Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

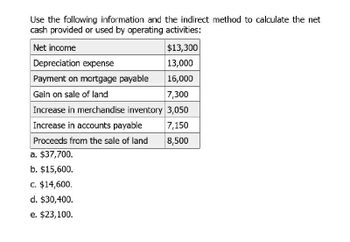

Transcribed Image Text:Use the following information and the indirect method to calculate the net

cash provided or used by operating activities:

Net income

$13,300

Depreciation expense

13,000

Payment on mortgage payable

16,000

Gain on sale of land

7,300

Increase in merchandise inventory 3,050

Increase in accounts payable

7,150

Proceeds from the sale of land

8,500

a. $37,700.

b. $15,600.

c. $14,600.

d. $30,400.

e. $23,100.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Global Corp. expects sales to grow by 8% next year. Using the percent of sales method and the data provided in the given tables 9. forecast: a. Costs except depreciation b. Depreciation c. Net income d. Cash e. Accounts receivable f. Inventory g. Property, plant, and equipment h. Accounts payable (Note: Interest expense will not change with a change in sales. Tax rate is 25%.) The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career. a. Costs except depreciation The forecasted costs except depreciation will be S million. (Round to one decimal place and enter all numbers as a positive.) b. Depreciation The forecasted depreciation will be S million. (Round to one decimal place and enter all numbers as a positive.) c. Net income The forecasted net…arrow_forwardConsider the following income statement: Sales Costs $ 602,184 391,776 Depreciation 89,100 Taxes Calculate the EBIT. EBIT 21% Calculate the net income. Net incomearrow_forwardCommon size analysis of the balance sheet expresses each item as a percentage of the _____________. Total Asset Revenue Base year figure Current assetarrow_forward

- When assets that have been sold and accounted for by the installment method are subsequently repossessed and returned to incentory, they should be recorded on the books at a. net realizable value b. net realizable value minus normal profit c. the amount of the installment receivable less associated deferred gross profit d. selling pricearrow_forwardWhich method measures depreciation directly? Oa. Sales comparison Ob. Cash equivalency O c. Age-life Od. Capitalized valuearrow_forwardProvide this question solution general accountingarrow_forward

- The following are classified as current liabilities on the balance sheet: Inventory, Short-term Debt, and Deferred Revenue. Short-term Debt, Accounts Payable, and Deferred Revenue. Sales Taxes Payable, Current Operating Lease Liabilities, and Common Stock. Short-term Debt, Income Taxes Payable, and Land. please xplain and give thge correct letterarrow_forwardCalculate the EBIT which should be used for the EV / EBIT multiple given the information below: Net revenues Cost of sales Gross Profit Selling, general and administrative expenses Amortization expense Restructuring costs Acquisition-related costs Asset impairment charges Gain on sales of assets Operating income Interest expense, net Loss on early extinguishment of debt Other expense, net Income (loss) before taxes (Benefit) provision for income taxes Net income (loss) Select one: 1,394,8 1,444.4 1,474.3 S 1,419.6 5,248.1 1,746.0 3,502.1 2,027.8 During fiscal 2050, the company sold assets relating to the Cutey brand for a total disposal price of $29.2. The Company allocated $4.2 of goodwill to the brand as part of the sale. The Company recorded a gain of $24.8 which has been reflected in Gain on sales of assets in the Consolidated Statement of Operations for the fiscal year ended June 30, 2050. 79.5 86.9 174.0 5.5 (24.8) 1,153.2 81.9 3.1 30.4 1,037.8 (40.4) 1,078.2arrow_forwardneed formula for cost of goods sold CURRENT ASSETS Cash and cash equivalents $ 607,987 $ 480,626 Accounts receivable, net 104,500 80,545 Inventory 26,445 26,096 Prepaid expenses and other current assets 54,906 57,076 Income tax receivable 282,783 27,705 Investments 343,616 400,156 Total current assets 1,420,237 1,072,204 Leasehold improvements, property and equipment, net 1,584,311 1,458,690 Long term investments 102,328 0 Restricted cash 27,849 27,855 Operating lease assets 2,767,185 2,505,466 Other assets 59,047 18,450 Goodwill 21,939 21,939 Total assets 5,982,896 5,104,604 Current liabilities: Accounts payable 121,990 115,816 Accrued payroll and benefits 203,054 126,600 Accrued liabilities 164,649 155,843 Unearned revenue 127,750 95,195 Current operating lease liabilities 204,756 173,139 Total current liabilities 822,199 666,593 Commitments and contingencies (Note 12) Long-term operating lease liabilities 2,952,296…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning