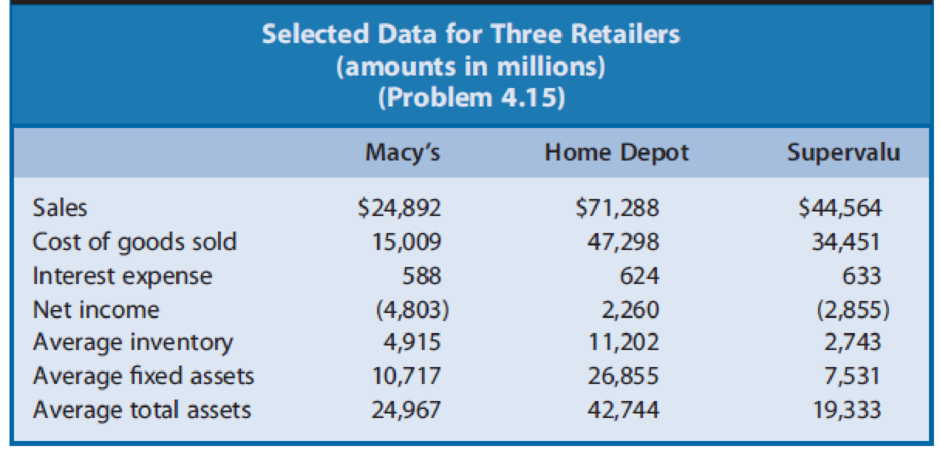

Exhibit 4.22 presents selected operating data for three retailers for a recent year. Macy’s operates several department store chains selling consumer products such as brand-name clothing, china, cosmetics, and bedding and has a large presence in the bridal and formalwear markets (under store names Macy’s and Bloomingdale’s). Home Depot sells a wide range of building materials and home improvement products, which includes lumber and tools, riding lawn mowers, lighting fixtures, and kitchen cabinets and appliances. Supervalu operates grocery stores under numerous brands (including Albertsons, Cub Foods, Jewel-Osco, Shaw’s, and Star Market).

Exhibit 4.22

REQUIRED

- a. Compute the rate of

ROA for each firm. Disaggregate the rate of ROA into profit margin for ROA and assets turnover components. Assume that the income tax rate is 35% for all companies. - b. Based on your knowledge of the three retail stores and their respective industry concentrations, describe the likely reasons for the differences in the profit margins for ROA and assets turnovers.

Trending nowThis is a popular solution!

Chapter 4 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

- Read the case below and answer the questions following it. DURAPLAST Company Ltd., opened its doors in 1979 as a wholesale supplier of plumbing equipment, tools, and parts to hardware stores, home-improvement centers, and professional plumbers in the Accra-Tema Metropolitan area. Over the years they have expanded theiroperations to serve customers across the nation and now employ over 200 people as technical representatives, buyers, warehouse workers, and sales and office staff. Most recently DURAPLAST has experienced fierce competition from the large online discount stores such as Qualiplast and Interplast. In addition, the company is suffering from operational inefficiencies related to its archaic information system. DURAPLAST’s revenue cycle procedures are described in the following paragraphs. Revenue Cycle DURAPLAST’s sales department consists of 17 full-time and part-time employees. They receive orders via traditional mail, e-mail, telephone, and the occasional walk-in.…arrow_forwardRead the case below and answer the questions following it. DURAPLAST Company Ltd., opened its doors in 1979 as awholesale supplier of plumbing equipment, tools, and parts to hardware stores, home-improvement centers, and professional plumbers in the Accra-Tema Metropolitan area. Over the years they have expanded their operations to serve customers across the nation and now employ over 200 people as technical representatives, buyers, warehouse workers, and sales and office staff. Most recently DURAPLAST has experienced fierce competition from the large online discount stores such as Qualiplast and Interplast. In addition, the company is suffering from operational inefficiencies related to its archaic information system. DURAPLAST’s revenue cycle procedures are described in the following paragraphs. Revenue Cycle DURAPLAST’s sales department consists of 17 full-time andpart-time employees. They receive orders via traditional mail, e-mail, telephone, and the occasional walk-in.…arrow_forwardRead the case below and answer the questions following it. DURAPLAST Company Ltd., opened its doors in 1979 as awholesale supplier of plumbing equipment, tools, and parts to hardware stores, home-improvement centers, and professional plumbers in the Accra-Tema Metropolitan area. Over the years they have expanded their operations to serve customers across the nation and now employ over 200 people as technical representatives, buyers, warehouse workers, and sales and office staff. Most recently DURAPLAST has experienced fierce competition from the large online discount stores such as Qualiplast and Interplast. In addition, the company is suffering from operational inefficiencies related to its archaic information system. DURAPLAST’s revenue cycle procedures are described in the following paragraphs. Revenue Cycle DURAPLAST’s sales department consists of 17 full-time andpart-time employees. They receive orders via traditional mail, e-mail, telephone, and the occasional walk-in.…arrow_forward

- Show-Off, Inc., sells merchandise through three retail outlets-in Las Vegas, Reno, and Sacramento-and operates a general corporate headquarters in Reno. A review of the company's income statement indicates a record year in terms of sales and profits. Management, though, desires additional insights about the individual stores and has asked that Judson Wyatt, a newiy hired intern, prepare a segmented income statement. The following information has been extracted from Show-Off's accounting records: • The sales volume, sales price, and purchase price data follow: Reno Sacramento Las Vegas 37,100 units $ 19.00 8.75 Sales volume Unit selling price Unit purchase price 41, 100 units $ 17.50 8.75 46, 040 units $ 15.25 9.75 •The following expenses were incurred for sales commissions, local advertising, property taxes, management salaries, and other noncontrollable (but traceable) costs: Reno Las Vegas 5% Sacramento 5% Sales commissions 5% Local advertising Local property taxes Sales manager…arrow_forwardDURAPLAST Company Ltd., opened its doors in 1979 as a wholesale supplier of plumbing equipment, tools, and parts to hardware stores, home-improvement centers, and professional plumbers in the Accra-Tema Metropolitan area. Over the years they have expanded their operations to serve customers across the nation and now employ over 200 people as technical representatives, buyers, warehouse workers, and sales and office staff. Most recently DURAPLAST has experienced fierce competition from the large online discount stores such as Qualiplast and Interplast. In addition, the company is suffering from operational inefficiencies related to its archaic information system. DURAPLAST’s revenue cycle procedures are described in the following paragraphs. Revenue Cycle DURAPLAST’s sales department consists of 17 full-time and part-time employees. They receive orders via traditional mail, e-mail, telephone, and the occasional walk-in. Because DURAPLAST is a wholesaler, the vast majority of its…arrow_forwardDURAPLAST Company Ltd., opened its doors in 1979 as a wholesale supplier of plumbing equipment, tools, and parts to hardware stores, home-improvement centers, and professional plumbers in the Accra-Tema Metropolitan area. Over the years they have expanded their operations to serve customers across the nation and now employ over 200 people as technical representatives, buyers, warehouse workers, and sales and office staff. Most recently DURAPLAST has experienced fierce competition from the large online discount stores such as Qualiplast and Interplast. In addition, the company is suffering from operational inefficiencies related to its archaic information system. DURAPLAST’s revenue cycle procedures are described in the following paragraphs. Revenue Cycle DURAPLAST’s sales department consists of 17 full-time and part-time employees. They receive orders via traditional mail, e-mail, telephone, and the occasional walk-in. Because DURAPLAST is a wholesaler, the vast majority of its…arrow_forward

- DURAPLAST Company Ltd., opened its doors in 1979 as a wholesale supplier of plumbing equipment, tools, and parts to hardware stores, home-improvement centers, and professional plumbers in the Accra-Tema Metropolitan area. Over the years they have expanded their operations to serve customers across the nation and now employ over 200 people as technical representatives, buyers, warehouse workers, and sales and office staff. Most recently DURAPLAST has experienced fierce competition from the large online discount stores such as Qualiplast and Interplast. In addition, the company is suffering from operational inefficiencies related to its archaic information system. DURAPLAST’s revenue cycle procedures are described in the following paragraphs. Revenue Cycle DURAPLAST’s sales department consists of 17 full-time and part-time employees. They receive orders via traditional mail, e-mail, telephone, and the occasional walk-in. Because DURAPLAST is a wholesaler, the vast majority of its…arrow_forwardDURAPLAST Company Ltd., opened its doors in 1979 as a wholesale supplier of plumbing equipment, tools, and parts to hardware stores, home-improvement centers, and professional plumbers in the Accra-Tema Metropolitan area. Over the years they have expanded their operations to serve customers across the nation and now employ over 200 people as technical representatives, buyers, warehouse workers, and sales and office staff. Most recently DURAPLAST has experienced fierce competition from the large online discount stores such as Qualiplast and Interplast. In addition, the company is suffering from operational inefficiencies related to its archaic information system. DURAPLAST’s revenue cycle procedures are described in the following paragraphs. Revenue Cycle DURAPLAST’s sales department consists of 17 full-time and part-time employees. They receive orders via traditional mail, e-mail, telephone, and the occasional walk-in. Because DURAPLAST is a wholesaler, the vast majority of its…arrow_forwardBURTS BEES, Durham, North Carolina Burts Bees describes itself as an Earth-Friendly, Natural Personal Care Company that produces products for health, beauty, and personal hygiene. The company manufactures over 150 products distributed in nearly 30,000 retail outlets worldwide. As a merchandising company, Burts Bees follows its inventory closely. This requires monitoring the receipt, production, purchasing, and planning of inventory. At the end of each time period, Burts Bees must make adjusting entries to prepare its financial statements accurately. Many of the adjustments are entries you have already learned, such as depreciation, expiration of prepaid expenses, adjustment of supplies used, and recording of accrued expenses. However, merchandising companies also require adjusting entries related to merchandise inventory. Companies such as Burts Bees monitor inventory, prepare a worksheet, and record adjusting entries using either the perpetual or periodic inventory system. Using your book and/or conducting a brief Internet search to find the differences between perpetual and periodic inventory systems, answer the following questions: 1. What type of inventory system do you think Burts Bees uses? Why? 2. Using the inventory system you selected in no. 1, what is an example of the type of journal entry Burts Bees would make when purchasing merchandise on account? 3. Using the inventory system you selected in no. 1, what journal entry would Burts Bees use to record the sale of merchandise on account?arrow_forward

- ABC, wholesale, customer protability. Veritek Wholesalers operates at capacity and sells furniture items to four department-store chains (customers). Mr. Veritek commented, “We apply ABC to determine product-line protability. The same ideas apply to customer protability, and we should nd out our customer protability as well.” Veritek Wholesalers sends catalogs to corporate purchasing departments on a monthly basis. The customers are entitled to return unsold merchandise within a six-month period from the purchase date and receive a full purchase price refund. The following data were collected from last year’s operations:arrow_forwardJodi's Chop Shop is a retail chain specializing in salon-quality hair-care products. During the year, Jodi's Chop Shop had sales of $39,235,000. The company began the year with $3,500,000 of merchandise inventory and ended the year with $4,445,000 of inventory. During the year, Jodi's Chop Shop purchased $24,215,000 of merchandise inventory. The company's selling, general, and administrative expenses totaled $7,185,000 for the year. Prepare Jodi's Chop Shop's income statement for the year. Begin by calculating Jodi's Chop Shop's cost of goods sold using the table below. Jodi's Chop Shop Calculation of Cost of Goods Sold For the Year Ended Beginning inventory Purchases Plus: Cost of goods available for sale Less: Ending inventory Cost of goods soldarrow_forward- Required information [The following information applies to the questions displayed below.] Ellery Products manufactures various components for the fashion industry. Ellery buys fabric from two vendors: Ewers Textiles and Bramford Materials. Ellery chooses the vendor based on price. Once the fabric is received, it is inspected to ensure that it is suitable for manufacturing purposes. Ellery disposes of fabric that is deemed unsuitable. The controller at Ellery collected the following information on purchases for the past quarter. 2 Total purchases (yards). Fabric discarded (yards) Bid Assume that the average quality, measured by the amounts discarded from the two companies, will continue as in the past. The purchasing manager has just received bids on an order for 800 yards of fabric from both Ewers and Bramford. Ewers bid $2,280 and Bramford bid $2,156. Required: a. What bid by Ewers would make Ellery indifferent between buying from Ewer or Bramford? Note: Round your answer to 2…arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,