FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

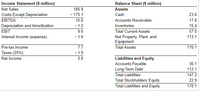

Transcribed Image Text:Global Corp. expects sales to grow by 8% next year. Using the percent of sales method and the data provided in the given tables 9. forecast:

a. Costs except depreciation

b. Depreciation

c. Net income

d. Cash

e. Accounts receivable

f. Inventory

g. Property, plant, and equipment

h. Accounts payable

(Note: Interest expense will not change with a change in sales. Tax rate is 25%.)

The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career.

a. Costs except depreciation

The forecasted costs except depreciation will be S million. (Round to one decimal place and enter all numbers as a positive.)

b. Depreciation

The forecasted depreciation will be S million. (Round to one decimal place and enter all numbers as a positive.)

c. Net income

The forecasted net income will be s million. (Round to one decimal place.)

d. Cash

The forecasted cash will be S million. (Round to one decimal place.)

e. Accounts receivable

The forecasted accounts receivable will be S million. (Round to one decimal place.)

f. Inventory

The forecasted inventory will be S million. (Round to one decimal place.)

g. Property, plant, and equipment

The forecasted property, plant, and equipment will be $ million. (Round to one decimal place.)

h. Accounts payable

The forecasted accounts payable will be $

million. (Round to one decimal place.)

Transcribed Image Text:Income Statement ($ million)

Balance Sheet ($ million)

Net Sales

185.9

Assets

Costs Except Depreciation

- 175.1

Cash

23.8

EBITDA

10.8

Accounts Receivable

17.8

Depreciation and Amortization

EBIT

- 1.2

Inventories

15.4

9.6

Total Current Assets

57.0

Interest Income (expense)

- 1.9

Net Property, Plant, and

Equipment

113.1

7.7

- 1.9

Pre-tax Income

Total Assets

170.1

Taxes (25%)

-

Liabilities and Equity

Accounts Payable

Long-Term Debt

Net Income

5.8

35.1

112.1

Total Liabilities

147.2

Total Stockholders' Equity

Total Liabilities and Equity

22.9

170.1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The time value of money indicates that t of Select one: estion O a. the money obtained today is worth less than money received in future O b. The money obtained today is worth more than money received in future O C. There is no difference in the value of money obtained today and the in future O d. None of the answers is correct 369C Sunnyarrow_forwardWhat is the payback period for the following set of cash flows? (Round your answer to 2 decimal places, e.g., 32.16.) Cash Year Flow $5,500 1 1,275 1,475 1,875 1,375 3 4 Payback period yearsarrow_forwardUneven Cash Flow Stream Find the present values of the following cash flow streams. The appropriate interest rate is 6%. Round your answers to the nearest cent. (Note that, when working with the calculator's cash flow register, you must enter CF0 = 0. ) Year Cash Stream A Cash Stream B 1 $100 $300 2 400 400 3 400 400 4 400 400 5 300 100 Stream A $ _______Stream B $ _______arrow_forward

- Give answer within 45 min.... I will give you up vote immediately.... it's very urgent...arrow_forwardAccounting Questionarrow_forwardWhen lives are equal adjustments to cash flows are not required.. The MEAS can be compared by directly comparing their equivalent worth (PW, FW, or AW) calculated using the MARR. The decision will be the same regardless of the equivalent worth method you use. For a MARR of 12%, select from among the MEAS below. ..... . ... .... ..... ... ..... .... Alternatives A C Capital investment -$150,000 -$85,000 -$75,000 -$120,000 Annual revenues $28,000 $16,000 $15,000 $22,000 Annual expenses -$1,000 -$550 -$500 -$700 Market Value (EOL) $20,000 $10,000 $6,000 $11,000 Life (years) 10 10 10 10arrow_forward

- A(n) ____ in the supply of peso for sale will cause the peso to ____. A. increase; appreciate B. increase; depreciate C. decrease; depreciate D. decrease; appreciate E. both the 2nd and 4th options are correctarrow_forwardWhat is the payback period for the following set of cash flows? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Year 01234 Cash Flow -$ 5,700 1,350 1,550 1,950 1,450 Payback period yearsarrow_forwardAssets Cash Receivables (net) Inventory PP & E (net) Patents&Licenses Goodwill Total assets Liabilities & Equity Accounts payable Short term debt Long term debt Preferred stock Common Equity Total Liabilities + Equity New Chip Corp Balance Sheet at 12/31/22 ($ in Millions) 31 45 64 215 28 19 402 53 19 179 23 128 402arrow_forward

- Consider the following cash flows: Year 01234 Cash Flow -$5,100 1,500 2,600 1,300 1,000 What is the payback period for the cash flows? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Payback period yearsarrow_forwardP1 and P2 have a default setting of 1.00, meaning only the first payment is analyzed. Scroll down to the balance after the first payment, amount paid toward principal, and amount paid toward interest. BAL = $443,963.80 PRN = $56,036.20 INT = $40,000.00 To examine the last payment, change P1 and P2 to 7 and review the amortization output: What is the remaining balance? How much of the final payment goes toward repaying principal? How much of the final payment goes toward paying interest?arrow_forwardConsider the following cash flows: Year Cash Flow 0 –$ 34,000 1 13,600 2 18,100 3 11,000 What is the IRR of the cash flows? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education