FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

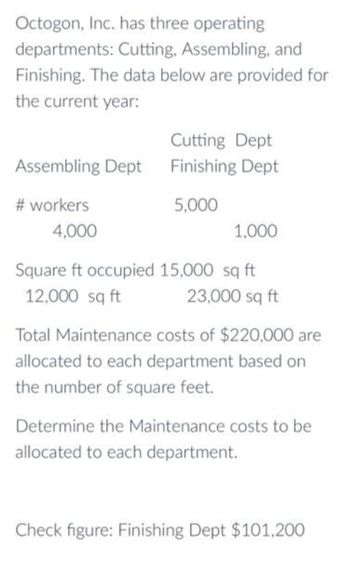

Transcribed Image Text:Octogon, Inc. has three operating

departments: Cutting, Assembling, and

Finishing. The data below are provided for

the current year:

Assembling Dept

# workers

4,000

Cutting Dept

Finishing Dept

5,000

1,000

Square ft occupied 15,000 sq ft

12,000 sq ft

23,000 sq ft

Total Maintenance costs of $220,000 are

allocated to each department based on

the number of square feet.

Determine the Maintenance costs to be

allocated to each department.

Check figure: Finishing Dept $101,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sierra Company has two operating departments: Mixing and Bottling. Mixing occupies 26,940 square feet. Bottling occupies 17,960 square feet. Maintenance costs of $210,000 are allocated to operating departments based on square feet occupied. Determine the maintenance costs allocated to each operating department. Department Square Feet Mixing Bottling Total 0 Percent of Total % % 88 0.00 % Allocated Amount $ 0arrow_forwardEquivalent Units of Production Data for the two departments of Kimble & Pierce Company for June of the current fiscal year are as follows: Drawing Department Winding Department Work in process, June 1 5,800 units, 50% completed 3,800 units, 65% completed Completed and transferred to next processing department during June 79,500 units 78,100 units Work in process, June 30 4,400 units, 75% completed 5,200 units, 20% completed Production begins in the Drawing Department and finishes in the Winding Department. a. If all direct materials are placed in process at the beginning of production, determine the direct materials and conversion equivalent units of production for June for the Drawing Department. If an amount is zero, enter in "0". Drawing Department Direct Materials and Conversion Equivalent Units of Production For June Whole Units Direct MaterialsEquivalent Units ConversionEquivalent Units Inventory in process, June 1 fill in the blank…arrow_forwardHalligan Company manufactures a product in four departments. Data for the first department follow: Production: Units in process, July 1, 75% complete Units completed and transferred out Units in process, July 31, 25% complete Costs: Work in process, July 1 Costs added during the month Halligan uses FIFO costing. Required: 60,000 150,000 30,000 $193,500 $500,625 1. Prepare a physical flow analysis for the first department for July. 2. Calculate equivalent units of production for the first department for July. 3. Calculate unit cost for materials, conversion, and in total for the first department for July. 4. Calculate the cost of units transferred out and the cost of ending work in process. 5. Prepare a cost reconciliation for the first department for July.arrow_forward

- Betty DeRose, Inc. operates two departments, the handling department and the packaging department. During April, the handling department reported the following information: work in process, April 1 units started during April work in process, April 30 units 27,000 59,000 34,000 work in process, April 1 costs added during April total costs % complete DM 60% DM $ 25,310 $190,720 $216,030 70% The cost of beginning work in process and the costs added during April were as follows: % complete conversion 85% Conversion $191,175 $208,985 $400,160 40% Total cost $216,485 $399,705 $616,190 Calculate the total cost of the handling department's work in process inventory at April 30 using the weighted average process costing method.arrow_forwardThe following table presents the activities and activity drivers that LampPlus uses in manufacturing Product 1 and Product 2. Complete the table: Activity Design Preparation Machining Finishing Inspection Packaging Shipping Cost Activity Driver $ 39,060 Design time $ 67,650 Labor hours 105,200 Machine hours $ Batches Units Orders $ 12,720 Packages Driver Usage Prod. 1 840 3,130 209 76 Prod. 2 1,330 hours hours 300 56 Activity Rate $ $ $ $ /hour /hour 20 /hour 50 /batch 17 /unit 302 /order /package Activity Cost:Prod. 1 $ $ $ $ 34,430 31,200 Activity Cost:Prod. 2 9,690 $ 12,986 $ 19,720 3,600arrow_forwardThe work-in-process account for Department #2 for the month of December of the current year is presented below: Work in Process - Department #2 Beginning (1,200 units, 1⁄4 completed) - P1,200 Transferred out (6,200 units) ??? Transferred in from Department #1 (6,000 units) - 3,600 Direct labor - 8,000 Factory overhead - 4,800 Ending (1,000 units, 1⁄2 completed) - ??? No additional direct materials are added in Department #2. The department uses FIFO method. How much is the cost of goods transferred out?12,80017,66016,00013,000 How much is the cost of ending work in process?1,6006002,6001,000arrow_forward

- Barone Co. manufactures its products in a continuous process involving two departments, Machining and Assembly. Prepare journal entries to record the following transactions related to production during April: a) Materials purchased on account, $180,000. b) Materials requisitioned by: Machining, $73,000 direct and $9,000 indirect materials; Assembly, $4,900 indirect materials. c) Machining Department transferred $98,300 to Assembly Department; Assembly Department transferred $83,400 to finished goods.arrow_forwardData for the two departments of Kimble & Pierce Company for June of the current fiscal year are as follows: Drawing Department Winding Department Work in process, June 1 4,800 units, 25% completed 3,200 units, 75% completed Completed and transferred to next processing department during June 65,800 units 64,600 units Work in process, June 30 3,600 units, 60% completed 4,400 units, 25% completed Production begins in the Drawing Department and finishes in the Winding Department. Question Content Area a. If all direct materials are placed in process at the beginning of production, determine the direct materials and conversion equivalent units of production for June for the Drawing Department. If an amount is zero, enter in "0". Whole Units Direct MaterialsEquivalent Units ConversionEquivalent Units Inventory in process, June 1 fill in the blank da6e050cefa9faa_1 fill in the blank da6e050cefa9faa_2 fill in the blank da6e050cefa9faa_3 Started and completed in…arrow_forwardSelected T-accounts of Moore Company are given below for the just completed year: Balance 1/1 Debits Balance 12/31 Debits Debit Debits Debit Balance 1/1 Direct materials Direct labor Overhead Balance 12/31 Debits Debit Debit Debit Balance 1/1 Debits Balance 12/31 Debit Raw Materials 15,000 Credits 120,000 25,000 Manufacturing Overhead 230,000 Credits Work in Process 20,000 Credits 90,000 150,000 240,000 ? Factory Wages Payable 185,000 Balance 1/1 Credits Finished Goods 40,000 Credits ? Credit 60,000 Cost of Goods Sold Credit Balance 12/31 Credit Credit Credit Credit ? ? 470,000 9,000 180,000 4,000 ? Required: 1. What was the cost of raw materials used in production? 2. How much of the materials in (1) above consisted of indirect materials? 3. How much of the factory labor cost is indirect labor?arrow_forward

- Information from the records of Conundrum Company for September was as follows: Sales $307,500 Selling and administrative expenses 52,500 Direct materials used 66,000 Direct labor 75,000 Variable factory overhead 50,000 Factory overhead 51,250 Inventories Sept. 1 Sept 30 Direct materials $ 8,000 $10,500 Work in process 18,750 21,000 Finished goods 17,250 14,250 Conundrum Company produced 20,000 units.What is the total product cost per unit (rounded to the nearest cent)? a.$12.24 b.$14.74 c.$12.11 d.$12.18arrow_forwardPlease show your solution asap thanksarrow_forward2.2 Units of production data for the two departments of Pacific Cable and Wire Company for November of the current fiscal year are as follows:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education