FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

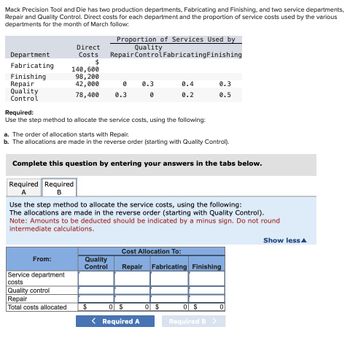

Transcribed Image Text:Mack Precision Tool and Die has two production departments, Fabricating and Finishing, and two service departments,

Repair and Quality Control. Direct costs for each department and the proportion of service costs used by the various

departments for the month of March follow:

Department

Fabricating

Finishing

Repair

Quality

Control

Direct

Costs

$

140, 600

98, 200

42,000

78,400

Required Required

A

B

From:

Required:

Use the step method to allocate the service costs, using the following:

Service department

costs

Quality control

Repair

Total costs allocated

Proportion of Services Used by

Quality

Repair Control FabricatingFinishing

a. The order of allocation starts with Repair.

b. The allocations are made in the reverse order (starting with Quality Control).

0

0.3

Complete this question by entering your answers in the tabs below.

Quality

Control

0.3

0

Use the step method to allocate the service costs, using the following:

The allocations are made in the reverse order (starting with Quality Control).

Note: Amounts to be deducted should be indicated by a minus sign. Do not round

intermediate calculations.

$

0.4

0.2

0 $

< Required A

0.3

0.5

Cost Allocation To:

Repair Fabricating Finishing

0 $

0 $

Required B

0

Show less

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Caro Manufacturing has two production departments, Machining and Assembly, and two service departments, Maintenance and Cafeteria. Direct costs for each department and the proportion of service costs used by the various departments for the month of August follow: Proportion of Services Used by Department Direct Costs Maintenance Cafeteria Machining Assembly Machining $ 140,000 Assembly 71,000 Maintenance 51,000 — 0.2 0.6 0.2 Cafeteria 36,000 0.6 — 0.2 0.2 Required: Use the step method to allocate the service costs, using the following: a. The order of allocation starts with Maintenance. b. The allocations are made in the reverse order (starting with Cafeteria).arrow_forwardMack Precision Tool and Die has two production departments, Fabricating and Finishing, and two service departments, Repair and Quality Control. Direct costs for each department and the proportion of service costs used by the various departments for the month of March follow: Department Fabricating Finishing Repair Quality Control Proportion of Services Us by Quality Direct Costs Repair $ 130,600 90, 200 38,400 71, 600 0 0.8 Control Fabricating Finishing 0.2 0 Required: Use the step method to allocate the service costs, using the following: 0.5 0.1 a. The order of allocation starts with Repair. b. The allocations are made in the reverse order (starting with Quality Control). 0.3 0.1arrow_forwardDuring the past month, the following costs were incurred in the three production departments and two service departments of Kim & Co.: Supplying Department Administration Factory support Direct cost From: Service department costs Administration Factory support Total allocations Administration Direct costs Total costs 0.10 $ 640,000 Using Department Factory Support Fabrication 0.40 0.30 0.20 $1,720,000 $1,330,000 Required: Allocate service department costs to Fabrication, Assembly, and Finishing using the reciprocal method, and determine the total costs of Fabrication, Assembly, and Finishing after this allocation. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your final answers to the nearest whole dollar amounts.) Assembly 0.20 0.20 $284,000 Administration Factory Support Finishing 0.10 0.50 $254,000 Cost Allocation To: Fabrication Assembly Finishingarrow_forward

- es Caro Manufacturing has two production departments, Machining and Assembly, and two service departments, Maintenance and Cafeteria. Direct costs for each department and the proportion of service costs used by the various departments for the month of August follow: Department. Machining Assembly Maintenance Cafeteria Required A Direct Costs $135,000 85,000 47,000 36,000 Required: Use the step method to allocate the service costs, using the following: a. The order of allocation starts with Maintenance. b. The allocations are made in the reverse order (starting with Cafeteria). Complete this question by entering your answers in the tabs below. Required B Required A Proportion of Services Used by Maintenance. Cafeteria. Machining Assembly 0.7 The order of allocation starts with Maintenance. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations.) Required B Required: Use the step method to allocate the service costs, using the following: a. The…arrow_forwardSequential (Step) Method of Support Department Cost Allocation Chekov Company has two support departments, Human Resources and General Factory, and two producing departments, Fabricating and Assembly. Direct costs Normal activity: Number of employees Square footage Human Resources General Factory Direct costs Allocate: General Factory Support Departments Human Resources Human Resources Total after allocation $150,000 1,500 The costs of the Human Resources Department are allocated on the basis of number of employees, and the costs of General Factory are allocated on the basis of square footage. Now assume that Chekov Company uses the sequential method to allocate support department costs. The support departments are ranked in order of highest cost to lowest cost. Required: 1. Calculate the allocation ratios (rounded to six significant digits) for the four departments using the sequential method. If an amount is zero, enter "0". Use the rounded values for subsequent calculations. Human…arrow_forward[The following information applies to the questions displayed below.] Mack Precision Tool and Die has two production departments, Fabricating and Finishing, and two service departments, Repair and Quality Control. Direct costs for each department and the proportion of service costs used by the various departments for the month of March follow: Department Fabricating Finishing Repair Quality Control Direct Costs $ 133,600 96, 200 41,100 76,700 Fabricating Finishing Repair Total Allocated Costs 0 0.8 Proportion of Services Used by Quality Control 0.2 0 Fabricating Finishing Exercise 11-25 (Algo) Cost Allocation: Direct Method (LO 11-1) 0.6 0.1 Required: Compute the allocation of service department costs to producing departments using the direct method. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar. 0.2 0.1arrow_forward

- 1arrow_forwardPlease heklp I am having issues solving this problem Kansas Supplies is a manufacturer of plastic parts that uses the weighted-average process costing method to account for costs of production. It produces parts in three separate departments: Molding, Assembling, and Packaging. The following information was obtained for the Assembling Department for the month of April. Work in process on April 1 had 110,000 units made up of the following. Amount Degree of Completion Prior department costs transferred in from the Molding Department $ 152,900 100 % Costs added by the Assembling Department Direct materials $ 89,100 100 % Direct labor 37,540 60 % Manufacturing overhead 25,070 50 % $ 151,710 Work in process, April 1 $ 304,610 During April, 510,000 units were transferred in from the Molding Department at…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education