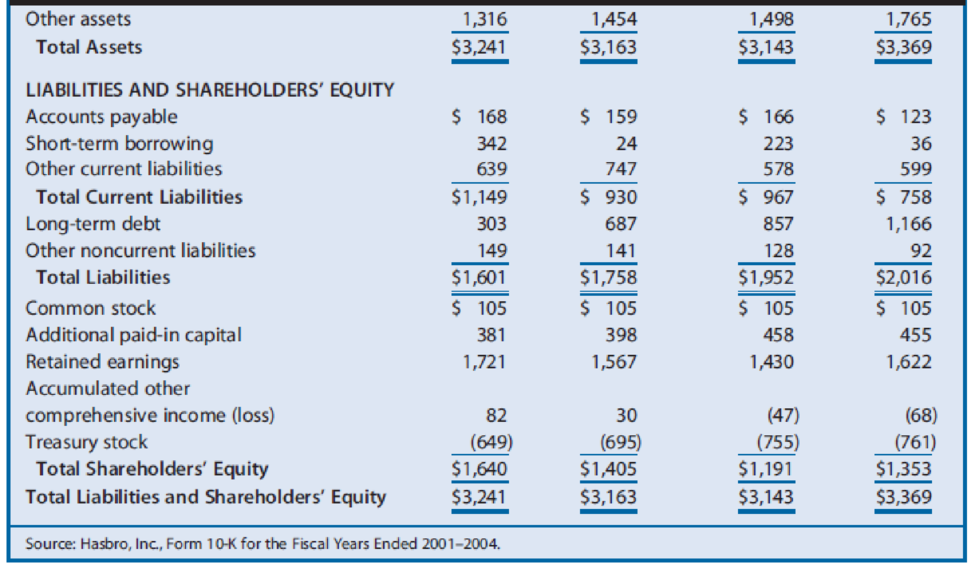

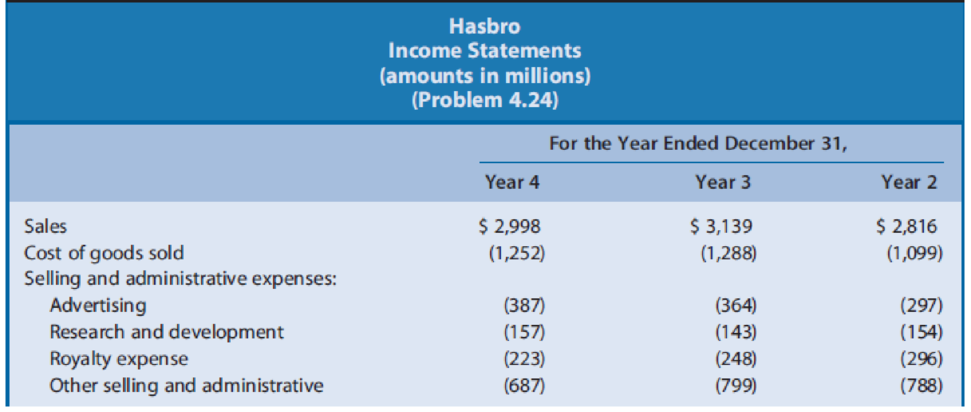

Hasbro is a leading firm in the toy, game, and amusement industry. Its promoted brands group includes products from Playskool, Tonka, Milton Bradley, Parker Brothers, Tiger, and Wizards of the Coast. Sales of toys and games are highly variable from year to year depending on whether the latest products meet consumer interests. Hasbro also faces increasing competition from electronic and online games. Hasbro develops and promotes its core brands and manufactures and distributes products created by others under license arrangements. Hasbro pays a royalty to the creator of such products. In recent years, Hasbro has attempted to reduce its reliance on license arrangements, placing more emphasis on its core brands. Hasbro also has embarked on a strategy of reducing fixed selling and administrative costs in an effort to offset the negative effects on earnings of highly variable sales. Exhibit 4.30 presents the balance sheets for Hasbro for the years ended December 31, Years 1 through 4. Exhibit 4.31 presents the income statements and Exhibit 4.32 presents the statements of cash flows for Years 2 through 4.

Exhibit 4.30

Exhibit 4.31

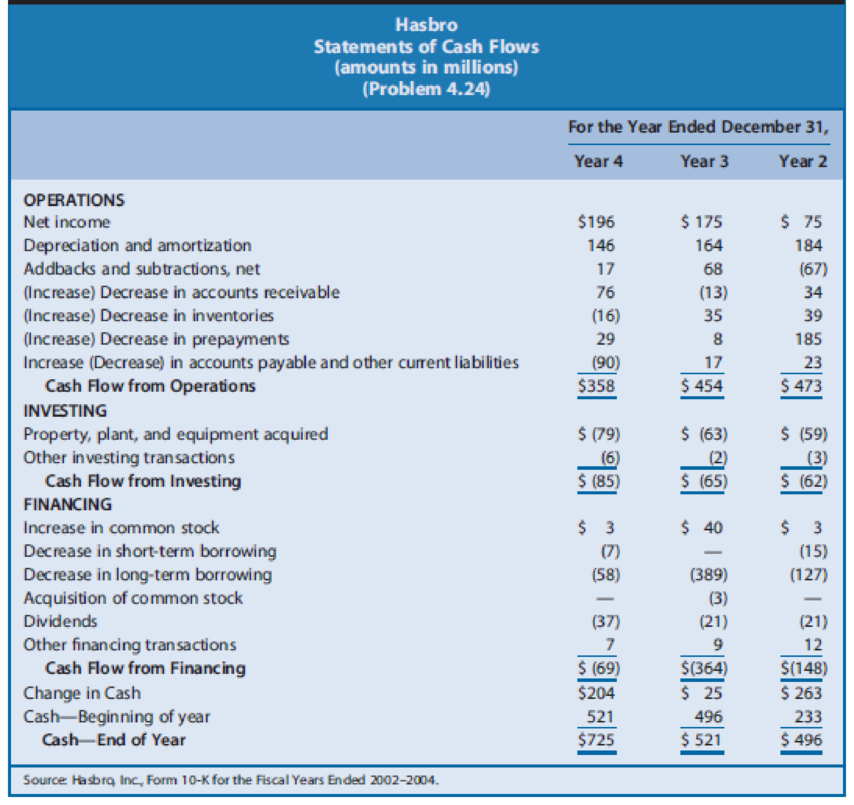

Exhibit 4.32

REQUIRED

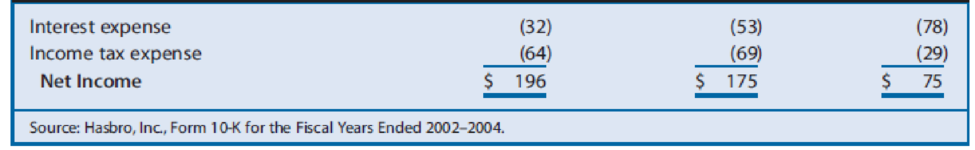

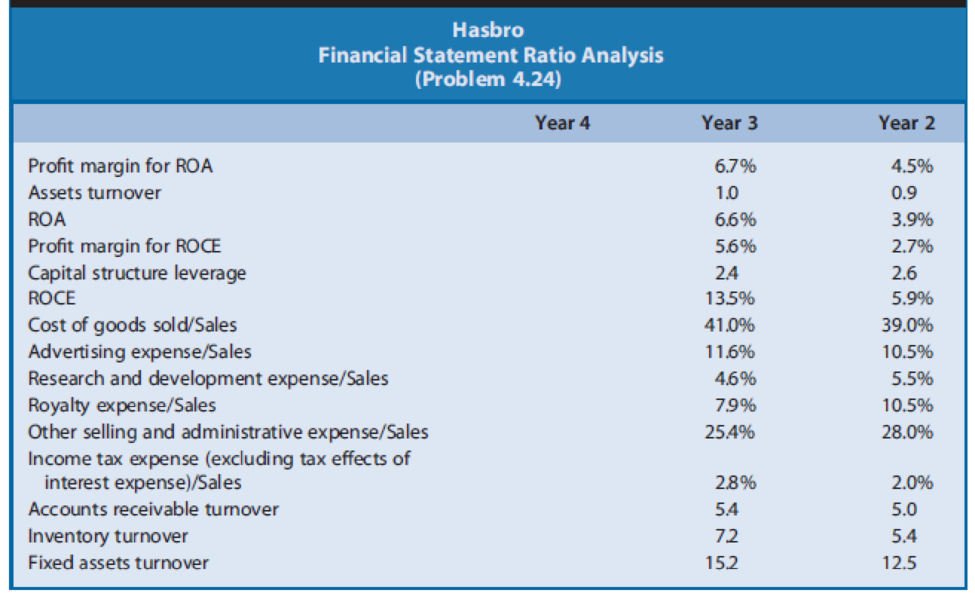

- a. Exhibit 4.33 presents profitability ratios for Hasbro for Year 2 and Year 3. Calculate each of these financial ratios for Year 4. The income tax rate is 35%.

- b. Analyze the changes in

ROA and its components for Hasbro over the three-year period, suggesting reasons for the changes observed. - c. Analyze the changes in ROCE and its components for Hasbro over the three-year period, suggesting reasons for the changes observed.

Exhibit 4.33

Trending nowThis is a popular solution!

Chapter 4 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

- Blakefield, Inc. has grown significantly over the past decade through innovation and acquisition. Information on several of its divisions follows. • The OlliePods division sells children's recreational shoes. The division's president is responsible for all short-run decisions on the manufacturing and sale of the shoes. • The Polyspreen division manufactures the main ingredient for the shoes produced by Olliepods. All Polyspreen output is transferred to the OlliePods division. . All long-run strategic decisions for the Olliepods and Polyspreen divisions are made by the staff at corporate headquarters. Monk Recreation, which operates a regional chain of retail sporting goods stores, is Blakefield's newest corporate acquisition. Blakefield managers have decided to retain all Monk Recreation employees, and all decision-making responsibility related to the sporting goods stores remains with those employees. ● (a) Classify each of the three divisions of Blakefield, Inc. as a cost center, a…arrow_forwardSembotix Company has several divisions including a Semiconductor Division that sells semiconductors to both internal and external customers. The company’s X-ray Division uses semiconductors as a component in its final product and is evaluating whether to purchase them from the Semiconductor Division or from an external supplier. The market price for semiconductors is $100 per 100 semiconductors. Dave Bryant is the controller of the X-ray Division, and Howard Hillman is the controller of the Semiconductor Division. The following conversation took place between Dave and Howard: Dave: I hear you are having problems selling semiconductors out of your division. Maybe I can help. Howard: You’ve got that right. We’re producing and selling at about 90% of our capacity to outsiders. Last year, we were selling 100% of capacity. Would it be possible for your division to pick up some of our excess capacity? After all, we are part of the same company. Dave: What kind of price could you give…arrow_forwardSembotix Company has several divisions including a Semiconductor Division that sells semiconductors to both internal and external customers. The company's X-ray Division uses semiconductors as a component in its final product and is evaluating whether to purchase them from the Semiconductor Division or from an external supplier. The market price for semiconductors is $100 per 100 semiconductors. Dave Bryant is the controller of the X-ray Division, and Howard Hillman is the controller of the Semiconductor Division. The following conversation took place between Dave and Howard: Dave: I hear you are having problems selling semiconductors out of your division. Maybe I can help. Howard: You've got that right. We're producing and selling at about 90% of our capacity to outsiders. Last year we were selling 100% of capacity. Would it be possible for your division to pick up some of the excess capacity? After all, we are part of the same company. Dave: What kind of price can you give me?…arrow_forward

- Stark and Company is a manufacturer that sells robots predominantly in the Asian market. Times have been tough for the auto industry and Stark and Company is no different. The company is under tremendous pressure to turn a profit. Several years ago, as analysts were predicting a large downturn in the robot industry, Stark decided to purchase a smaller niche robot maker in the hopes of capturing a different segment of the consumer market and to better learn the manufacturing processes of other robot makers. Starks still operates as two separate divisions, Classic and New Age, with each division manager employing a different manufacturing philosophy. The Classic manager is concerned with low input costs and quantity in production in addition to brand recognition and robot power. The New Age manager is concerned with quality and innovation in manufacturing, fuel-efficient and environmentally friendly robots. SAC continued to suffer losses even with the addition of the New Age division.…arrow_forwardFillmore Industries is a vertically integrated firm with several divisions that operate as decentralized profit centers. Fillmore's Systems Division manufactures scientific instruments and uses the products of two of Fillmore's other divisions. The Board Division manufactures printed circuit boards (PCBs). One PCB model is made exclusively for the Systems Division using proprietary designs, while less complex models are sold in outside markets. The products of the Transistor Division are sold in a well-developed competitive market; however, one transistor model is also used by the Systems Division. The costs per unit of the products used by the Systems Division are as follows: PCB Transistor Direct materials 1,85 0,40 Direct labor 4,20 0,90 Variable overhead 2,40 0,70 Fixed overhead…arrow_forwardMorning Sky, Inc. (MSI), manufactures and sells computer games. The company has several product lines based on the age range of the target market. MSI sells both individual games as well as packaged sets. All games are in CD format, and some utilize accessories such as steering wheels, electronic tablets, and hand controls. To date, MSI has developed and manufactured all the CDs itself as well as the accessories and packaging for all of its products. The gaming market has traditionally been targeted at teenagers and young adults; however, the increasing affordability of computers and the incorporation of computer activities into junior high and elementary school curriculums has led to a significant increase in sales to younger children. MSI has always included games for younger children but now wants to expand its business to capitalize on changes in the industry. The company currently has excess capacity and is investigating several possible ways to improve profitability. MSI is…arrow_forward

- Morning Sky, Inc. (MSI), manufactures and sells computer games. The company has several product lines based on the age range of the target market. MSI sells both individual games as well as packaged sets. All games are in CD format, and some utilize accessories such as steering wheels, electronic tablets, and hand controls. To date, MSI has developed and manufactured all the CDs itself as well as the accessories and packaging for all of its products.The gaming market has traditionally been targeted at teenagers and young adults; however, the increasing affordability of computers and the incorporation of computer activities into junior high and elementary school curriculums has led to a significant increase in sales to younger children. MSI has always included games for younger children but now wants to expand its business to capitalize on changes in the industry. The company currently has excess capacity and is investigating several possible ways to improve profitability. MSI’s…arrow_forwardMorning Sky, Inc. (MSI), manufactures and sells computer games. The company has several product lines based on the age range of the target market. MSI sells both individual games as well as packaged sets. All games are in CD format, and some utilize accessories such as steering wheels, electronic tablets, and hand controls. To date, MSI has developed and manufactured all the CDs itself as well as the accessories and packaging for all of its products.The gaming market has traditionally been targeted at teenagers and young adults; however, the increasing affordability of computers and the incorporation of computer activities into junior high and elementary school curriculums has led to a significant increase in sales to younger children. MSI has always included games for younger children but now wants to expand its business to capitalize on changes in the industry. The company currently has excess capacity and is investigating several possible ways to improve profitability. MSI…arrow_forwardMorning Sky, Inc. (MSI), manufactures and sells computer games. The company has several product lines based on the age range of the target market. MSI sells both individual games as well as packaged sets. All games are in CD format, and some utilize accessories such as steering wheels, electronic tablets, and hand controls. To date, MSI has developed and manufactured all the CDs itself as well as the accessories and packaging for all of its products.The gaming market has traditionally been targeted at teenagers and young adults; however, the increasing affordability of computers and the incorporation of computer activities into junior high and elementary school curriculums has led to a significant increase in sales to younger children. MSI has always included games for younger children but now wants to expand its business to capitalize on changes in the industry. The company currently has excess capacity and is investigating several possible ways to improve profitability. MSI is…arrow_forward

- Morning Sky, Inc. (MSI), manufactures and sells computer games. The company has several product lines based on the age range of the target market. MSI sells both individual games as well as packaged sets. All games are in CD format, and some utilize accessories such as steering wheels, electronic tablets, and hand controls. To date, MSI has developed and manufactured all the CDs itself as well as the accessories and packaging for all of its products.The gaming market has traditionally been targeted at teenagers and young adults; however, the increasing affordability of computers and the incorporation of computer activities into junior high and elementary school curriculums has led to a significant increase in sales to younger children. MSI has always included games for younger children but now wants to expand its business to capitalize on changes in the industry. The company currently has excess capacity and is investigating several possible ways to improve profitability. MSI is…arrow_forwardMorning Sky, Incorporated (MSI), manufactures and sells computer games. The company has several product lines based on the age range of the target market. MSI sells both individual games as well as packaged sets. All games are in CD format, and some utilize accessories such as steering wheels, electronic tablets, and hand controls. To date, MSI has developed and manufactured all the CDs itself as well as the accessories and packaging for all of its products. The gaming market has traditionally been targeted at teenagers and young adults; however, the increasing affordability of computers and the incorporation of computer activities into junior high and elementary school curriculums has led to a significant increase in sales to younger children. MSI has always included games for younger children but now wants to expand its business to capitalize on changes in the industry. The company currently has excess capacity and is investigating several possible ways to improve profitability. E7-9…arrow_forwardMorning Sky, Incorporated (MSI), manufactures and sells computer games. The company has several product lines based on the age range of the target market. MSI sells both individual games as well as packaged sets. All games are in CD format, and some utilize accessories such as steering wheels, electronic tablets, and hand controls. To date, MSI has developed and manufactured all the CDs itself as well as the accessories and packaging for all of its products. The gaming market has traditionally been targeted at teenagers and young adults; however, the increasing affordability of computers and the incorporation of computer activities into junior high and elementary school curriculums has led to a significant increase in sales to younger children. MSI has always included games for younger children but now wants to expand its business to capitalize on changes in the industry. The company currently has excess capacity and is investigating several possible ways to improve profitability.…arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning