FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

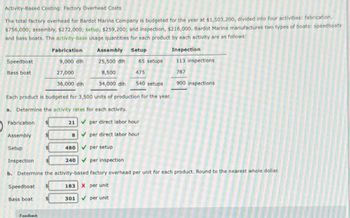

Transcribed Image Text:Activity-Based Costing: Factory Overhead Costs

The total factory overhead for Bardot Marine Company is budgeted for the year at $1,503,200, divided into four activities: fabrication,

$756,000; assembly, $272,000; setup, $259,200; and inspection, $216,000. Bardot Marine manufactures two types of boats: speedboats

and bass boats. The activity-base usage quantities for each product by each activity are as follows:

Inspection

Speedboat

Bass boat

Fabrication

Assembly

Setup

Speedboat

Each product is budgeted for 3,500 units of production for the year.

a. Determine the activity rates for each activity.

Bass boat

Fabrication

9,000 dih

$

Feedback

27,000

36,000 dih

21

B

Assembly

25,500 dih

8,500

34,000 dih

480

Setup

per setup

65 setups

475

540 setups

✓per direct labor hour

✓ per direct labor hour

Inspection $

240✔ per inspection

b. Determine the activity-based factory overhead per unit for each product. Round to the nearest whole dollar.

183 X per unit

301 ✔ per unit

113 inspections

787

900 inspections

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Activity-Based Costing: Factory Overhead Costs The total factory overhead for Bardot Marine Company is budgeted for the year at $1,556,000, divided into four activities: fabrication, $760,000; assembly, $296,000; setup, $270,000; and inspection, $230,000. Bardot Marine manufactures two types of boats: speedboats and bass boats. The activity-base usage quantities for each product by each activity are as follows: Fabrication Assembly Setup Inspection Speedboat 10,000 dlh 27,750 dlh 72 setups 125 inspections Bass boat 30,000 9,250 528 875 40,000 dlh 37,000 dlh 600 setups 1000 inspections Each product is budgeted for 3,000 units of production for the year. a. Determine the activity rates for each activity. Fabrication $fill in the blank 1 per direct labor hour Assembly $fill in the blank 2 per direct labor hour Setup $fill in the blank 3 per setup Inspection $fill in the blank 4 per inspection b. Determine the activity-based factory overhead per unit…arrow_forwardIdris Inc. manufactures entry and dining room lighting fixtures. Five activities are used in manufacturing the fixtures. These activities and their associated budgeted activity costs and activity bases are as follows: Activity Casting Assembly Inspecting Setup Materials handling Budgeted Activity Cost Activity Base $218,960 Machine hours 151,900 Direct labor hours 21,340 Number of inspections 50,760 Number of setups 40,740 Number of loads Corporate records were obtained to estimate the amount of activity to be used by the two products. The estimated activity-base usage quantities and units produced follow: Activity Base Entry Dining Total Machine hours 5,050 4,470 9,520 Direct labor hours 4,340 6,510 10,850 Number of inspections 1,470 470 1,940 Number of setups 290 70 360 Number of loads 770 200 970 Units produced 10,000 5,000 15,000 a. Determine the activity rate for each activity. If required, round the rate to the nearest dollar. Activity Casting Assembly Inspecting Setup Activity…arrow_forwardActivity-Based Costing: Factory Overhead Costs NOORGOGUO The total factory overhead for Bardot Marine Company is budgeted for the year at $1,205,100, divided into four activities: fabrication, $528,000; assembly, $192,000; setup, $262,350; and inspection, $222,750. Bardot Marine manufactures two types of boats: speedboats and bass boats. The activity-base usage quantities for each product by each activity are as follows: Fabrication 8,250 dih 24,750 33,000 dih Assembly 24,000 dih 8,000 32,000 din 495 setups Each product is budgeted for 6,000 units of production for the year. a. Determine the activity rates for each activity. Fabrication per direct labor hour Assembly per direct labor hour Setup per setup. Inspection per inspection b. Determine the activity-based factory overhead per unit for each product. Round to the nearest whole dollar. Speedboat Bass boat Speedboat Bass boat per unit per unit Setup 59 setups 436 Inspection 103 inspections 722 825 inspectionsarrow_forward

- Delph Company uses job-order costing with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 54,000 machine-hours would be required for the period's estimated level of production. It also estimated $1,040,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $5.00 per machine-hour. Because Delph has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates: Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Job D-70 Direct materials cost Direct labor cost Machine-hours Job C-200 Direct materials cost Direct labor cost Machine-hours During the year, the company had no beginning or ending inventories and it…arrow_forwardFeldpausch Corporation has provided the following data from its activity-based costing system: Activity Cost Pool Total Cost Total Activity Assembly $ 1,398,250 65,800 machine-hours Processing orders $ 69,451 2,520 orders Inspection $ 184,800 2,400 inspection-hours The company makes 920 units of product W26B a year, requiring a total of 1,290 machine-hours, 61 orders, and 40 inspection-hours per year. The product's direct materials cost is $57.55 per unit and its direct labor cost is $13.56 per unit. The product sells for $123.50 per unit. According to the activity-based costing system, the product margin for product W26B is: (Round your intermediate calculations and final answers to 2 decimal places.)arrow_forwardCarlton, Inc. manufactures model airplane kits and projects production at 550, 420, 150, and 800 kits for the next four quarters. (Click the icon to view the manufacturing information.) Prepare Carlton's direct materials budget, direct labor budget, and manufacturing overhead budget for the year. Round the direct labor hours needed for production, budgeted overhead costs, and predetermined overhead allocation rate to two decimal places. Round other amounts to the nearest whole number. Begin by preparing Carlton's direct materials budget. Direct materials (ounces) per kit Direct materials needed for production. Plus: Total direct materials needed Less: Budgeted purchases of direct materials Direct materials cost per ounce Budgeted cost direct materials purchases Carlton, Inc. Direct Materials Budget For the Year Ended December 31 First Second Quarter Quarter Third Quarter Fourth Quarter Total More info Direct materials are five ounces of plastic per kit and the plastic costs $3 per…arrow_forward

- Kaumajet Factory produces two products: table lamps and desk lamps. It has two separate departments: Fabrication and Assembly. The factory overhead budget for the Fabrication Department is $644,490, using 325,500 direct labor hours. The factory overhead budget for the Assembly Department is $596,624, using 76,100 direct labor hours. If a table lamp requires 4 hours of fabrication and 7 hour of assembly, the total amount of factory overhead that Kaumajet Factory will allocate to table lamps using the multiple production department factory overhead rate method with an allocation base of direct labor hours if 9,200 units are produced is a.$72,128 b.$312,751 c.$150,035 d.$577,760arrow_forwardSolomons, Inc. has refined its allocation system by separating manufacturing overhead into two cost pools, one for each department. The estimated cost for the mixing department, $615,000, will be allocated based on direct labor hours, and the estimated direct labor hours for the year are 201,000. The estimated cost for the packaging department, $293,000, will be allocated based on direct labor hours, and the estimated machine hours for the year are 59,200. In October, the company incurred 17,240 direct labor hours in the mixing department and a total of 14,260 machine hours in the packaging department.(Round your answers to two decimal places when needed and use rounded answers for all future calculations).1. Compute the predetermined overhead allocation rates. Department Total estimated overhead cost ? Total estimated quantity of the overhead allocation base = Predetermined Overhead Allocation Rate (Per Machine Hour) Mixing Department = Packaging Department =…arrow_forwardHaresharrow_forward

- The Kaumajet Factory produces two products - table lamps and desk lamps. It has two separate departments - Finishing and Production. The overhead budget for the Finishing Department is $550,000, using 500,000 direct labor hours. The overhead budget for the Production Department is $400,000 using 80,000 direct labor hours.If the budget estimates that a desk lamp will require 1 hours of finishing and 2 hours of production, what is the total amount of factory overhead the Kaumajet Factory will allocate to desk lamps using the multiple production department factory overhead rate method with an allocation base of direct labor hours, if 26,000 units are produced? a.$288,600 b.$475,000 c.$540,000 d.$187,200arrow_forwardDashboard Inc. manufactures and assembles automobile instrument panels for both eCar Motors and Greenville Motors. The process consists of a lean product cell for each customer’s instrument assembly. The data that follow concern only the eCar lean cell. For the year, Dashboard Inc. budgeted the following costs for the eCar production cell: Conversion Cost Categories Budget Labor $800,000 Supplies 275,000 Utilities 325,000 Total 1,400,000 Dashboard Inc. plans 2,000 hours of production for the eCar cell for the year. The materials cost is $240 per instrument assembly. Each assembly requires 24 minutes of cell assembly time. There was no April 1 inventory for either Raw and In Process Inventory or Finished Goods Inventory. The following summary events took place in the eCar cell during April: Electronic parts and wiring were purchased to produce 450 instrument assemblies in April. Conversion costs were applied for the production of 400 units in…arrow_forwardChenango Industries uses 12 units of part JR63 each month in the production of radar equipment. The cost of manufacturing one unit of JR63 is the following: 5 4,000 Direct naterial Material handling (20x of direct-naterial cost) Direct labor Manufarturing overhead (150% of direct labor) 39,000 S8,500 Total manufacturing cost $102, 300 Material handling represents the direct variable costs of the Recelving Department that are applied to direct materials and purchased components on the basis of their cost. This is a separate charge in addition to manufacturing overhead. Chenango Industries' annual manufacturing overhead budget is one-third variable and two thirds fixed. Scott Supply, one of Chenango Industries' reliable vendors. has offered to supply part number JR63 at a unit price of $64,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education