Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ces

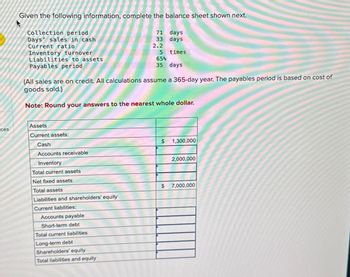

Given the following information, complete the balance sheet shown next.

Collection period

Days' sales in cash

Current ratio

Inventory turnover

Liabilities to assets

Payables period

Assets

Current assets:

Cash

Accounts receivable

Inventory

Total current assets

Net fixed assets

Total assets

(All sales are on credit. All calculations assume a 365-day year. The payables period is based on cost of

goods sold.)

Note: Round your answers to the nearest whole dollar.

Liabilities and shareholders' equity

Current liabilities:

71 days

33

days

2.2

times

Accounts payable

Short-term debt

Total current liabilities

Long-term debt

Shareholders' equity

Total liabilities and equity

5

65%

35 days

$

$

1,300,000

2,000,000

7,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- A company reports the following: Sales $890,600 Average accounts receivable (net) 44,530 Determine (a) the accounts receivable turnover and (b) the number of days' sales in receivables. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume a 365-day year. a. Accounts receivable turnover 20 b. Number of days' sales in receivables 18 X daysarrow_forwardA company reports the following: Sales $838,040 Average accounts receivable (net) 51,100 Round your answers to one decimal place. Assume a 365-day year. a. Determine the accounts receivable turnover. b. Determine the number of days' sales in receivables.arrow_forwardA company reports the following: Line Item Description Amount Sales $235,060 Average accounts receivable (net) 51,100 Determine (a) the accounts receivable turnover and (b) the days’ sales in receivables. When required, round your answers to one decimal place. Assume a 365-day year. Line Item Description Answer a. Accounts receivable turnover b. Days' Sales in Receivablesarrow_forward

- What is the Sharpe ratio (S) of your risky portfolio and your client’s overall portfolio? , assume that you manage a risky portfolio with an expected rate of return of 17% and a standard deviation of 27%. The T-bill rate is 7%.arrow_forwardA company reports the following: Sales $1,460,000 Average accounts receivable (net) 100,000 Determine (a) the accounts receivable turnover and (b) the number of days' sales in receivables. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume a 365-day year. a. Accounts receivable turnover fill in the blank 1 b. Number of days' sales in receivables fill in the blank 2 daysarrow_forwardcalculate these (d) Current ratio :1 (e) Accounts receivable turnover times (f) Average collection period daysarrow_forward

- A company reports the following: Sales $956,300 Average accounts receivable (net) 73,000 Round your answers to one decimal place. Assume a 365-day year. a. Determine the accounts receivable turnover.fill in the blank 1 b. Determine the number of days' sales in receivables.fill in the blank 2arrow_forwardAccounts Receivable Analysis A company reports the following: Sales $429,240 Average accounts receivable (net) 30,660 Determine (a) the accounts receivable turnover and (b) the number of days' sales in receivables. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume a 365-day year. a. Accounts receivable turnover fill in the blank 1 b. Number of days' sales in receivables fill in the blank 2 daysarrow_forwardSuppose the 2022 financial statements of 3M Company report net sales of $23.1 billion. Accounts receivable (net) are $3.2 billion at the beginning of the year and $3.25 billion at the end of the year. Compute 3M’s accounts receivable turnover. - Accounts Recievable turnover ratio=? (times) Compute 3M’s average collection period for accounts receivable in days - Average collection period =? (days)arrow_forward

- The following data are taken from the financial statements of Sigmon Inc. Terms of all sales are 2/10, n/45. 20Y3 20Y2 20Y1 Accounts receivable, end of year $120,200 $128,000 $134,800 Sales on account 719,780 670,140 a. For 20Y2 and 20Y3, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Round answers to one decimal place. Assume a 365-day year.arrow_forwardThe financial statements of the Sunland Company report net sales of $384000 and accounts receivable of $50400 and $33600 at the beginning of the year and the end of the year, respectively. What is the average collection period for accounts receivable in days?arrow_forwardcompute number of days sales in receivables round your calculation and answer assume 365 days ina yeararrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education