FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

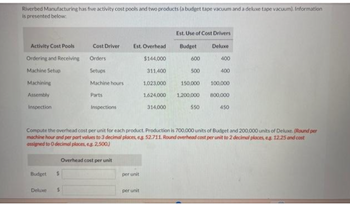

Transcribed Image Text:Riverbed Manufacturing has five activity cost pools and two products (a budget tape vacuum and a deluxe tape vacuum). Information

is presented below:

Activity Cost Pools

Ordering and Receiving

Machine Setup

Machining

Assembly

Inspection

Budget $

Cost Driver

Orders

Setups

Machine hours

Deluxe $

Parts

Inspections

Overhead cost per unit

Est. Overhead

$144,000

311,400

1,023,000

1,624,000

314,000

per unit

Est. Use of Cost Drivers

Budget

per unit

600

500

150,000

1.200,000

550

Deluxe

400

Compute the overhead cost per unit for each product. Production is 700.000 units of Budget and 200.000 units of Deluxe. (Round per

machine hour and per part values to 3 decimal places, eg 52.711. Round overhead cost per unit to 2 decimal places, e.g. 12.25 and cost

assigned to 0 decimal places, eg. 2,500.)

400

100,000

800,000

450

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardProduct Costing and Decision Analysis for a Service Company Pleasant Stay Medical Inc. wishes to determine its product costs. Pleasant Stay offers a variety of medical procedures (operations) that are considered its “products.” The overhead has been separated into three major activities. The annual estimated activity costs and activity bases follow: Activity Budgeted Activity Cost Activity Base Scheduling and admitting $432,000 Number of patients Housekeeping 4,212,000 Number of patient days Nursing 5,376,000 Weighted care unit Total costs $10,020,000 Total “patient days” are determined by multiplying the number of patients by the average length of stay in the hospital. A weighted care unit (wcu) is a measure of nursing effort used to care for patients. There were 192,000 weighted care units estimated for the year. In addition, Pleasant Stay estimated 6,000 patients and 27,000 patient days for the year. (The…arrow_forwardTeach Gear Inc. produces 3 types of office equipment; Bronze, silver and Gold and uses an activity-based product costing system. They have identified 5 activities. Each activity, it costs and related activity driver is summarized below: Activity Material handling Material insertion Activity Units to be produced Orders to be shipped Number of parts per unit Machine hours per unit Labor hours per unit Cost Tasks: Automated Machinery finishing Packaging The following data are provided for each product line: Activity driver Number of parts Number of parts 350,000 Machine hours 150,000 Labor hours 90,000 Orders shipped Bronze P120,000 240,000 6,000 1,200 4. 1 2 Silver 4,000 800 5 2 3 Gold 2,000 400 8 3 لنا Make a narrative recommend the unit cost per unit of Bronze, Silver and Gold using the ABC system. In support of your recommendation show your solution presenting: 1. The computation of the activity cost rates 2. the computation of the estimated volume (TOTAL PARTS, TOTAL MACHINE HOURS,…arrow_forward

- Support department cost allocation-direct method Becker Tabletops has two support departments (Janitorial and Cafeteria) and two production departments (Cutting and Assembly). Relevant detail Support Department Cost Driver Square footage to be serviced Janitorial Department Cafeteria Department Number of employees Janitorial Department $310,000 Cafeteria Department $169,000 5,000 3 Janitorial Department cost allocation. Cafeteria Department cost allocation Cutting Department $1,504,000 Department costs Square feet 50 1,000 Number of employees 10 30 Allocate the support department costs to the production departments using the direct method. Cutting Department Assembly Department $580,000 4,000 10 Assembly Departmentarrow_forwardDhepaarrow_forwardO&G Company manufactures console tables and uses an activity-based costing system to allocate all manufacturing conversion costs. Each console table consists of 40 separate parts totaling $250 in direct materials and requires 5.0 hours of machine time to produce. Additional information follows: Activity Materials handling Allocation Base Number of parts Machine hours Number of parts Number of finished units Machining Assembling Packaging What is the number of finished console tables? OA 200 OB. 467 OC. 25 OD. Cannot be determined from the information given Cost Allocation Rate $3.00 per part $4.80 per machine hour $1.00 per part $4.00 per finished unitarrow_forward

- Mack Precision Tool and Die has two production departments, Fabricating and Finishing, and two service departments, Repair and Quality Control. Direct costs for each department and the proportion of service costs used by the various departments for the month of March follow: Department Fabricating Finishing Repair Quality Control Proportion of Services Us by Quality Direct Costs Repair $ 130,600 90, 200 38,400 71, 600 0 0.8 Control Fabricating Finishing 0.2 0 Required: Use the step method to allocate the service costs, using the following: 0.5 0.1 a. The order of allocation starts with Repair. b. The allocations are made in the reverse order (starting with Quality Control). 0.3 0.1arrow_forwardplease answer do not image.arrow_forwardPlease help me. Thankyou.arrow_forward

- Support department cost allocation-direct method Becker Tabletops has two support departments (Janitorial and Cafeteria) and two production departments (Cutting and Assembly). Relevant details for these departments are as follows: Support Department Janitorial Department Cafeteria Department Cost Driver Square footage to be serviced Number of employees Janitorial Department $300,000 Janitorial Department cost allocation Cafeteria Department cost allocation Cafeteria Department $170,000 4,700 2 44 8 Department costs Square feet Number of employees Allocate the support department costs to the production departments using the direct method. Cutting Department LA Cutting Department $1,500,000 2,400 21 $ Assembly Department SA Assembly Department $680,000 3,600 9 S < 11:15 PM 2/25/2024arrow_forwardCarla Vista Industries has three activity cost pools and two products. It expects to produce 2,700 units of Product SZ09 and 1,400 of Product NZ16. Having identified its activity cost pools and the cost drivers for each pool, Carla Vista accumulated the following data relative to those activity cost pools and cost drivers. question: Assign the overhead cost to the two products: SZ09$? and NZ16$?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education