Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What is the debt to equity ratio ?

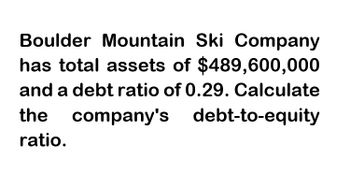

Transcribed Image Text:Boulder Mountain Ski Company

has total assets of $489,600,000

and a debt ratio of 0.29. Calculate

company's debt-to-equity

the

ratio.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Debt-to-Total-Assets RatioRuby Company’s balance sheet reports the following totals: Assets = $40,000; Liabilities = $25,000; Stockholders’ Equity = $15,000. Determine the company’s debt-to-total-assets ratio.arrow_forwardWhat is the debt to equity ratio for the general accounting question ?arrow_forwardBoulder Mountain Ski Company has total assets of $402,300,000 and a debt ratio of 0.27. Calculate the company’s debt-to-equity ratio. Round to two decimal places.arrow_forward

- XYZ Company reported the following information: Total Assets $500,000, Total Liabilities $200,000, and Equity $300,000. Calculate the debt-to-equity ratio and the equity multiplier.arrow_forwardYou find the following financial information about a company: net working capital = $7, 809; total assets $11,942; and long-term debt Multiple Choice $9, 115 $4, 507 $10, 339 $6, 129 $4, 133 = = = $1, 287; fixed assets $4,589. What is the company's total equity?arrow_forwardSs stores has total debt of $4910 and a debt equity ratio of 0.52. What is the value of the total assets?arrow_forward

- Jessica Company has total assets of P180,000 and total liabilities of P54,000. Jessica's debt-to-equity ratio is closest to * Choices: 2.3. .32. .30. .43.arrow_forwardA company’s balance sheet reveals it has total assets of $8,081,700, total liabilities of $2,966,700, and total equity of $5,115,000. The current debt-to-equity ratio for this company is: 0.37. 0.58. 0.63. 1.72. 2.72.arrow_forwardSouthern Style Realty has total assets of S485, 390, net fixed assets of $250,000, current liabilities of S 23,456, and long-term liabilities of $148.000. What is the total debt ratio? Multiple Choice .30.35.69.53.68.arrow_forward

- Stark Company's most recent balance sheet reported total assets of $2,000,000, total liabilities of $750,000, and total equity of $1,250,000. Its debt-to-equity ratio is: Mutiple Choice 0.37 0.63 1.67 0.60 1.00arrow_forwardBarger Corporation has the following data as of December 31, 2024: Total Stockholders' Equity Total Current Liabilities Total Current Assets $ 36,210 58,200 181,630 Other Assets Long-term Liabilities Property, Plant, and Equipment, Net Compute the debt to equity ratio at December 31, 2024. (Round your answer to two decimal places, X.XX.) = = C $? 45,600 269,640 Debt to equity ratioarrow_forwardStark Company's most recent balance sheet reported total assets of $1.74 million, total liabilities of $0.88 million, and total equity of $0.86 million. Its Debt to equity ratio is: Multiple Choice 0.51 0.49 0.98arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning